Chicago Board Pushes SEC to Speed Up Crypto ETF Approvals

The Chicago Board Options Exchange has taken a major step toward streamlining the approval process for cryptocurrency ETFs in the United States.

In a recent filing with the U.S Securities and Exchange Commission (SEC), CBOE news proposed a rule that could significantly cut down the time needed to list new crypto ETFs. If it gets approved the issuers would no longer have to go through the lengthy 180 day application process.

CBOE news Push for a Uniform ETF Framework

CBOE submitted a 19b-filing that requests the SEC to allow a standardized listing process for crypto which includes commodity based trust shares like spot Bitcoin ETFs and similar offerings.

The proposed rule will eliminate the need for individual approvals for every new ETF and allow users to list their products faster once they meet the mentioned criteria.

Industry analysts believe that this move could reshape the ETF landscape and give competition to CBOE news over rivals like Nasdaq and NYSE.

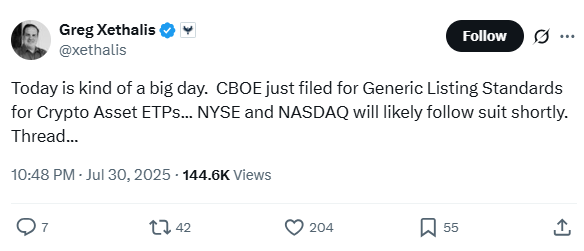

Recently, James Seyffart, research analyst at Bloomberg has shared the CBOE news on his X handle, he said that “the framework and Generic listing standards we have been looking for with regards to digital assets in an Exchange Traded Fund wrapper. That is a big deal!”

Source: X

Potential Impact on Crypto ETF Timelines

The SEC currently has up to 240 days to issue a decision on the proposal. This development follows reports that suggest that the Exchange Commission is exploring ways to reduce the listing time for Exchange Traded Fund to as little as 75 days and replacing the currently lengthy process.

If CBOE news request is accepted it could open doors for faster market entry of

Various digital asset based on it including the future tied to altcoins like Solana and XRP.

Key Provisions of the Proposed Amendment

According to the filing, any underlying asset must have an existing contract on a designated contract market for at least 6 months before its listing. The proposal also includes requirements for staking and liquidity risk management programs.

This ensures that at least 85% of assets remain available for redemption . Experts like Greg Xenthalis from Duke Law School suggest that the rule change could qualify Solana for listing as early as October 10 if approved.

Source: X

Recently , CBOE BZX also filed with the SEC to launch a new ETF that will track the Injective (INJ) token's market performance.

Conclusion

CBOE news latest proposal shows the growing momentum for crypto in the U.S market. With the recent SEC approvals for in-kind redemptions on Bitcoin and Ethereum ETFs , the regulatory environment appears to be softening

Also read: CoinDCX Cryptocurrency Theft: Rahul Agarwal the Real Mastermind?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。