Top Crypto News and Market Highlights You Shouldn’t Miss Today

Crypto News Update: Today's global crypto news cycle reflects a cautious market with key economic decisions ahead, record-breaking treasury buys, and major global tax policy shifts. The total market cap stands at $3.92 trillion, marking a 5.1% drop in the past 24 hours.

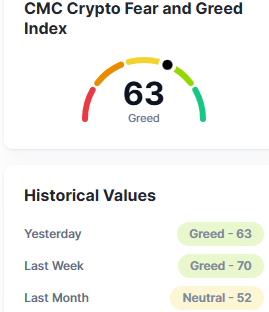

Investors are watching the crypto news and market closely, as daily trading volume reaches $138 billion. Bitcoin leads with a dominance of 59.8%, followed by Ethereum at 11.6%. Meanwhile, the Fear & Greed Index remains unchanged at 63, showing no shift in market sentiment since yesterday.

Source: CoinMarketCap

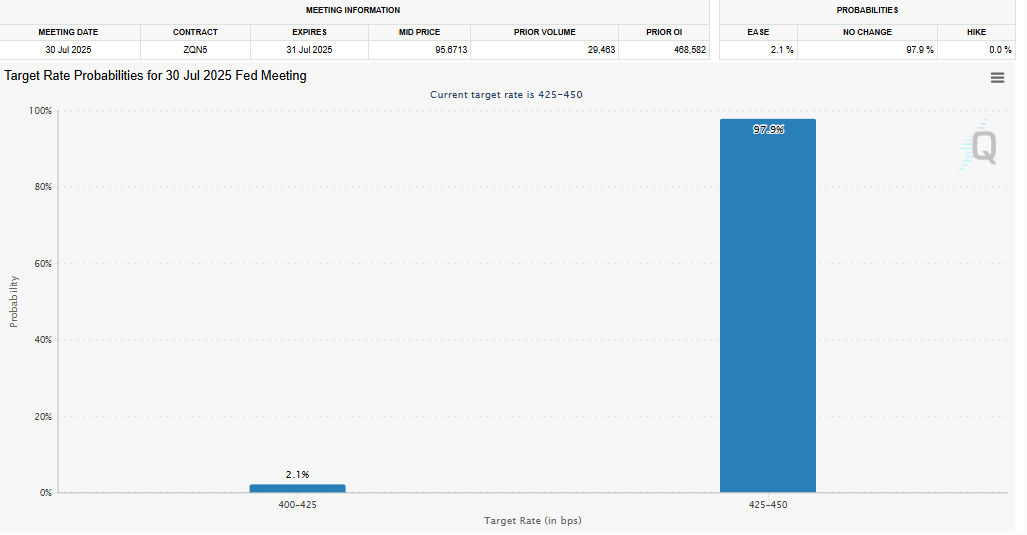

Fed Rate Cut Unlikely - Markets Wait for Powell's Judgment

The Federal Reserve is likely to leave interest rates as they are cautious of the strong GDP and labor data. CME FedWatch only indicates a 2% probability of a rate cut on July 30 . Although there has been political pressure from Donald Trump to reduce rates before the 2026 election, Fed Chairman Jerome Powell is still hesitant.

Bitcoin currently stands at $117,611, slightly down 1% within the last 24 hours, while Ethereum fell marginally by 0.21%, now standing at $3,832.49.

Although minimal, these changes are indicative of caution as the Crypto News responds to macroeconomic decisions.

Source: FedWatch Tool

Crypro News: Kraken Sees $500M Raise Before 2026 IPO

U.S. exchange Kraken is set to raise $500 million in order to increase its valuation to $15 billion prior to a 2026 IPO . This was revealed by Wu Blockchain and other reports. The co-CEO who joined in 2024, Arjun Sethi, will spearhead this strategic initiative.

A Trump administration that is more cryptocurrency-friendly has pushed Kraken's IPO plans. The SEC earlier this year dismissed a lawsuit against the exchange. Kraken also got licenses to issue electronic money and extend its services worldwide. Kraken has just launched its peer-to-peer app Krak and has been approved in Europe under the MiCA framework.

Source: X

Indonesia Raises Digital Assest Taxes - What You Need to Know

Indonesia's Finance Ministry rolled out new crypto tax regulations , which will become operative on August 1, 2025. Domestic exchange sellers' tax will increase to 0.21% from the current 0.1%, whereas sellers on foreign platforms will have to pay 1%, as against the previous 0.2%. VAT on mining for cryptocurrency has also been raised from 1.1% to 2.2%.

Buyers have benefited in a welcome change as VAT on purchases has been eliminated. The mining special income tax has also been eliminated, and as of 2026, mining income will be subject to ordinary personal or corporate tax provisions.

These are introduced with Indonesia's decentralised space exploding in 2024, with more than $39.6 billion in volumes of transactions and 20 million account users, outnumbering its stock investors. The government hopes to increase revenue, regulate tax compliance, and encourage trading on regulated exchanges.

Source: WuBlockchain

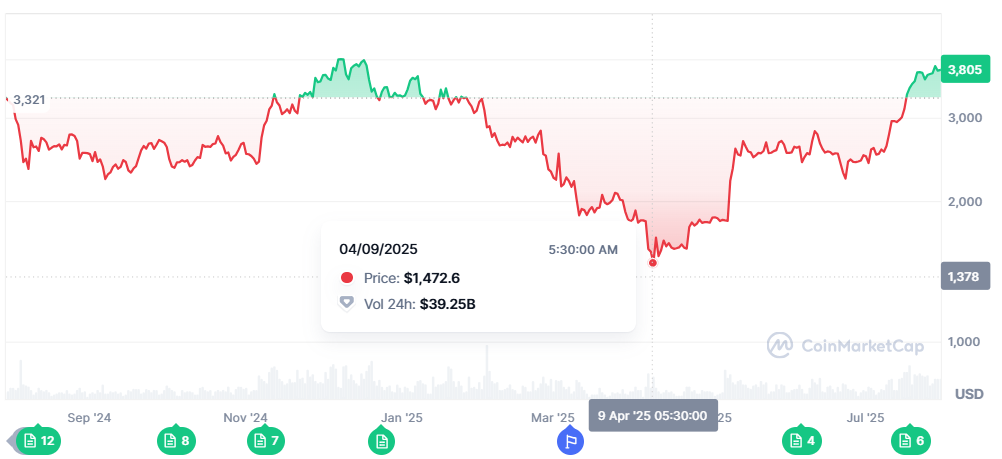

Ethereum Celebrates 10 Years – $300B Market Cap

It's Ethereum's 10th birthday today .Created by Vitalik Buterin, the network went live in 2015 after it had its ICO and raised $18 million. Today, with a market cap of $300 billion, it is the second-largest cryptocurrency after Bitcoin.

In the last 10 years, Ethereum has brought about large-scale innovations such as smart contracts, ERC-20 tokens, NFTs, DAOs, DeFi platforms, and Layer-2 networks. These have changed the way individuals develop and utilize blockchain applications.

As a way of celebrating this milestone, there is a free Ethereum Torch NFT that can be minted until July 31st. This special drop has also gained attention in today's crypto news.

Between the years 2017 and 2020, the price of Ethereum rose from $10 to $900, powering DeFi projects such as Uniswap, MakerDAO, and Compound. These platforms revolutionized trading, lending, and borrowing crypto without banks- altering the future of finance forever.

Sourc: CoinMarketCap

Strategy Bitcoin Buys $2.4B BTC - Largest of 2025

Strategy Bitcoin , previously MicroStrategy, has made headline in today's Crypto News by just purchased 21,021 BTC for $2.46 billion at an average price of $117,256 per token. It increases their holdings to 628,791 BTC, worth more than $456.8 billion.

IPO Proceeds Fuel the Acquisition

It was financed from its STRC IPO, which raised $2.521 billion—the biggest IPO in 2025 to date. STRC will begin trading on Nasdaq from July 30.

MSTR Stock Down, But Optimism Up

In spite of Strategy's stock falling below $400, the company is still optimistic about Bitcoin. With more than 25% BTC gains year to date, it is the leading largest BTC-holding public company, even overtaking NVIDIA in corporate treasury rankings.

Final Thoughts

Today’s crypto news reflects the maturity of the market. From central bank decisions and IPO plans to global tax policy and a decade of Ethereum, the crypto news is becoming tightly connected with traditional finance. Though price dips show short-term hesitation, the long-term signals—especially bold moves like Strategy’s BTC buy and Kraken’s IPO plan—show that market is still seen as the future of finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。