September Rate Cut Odds Fall: Will Trump Take Action Against Powell?

Federal Reserve Holds Rates Steady, Signals Caution

On July 30, 2025, the Federal Reserve Chair Jerome Powell conducted a press conference after the Federal Open Market Committee (FOMC) meeting . The Fed voted to maintain the interest at between 4.25 and 4.5%. This was decided because the economy was experiencing deceleration in growth, but still had good job market conditions.

Powell pointed out that inflation remains above the 2% target of the Fed, but has since declined to what it was before. The Federal is still concerned with its dual mandate of maximising employment and stable prices.

Source: X

Economic Overview by Chair Powell

Economic Growth: The economy of the United States expanded at a rate of 1.2% in the first half of 2025, which is a decline compared to 2.5% in 2024. Although the second quarter recorded a better 3% growth, this has been attributed partly to the volatile trade figures.

Labour Market: Employment is stable as the average monthly payroll job growth stood at 150,000. The unemployment level remained low at 4.1%, which indicated a good job market that was close to full employment.

Source: X

Inflation Trends: This has decreased since the middle of 2022, but it is still a bit higher. The core Personal Consumption Expenditures (PCE) index, which does not include food and energy, increased 2.7% in the last year. Prices are rising with services inflation slowing down, but tariffs are raising prices of some commodities.

Market Reaction: Split FOMC Vote and Rate Cut Expectations

According to the Powell statement, vote of the FOMC was 9-2 , the biggest divide of the members in more than 30 years. This split points to confusion on the monetary policy direction.

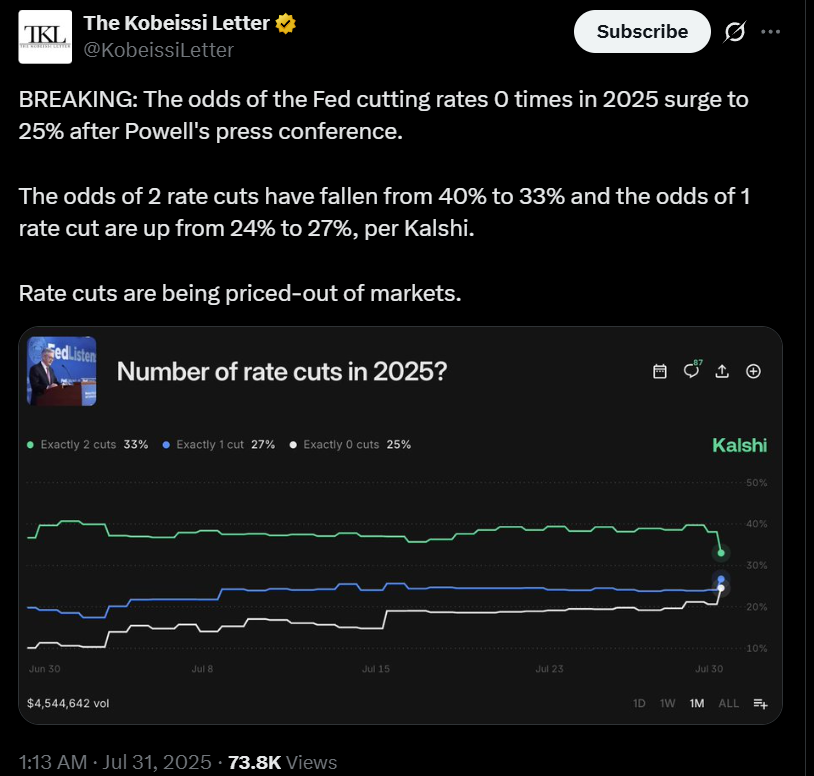

After the remarks of Powell, the market expectations of rate cuts in 2025 have changed significantly:

-

The probability of zero rate cuts in 2025 increased steeply to 25%.

-

The probability of two rate cuts decreased by 40% to 33%.

-

The probability of a single rate reduction rose by a small margin to 27% as compared to 24%.

Source: X

Such developments indicate that reductions are increasingly becoming less likely, with investors considering the risks of inflation and the deceleration of economic growth.

Why Are Rate Cuts Being Priced Out?

There are a number of reasons that are shaping a more conservative attitude:

-

The risks of inflation are still present, particularly due to tariffs that increase prices in certain sectors.

-

The pace of economic growth has been reduced, although not to the extent that would persuade the Fed to relax policy just yet.

-

The Fed does not want to allow a temporary increase in prices to become sustained inflation.

-

Doubt as to the long-term economic effect of government policy, such as tariffs.

Powell emphasised that the Fed will maintain long-term inflation expectations anchored and that the Fed will act swiftly should the need arise.

Looking Ahead: What to Expect from the Fed?

The Federal Reserve will be keen on the incoming economic data in the next few months before deciding on the interest. As per Powell, Debates over the monetary policy framework of the Federal and the possible revision of strategies are underway, and they should end in late summer. They try to achieve a balance between promoting employment and avoiding the occurrence of inflation once more.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。