$1.25 billion, where can it take BNB?

Written by: Lin Wanwan, Rhythm

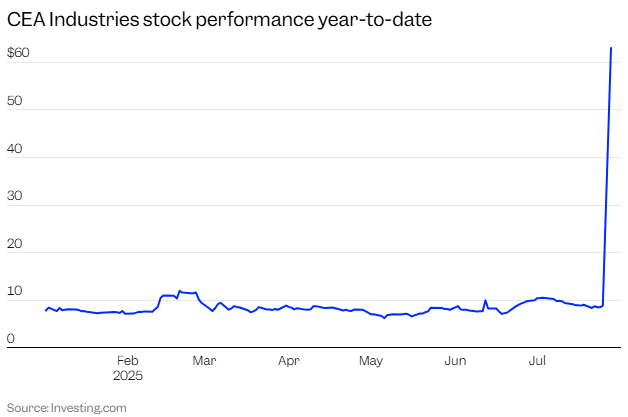

On July 28, the long-rumored BNB treasury "orthodox army" ultimately landed on a small nicotine e-cigarette company named VAPE — this previously sub-$10 million small-cap stock unexpectedly became the lucky choice personally selected by the richest Chinese.

The news leaked early, causing the stock to surge over 1800%+ in pre-market trading. After the opening, the stock price jumped from Friday's closing price of $8.88 to an intraday high of $82.88.

Insiders revealed to Rhythm BlockBeats that Binance's related investment team had initiated the shell company acquisition and private placement financing preparations for the BNB treasury project as early as the beginning of July. Another insider indicated that to prevent the shell resources from encountering "mouse warehouse" risks before landing, the team had simultaneously purchased multiple small shell companies in the U.S. stock market, finalizing the target VAPE only at the last moment.

Behind this stock price anomaly is a PIPE private placement financing agreement — amounting to as much as $500 million, led by 10X Capital and YZi Labs, aiming to make VAPE the largest publicly listed BNB treasury company in the world.

This is not a retail frenzy, but a meticulously structured capital experiment — a new arbitrage path regarding "compliance holding of BNB + valuation premium of a listed company," which may also represent a breakthrough in the parallel narrative of the Binance ecosystem.

VAPE, this previously obscure company, is now being remembered by a broader capital market as a key variable in the "BNB treasury" narrative.

Dissecting the BNB Treasury Operation Path: From Shell to Valuation Leverage

On July 28, VAPE (formerly CEA Industries) officially announced that the PIPE private placement financing led by 10X Capital and YZi Labs has a preliminary financing scale of $500 million, including $400 million in cash + $100 million in cryptocurrency asset subscriptions. Additionally, if all attached warrants are exercised, the total financing scale could expand to a maximum of $1.25 billion.

This financing is not only astonishing in scale but also clearly positioned: VAPE aims to create the world's largest publicly listed BNB treasury company, bringing BNB into the capital market to attract compliant funds to participate in the BNB Chain ecosystem through asset allocation models.

This also means that VAPE is no longer the hardware or retail supplier of the past, but has transformed into a financial structure platform focused on BNB, integrating the value and revenue mechanism of BNB into the capital structure of a listed company.

After the completion of the PIPE financing, VAPE will be led by a core team with institutional and digital asset backgrounds — David Namdar (co-founder of Galaxy Digital, now a senior executive at 10X Capital) will serve as CEO; Russell Read (former Chief Investment Officer of CalPERS, now CIO of 10X Capital) will take on the role of CIO; Saad Naja (a seasoned operator with backgrounds in Kraken and Exinity) will also join the company's executive team.

Meanwhile, 10X Capital will act as the asset manager for the BNB treasury, responsible for structural design, capital operations, and subsequent strategy implementation; YZi Labs will provide strategic support to facilitate the smooth execution of the PIPE placement. Over 140 institutions and crypto funds (such as Pantera Capital, Blockchain.com, GSR, Arrington, etc.) participated in this financing, forming a strong capital endorsement.

Rhythm BlockBeats dissects this VAPE announcement, stating that the funds raised will be used to establish a long-term treasury strategy centered on BNB. In the next 12–24 months, VAPE will build an initial BNB position and scale up through methods such as ATM (At-The-Market) issuance; it will consider participating in BNB staking, lending, DeFi protocol yields, etc., to obtain structured returns while setting a conservative risk framework.

This operational model is similar to MicroStrategy's BTC treasury model but focuses on BNB, which has stronger ecological utility, supplementing the holding appreciation logic with yield strategies to create cash flow and premium space.

After the PIPE concludes, VAPE will become one of the largest publicly traded companies providing exposure to a single Layer-1 blockchain.

In simple terms, the final form of this financing is to equip the company with a "crypto arsenal" valued at $1.25 billion to buy BNB. In contrast, SharpLink (SBET), as the earliest company to bet on the ETH treasury concept, had a total financing of only $525 million.

After the transaction lands: how will the stock price move?

After signing the PIPE, VAPE announced that this financing is expected to be completed by July 31, 2025. At that time, the funds will be received, and the company's updated capital management strategy will take effect. According to the announcement, the company's common stock will continue to trade on the Nasdaq capital market, with the stock code remaining "VAPE."

The essence of PIPE financing is a form of "discounted funding exchange" through a targeted issuance. In simple terms, the company sells stock to specific investors at a discount in exchange for a large sum of money. In VAPE's main financing amount of $500 million, $400 million is cash, meaning the other $100 million is BNB assets. It also includes a warrant mechanism that could reach up to $1.25 billion. In short, the company will issue a large number of new shares and warrants to PIPE investors.

This will directly lead to two structural results: the dilution of existing shareholders' ownership percentage. If calculated on a fully diluted basis, the voting rights and profit-sharing ratio of old shareholders will significantly decline; the company's capital structure will become more complex. Warrants, attached lock-up clauses, phased exercise mechanisms, etc., will make the company's valuation method in the capital market lean more towards a "structural model" rather than a fundamental model.

As the PIPE placement is completed, VAPE's equity structure will shift from "controlling type" to "circulating type," especially after the warrants are exercised, the company's freely circulating capital will experience a significant increase.

This is particularly evident in VAPE's PIPE terms: this round of transactions has designed a large proportion of warrant mechanisms, allowing investors to subscribe for new shares of the company at prices below the market price at specific time points, forming a typical warrant + placement arbitrage structure.

Image source: crypto-economy

Specifically, these types of warrants generally have the following characteristics — extremely low pricing: far below the public market stock price, creating potential arbitrage space; phased unlocking: some warrants unlock upon completion of financing, while others have price triggers, time rolling, and other mechanisms; possibly executed dynamically with market prices: when the stock price exceeds a certain threshold (e.g., 2-3 times the PIPE pricing), it may trigger forced exercise or accelerated conversion clauses.

Under this structure, VAPE's stock price behavior will not only be driven by fundamental factors but will also be influenced by the actions of PIPE investors. Once the valuation deviates from the actual asset level, this structure will create strong cash-out motives, becoming a source of liquidity shock.

So, in terms of stock price, will it rise or fall?

We analyze VAPE based on existing PIPE cases. This structural game roughly presents the following three-phase path:

Phase One: Expectation-Driven Phase (Already Occurred)

After the PIPE announcement on July 28, VAPE's stock price surged 800% in pre-market trading, soaring from $8.88 to the $80 range, triggering multiple circuit breakers. At this time, the market had not yet focused on fundamentals, pricing based solely on the narrative expectations in the announcement, creating strong speculative sentiment.

Since the financing has not yet been received and the subscription warrants have not been unlocked, the market is in a "low circulation, high emotion, no supply" structure, making the stock price extremely sensitive to expectations.

Phase Two: Structural Release Phase (After Transaction Completion)

It is expected that after the transaction is completed on July 31, funds will be in place, and some PIPE investors will receive initial shares and transferable warrants.

At this point, the market enters a delicate interval: if the stock price remains high, warrant holders may choose to quickly exercise their rights to cash out, creating price pressure; if the market loses confidence in the treasury model, early arbitrageurs will exit first; if the company discloses that it has not built up BNB as expected, it will also weaken the "on-chain NAV anchoring" expectations.

In this phase, volatility will significantly increase, and the pricing dominance will shift from "value anchoring" to "funding behavior."

Phase Three: Valuation Reversion or Secondary Narrative Initiation

If BNB performs strongly and the company releases on-chain yield details, the market may refocus on the "Crypto NAV+" model, pushing valuations into a secondary rise; if market sentiment cools or PIPE parties continue to cash out, the company's stock price will revert to the asset value center or enter a liquidity vacuum.

This is also the key phase where most PIPE projects ultimately diverge — some enter secondary long-term trading logic, while others become "telling the story, funds exit" one-time cases.

Rises may come from structural scarcity; falls often begin with liquidity stalling. Both paths have repeatedly appeared in other PIPE cases. Therefore, between rising and falling, it is not a value judgment but a race against the speed of liquidity release.

Selection of Shell Company: What Conditions Does VAPE Meet?

If we trace back the story of VAPE, we will see a completely different starting point.

VAPE's predecessor was CEA Industries, a company focused on indoor agriculture and cannabis temperature control systems. Its subsidiary Surna mainly provided services such as LED lighting, air circulation, and hydroponic equipment, with clients primarily being North American cannabis growers. The company has long been in a "three lows" state of low growth, low profit, and low market value.

According to data from StockAnalysis and TipRanks, by the end of 2024, the company's annual revenue will be less than $6 million, and its market value has long hovered below $10 million, with extremely low trading volume in the U.S. stock market.

In 2024, the company attempted its first strategic transformation: acquiring the central Canadian vape chain brand Fat Panda for CAD 18 million, which has 33 stores and annual revenue exceeding CAD 38 million, with an EBITDA margin close to 21%. This marks an attempt to shift from a "hardware seller" to "end retail," indicating VAPE's move from being a device supplier to a consumer brand.

However, this was not enough to support a revaluation of the company.

Thus, VAPE has not been eye-catching in the past; it could even be described as "a sinking ship in the capital market." Yet, these criticized flaws have become the most valuable traits of a "shell company" — a shell that is small enough; a clean equity structure; an untapped market value space; and a narrative vacuum in the crypto market (BNB exposure).

For VAPE, whether it can become a "MicroStrategy of BNB" remains to be seen. But it is certain that it is no longer the original e-cigarette company; it has transformed into a programmable shell nested within the capital game — the shell is a publicly listed company in the U.S. stock market, the core is a structured financial instrument, and the soul is the ability to manipulate narratives and emotions.

Control and Core Team: Who is Driving This Financing?

Behind this transformation experiment of "exchanging assets for valuation," VAPE plays the role of a financial vehicle rather than an operating entity. The real driving force behind this transformation is a team focused on capital structure as a core tool — a mixed team with backgrounds in finance and crypto, whose goal is not just to complete a financing round but to build a self-consistent valuation closed loop: from primary placement to on-chain asset accumulation, and then to secondary market narrative release.

After the PIPE signing, the actual control logic of the company has changed. The original management team, primarily with industrial and retail backgrounds, does not possess the capability to lead on-chain treasury and structured asset management. The real control gradually shifts to the financing leaders — 10X Capital and YZi Labs.

10X Capital: The leading institution for this PIPE, focusing on SPAC mergers, cross-border capital arbitrage, and structured trading, is a typical "leveraged capital engineer." Since 2023, this team has attempted to extend the MSTR model to ETH, SOL, and even LSD tracks, and this bet on BNB clearly aims to replicate MicroStrategy's treasury + valuation compounding structure.

YZi Labs: The strategic advisor for this round of transactions, widely believed to have actual connections with the CZ family fund, is a key behind-the-scenes driver of BNB treasury and public company pathways. The endorsement of this institution is almost regarded as clear support from the Binance camp. In the VAPE project, it participated in the early screening of shell resources, assisted in promoting the media's voice rhythm, and collaborated with some investors and market-making teams to formulate a narrative strategy of "accumulation — exposure — valuation derivation."

The most significant feature of this capital structure arrangement is that VAPE is no longer the creator of value itself but is designed as an intermediary platform for value release. 10X Capital provides structure and rhythm, YZi Labs provides narrative and channels, and BNB is embedded as the underlying asset. Together, the three have completed a closed-loop design from the asset side to the market side.

Whether the story holds true ultimately depends on whether the on-chain positions can be realized and whether market confidence can be sustained. For most retail investors and observers, the emergence of VAPE is not an endpoint but rather a prelude to the accelerated arrival of the "structural arbitrage era."

Image source: bankless

Epilogue

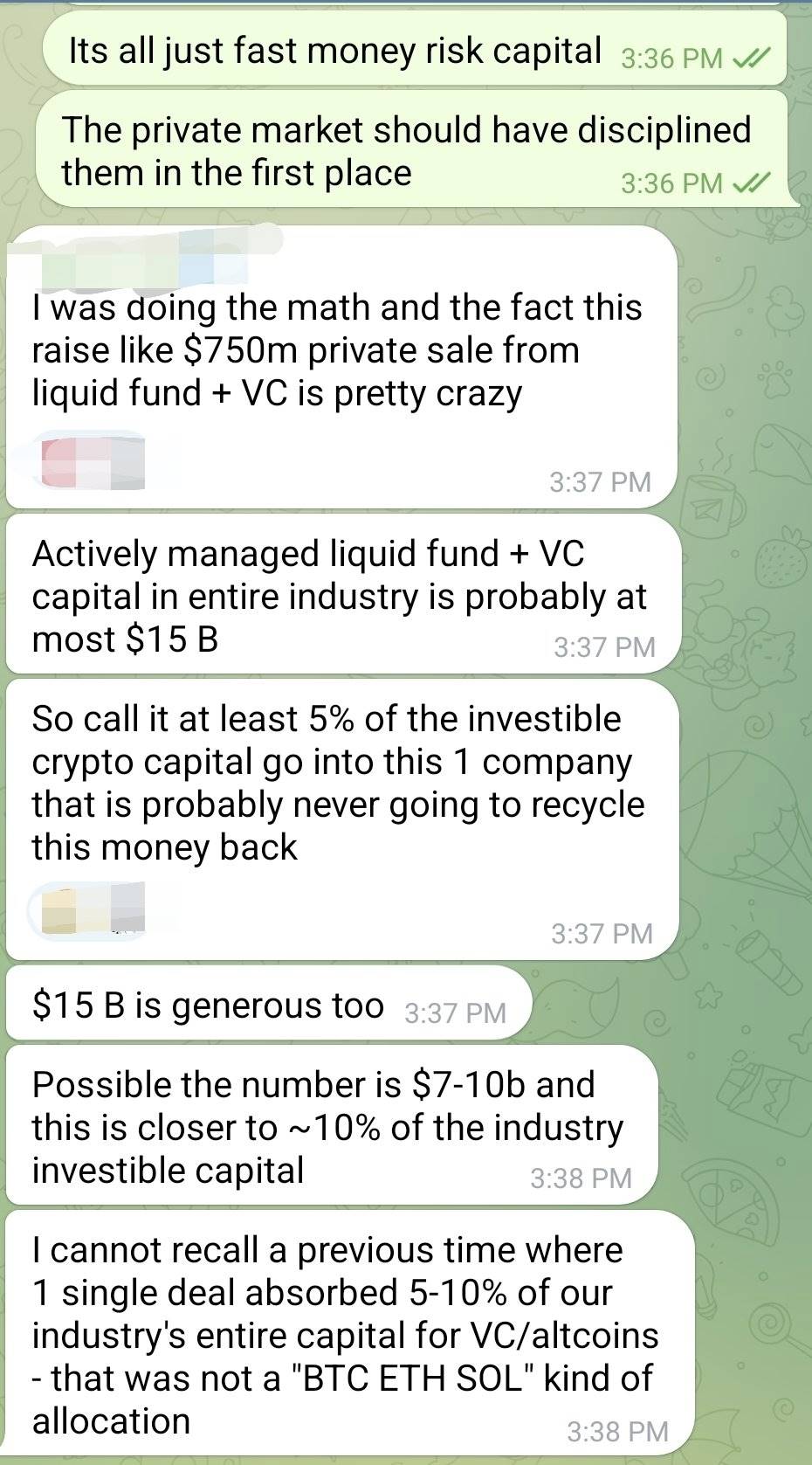

In a conversation among investors circulating on Telegram, someone calculated: the entire crypto industry has about $7-15 billion in active capital available for VC and liquidity fund allocation. VAPE's current PIPE financing, with a maximum expected amount of $1.25 billion, could, in extreme cases, siphon off about 5-10% of the industry's investable capital.

"I have never seen a non-BTC / ETH / SOL project absorb so much funding in a single deal," he said, "and this company is unlikely to ever recycle this money back into the industry."

This is not only a risk issue of excessive capital concentration but also means that the already tight liquidity in the crypto industry is being "siphoned" by an unverified model.

During a bull market, liquidity should be used to activate diverse innovations and provide flexibility for early projects in DeFi, payments, infrastructure, etc. Now, this capital is concentrated on a "story shell" that revolves around a nested PIPE structure and shell resource speculation. If VAPE succeeds, it will certainly replicate more crypto versions of MicroStrategy; but if it fails, it may become a typical case of resource misallocation at the industry level.

Capital can write narratives and create bubbles. In the intersection of crypto finance, everything seems like a victory of structural arbitrage until the moment liquidity completely dries up, at which point we will know whether there is "blood-making ability."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。