Treehouse 固定收益协议正式启动 TGE,原生代币 TREE 已于以太坊主网上线,并同步登陆多家中心化与去中心化交易所。代币生成事件(TGE)命名为「Gaia」,象征生态繁荣的萌芽。

首波释放包括高达 75% APR 的预存质押奖励,并启动大规模空投活动,回馈过去一年积极参与生态发展的社群用户。

Treehouse TGE — GAIA 正式启动!

去中心化固定收益协议Treehouse今日正式启动代币生成事件(Token Generation Event, TGE),原生代币 TREE 现已于以太坊主网上线。本次 TGE 被命名为「Gaia」,象征Treehouse 生态的全新起点。 Gaia 是希腊神话中的大地之母,被视为万物的源头与自然的起点,寓意着 Treehouse 将从此深根茁壮、蓬勃发展。

此次TGE 不仅标志着 Treehouse 协议迈入崭新阶段,也同步启动大规模空投活动,除了回馈过去一年积极参与生态、产品与活动的用户外,也使忠诚用户能进一步参与 Treehouse 固定收益生态的发展。

空投资格说明:谁能领取TREE?

只要你曾参与GoNuts(Treehouse 的积分活动) 第一季,累积一定数量的 Nuts(Treehouse 的积分)及徽章,或是持有 Treehouse NFT (Treehouse Squirrel Council),即能获得TREE 空投。用户可前往 Gaia 基金会的空投检查器连接钱包以确认是否符合资格。

若想详细了解Treehouse 空投资格,可阅读空投检查器博客及官方文档。

Treehouse:专注于构建 DeFi 固定收益基础设施

Treehouse 正在构建去中心化固定收益协议层(Decentralized Fixed Income Layer),致力于解决当前 DeFi 世界收益波动大、利率不透明、利率缺乏标准化等核心问题。

在传统金融市场中,固定收益资产的市场规模高达数十兆美元,是支撑全球资本市场稳定与流动性的关键。但在DeFi 世界,固定收益基础设施尚未成熟,缺乏统一的基准利率及稳定收益机制,使得投资人与协议开发者无法有效管理风险与报酬。

Treehouse 期望透过标准化利率机制与可组合的收益资产,补足这一缺口,整体架构由两大核心产品构成:

tAssets

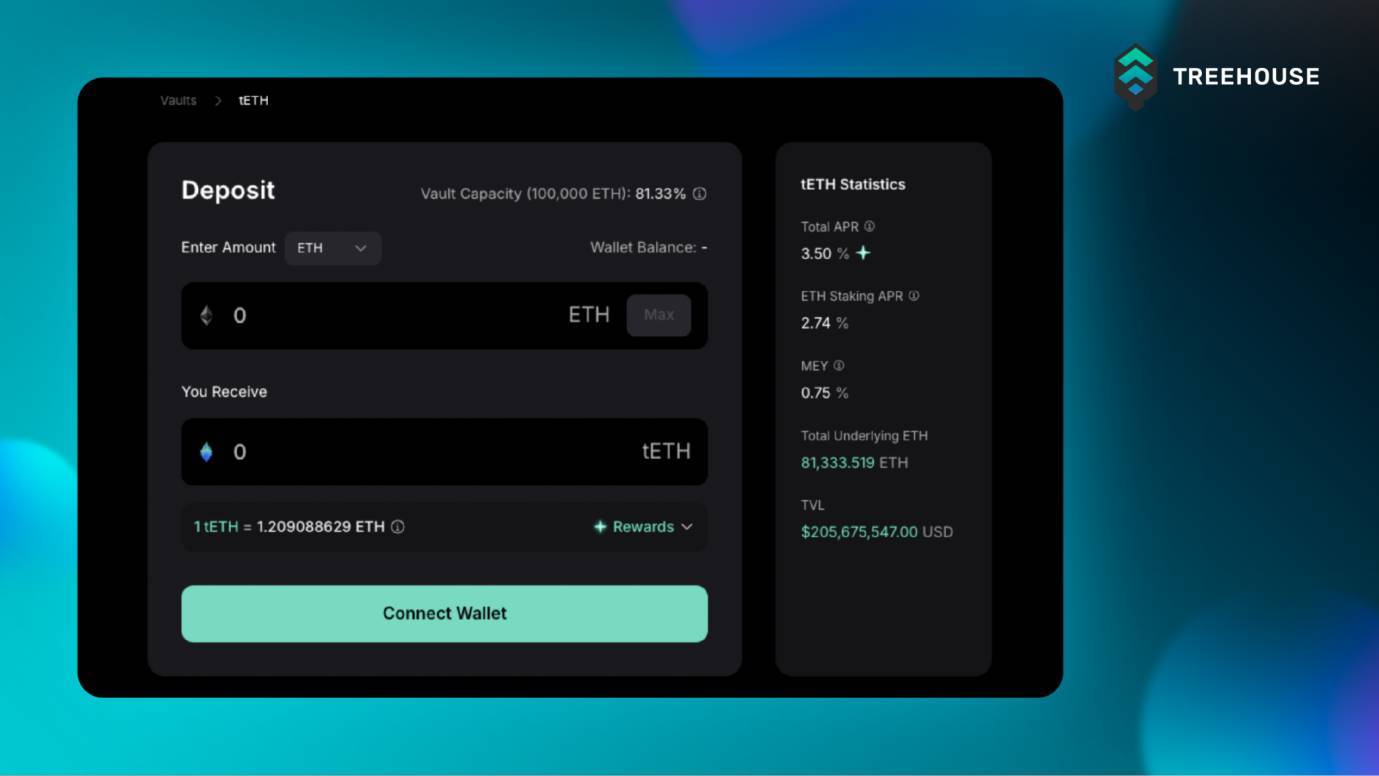

tAssets 是一种内建收益策略的新一代流动性质押代币,除了提供基础的质押收益外,还透过借贷与质押利率间的利差进行套利,提供用户更高的质押收益。以 tETH 为例,用户可透过提供 ETH 或 stETH 来兑换 tETH,并获得约 3.5 - 5% 的年收益。目前tAssets 已于以太坊、Arbitrum 及 Mantle 上线,未来预计会于更多链上线。

另外,透过集成多元的DeFi 协议 (Aave, Balancer, Compound, Curve, Pendle及Silo 等),tAssets 具有强大的流动性及可组合性,使用户在持续获取收益的同时,仍能自由参与各种 DeFi 生态。

马上体验tAssets,让你的 ETH 不再闲置!前往 Treehouse dApp赚取稳定收益。

DOR(Decentralized Offered Rates, 去中心化拆借利率)

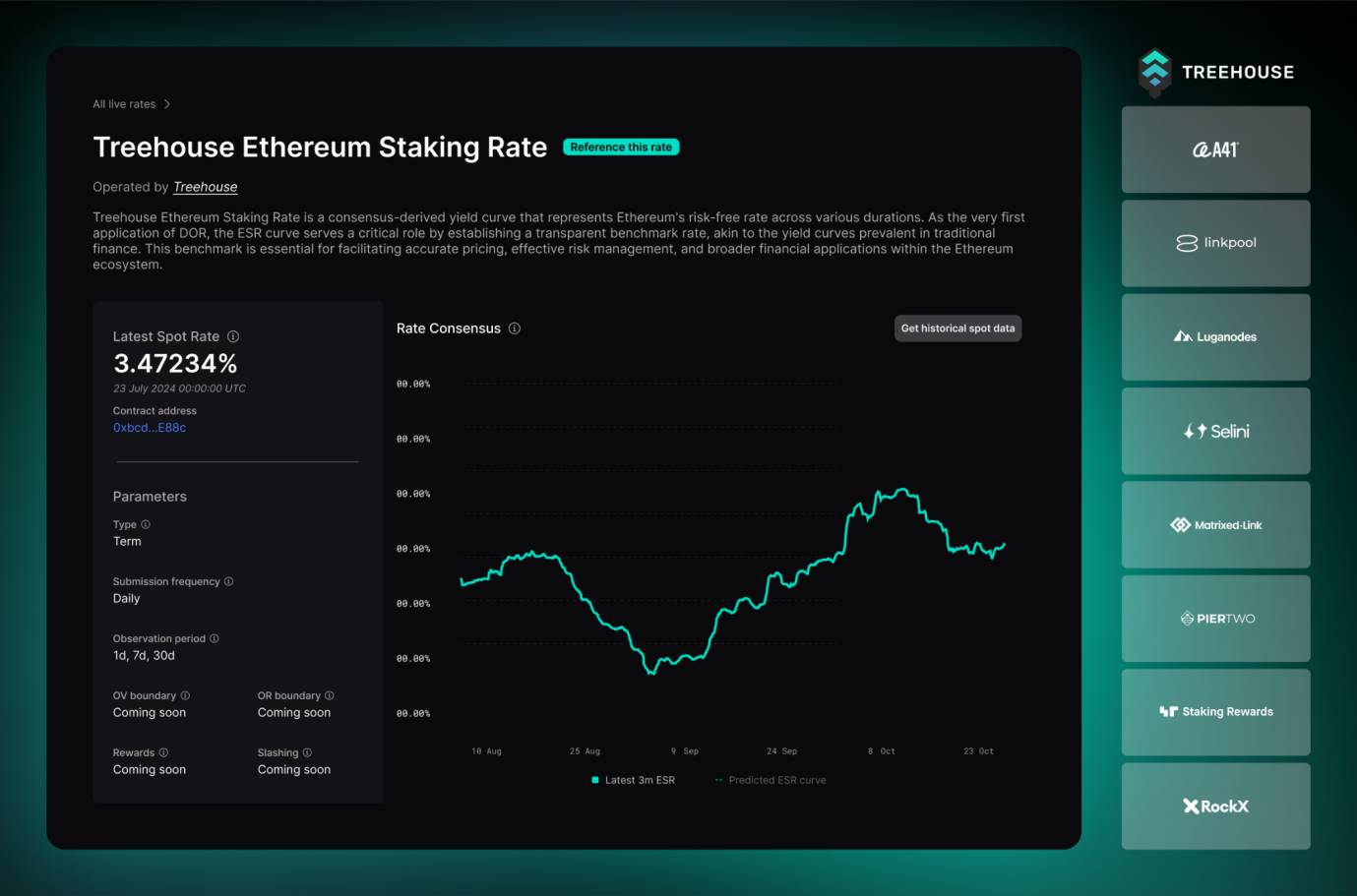

DOR 是一个去中心化利率共识机制,提供类似传统金融中的 LIBOR 或 SOFR 的基准利率框架。透过与多间质押服务提供商、做市商及交易所(Treehouse 称其为专家组, Panelists)合作,使固定收益产品、结构化金融工具及利率衍生品在 DeFi 领域中有可靠的利率来源作为参考,以实现规模化发展。

如上所述,DOR 利率的形成并非由 Treehouse 单独制定,而是由多位专家组提供独立预测。专家组使用专有模型与数据,在每日固定时间提交对 1 天、7 天与 30 天市场利率的判断,系统再将多方预测整合为共识利率。这一过程确保利率来源去中心化,并对所有用户公开透明。

DOR 的首个基准利率为 Treehouse 以太坊质押利率(Treehouse Ethereum Staking Rate, TESR),这是一条专门针对以太坊质押打造的协议原生利率曲线,TESR 透过提供清晰的利率标准,使质押产品发行者及用户获得可预测的质押利率曲线,从而实现更稳定的金融产品设计。

目前,Treehouse 已拥有超过 43,000 名独立用户,总锁仓量(TVL)突破 5.5 亿美元(约 14 万颗 ETH),并与多个主流 DeFi 协议建立战略合作关系,逐步打造完整的 DeFi 的固定收益利率层!

TREE 代币用途与生态价值

TREE 是 Treehouse 生态系中的原生代币,透过多项设计推动协议成长、实现去中心化治理,并鼓励用户积极参与。作为 DOR 协议的核心组件,TREE 在生态中具备以下关键用途:

● 链上查询费用(Querying Fees):链上合约或机构若想使用DOR 数据需支付费用,类似预言机的概念。此费用将回馈给 Treehouse 生态,并确保资料使用的公平性。

● 专家组质押(Panelist Staking):专家组(用于提供利率数据或预测的个体或机构)必须质押TREE 或 tAssets 以参与 DOR 利率设定的过程,用于激励提交准确数据并维持利害关系。

● 共识奖励(Consensus Payouts):根据预测准确度,TREE 将奖励给专家组和委托者(将资产委托给专家组以履行 DOR 职责的利益相关者),以激励他们提供可靠数据并积极参与。

● 治理权(Governance):TREE 持有者拥有协议治理权,能对 Treehouse 的发展路线进行投票并参与决策。

● DAO 资助(DAO Grants):Treehouse DAO 分配资金用于项目合作,以激励 Treehouse 生态系统内的产品开发,推动创新并扩展像 DOR 机制这样的数据源。

此外,预存金库质押(Pre-Deposit Vault Staking) 是 TREE 自 Gaia 启动后推出的首个应用场景。该金库为 DOR 协议设计的初期质押工具,让持有者可根据历史表现选择值得信任的专家组进行质押,并获得高达 50–75% APR 的收益。由于金库总量有限,建议早期通过质押页面参与以获得高额的TREE 奖励。

若想详细了解预存金库的参与方式,可阅读预存金库博客及官方文档。

预存金库质押(Pre-Deposit Vault Staking):预存金库是为 DOR 共识机制而设计,每位专家组(用于提供利率数据或预测的个体或机构)拥有自己的质押金库,TREE 持有者可根据历史数据选择信任的专家组并进行质押,并在质押满 9 个月后获得 ~50-75% APR 的收益。

TREE 代币经济

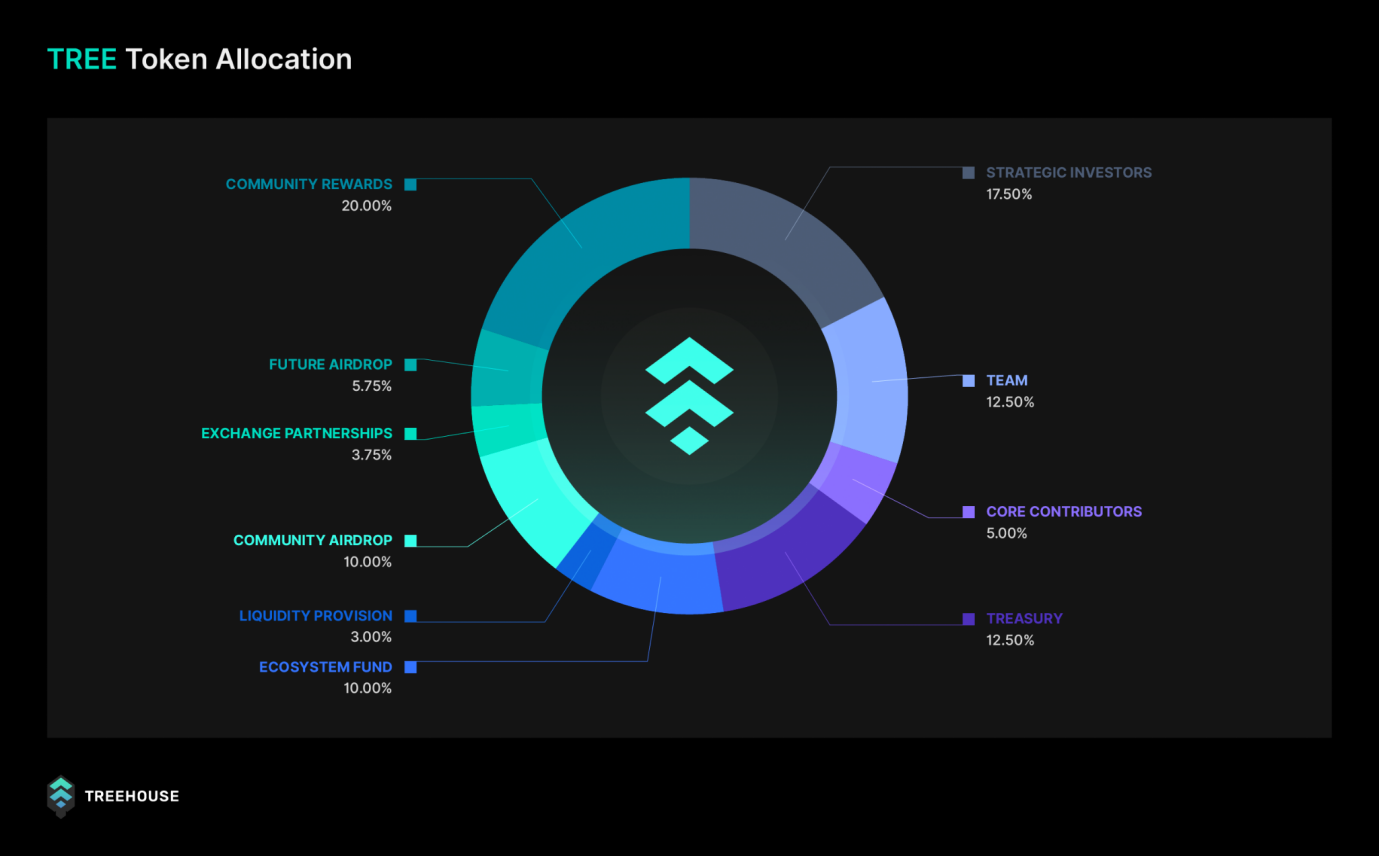

TREE 总量为 10 亿颗,其中将有 18.6% 于 TGE 当下解锁流通。本次分配设计以「社群为先」为核心,致力于让真正参与、贡献、支持 Treehouse 协议的用户成为最大的受益者。

为此,超过三分之一的代币总量直接回馈给社群:

● 20% 用于社区激励,奖励持续参与Treehouse 协议建设的长期贡献者。

● 10% 作为社区空投发放,感谢早期用户在Treehouse 发展初期的支持与参与。

● 5.75% 保留给未来空投与推广活动,让更多用户能在协议成长中共享成果。

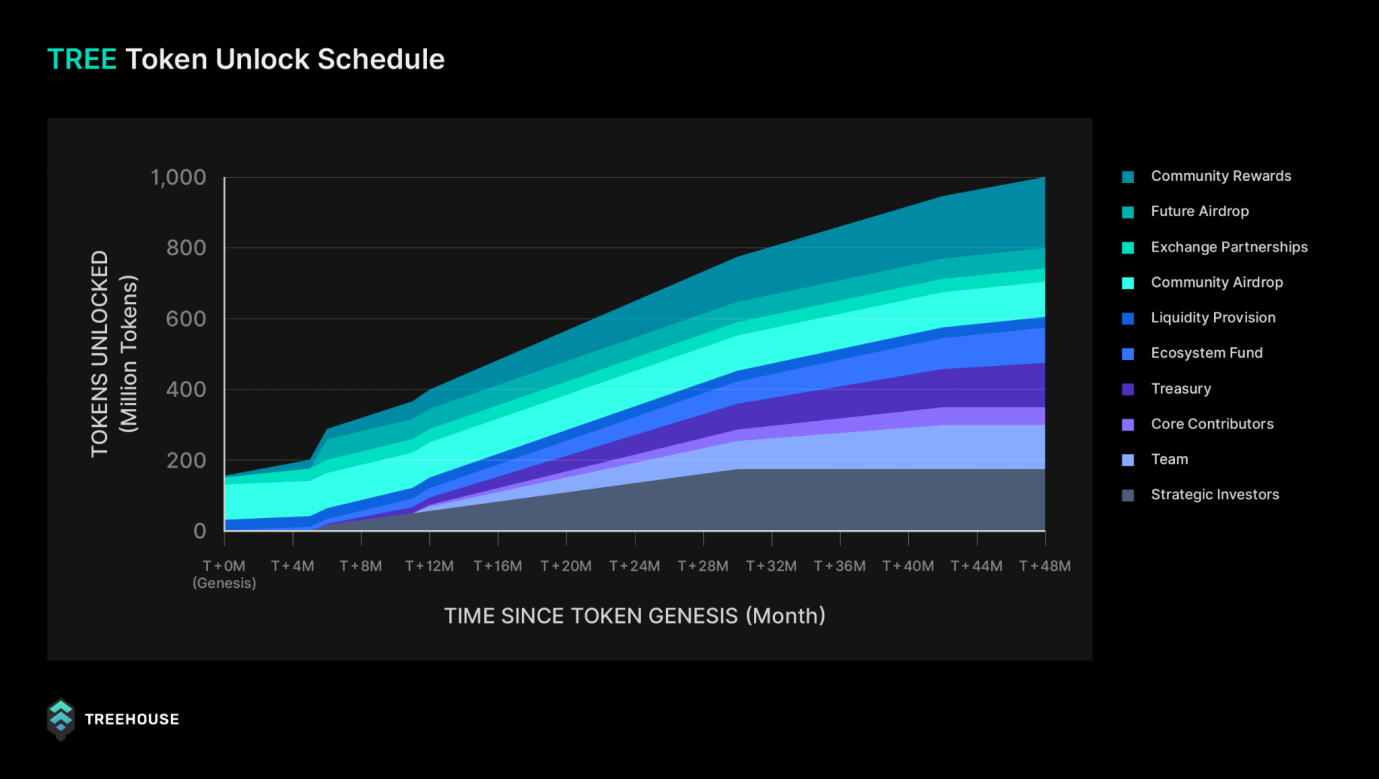

整体代币将在4 年内陆续解锁,并透过智能合约与 DAO 机制进行治理,实现透明、长远且去中心化的激励体系。

此外,战略投资人、核心贡献者与团队的代币份额皆设有至少6 个月的锁仓期,确保长期承诺,并有效降低 TGE 初期的潜在抛压。从下方的解锁曲线图中可见,初期流通代币主要来自社群分配,确保生态稳定启动。

若想详细了解更详细的代币经济细节,可阅读代币经济官方文档。

是时候领取TREE 空投了!

如果你参与了Treehouse Protocol 的 GoNuts 第二季,现在可以检查你是否符合 TREE 空投的资格,并于以太坊主网上领取!

此次空投用户分为两类:

● 非锁仓(Non-Vested)用户:可立即领取100% 基础配额及 100% 金库奖励(Treasury Bonus),也就是说将获得 2 倍数量的空投!同时,也可选择是否将代币质押至预存金库(Pre-Deposit Vault)获得额外 50-75% TREE 奖励及 GoNuts 第二季增益。

● 锁仓(Vested)用户:100% 基础配额被自动质押,将在一年内线性解锁 100% 金库奖励,并自动获得 GoNuts 第二季增益。若提前领取,则仅能依比例获得已解锁的金库奖励并失去增益。

用户的分类依据、质押教学及领取流程,详情可见Treehouse 文档的领取流程教学。

如何获得更多TREE?

错过第一季空投也没关系!你仍有多种方式参与Treehouse 生态并取得 TREE。

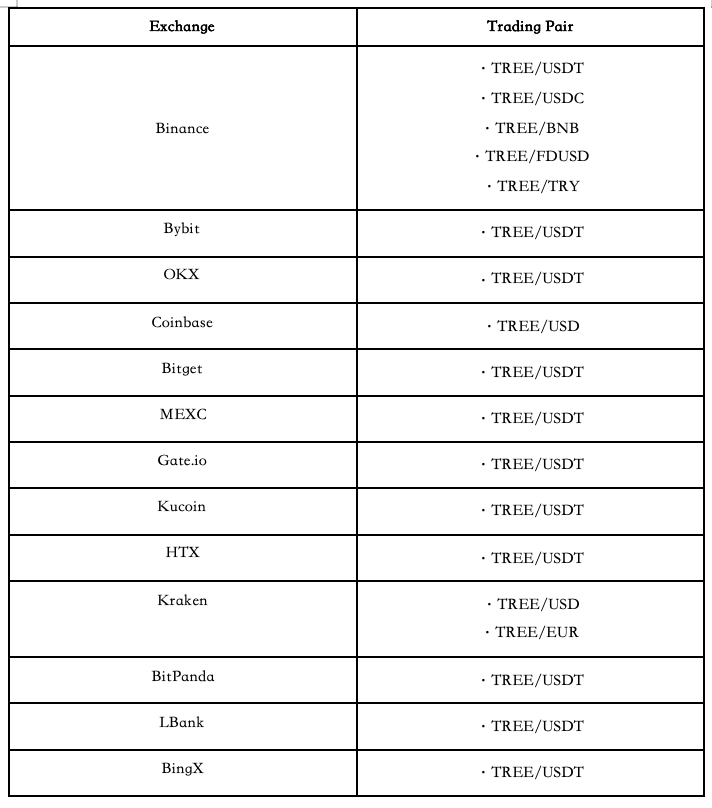

目前TREE 已在多家中心化交易所上架,开放用户进行自由交易,包含:

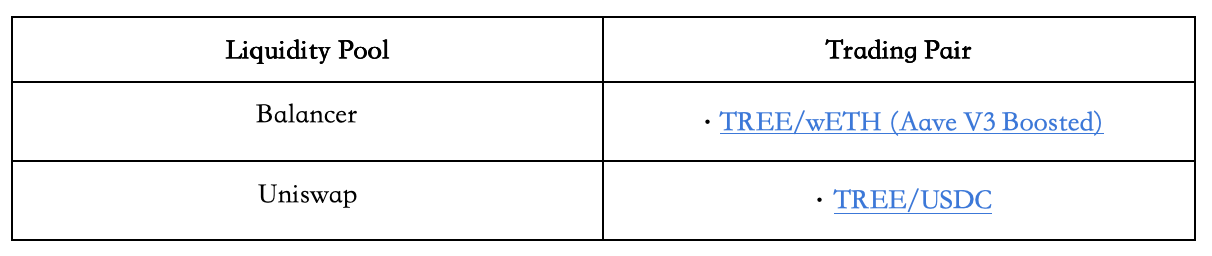

除此之外,Treehouse 也在 Uniswap 和 Balancer 上建立了流动性池,你可以透过 wETH 或 USDC 快速兑换 TREE:

下一波TREE 空投等你来拿!快加入 GoNuts 第二季

随着Gaia 启动,GoNuts 第二季也早已正式展开 —— 不论你是第一次闯入黑暗森林,还是从第一季就开始坚持每日耕耘的松鼠,现在正是再次出发、放大收益的绝佳时机。

只要你持有tETH、参与流动性提供、完成每周任务或使用 Treehouse 伙伴协议,每天都能持续累积 Nuts。再搭配第二季崭新的增益、徽章及等级系统,让你在第二季赚得比第一季更疯、更快、更多!

这不只是空投,而是整个Treehouse 生态的参与邀请。每一颗 Nut、每一次互动,都是你累积 TREE、解锁专属奖励与未来空投资格的关键。

阅读GoNuts Season 2 指南,详细了解如何高效累积Nuts。

Treehouse 未来发展:迈向更多链并推出更多金融工具

随着生态不断扩展,Treehouse 正积极将 tAssets 部署至更多 Layer 1与 Layer 2 网络,提升用户的参与范围与资产效率。DOR 也将持续推出更多元的基准利率,并逐步与更多 DeFi 协议集成,构建链上可信的利率基准框架。

同时,我们也将推出其他金融衍生性产品如「远期利率协议(Forward Rate Agreements, FRAs)」,支援更大规模的机构级与 DeFi 原生应用场景。

森林的故事还在尚未结束,下一笔由你来书写,现在正是加入Treehouse 的最佳时机!

立即前往Treehouse:https://app.treehouse.finance

GoNuts 第二季详细指南:https://treehouse.finance/blog/s2-nuts-guide

追踪官方X:https://twitter.com/TreehouseFi

加入Discord 社群:https://discord.gg/treehousefi

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。