Why Investors Should Pay Attention to Tron $1B SEC Filing

In a bold move, connecting blockchain assets with the traditional financial market, Tron Inc. has filed a $1 billion shelf registration with the U.S. SEC , showing plans to grow and bring its TRX token closer to mainstream finance.

Source: X

With this aim, will we see Tron-backed derivatives or yield products listed on mainstream exchanges? Or could the token soon serve in multi-chain institutional settlement layers?

$1B SEC filing Shelf Registration, Puts virtual Currency at Core

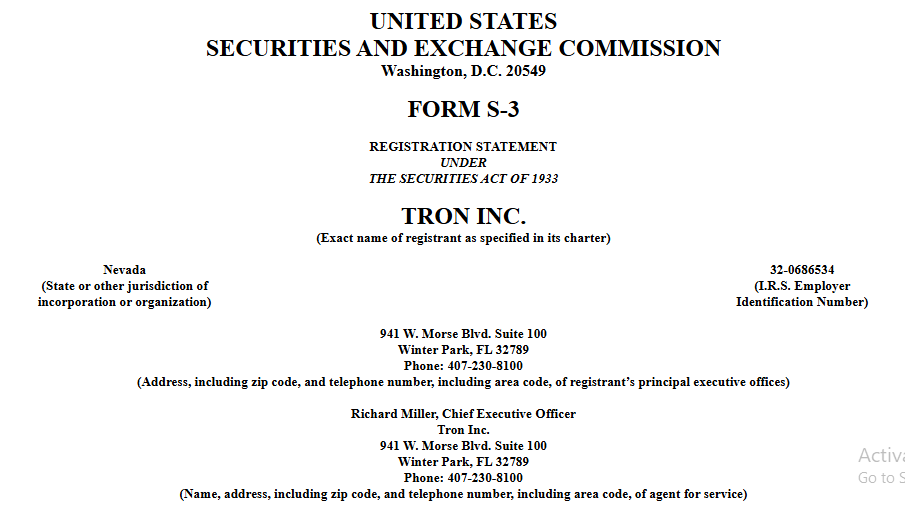

Filed on July 28, this shelf registration empowers the Nevada-based company to offer different types of securities, like common stock, debt, and warrant, whenever needed over time. More importantly for the crypto world, the $1B SEC filing reveals a plan where the token plays a key role, as both a main treasury asset and a tool for future fundraising.

Source: Security and Exchange Commission

Shelf registration: On-Demand Capital Access

Tron inc.’s Form S-3 filing means it doesn’t have to raise all $1billion at once. Instead, it can sell parts of it over time, depending on the market and its plans. This flexible setup, often used by big tech companies, helps to act quickly when there are good opportunities.

How does this $1B SEC filing matter for the investors? Well, $1B SEC filing is not just paperwork, it is a flexible financial money raising approach that can help Tron grow its digital asset reserves, launch new products, or team up with other sector’s companies. Since Crypto markets are still unpredictable, this filing shows the firm is getting ready for anything, and if a company is certain then obviously investors of that company are also liable for that security.

TRX treasury, 365M tokens and Growing

Tron Inc. currently holds 365 million TRX (currently labelled at ~$0.3293), one of the largest known reserves among publicly traded firms. These tokens are safely stored and watched over by BiT Global Trust, a well known digital assets custodian. Instead of using them for quick profits, Tron treats the Virtual asset as a long term reserve asset.

With this registration, Tron could use future funds to buy more digital currency, strengthening both liquidity and its control over the ecosystem. It also hints at future staking or lending strategies.

With these strategies is Tron Inc. quietly preparing to become the Microstrategy of TRX? Or could we see TRX playing a role of DeFi institutional bridging?

Big Picture - The Currency Moves Closer to the Financial Core

Tron Inc.’s $1B SEC filing is not just about raising money, it is a big move to make TRX a serious business asset. While many other tokens face regularity pressure, Tron is following the SEC rules and building a link between crypto and traditional finance. It is not just a token, it is a part of the infrastructure.

Also read: CEX.IO Power Tap Daily Quiz Answer Today 29 July 2025: Win Big!免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。