Fed Rate Cut Meeting July 29: Rates Calm, Chaos as Trump Eyes Powell

As the Federal Reserve’s highly anticipated FOMC meeting kicks off on July 29–30, the market appears unusually calm—but that calm may not last.

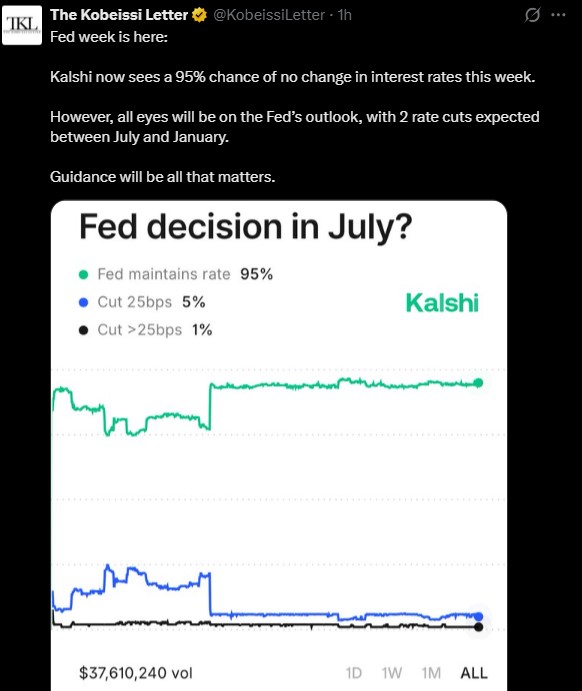

According to Kalshi, a prediction platform backed by real-money forecasts, there's a 95% chance that it will not raise interest rates during this Fed rate cut meeting .

But here’s the catch—this meeting may not be remembered for what the Fed does, but for what donald said to powell.

Fed Week Calm? 95% Say No Hike—But That’s Not the Full Story

As highlighted in the Kobeissi Letter’s recent X post, only 5% of participants predict a 25 bps cut, while less than 1% expect a deeper cut. So now the real attention is on what the Federal reserve system signals next.

Source: The Kobeissi Letter

Wall Street is already betting on two rate cuts between now and January 2026, thanks to weakening labor market data and cooling inflation.

As a result, forward guidance—its commentary about future decisions—has become the real market mover. Investors and crypto traders alike are closely listening for dovish signals that could inject liquidity and boost risk assets.

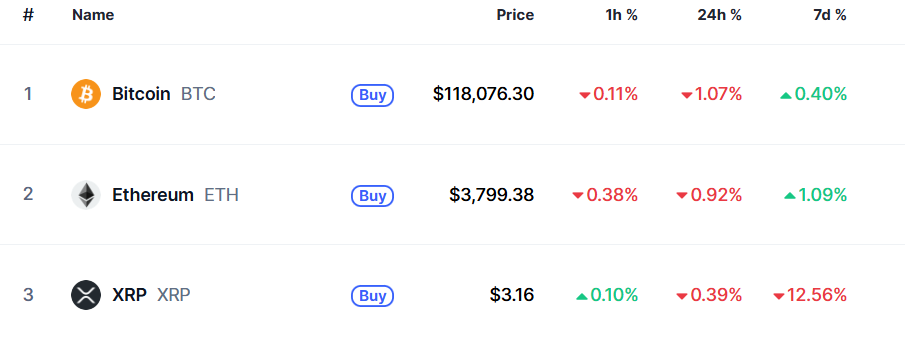

For the crypto world, especially, a soft Federal reserve stance often triggers short-term rallies, as seen in Bitcoin and Ethereum's behavior this past week—even though both have pulled back slightly in the last 24 hours.

Trump’s Powell Bombshell: “He’s Leaving Very Soon” —Why Now?

Just as markets were digesting rate expectations, the latest trump news today ignited fresh uncertainty. In a Coin Bureau –highlighted post on Truth Social, he said:

“Powell is leaving very soon. I’ll miss him.”

This line has sparked speculation about, will Powell resign on fed meeting day? The answer remains unpredictable, but the combination of no rate cut expectations and rumors of Powell’s resignation has created a dual volatility narrative that markets can't ignore.

Crypto Market Faces Double Uncertainty: Policy + Politics

As of now, the global crypto market cap stands at $3.91 trillion, with 24h trading volume surging 43.88% to $176.18 billion. Despite the recent mild dip in BTC, and ETH, this week’s events could set the tone for the next major move.

If Powell is replaced, it could lead to a reset in the Trump's tone—either toward faster easing or unpredictable tightening. As of now crypto market sentiment is in a greed position at 75 as seen in the chart.

As a cryptocurrency analyst, I believe traders should stop focusing solely on whether rate cuts happen or not. The bigger question is: Who will be leading the Fed when those cuts happen?

Conclusion: The Fed May Pause, But Will the Ground Shift Beneath It?

The fed rate cut meeting may deliver no surprises on paper, but the subtext is powerful. On one side, Kalshi no rate cuts prediction , supporting risk-on assets like crypto.

On the other, Trump’s unexpected comment on Jerome injects doubt into the FOMC leadership stability.

With rising speculation around Powell’s future, crypto market volatility is far from over. This isn’t just about monetary policy—it’s about monetary power.

Also read: Top Cryptocurrency Market Events You Can't Miss This Week免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。