Where does the "traffic" that can attract real money come from?

Written by: Squid | drift

Translated by: Saoirse, Foresight News

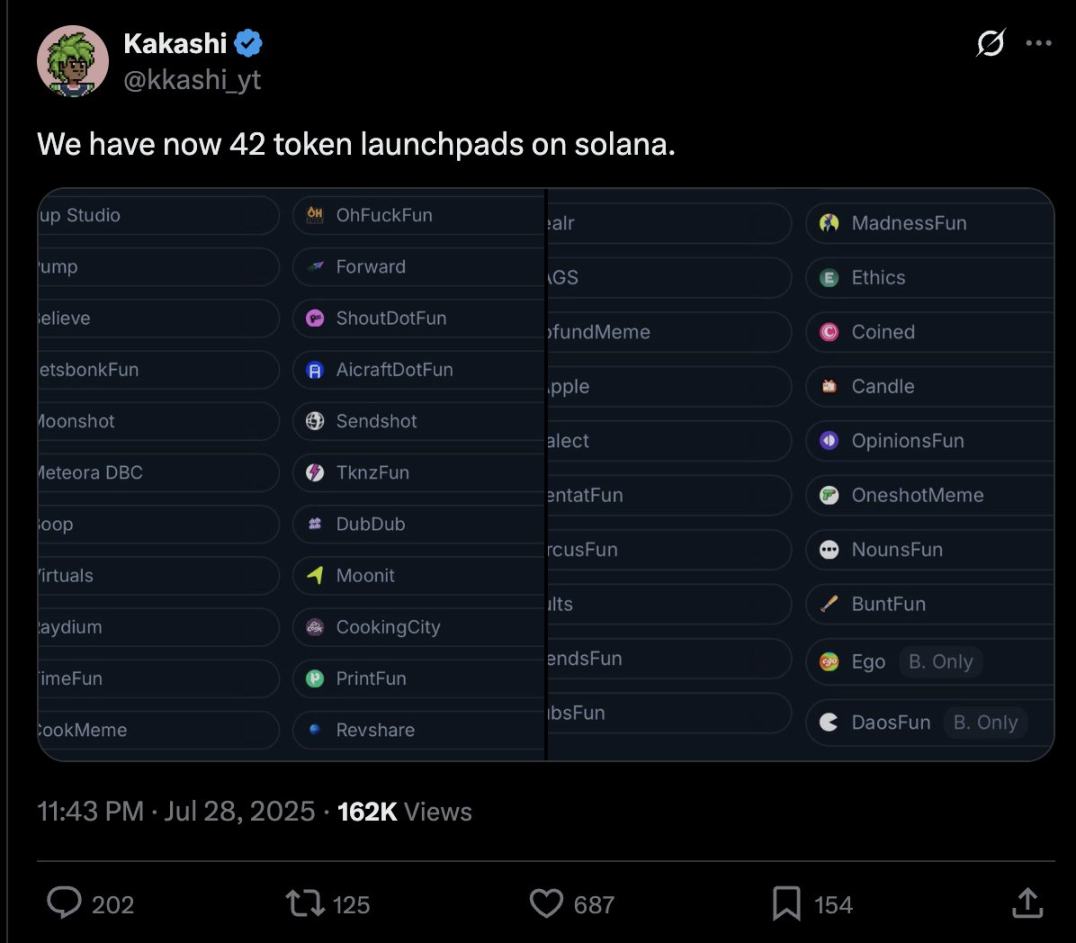

There are already dozens of homogeneous Launchpads on Solana, and new ones are being added every day.

This article aims to provide a simple framework to help sort out the chaos in the industry and provoke thought. We start with the core question:

Why do users choose new Launchpads instead of Pump.Fun (or today's Bonk)?

Users can be divided into two categories: bidders and deployers. Although these two groups are highly related, since funds are a scarce resource, bidders are the core group we focus on first.

To analyze why buyers choose new platforms over leading platforms, the answer is simple: they believe new platforms offer more opportunities to make money. However, many of these factors are beyond the platform's control, so this article focuses on two major driving factors that the platform can control:

Assets: Can the platform create assets with significantly differentiated value?

Flows: Does the platform have a differentiated deployer process?

Let’s delve deeper.

Assets

People buy tokens for two main reasons: speculation (believing the token will appreciate) and utility (the token has practical uses).

- On the speculative level: There are many driving factors for speculation, mainly including memes (like Meme coins) and fundamentals (such as value derived from reserves, cash flow, etc.).

However, Launchpads cannot create differentiation on the speculative level. Memes are spontaneous and depend on the market, while fundamental factors like returns are ultimately determined by the project party or product.

- On the utility level: Utility is more flexible, which is "besides speculation, why do people buy tokens?" (Of course, utility is closely related to speculation, as utility can drive speculation). For example, access rights to tokens, transaction fee discounts, governance rights, etc., all fall under the category of utility.

Launchpads can create advantages in utility by providing differentiated supporting infrastructure and tools, allowing deployers to connect from day one. This type of support can take various forms, but competition may focus more on platforms that are more concentrated in vertical fields. It is important to note that the supporting infrastructure must not only provide unique utility to the tokens but also create "valuable utility," meaning giving users a compelling reason to purchase.

Social Token Case: Ego vs Time.Fun

Both attempt to tokenize social influence, and each creator can only issue one "soulbound token" linked to their Twitter account.

Ego's token, while owned by the creator, lacks direct utility. This "flexibility" leads creators to lack motivation to build utility, ultimately making its token no different from those on Pump platforms.

Time.Fun is different. It has built-in utility functions for the token, allowing creators to quickly create value and profit through the token, thus achieving sustained user activity.

(Note: I acknowledge the Ego team; I chose this case because I believe they will continue to optimize.)

Additionally, "providing utility" does not equal "creating value." For example, many tweet-based tokenization platforms integrate tweets into their supporting infrastructure, forming "value-based curated social streams." While this is a form of utility, if no one uses that social stream, its value is zero. Such platforms often struggle to create real value.

It is worth noting that creating value is not easy and requires careful assessment of whether the supporting infrastructure or design is genuinely valuable. At the same time, differentiation is relative. Current industry trends like "token buyback tools" and "project economics tied to token flywheels," while valuable in the short term, will soon become standardized technology. Once differentiation is lost, it no longer holds appeal.

In summary, when evaluating new platforms from the perspective of "assets," one must consider: where does the differentiation of the token lie? Does this differentiation add value to the token?

The areas I am currently focusing on include: incentive-based distributed training, next-generation decision markets (which have some interesting mechanisms), niche real-world assets (with some novel designs), and initial coin offering mechanisms (ICM, which is in its early stages and has great potential).

Flows

Next, let’s explore another differentiating factor: exclusive deployer "flows." This is similar to the "deal flow" in venture capital, the core is whether the platform can attract the hottest projects to launch.

From the perspective of limited partners (LPs), one of the key criteria for evaluating venture capital firms is whether they have high-quality exclusive deal flow. This logic also applies to Launchpads. The return structures of both are similar (leading projects contribute most of the trading volume/revenue), and the essence is "to let those who create value choose you over homogeneous competitors."

For example, a counterpoint suggests that Believe's early success did not stem from mechanism design (in fact, I do not agree with that design), but rather because its founder Pasternak could attract Web2 entrepreneurs who would not otherwise issue tokens—this is the value of flow.

Large platforms inherently have a traffic advantage: they have users, ecosystem integration capabilities, and distribution channels. However, user attention is a scarce resource, and new platforms must rely on tangible differentiation to attract traffic.

Here are some common factors for flow differentiation:

Founder Influence: The crypto industry is small, and connections are crucial. Does the platform's founder have enough social resources to attract deployers? Can they garner social support for the token after the project launches? (e.g., Pasternak)

Development Momentum: Does the platform have successful launch cases? For example, Bonk's Launchpad, due to the successful token issuance, incentivized more people to issue and bid on tokens, creating a "social flywheel effect." Early-stage platforms should filter quality projects to provide in-depth support; a few failed launches can destroy a platform, as the flywheel effect is bidirectional.

Specialized Positioning: If a platform focuses on a specific niche, having a specialized community can enhance project exposure. For example, in the fields of AI agents and virtual assets (even though the tokens themselves are homogeneous), especially when the platform targets non-crypto native users, the advantages of specialization are more pronounced.

Capital Formation Ability: For projects leaning towards commercial attributes, the ability to raise funds in the early stages may affect their ultimate success. Does the platform's issuance mechanism and coverage help facilitate higher levels of capital formation?

Utility: As mentioned earlier, the utility of assets can directly attract traffic.

In summary, when evaluating new platforms from the perspective of "flows," one must consider: why do deployers choose this platform? What are their current reasons for choosing it? Does this differentiation have stickiness and scalability?

Market Perspectives

Here is my analysis of the trends of mainstream Launchpads in the market (noting the chains for those on Solana):

BonkFun: Industry leader, with significant meme advantages. Its leading position is more stable than expected, and it is unlikely to be shaken unless a completely new incentive mechanism platform emerges.

Raydium, Jup, Orca (upcoming): Assets lack differentiation, and technology has been standardized, but they can still maintain traffic due to brand and capital advantages. The focus of competition is on business development; whoever can attract more platform partnerships and better support popular tokens will win.

Pump.fun: Lacks differentiation before launching more streaming features, and traffic is declining. Unless incentive measures are initiated or new products are released, it is unlikely to return to its peak in the short term. Aggressive acquisitions or capital operations may become variables.

Block: Has differentiation on the asset level due to its partnership with WLFI.

Zora: (deployed on Base chain) has become a leading platform relying on the traffic of the Base ecosystem, but due to asset homogeneity, its market share may decline as more platforms enter (though support from the Base camp may reverse this trend).

Doppler: As the "Launchpad of Launchpads," it has high industry recognition and good development prospects.

MetaDAO: Asset creation has differentiation, but it needs to prove the value of its governance mechanism.

Vertigo: Assets lack differentiation (anti-sniping technology has been standardized), but there are still opportunities to attract deployers.

Believe: (deployed on BNB Smart Chain) has a core advantage in traffic, but currently, deployers are leaving, and market sentiment is unclear. I still have expectations for this project and need to assess its health through new launch projects.

heaven: (deployed on BNB Smart Chain) has excellent design, but the core issue is how to attract high-quality deployers; its investors may provide support.

The Metagame (deployed on BNB Smart Chain), Trends: Details are unknown, but the team consists of seasoned crypto-native players (which is crucial), and they are expected to break through in the social field.

Conclusion

Verticalization is an important opportunity, but it must create real value.

Early positioning is easier to yield returns than betting on "defensive" or market growth.

Novelty should be valued.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。