The dominance of the US dollar stablecoin will bring strategic and economic advantages to the United States, allowing it to finance its debt at a lower cost while exerting global influence.

Written by: Bao Yilong, Wall Street Insights

The European Central Bank warns that a dollar-dominated digital currency system poses a strategic challenge to European monetary sovereignty. Without strategic countermeasures, European financial stability and monetary autonomy may be eroded.

On July 28, Jurgen Schaaf, an advisor in the ECB's Market Infrastructure and Payments department, published an article stating that if dollar stablecoins are widely used in the Eurozone, the ECB's control over monetary policy may be weakened.

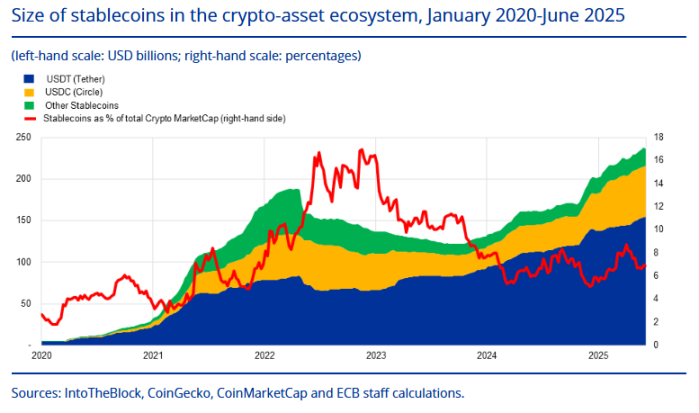

Dollar stablecoins dominate the global market, accounting for about 99% of the total market value of stablecoins. In contrast, euro stablecoins remain marginal, with a market value of less than 350 million euros.

_ (Dollar stablecoins dominate the global market)_

_ (Dollar stablecoins dominate the global market)_

With the GENIUS Act signed by Trump potentially taking effect in a few weeks, the supply of stablecoins is expected to grow from $230 billion in 2025 to $2 trillion by the end of 2028. Schaaf warns that this trend, combined with political support for stablecoins in the US, will further tilt the balance in favor of the US, potentially lowering borrowing costs in the Eurozone while increasing its financing costs.

Previously, ECB officials had warned that stablecoins could pose financial stability risks. If a mainstream stablecoin were to suddenly collapse, the shock could spread throughout the financial system. According to the Bank for International Settlements in its "2025 Annual Economic Report," many stablecoins have previously experienced "serious deviations" from their pegged exchange rates.

Potential Impact on European Monetary Sovereignty

If dollar stablecoins are widely used for payments, savings, or settlements in the Eurozone, the ECB's control over monetary conditions may be weakened.

The use of stablecoins is rapidly expanding. Initially used for cryptocurrency trading and cross-border remittances, they are now being adopted by mainstream payment and commercial giants.

Major US card organizations like Visa and Mastercard have begun integrating stablecoins into their global products, while retailers like Walmart and Amazon are also exploring the use of stablecoins, which could lead to a significant number of transactions bypassing traditional banking systems.

Schaaf points out that some platforms even offer interest on stablecoin holdings, making their function similar to money market funds, which could divert bank deposits and pose a greater threat to the bank-centered European financial system.

This erosion, while gradual, could replicate patterns observed in some "dollarized" economies, especially when users seek safety or yield advantages that euro-denominated instruments cannot provide.

Once this dynamic is established, it will be difficult to reverse, given the "network effects" and economies of scale associated with stablecoins. In the realm of tokenized settlements, a reliable digital cash equivalent is crucial; without a credible euro alternative, dollar stablecoins may solidify their first-mover advantage.

Analysts believe that this dominance of the dollar will bring strategic and economic advantages to the US, allowing it to finance its debt at a lower cost while exerting global influence. For Europe, this means higher financing costs relative to the US, diminished monetary policy autonomy, and geopolitical dependency.

Europe's Strategic Response Options

In light of this situation, Schaaf states that the ECB clearly has no room for complacency, but there are still various options in the ECB's policy toolbox.

First, policymakers can provide more support for euro-denominated stablecoins that are appropriately regulated. If designed well and effectively mitigating risks, high-quality euro stablecoins can meet legitimate market demand and help enhance the euro's international role.

Second, the ECB's digital euro project and innovations from the private sector should be viewed as complementary elements of a broader European digital payment strategy. Particularly at the payment interaction end, the digital euro is expected to become a strong line of defense for European monetary sovereignty.

Third, strengthening the application of distributed ledger technology (DLT) in financial markets is crucial. The ECB's recently announced short-term and long-term initiatives—Pontes and Appia projects—are key contributions in this area, aimed at improving cross-border payment efficiency and settlement capabilities.

Finally, global coordination on stablecoin regulation is essential. Without consistent rules, the current fragmented landscape may persist, exacerbating financial instability, regulatory arbitrage, and the dollar's dominance globally.

In summary, stablecoins are no longer a niche phenomenon but an integral part of digital finance. Europe's stable institutional framework and rule-based approach provide a foundation of trust; if leveraged effectively through robust regulation, infrastructure investment, and digital currency innovation, the euro may emerge stronger in this transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。