With Trump officially signing the GENIUS Act in the White House, this marks the first formal establishment of a regulatory framework for digital stablecoins in the United States, which also means that many stablecoin issuers will face a new round of challenges. Many people may be unfamiliar with the GENIUS Act and may have the following questions:

- What regulatory measures for stablecoins are mentioned in the US GENIUS Act…?

- What impact does this act have on USDT and Tether…?

- Can Tether take appropriate countermeasures…?

- What are the differences between this act and Hong Kong's Stablecoin Act…?

The Crypto Law team, rooted in the field of cross-border blockchain compliance for many years, will address the above questions one by one.

(Image source: CCTV program official website)

1. What does the GENIUS Act actually say?

First, let’s understand the GENIUS Act. The GENIUS Act, officially known as the "Guidance and Establishment of a National Innovation Act for US Stablecoins," is also referred to as the US "Stablecoin Act." The purpose of this act is to establish a comprehensive legal and regulatory framework for payment stablecoins in the United States to promote financial innovation, protect consumers, strengthen monetary sovereignty, and maintain financial stability. Below is a brief introduction to the regulatory framework of the GENIUS Act:

1. Core definitions and scope of the act: The act primarily regulates payment stablecoins, which are defined as digital currencies used for payments or settlements that are pegged to a fixed currency value. The act requires that only "authorized payment stablecoin issuers" can issue stablecoins in the United States. Authorized issuers must be subsidiaries of insured deposit institutions, federally qualified non-bank payment stablecoin issuers, or state-qualified payment stablecoin issuers. (Act reference: GENIUS Act, Section 2(22))

2. Regulatory framework of the act: The act establishes a unique dual-track regulatory system. For stablecoins with issuance exceeding $10 billion, the regulatory framework of the Federal Reserve for deposit institutions and the Office of the Comptroller of the Currency for non-bank issuers will apply. For issuers with issuance below $10 billion, they can choose a state regulatory path. The act's reserve requirement: One of the most important consumer protection measures in the act is the 100% reserve requirement. Issuers must hold at least one dollar in permissible reserves for every dollar of stablecoin issued. Permissible reserves include: coins and currency, bank deposits, short-term government bonds, repurchase agreements, money market funds, and central bank reserve deposits. (Act reference: GENIUS Act, Section 4(a)(1))

3. Transparency and disclosure requirements of the act: The act requires issuers to establish and disclose stablecoin redemption procedures and to report regularly on outstanding stablecoins and the composition of reserves. (Act reference: GENIUS Act, Section 6(a)(2))

4. National security and anti-money laundering provisions of the act: The act classifies payment stablecoin issuers as financial institutions under the Bank Secrecy Act, which means they must: maintain effective anti-money laundering and sanctions compliance programs; keep appropriate records of stablecoin transactions; monitor and report suspicious activities; implement policies to prevent, freeze, and reject transactions that violate federal or state laws; and establish customer identification programs. (Act reference: GENIUS Act, Section 8(a))

2. What impact does this act have on USDT and Tether?

First, let’s explain what USDT is. USDT is one of the most representative stablecoins in the current cryptocurrency market, officially known as Tether. It is issued by Tether and aims to maintain price stability by pegging to fiat currencies (mainly the US dollar), serving as an important liquidity tool and value storage medium in the cryptocurrency market. The core design of USDT is to promise that for every USDT issued, one dollar will be deposited in a bank account as a reserve, theoretically maintaining a 1:1 peg. Users can exchange USDT for dollars at any time to ensure price stability. Compared to traditional cross-border remittance methods, USDT transactions are faster, have relatively lower fees, and are not restricted by geography or bank operating hours, allowing for more efficient cross-border fund transfers.

(Image source: CoinMarketCap)

According to the content of the act, it is certain that this act severely restricts the development of USDT. The GENIUS Act is a US act, and USDT is also a US product. After the implementation of this act, based on the aforementioned content of the GENIUS Act, it is almost certain that Tether will not be able to fully meet compliance conditions. Therefore, in the future of the stablecoin market, Tether's market share will only be continuously encroached upon until a substitute emerges. Even if Tether retains a share in the future stablecoin market, it is likely to be used only in specific segments.

As for why Tether cannot meet its requirements, the Crypto Law team will outline the core content of the act:

First, the act clearly states that stablecoins are not subject to the securities and commodities regulatory system, but are primarily regulated by the banking system;

Second, the reserves required by the act must be high-quality liquid assets, such as cash in US dollars, Federal Reserve deposits, bank demand deposits, government bonds maturing within 93 days, or overnight reverse repurchase agreements, authorized payment stablecoin issuers must maintain reserves equal to (1:1) to the stablecoins they issue. (Act reference: GENIUS Act, Section 4(a)(1))

In addition, authorized payment stablecoin issuers with a total issuance exceeding $50 billion, and not subject to the reporting requirements of the 1934 Securities Exchange Act, must prepare annual financial statements in accordance with US Generally Accepted Accounting Principles (GAAP) to disclose any related party transactions; (Act reference: GENIUS Act, Section 3(10)(A))

(Image source: CCTV program official website)

Fourth, anti-money laundering and KYC (Know Your Customer) are core regulatory requirements in the financial industry and compliance field, and the requirements for verifying customer identity, assessing risks, and preventing illegal activities such as money laundering, terrorist financing, and fraud are very strict. Issuers must not misappropriate reserves and must publish reserve proof audited by a registered accounting firm every month, and comply with the Bank Secrecy Act; (Act reference: GENIUS Act, Section 3(5)(A))

Fifth, for holders of stablecoins, the act grants a super priority, in other words, if the issuer goes bankrupt, the claims of stablecoin holders take precedence over all other creditors, thus achieving "priority of repayment." This "priority of repayment" also encourages more people to purchase the stablecoins issued by the issuer, while further ensuring the legitimate rights and interests of stablecoin subscribers. (Act reference: GENIUS Act, Section 10 (3))

For Tether, the issuer of USDT, it cannot meet many of the requirements of the GENIUS Act.

First, the requirement for reserves in the GENIUS Act is "full reserve support," while Tether's current reserves are only about 85%, which does not meet the standards of the GENIUS Act. This could lead to price fluctuations of the stablecoin and a collapse of user trust.

Second, Tether's auditing firm is BDO Italia, which does not meet the standards of the Public Company Accounting Oversight Board in the United States.

Third, Tether needs to sell its non-compliant asset reserves, such as Bitcoin, precious metals, corporate notes, and secured loans, and must replace them with compliant assets.

Additionally, Tether has a high market capitalization, which has reached the threshold for direct federal regulation. Therefore, the Crypto Law team believes that Tether will find it difficult to support the monthly disclosure and strict anti-money laundering requirements (issuers of stablecoins totaling over $50 billion and non-SEC reportable entities must undergo annual financial statement audits).

Besides Tether, companies like Circle (USDC issuer), Paxos (PAX, USDP issuer), and Gemini (GUSD issuer) will also be subject to varying degrees of restrictions under the GENIUS Act, such as liquidity of reserve assets, disclosure audits, etc. Therefore, the impact of the GENIUS Act is not limited to one issuer; it has a significant impact on the entire stablecoin market.

(Image source: CCTV program official website)

According to the GENIUS Act, if stablecoin issuers led by Tether are unable to meet the requirements of the act, they will face severe penalties.

First, if Tether fails to complete US entity registration or reserve rectification within the transition period, its USDT will be deemed an "illegal payment instrument," and the act of issuance itself will constitute a violation of the law, potentially leading to criminal charges. (Act reference: GENIUS Act, Section 4(a)(12))

In addition, three years after the act takes effect, any foreign stablecoin issuer (including Tether) that is not licensed in the United States will be prohibited from issuing, selling, or providing trading services within the United States. Digital asset service providers (such as exchanges) that violate this regulation will face a maximum daily fine of $100,000, while Tether, as the issuer, may be placed on the "non-compliance list" published by the Treasury Department, leading to its stablecoin being forcibly delisted from US platforms (Act reference: GENIUS Act, Section 18 (a)(4)).

Of course, for non-compliance regarding reserve assets (such as holding non-permissible assets), failure to disclose reserve reports on time, or violations of anti-money laundering obligations, the Treasury may impose a maximum daily fine of $1 million on Tether (Act reference: GENIUS Act, Section 18 (a)(4)).

Faced with such numerous adverse consequences, it can be said that the implementation of the GENIUS Act has issued a "final ultimatum" to stablecoin issuers like Tether.

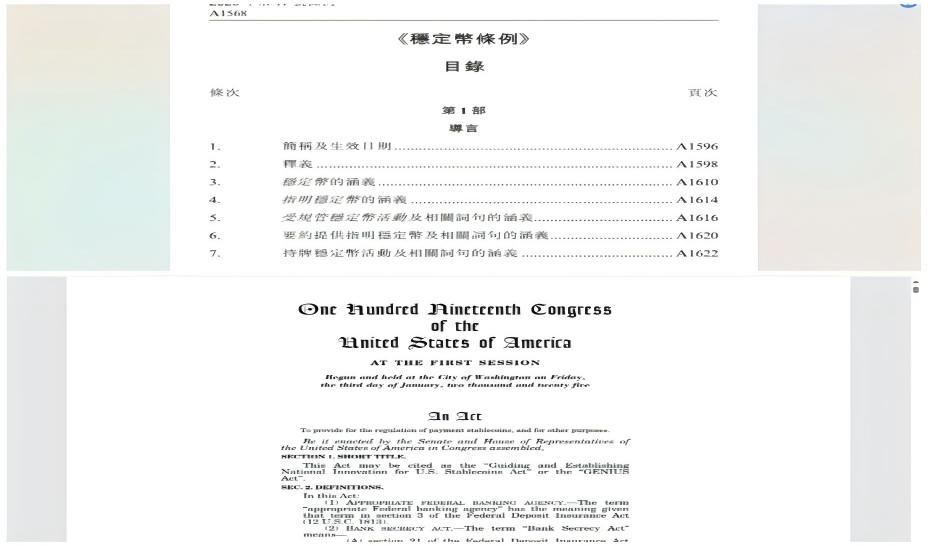

(Image source: Congress.Gov)

3. What are the differences between the GENIUS Act and Hong Kong's Stablecoin Ordinance?

Now that Trump has officially signed the GENIUS Act, it means that the act has officially come into effect, and coincidentally, Hong Kong's Stablecoin Ordinance is also set to take effect on August 1, 2025. Both regulations are aimed at the regulatory policies for "stablecoins" in the cryptocurrency space. Many may ask, what are the differences between these two "stablecoin regulations" from two different regions? In other words, if one wants to issue stablecoins in these two regions, what are the differences in regulatory control between the US and Hong Kong? The following will provide answers.

First, the entry requirements for issuers differ between the two regions. In the US, registration must be done as a US-registered entity or as a foreign entity registered through the OCC (which must prove that its home country's regulation is equivalent), and compliance rectification must be completed within three years; otherwise, entry into the US market is prohibited. In Hong Kong, the registering entity must be a Hong Kong registered company or an overseas bank recognized by the Monetary Authority (such as HSBC or Standard Chartered), and non-bank institutions must have a paid-up capital of HKD 25 million (banks can be exempted).

Second, the reserve asset requirements differ. The US only allows cash and US Treasury bonds maturing within 93 days as reserve assets, prohibiting investments in commercial paper, crypto assets, and other non-compliant assets as reserves. Hong Kong requires that reserve assets must strictly match the pegged currency (for example, a Hong Kong dollar stablecoin must hold Hong Kong dollar cash or short-term bonds) and prohibits paying interest to holders, directly limiting the "interest-bearing stablecoin" business model.

Third, the requirements for transparency and auditing standards differ between the US and Hong Kong. The US requires monthly public disclosure of the composition, market value, and audit reports of reserve assets, with annual audits conducted by PCAOB-certified firms, and the CEO/CFO must sign a compliance statement (Act reference: GENIUS Act, Section 4(10)(a)(iii)).

Hong Kong also requires regular disclosure of the composition, market value, and audit results of reserve assets, but does not mandate PCAOB qualifications, only requiring "independent audits."

Fourth, the penalties for violations differ between the two. In the US, violations can incur fines of up to $1 million per day and may trigger civil damages and criminal charges (such as securities fraud, which can lead to up to 10 years in prison). In Hong Kong, unlicensed issuance can incur fines of up to HKD 5 million and 7 years in prison, while fraudulent activities can incur fines of up to HKD 10 million and 10 years in prison.

From the comparison of these four dimensions, it can be seen that Hong Kong strikes a more balanced approach between stability and innovation, thus having a more inclusive policy, but the competition for obtaining licenses is more intense; whereas the US focuses more on maintaining the hegemony of the US dollar, imposing strict restrictions on US dollar stablecoin issuers. Therefore, choosing which country to issue stablecoins has its own advantages and disadvantages.

(Image source: Foresight NEWS)

4. Interpretation by Crypto Law

Based on this, the Crypto Law team believes that the introduction of the GENIUS Act sets a critical 300-day window for Tether. Although the act provides an 18-month (approximately 540 days) transition period, if Tether fails to present a compliant solution that meets the act's requirements within 300 days, the market prospects for USDT will be fundamentally determined. If USDT cannot pass compliance recognition in the US, its global market share expansion will face fundamental restrictions—even if Tether continues to issue USDT and increase the total token supply, the decline in its market share will still become an inevitable trend.

Regarding its future direction, the following possibilities can be anticipated:

First, Tether may choose an "offshore ecological niche" strategy, actively avoiding countries and regions with strict stablecoin regulations, and instead indirectly participate in local markets through intermediary mechanisms;

Second, if the company cannot break through compliance bottlenecks, it may face systemic risks due to a loss of market trust, ultimately being squeezed out of the mainstream market by other compliant stablecoin issuers;

Third, it may maintain a "lukewarm" status—given that there are still some regulatory gray areas in stablecoin issuance, USDT may still have room for existence in specific scenarios where it has penetrated early, neither abruptly exiting the market nor being able to regain a dominant position in the global market.

Additionally, the Crypto Law team notes that the GENIUS Act and Hong Kong's Stablecoin Ordinance, which will take effect on August 1, share common characteristics: both are centered on "stablecoin issuance rules" as the core legislative direction and aim to maximize the protection of investors' legitimate rights and interests through corresponding redemption systems and mandatory disclosure requirements for stablecoin issuers. Therefore, although the regulatory details for stablecoin issuance differ between the two regions, investors' rights can be strictly protected.

This represents the personal views of the author and does not constitute legal advice or opinions on specific matters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。