Cryptocurrency revenue grew 98% to $160 million, becoming the main driver of performance growth.

Written by: Long Yue

Source: Wall Street Insight

With the boost from the cryptocurrency trading boom, "American internet celebrity brokerage" Robinhood delivered a quarterly report that exceeded market expectations.

According to the statement released by the company on Wednesday, its total net revenue for the second quarter increased by 45% year-on-year to $989 million, surpassing the average analyst expectation of $921.5 million.

Among these, digital currency trading revenue became the biggest highlight, surging 98% year-on-year to $160 million, nearly doubling, and just slightly below the analyst expectation of $162.1 million. This performance ended a record of three-digit growth for five consecutive quarters.

The company's net profit also performed impressively, doubling expectations to $386 million, or 42 cents per share.

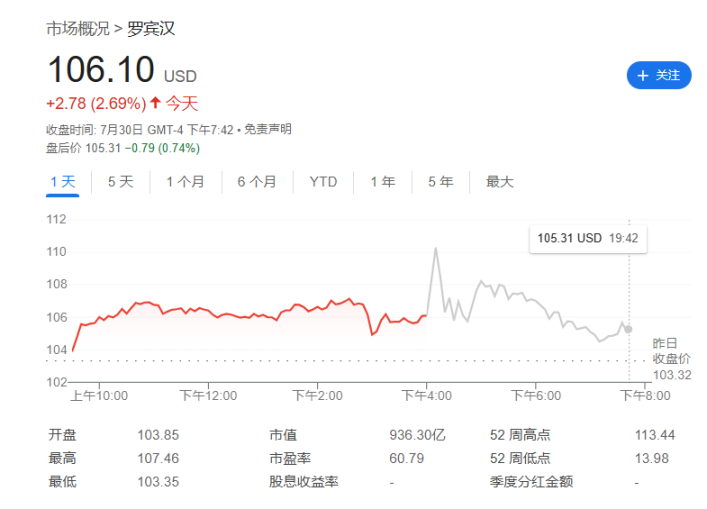

Boosted by the performance, Robinhood's stock price rose 3.34% in after-hours trading, but later turned to a decline of 0.7%. Its cumulative increase for the year has reached 185%.

Company executives expressed optimism about the outlook. Chief Financial Officer Jason Warnick stated in the announcement, "July has started off well for the third quarter, with net customer deposits accelerating to about $6 billion, and various trading activities remain strong."

Tokenized Stock Business Draws Regulatory Attention

Robinhood is accelerating its innovative steps in the cryptocurrency field.

In June of this year, the company began offering "tokenized" stocks to 150,000 customers in 30 countries across Europe. CEO Vlad Tenev described this move as "the biggest innovation in our industry in the past decade."

However, this business quickly attracted scrutiny from European regulators.

A previous article from Wall Street Insight noted that Robinhood's tokenized stock trading business allows European retail investors to purchase tokens linked to equity in unlisted companies like OpenAI and SpaceX. However, this move faced strong opposition and warnings from OpenAI, and also caught the attention of European regulatory authorities, with the Bank of Lithuania launching an investigation into Robinhood's stock token products.

Sticking to a Partnership Model with Banks

Amid the trend of fintech companies applying for banking licenses, Robinhood has chosen a different path. Tenev stated during Wednesday's analyst conference call that he prefers to collaborate with banks rather than becoming a bank directly.

"The downsides of obtaining a banking license outweigh the benefits," Tenev said. He revealed that Robinhood is working with the fintech-friendly Coastal Community Bank to launch bank-like products.

This strategic choice reflects the company's consideration of seeking a balance between rapid expansion and compliance risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。