In-depth analysis of key players and potential trends in the Korean won stablecoin, stepping into the future landscape of the Korean won stablecoin.

Written by: Deep Tide TechFlow

With the implementation of the "GENIUS Act," the United States' scheme to consolidate the dollar's hegemony through stablecoins has officially entered a "legally binding" phase. While dollar stablecoins attract global attention, a global competition for a multipolar monetary system centered around stablecoins is unfolding, vying for monetary discourse power in a new economic and trade landscape.

In the Western world, dollar stablecoins lead the market, with euro and pound stablecoins blooming in various forms; in the Eastern world, apart from the highly anticipated Hong Kong dollar stablecoin, the Korean won stablecoin is experiencing unprecedented development opportunities in the crypto-rich land of South Korea:

On one hand, there is strong support from the new president: As the 21st president of South Korea elected in June this year, Lee Jae-myung has promised to build a stablecoin system anchored to the Korean won as a strategic tool to prevent capital outflow and strengthen the financial sovereignty of the local currency.

On the other hand, there is a strong response from the Korean crypto market: Major players including Samsung SDS, LG CNS, and eight major banks in South Korea have announced plans to issue Korean won stablecoins, while the representative public chain project Kaia has announced plans to collaborate with super applications like Kakao Pay and LINE NEXT to launch a Korean won stablecoin.

Once the news was announced, Kakao Pay's stock price surged nearly 30%, and Kaia's eponymous token $KAIA saw a 24-hour increase of over 20%, reflecting the market's optimism and expectations for Kaia as the top seed for the Korean won stablecoin.

With the support of the "Myeong-ro" policy, will the Korean won stablecoin seize the opportunity to rise?

In the face of a competitive environment with many contenders, why is Kaia, which shouts "Stablecoin Summer," considered a necessary infrastructure for promoting the Korean won stablecoin to the world?

This article aims to deeply analyze the key players and potential trends of the Korean won stablecoin, stepping into the future landscape of the Korean won stablecoin.

New president, new cycle, the Korean crypto-rich land is witnessing a melee over the Korean won stablecoin

The Korean market is calling for the Korean won stablecoin.

Faced with the unshakeable realities of slowing economic growth, depreciation of the Korean won, low interest rates, weak performance in real estate and the stock market, and class rigidity limiting upward mobility for young people, the Korean public is looking forward to a financial disruption that can change the status quo;

And stablecoins, as the new president Lee Jae-myung stated, are an effective measure to prevent Korean wealth from flowing overseas through dollar-denominated digital assets.

Statistics show that in the first quarter of 2025, digital assets transferred overseas from Korean crypto exchanges reached approximately 56.8 trillion won, with stablecoins accounting for about 47.3%. This highlights the demand from Korean investors for the efficient capital flow represented by stablecoins, but it has also raised systemic concerns in Korea regarding monetary sovereignty, security compliance, and foreign exchange outflow.

However, it is worth noting that while capital is flowing out, the Korean won has continued to strengthen against the dollar, appreciating by about 6.5% in 2025. This contrast further indicates that Korean investors are not favoring dollar stablecoins, but rather lack alternative options priced in Korean won in the dollar-dominated crypto market, making the Korean won stablecoin an important avenue for realizing the return of financial sovereignty.

Korea has an unparalleled "national foundation" for stablecoins.

As the crypto capital of the East, South Korea is not just a name without substance.

According to the Bank of Korea's "Annual Payment Settlement Report," as of April 2025, 25 million people have opened accounts at virtual asset exchanges to invest in cryptocurrencies. Considering that South Korea's total population is about 51 million, the proportion of crypto users is nearly 50%.

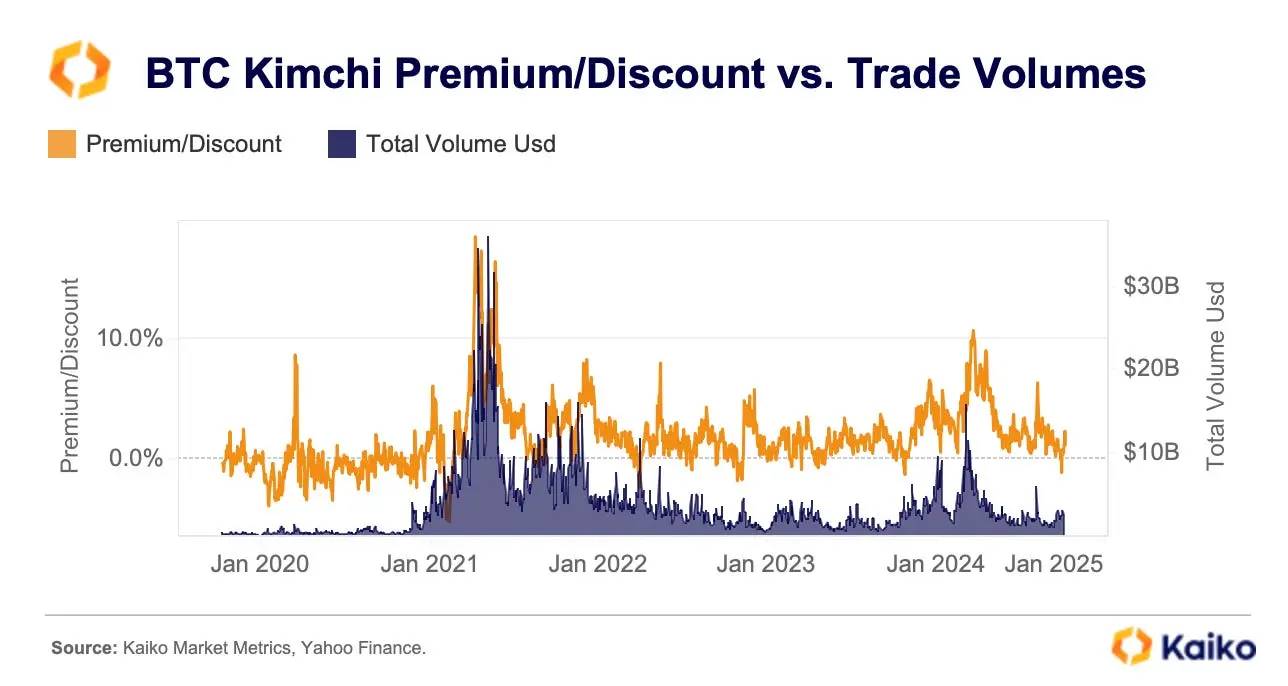

With a large base of crypto users, the enthusiasm for trading is equally high: statistics show that the five major domestic crypto exchanges in Korea manage a total of $73 billion in assets, with a daily average trading volume exceeding $10.7 billion in December, surpassing the two major Korean stock exchanges. Meanwhile, many are aware of the unique "kimchi premium" in the Korean crypto market, where cryptocurrency prices on Korean exchanges are 3% to 10% higher than on other major global exchanges, reflecting the high enthusiasm of local investors and the arbitrage demand under capital controls.

This fascinating bidirectional choice between the Korean won and stablecoins presents a strategic plan for the new president Lee Jae-myung, who sees supporting stablecoins not only as a choice in line with public sentiment but also as a strategy to revive the "Miracle on the Han River."

As a crypto-friendly president, stablecoins are a key focus of Lee Jae-myung's series of crypto commitments.

During the election phase, Lee Jae-myung advocated for the Korean won stablecoin, promising to build a stablecoin system anchored to the Korean won as a strategic tool to prevent capital outflow and strengthen the financial sovereignty of the local currency.

After officially taking office, on June 10, the ruling Democratic Party of Korea, under the leadership of the new president Lee Jae-myung, formally proposed a draft of the "Basic Law on Digital Assets," intending to allow qualified domestic companies to issue stablecoins. The approval authority for stablecoin issuers will be transferred from the Bank of Korea (BOK) to the Financial Services Commission, and the capital requirement for stablecoin issuers will be reduced from 5 billion won to 500 million won. This move marks that Korea may become the first major economy in Asia to officially open up the issuance of stablecoins by non-bank institutions, and the significantly lowered threshold further stimulates competition for domestic Korean won stablecoins.

In the face of unprecedented opportunities for the Korean won stablecoin, many local giants and banks in Korea are gearing up:

Due to the profound impact that stablecoins may have on monetary policy and transaction settlement systems, the Bank of Korea has responded promptly to the Korean won stablecoin. According to South Korean media "Economic Review," eight major banks in Korea plan to prepare to establish a joint venture to issue Korean won stablecoins, including Kookmin Bank, Shinhan Bank, Woori Bank, Nonghyup Bank, Korea Development Bank, Suhyup Bank, Citibank Korea, and Standard Chartered Bank Korea.

At the same time, major Korean conglomerates are also taking action: Samsung Group's IT solutions and system integration subsidiary Samsung SDS has launched Nexledger as an enterprise-level private chain solution, which can provide stablecoin issuance or custody services; additionally, LG's IT solutions and system integration subsidiary LG CNS possesses core capabilities in minting, clearing, auditing, and custody of on-chain asset management, which may make it a major beneficiary in the competition for the Korean won stablecoin through technological output.

Since announcing that the team will fully promote the deployment of the Korean won stablecoin, Kaia has become the top seed in many people's minds capable of driving the large-scale adoption of the Korean won stablecoin in the real world and leading it to the world.

How does Kaia stand out among a host of strong competitors?

Capital + Scenario Dual-Drive: The Unique Advantage of Asia's Top Web3 Ecosystem Kaia

The competition for stablecoins is fierce, and the key factors for the success of stablecoins are gradually becoming clear through multiple rounds of competition:

Compliance: A necessary prerequisite for sustainable development in a stable and trustworthy environment

Technology: The foundational base for the large-scale adoption of the Korean won stablecoin

Distribution: The key to quickly building a circulation network and realizing the practical application of the Korean won stablecoin

In terms of compliance, as the largest public chain project in Korea, Kaia has no worries.

Since regulatory intervention in 2017, the compliance of the Korean crypto market has undergone multiple evolutions, and Kaia has consistently embraced compliance, fully adhering to South Korea's regulations on crypto taxation, anti-money laundering, and DeFi regulation. As the Korean government’s monitoring of stablecoins becomes clearer, Kaia continues to provide financial services with a legal identity.

As Kaia Foundation President Seo Sang-min stated: Kaia understands Korean regulations and institutional positions better than overseas teams, thus being in a leading position in regulatory compliance, which is very beneficial for the Korean won stablecoin.

In the closely connected Japanese market, Kaia has also become an official member of the Japan Blockchain Association, being the first Layer 1 project to achieve this qualification.

In the future, as Kaia rolls out multiple layouts in the stablecoin space, more compliance measures are being systematically advanced globally, aiming to clear obstacles for promoting the Korean won stablecoin to the world.

In terms of technology, high performance, low barriers, and a smooth experience with integrated social attributes are Kaia's standout advantages.

Kaia envisions "providing infrastructure for consumer Dapps in payment, gaming, and social fields," all of which are characterized by high frequency, putting a significant test on foundational performance.

Kaia is formed from the merger of the Klaytn chain and the Finschia chain, showcasing a strong advantage in integration: as an Ethereum-compatible L1 public chain, Kaia's Istanbul BFT consensus framework is a further optimization based on Klaytn IBFT, enabling rapid final confirmation of blocks and supporting multi-node participation.

According to official documentation, the Kaia network can process up to 4,000 transactions per second, with a block generation time of just 1 second, and it features instant transaction certainty, meaning once a block is produced, it is final and there is no risk of traditional block rollback, providing a fast, efficient, and secure trading experience.

With the backing of the two major social platforms LINE and KakaoTalk, Kaia has rich and unique technical accumulation in smoothly converting Web2 users to Web3 users:

On one hand, Kaia supports features like account abstraction and Gas Fee delegation, significantly simplifying the user experience;

On the other hand, by integrating with LINE and KakaoTalk's identity and payment channels, Kaia opens the door for Web2 users to seamlessly explore the Kaia ecosystem with one click, allowing ordinary users to deeply explore the crypto world without additional registration.

Having discussed compliance and its advantages, let's now focus on distribution.

It can be said that stablecoin projects with technological and compliance advantages may not succeed, but stablecoin projects without distribution advantages will certainly not succeed, because the ultimate significance of issuing stablecoins is effective circulation.

In terms of distribution, Kaia possesses unparalleled advantages in promoting the practical circulation of stablecoins in households and integrating into rich consumer-level scenarios, whether it be user reach, resource integration, or landing scenarios.

Circulation requires users.

Kaia is formed from the merger of the Klaytn chain and the Finschia chain. Klaytn is backed by Kakao Talk, the most popular instant messaging application in South Korea, which has a penetration rate of nearly 95%. Finschia is supported by LINE, the most popular communication platform in Japan, which has over 200 million users across markets such as Japan, South Korea, Taiwan, and Thailand. The strong distribution capability brought by the cumulative user base of over 250 million from these two social platforms enables Kaia to effectively promote the Korean won stablecoin to hundreds of millions of Asian users.

Circulation also requires scenarios.

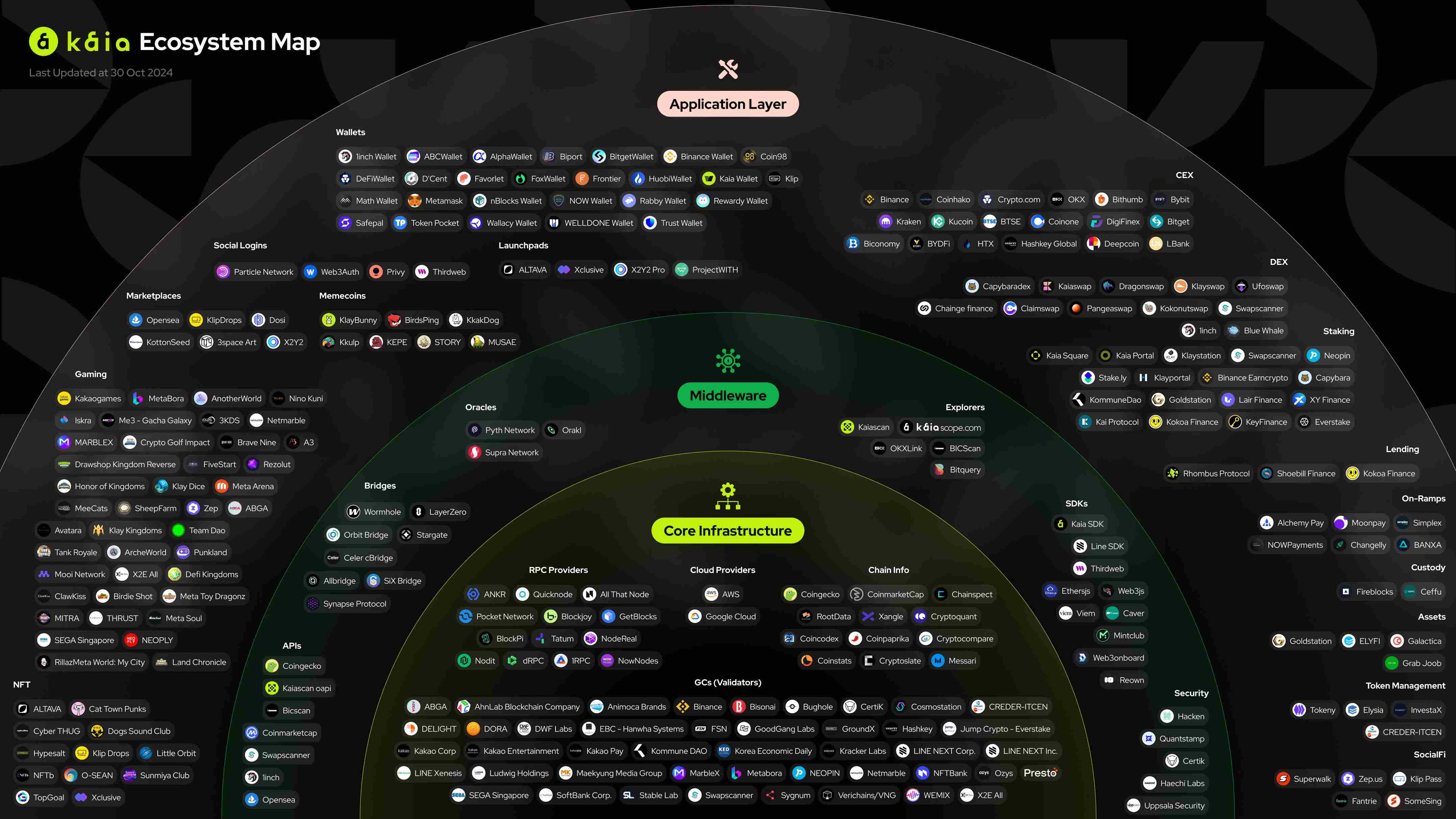

On one hand, after years of deepening its ecosystem, Kaia has built a vast and rich ecological matrix, leveraging Kakao Talk and LINE to educate and convert 250 million users.

Currently, Kaia has become one of the largest Web3 ecosystems in Asia, with ecological projects covering thousands of projects across multiple sectors such as DeFi, gaming, RWA, social, and NFTs, providing rich scenario support for the implementation of the Korean won stablecoin.

One of the most talked-about aspects is the impressive performance of Kaia Mini Dapps, which leverage mini-games: as decentralized applications (dApps) running on the LINE messaging platform, Kaia Mini Dapps quickly gathered over 65 million users within less than a year, with monthly transaction volumes exceeding 30 million. Users can seamlessly discover, download, and explore various dApps under the Kaia ecosystem through the Dapp Portal, enjoying reward mechanisms and conducting asset transactions.

Since the launch of the Dapp Portal, the number of newly created wallets on the Kaia blockchain has exceeded 100 million, with on-chain active users growing by over 280%, reaching nearly 9.5 million. With the support of Kaia's series of support programs, the number of developers, users, and transaction volumes around Kaia Mini Dapps continues to grow rapidly.

On the other hand, with its strong resource advantages and exceptional resource integration capabilities, Kaia is regarded as the only platform in South Korea currently capable of promoting the widespread adoption of the Korean won stablecoin in the real world.

It is important to note that Kaia has received clear support from the two social giants, Kakao Talk and LINE, both of which are backed by top-tier capital from Japan, South Korea, Europe, and the United States.

The company behind Kakao Talk is itself a South Korean internet giant, Kakao, which operates in multiple sectors including social, payment, and entertainment. In February 2023, Kakao announced the acquisition of a 9.05% stake in South Korea's most renowned entertainment agency, SM Entertainment, becoming its second-largest shareholder.

The strength behind LINE is equally formidable: its parent company, NAVER, is currently the largest information technology company in South Korea. Previously, it was reported that the vice chairman of South Korean semiconductor company Hanmi Semiconductor, Kwon Dong-sin, personally invested 31 billion won in LINE Next, acquiring an 8.5% stake.

It is worth mentioning that NAVER, the parent company of LINE, was formerly known as the South Korean group NHN, which owns South Korea's largest search engine NAVER and the online gaming site Hangame as its two pillar businesses. Moreover, the founder of Kakao Talk, Kim Beom-soo, is not only the founder of South Korea's largest gaming platform Hangame but also served as the CEO of NHN, later competing with Kakao and NAVER for dominance in the South Korean internet space.

Additionally, Kaia's supporters include Crescendo Equity Partners, a South Korean private equity firm sponsored by PayPal's "father" Peter Thiel, with major investors (LPs) including the National Pension Service of Korea, the Korean Teachers' Credit Union, the Korea Development Bank, and Korea Growth Finance.

In the intricate competitive relationship between giants, the fact that multiple major players have chosen to bet on Kaia not only reflects institutional confidence in Kaia but also signifies the convergence of more resources towards Kaia.

In fact, Kaia has already demonstrated its immense potential to penetrate consumer-level scenarios through social channels: KakaoTalk integrates KakaoPay, allowing users to remit money through KakaoPay, while LINE Pay has become one of the most popular cross-border payment methods in regions such as Japan, Thailand, and Taiwan.

Kaia has achieved integration with LINE and KakaoTalk's identity and payment channels, effectively enabling one-click integration of landing payment scenarios for LINE and KakaoTalk. The capital backing Kaia further promotes the expansion of its Korean won stablecoin into consumer scenarios such as tourism, fan economy, crypto cards, and crypto ATMs, providing a natural advantage for the real-world application of the Korean won stablecoin.

In April 2025, the Kaia Foundation announced a new round of financing, led by well-known VC firms 1kx and Blockchain Capital, with participants including Galaxy Digital, The Spartan Group, IDG Capital, Mirana Ventures, SNZ Holding, Comma3 Ventures, Caladan, Lingfeng Capital, Waterdrip Capital, and MEXC Ventures.

This financing aims to accelerate Kaia's development in business strategy formulation, collaboration on Kaia ecosystem projects, connections with traditional financial enterprises like Visa, content and marketing support, and provide in-depth support for Kaia's expansion in international markets, compliance framework construction, and ecosystem cooperation networks. By sharing business networks through institutional support, Kaia will further realize its logic of landing consumer-level scenarios while strengthening its influence in the global market.

With advantages in distribution, technology, and compliance, Kaia has become the top contender for the Korean won stablecoin in the eyes of many. While shouting the slogan "Stablecoin Summer," we have also seen Kaia's forward-looking layout and clear planning for the stablecoin track based on a series of recent initiatives.

Aiming for the target: Introducing native USDT as the first step in stablecoin strategic layout

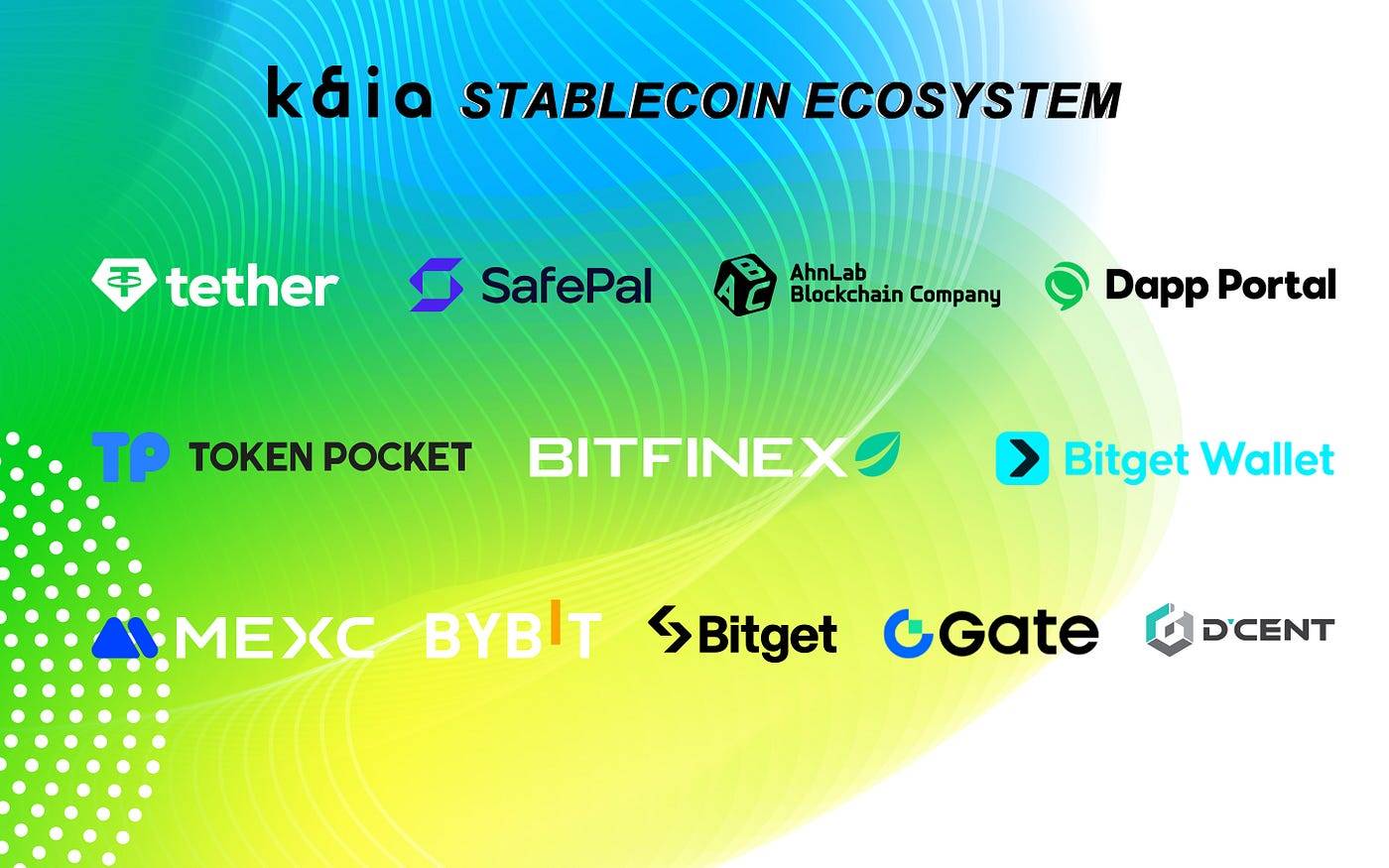

As a key milestone in the stablecoin sector of the Kaia ecosystem, Tether's native deployment of its stablecoin USDT on the Kaia blockchain marks the first chapter of Kaia's stablecoin strategic planning.

In May 2025, Tether officially issued native USDT on the Kaia chain. Unlike traditional USDT transferred through cross-chain bridges, Kaia's USDT is fully deployed in the form of native contracts on the Kaia network, directly managed and issued by Tether, ensuring real-time parity with 1:1 dollar reserves, further ensuring transaction speed, security, and accessibility. Kaia users can directly use the stablecoin for payments and cross-border transfers in their daily chat interface.

Surrounding USDT, Kaia has rapidly built a diversified application scenario through continuously improving its rich partnerships:

Currently, multiple partners, including Tether, Dapp Portal, Bybit, Bitfinex, Bitget, Gate, MEXC, Flipster, Holdstation, Bitkub, Coins.ph, Crypto.com, D’CENT, TokenPocket, and Bitget Wallet, have supported USDT-KAIA, providing users with diverse asset entry and exit channels, and effectively promoting Kaia's stablecoin services to reach a broader user base and richer application scenarios.

In addition to its special functionality, the native USDT on Kaia is even more exciting for its real consumer-level scenario implementation:

On July 30, the Kaia DLT Foundation announced a partnership with blockchain financial technology company DaWinKS, which officially supports the use of USDT issued by Kaia at its digital ATMs (DTMs) located at major tourist landmarks in South Korea.

This means that when you travel to South Korea, you don't even need to pre-book a bank exchange for Korean won; when you want to make a purchase, whether it's skincare products, idol merchandise, coffee, or cosmetic procedures, you can directly withdraw your USDT on the Kaia chain as Korean won through DaWinKS's ATMs (DTMs).

Alternatively, you can activate a prepaid card to achieve seamless integration between virtual assets and real payment scenarios: this card supports 85 fiat currencies from 15 countries, and before leaving the country, users can also exchange any remaining cash for US dollars. The exchange rate for digital asset conversion is calculated based on real-time daily rates.

Currently, DaWinKS has set up ATMs (DTMs) at seven landmark locations, including N Seoul Tower, Homeplus (Hogye and Centum City stores), Lotte Mart (Gwangbok store), LIFEWORK flagship store in Myeongdong, Myeongdong Money Club, and Namdaemun Exchange Café, with plans to gradually promote it in major Lotte Mart stores nationwide for broader user coverage.

In simple terms, Kaia is like the Asian version of PayPal, and the native USDT of Kaia, including the upcoming Korean won stablecoin, can be compared to PayPal's PYUSD, rapidly capturing the consumer market with its powerful business landscape.

Doesn't that sound incredibly attractive?

In fact, as the first step to ignite the "Stablecoin Summer," many view the application of native USDT within the Kaia ecosystem as a prelude to the arrival of the Korean won stablecoin, providing an important demonstration for the issuance, circulation, and implementation of the Korean won stablecoin.

With Kaia's in-depth exploration of the Korean won stablecoin alongside super applications like Kakao Pay and LINE NEXT, the true "Stablecoin Summer" is about to unfold.

Multiple Measures: Kaia Quickly Steps into "Stablecoin Summer"

Centered around USDT, Kaia will promote more plans in the future:

On one hand, the Gas abstraction feature is expected to launch in August 2025 and will gradually be integrated as a native function into dApps and wallets within the ecosystem. This feature allows users to pay transaction fees using various supported tokens, serving as a key infrastructure for achieving real-time global stablecoin payment experiences.

With the combination of native stablecoins and Gas abstraction, Kaia further becomes a zero-threshold entry point for Web3, helping users easily experience Web3 in daily scenarios such as social interactions, payments, and mini-games. Since its official launch two months ago, the transaction volume of USDT on the Kaia chain has already exceeded 2 billion, and with the launch of the Gas abstraction feature, Kaia USDT may welcome rapid growth in the next phase.

On the other hand, Kaia will continue to enhance the accessibility and practicality of USDT within the Kaia ecosystem, with specific measures including but not limited to continuously gaining support from more exchanges and wallets, achieving seamless transactions of USDT within LINE Mini DApp, and promoting USDT as a payment method for consumer applications in the Kaia ecosystem.

The series of measures announced so far has sparked unlimited imagination among the public regarding the future of Kaia's stablecoin:

It is important to note that under the current South Korean policy, only payment-type stablecoins are supported, and paying interest or returns to holders is prohibited. As a representative of compliant crypto projects in South Korea, Kaia announced a partnership with the cryptocurrency derivatives trading platform Flipster to celebrate the launch of Kaia's native USDT on Flipster with related themed activities. Withdrawals from the Kaia network not only incur zero fees but also allow users to earn an APR of up to 127%. Does this mean that Kaia is leading the South Korean market in exploring the future of "compliant interest-bearing stablecoins"?

Additionally, Kaia places particular emphasis on exploring the application of USDT in DeFi, RWA, and other scenarios, focusing on innovative DeFi projects such as on-chain perpetual futures based on USDT and promoting the deep integration of USDT with ecological RWA.

Kaia has never stopped its efforts in building RWA. The Kaia blockchain encompasses various real-world assets, such as gold, ships, and real estate. Previously, it was reported that the Kaia Foundation collaborated with an Indonesian shipping company to launch a ship RWA tokenization project, utilizing tokenization technology to optimize the ship purchasing process and enhance fundraising efficiency. In the future, Kaia also plans to launch fiat-backed stablecoins and bonds on-chain, expanding the range of assets available to developers.

In the current context of traditional institutions entering the market en masse and RWA thriving, will stablecoins + RWA yield products that can achieve real returns based on real scenarios become a new DeFi hotspot for Kaia?

Of course, the most noteworthy aspect of Kaia's stablecoin strategy is the Korean won stablecoin.

Previously, Kaia Foundation President Xu Shangmin and LINE NEXT CSO Kim Woosuk recently stated in an interview with the Daily Economic News:

"We are discussing stablecoins with domestic financial companies in South Korea. The discussions are still in the early stages, but we will develop stablecoin infrastructure in a user environment familiar to Koreans through strong cooperation with Kakao and LINE."

In the face of the fierce competition for the Korean won stablecoin among major giants in South Korea, especially the competitive advantages of banks, the president of the Kaia Foundation shared unique insights:

"Stablecoins issued by banks may be trustworthy, but they lack creativity. A model where the private sector develops technology and banks are responsible for anti-money laundering would be a good choice."

Indeed, Kaia's plan for the Korean won stablecoin is still in a very early stage, but Kaia's ambition to fully promote the issuance of the Korean won stablecoin, inject more liquidity anchored to real assets into the ecosystem, and accelerate the popularization and implementation of local Web3 applications in South Korea is already evident, and relevant preparations are underway.

According to South Korean media Naver News, Kaia will officially launch the first "Korean Stablecoin Hackathon" event on August 1 in collaboration with Tether, KakaoPay, and LINE NEXT. This event focuses on two directions: the Korean won stablecoin ideathon and application development based on Kaia-USDT, aiming to promote the development of compliant stablecoins and Web3 fintech in South Korea.

Participants will have the opportunity to publish Mini dApps on LINE Messenger, which has 196 million users, and receive VC review opportunities provided by Simsan Ventures and Kaia Wave, with a total prize pool of up to $72,500.

As the top contender for the Korean won stablecoin, Kaia's advantages are particularly prominent: on one hand, Kaia has built an integrated layout of "on-chain + social + payment" through cooperation with super applications like Kakao Pay and LINE NEXT, bringing a solid user base, a strong distribution network, and rich consumer application scenarios; on the other hand, since its merger with Klaytn and Finschia in August 2024, Kaia has shown strong growth momentum, and this growth trend will continue to be maintained in Kaia's diversified ecosystem building efforts. All of this lays a solid foundation for Kaia in promoting the global expansion of the Korean won stablecoin.

Although achieving the true implementation of the Korean won stablecoin will still require Kaia to face challenges such as further clarity on the compliance direction of the South Korean government, the keen competition from various rivals including the Korean Bankers' Alliance, and the rapid and effective realization of its roadmap, the curtain of "Stablecoin Summer" is gradually rising, and a global development path centered on the Korean won stablecoin is already unfolding. With the deepening exploration of stablecoins, Kaia has, in many ways, become an important force in promoting the Korean won onto the world stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。