Author: arndxt, Crypto KOL

Compiled by: Felix, PANews

We are currently at the end of an extremely financialized cycle.

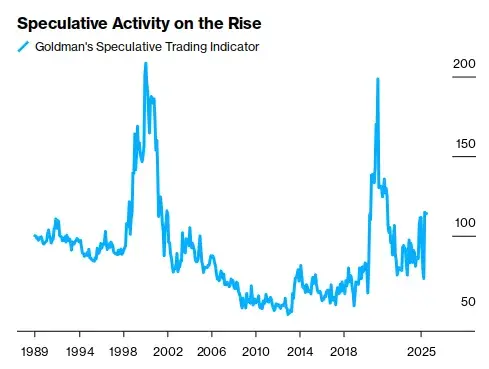

A certain altcoin can rise tenfold within a month, but may also drop 20% in a single day, while the crypto Twitter community reacts with surprise. We are in a bubble market, but the bubble is merely a surface phenomenon. The deeper issues lie in liquidity, distortions, and a civilization that is gradually collapsing under the weight of its own contradictions.

The S&P 500 index has reached a new high, and people are cheering. But if we take a step back, the so-called historical high is merely an illusion of liquidity, measured by a currency that has no support and is driven by inflation. Adjusted for inflation, the S&P index has made no progress since the 2000s. This is not "growth," but a chart of monetary supply.

Moreover, the Federal Reserve will not cut interest rates next week. The optimistic scenario is September; if the economic situation worsens, there may be a rate cut in December. But interest rate adjustments can no longer solve any problems. What we face now are structural issues, and only three things truly matter:

1. Slow Disintegration of the Debt System

The modern monetary order has reached its end. It is built on an ever-expanding debt base, and now it faces insurmountable internal contradictions. Old strategies (stimulus measures, bailouts, policy shifts) rely on a key illusion: the more debt, the greater the prosperity.

But this illusion is crumbling. Productivity growth has stagnated. Demographic structures are at odds with this system. The working-age population is shrinking, the dependency ratio is expanding, and consumption increasingly relies on credit rather than income. This machine is aging and can no longer self-repair.

Soros's theory of super bubbles is often misread as market analysis; in reality, it is a critique of epistemology—how false narratives support flawed systems. The 2008 crisis should have burst this myth. But it did not. The COVID-19 pandemic did, because the cost was moral. It has been proven that governments cannot protect their citizens in the most literal, biological sense. Many governments believe that survival is not equal for everyone.

The result is a decline in legitimacy. Today's institutions resemble facades supported by surveillance, subsidies, and psychological warfare. The Epstein case is not an anomaly but a brief revelation of the real structure: a system interwoven with crime, governance, and capital. The U.S. no longer conceals its corruption but monetizes it.

2. Intelligent Packaging

Discussions around Artificial General Intelligence (AGI) remain mired in naive optimism. Most people still believe that AI will be widely adopted like Excel or AWS, becoming a productivity tool and profiting through subscriptions.

This is an unrealistic fantasy.

If machines gain the ability to self-improve, simulate complex systems, and design new types of weapons—be they biological, chemical, or informational—they will not be open source.

Nuclear technology has not been democratized. CRISPR technology cannot be used indiscriminately. Every powerful technology ultimately becomes a tool of state governance, and superintelligence is no exception.

What Sam Altman implies, and what Jensen Huang quietly conveys through involvement in synthetic biology, is not about consumer productivity but about control over post-human trajectories. The multinational pharmaceutical company Moderna is a case in point; its upcoming products will not be sold at CVS pharmacies.

The public will not have access to AGI. The public will only interact with neutered fragments of AGI, encapsulated within user interfaces. The real systems will be hidden, restricted, and trained to serve strategic purposes. But this will not stop most people from harboring other ideas. However, belief cannot compete with infrastructure.

3. Time as the New Currency

So far, money can buy comfort, safety, and social status, but it cannot buy time. This situation is changing. As AI decodes genomes and the accelerated development of synthetic biology unfolds, we are moving towards an era where longevity becomes an engineered advantage.

But do not mistake this for a public health revolution. True longevity, cognitive enhancement, and embryo optimization will be extremely expensive, heavily regulated, and politically controversial. Governments are already overwhelmed by aging populations. They will not encourage longevity.

As a result, the rich will not only become richer but will also be biologically different, and not in a metaphorical sense. The ability to alter the human blueprint will create a new economic class: those who can escape the death curve through biotechnological patents.

Such a future cannot be scaled; it is a path of privilege. Longevity will become the ultimate luxury, priced only for a select few. This is why most "longevity funds" perform poorly. The return is survival, and survival cannot be scaled.

Fork in the Road: Three Civilizations Ahead

We are currently diverging into different tracks, each with its own political economy:

- Anesthetizing the masses (digital fentanyl): dopamine loops generated by AI, social media, virtual pornography, infinite scrolling. Overstimulation, malnutrition, politically irrelevant. This is the experience of most people. Cheap and scalable means of anesthesia.

- Cognitive elite (biological sublimation): a minority enhanced both biologically and intellectually. They do not seek economic returns but rather control over biology and death. They are fewer in number, wealthier, and increasingly difficult to reach.

- New Amish (conscious rejection) choose a third path of exit: those who disconnect, seek meaning outside of machines, and attempt to preserve human experience in a world designed to erase it. Spiritually affluent, strategically doomed.

The first group funds the second. The third group resists both.

Most people will "go with the flow" (blindly follow), barely staying afloat, unaware that they have become products rather than participants. But for those who foresee the future, choosing to exit is no longer neutral; it is a form of resistance.

Clear Strategy in a Fragmented World

The market is filled with noise. Cryptocurrencies, stocks, yield games—they are optional tools, not salvation. The real game is about life and death. The question is who can escape the collapse and under what conditions.

- The design of the monetary system is continuously degrading.

- Superintelligence will not become your productivity assistant.

- Biotechnology will isolate time itself.

- Epstein proved that power is isolated, not accountable.

If you understand this, the question is not how to "beat the market." It is about how to prepare for asymmetry in a system that no longer serves participants.

You will not see the truth in price trends but in systems thinking.

Most people will not look up. Most people will only believe when it is too late, even at any cost. Because dying in confusion is worse than dying broke.

Related reading: The Mental Codes Top Investors Won't Tell You

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。