Trump Tariffs on India at 25% If No Deal Struck by August 1

U.S. President Donald Trump has made it clear that a trade deal with India is still not done.

Speaking to reporters, he said there would be Trump Tariffs on India of 20% to 25% on its exports to the U.S. if no deal is confirmed by 1st August. Trump called India “a good friend” but said it charges higher tariffs than almost any other country.

The warning comes after months of back-and-forth talks between the two countries. While both sides have made progress in some areas, the big issues remain unsolved. For now, the possibility of Trump Tariffs on India is putting pressure on the Indian government to act fast.

Tariff Deadline Puts Pressure on India

The country is currently one of the U.S.’s largest trading partners.

-

In 2024, trade between the two nations reached $190 billion.

-

However, the U.S. still has a trade deficit of $45 billion with India, that the US President wants to fix.

As per the reports from Reuters, Governement is preparing for the worst as this Trump Tariffs on India. If no deal is signed by the August 1 deadline, Indian exports could be hit with steep tariffs.

Officials in Delhi say that while they’re not offering new concessions now, they are aiming to secure a broader, long-term deal in the months ahead.

No New Offers, Core Sectors Off Limits

India has already reduced rates on some of the few U.S. products, like whiskey and motorcycles.

But it refuses to open up its farm and dairy markets. These sectors are considered too crucial to compromise on.

Commerce Minister Piyush Goyal has said the nation will always protect its farmers and local food supply.

This refusal has become a major sticking point. The U.S. wants the country to allow imports of American dairy and genetically modified crops, but got a straight no.

Because of this, the threat of Trump Tariffs on India still looms large.

Analysts Warn of Ripple Effects

Experts are cautioning that Indian exports will be hit if such tariffs are imposed. That may drive the rupee down and push prices up in the domestic market. It may also damage business sentiment, particularly among international investors. The

And although the tariff battle is one of trade, its impact may reach wider. Financial markets, including cryptocurrencies, tend to respond when large economies conflict.

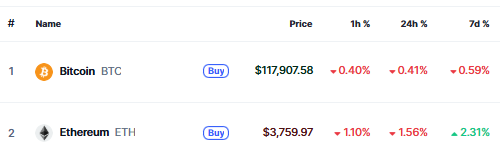

Previously, periods of uncertainty such as this have nudged Indian investors towards digital currencies like Bitcoin and Ethereum. The current global crypto market has a market cap of $3.86 Trillion and BTC is trading at $118,161 while ETH is trading at $3783.

Source: CoinMarketCap

Source: CoinMarketCap

What Does This Means for Crypto Investors?

If Trump Tariffs on India go into effect, they may lead to even more interest in crypto among Indian users. Weak rupee and uncertain economic prospects could urge people to hedge their savings with crypto. But if the economy falters, it will also lead to less trade and reduced volume in the short run.

Indian crypto investors need to keep a sharp eye. The next couple of days can determine the amount of pressure this trade tension will place on both the conventional as well as digital financial markets.

Also read: Syntax Verse Daily Quiz Answer 30 July 2025: Answer Inside!免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。