Misappropriation of Funds or Embezzlement? Where is the Key Evidence Chain Missing?

PART .01 Case Overview: Unveiling the Collision of Capital and Discipline

On July 27, 2025, a notice on the Shaolin Temple's official website shook the public opinion like thunder: Abbot Shi Yongxin is under investigation by multiple departments for suspected misappropriation of temple assets (amounting to possibly 800 million yuan), maintaining improper relationships with multiple women, and fathering an illegitimate child.

The Buddhist sanctuary has unexpectedly been swept into a significant storm. At the center of this storm is the CEO Shi Yongxin, who has built a "Buddhist commercial empire" over 26 years—starting with the establishment of China's first temple website in 1996, to founding the Henan Shaolin Intangible Asset Management Co., Ltd. in 2008, which became an important platform for the commercialization of Shaolin Temple, accumulating investments in 16 companies, with the largest single investment reaching 16 million yuan and a total investment nearing 80 million yuan. In 2022, he won commercial land in Zhengzhou for 452 million yuan, with a business footprint spanning cultural tourism, real estate, finance, and more, generating annual revenue exceeding 1.5 billion yuan.

However, under the penetrating scrutiny of the investigation team, a "nested" financial black hole was exposed: 800 million yuan in ticket revenue was funneled into a personal holding company through a dual-layer SPV structure, and then 130 million yuan was remitted to the British Virgin Islands under the guise of "international propagation," ultimately used to purchase an apartment in London, with rent flowing back to the temple's donation box via Bitcoin, forming a perfect money laundering loop.

PART .02 Key Facts: The Legal Boundaries of Misappropriation of Funds and Embezzlement

The Game of Subjective Intent

Is "International Propagation" genuine promotion or a false pretense?

Between 2016 and 2024, Shi Yongxin remitted 130 million yuan monthly to a British Virgin Islands company under the name of "International Propagation," totaling over 1.5 billion yuan. These funds were ultimately used to purchase an apartment worth 130 million yuan in Kensington, London, registered under his nephew Liu's name, with rent flowing back to the temple's donation box via a Bitcoin wallet, creating a closed loop of "funds exiting - asset acquisition - income returning."

According to Articles 271 and 272 of the Criminal Law, the core difference between the crime of misappropriation of funds and embezzlement lies in whether the actor has the intent to illegally possess.

If Shi Yongxin used the funds for personal investments, such as the London property, and laundered the money through Bitcoin to conceal the flow of funds, he may be deemed to have permanently possessed the funds, fitting the characteristics of embezzlement.

However, if it can be proven that he planned to return the funds, such as fabricating the "International Propagation" project as a pretext, it may constitute misappropriation of funds. Nevertheless, the investigation team found that he transferred funds to overseas casino accounts via USDT and left no traces of repayment, which leans more towards the subjective intent of embezzlement.

Evidence Chain Construction of Behavioral Methods

Legitimate funds under disguise?

In 2023, the Henan Shaolin Martial Arts Equipment Factory (actually controlled by Shi Yongxin's cousin Chen) sold "custom meditation robes" worth 30 million yuan to the Shaolin Temple, but an audit revealed that the actual cost of this batch of clothing was only 8 million yuan, with a difference of 22 million yuan transferred to Chen's personal account through a "virtual inventory" account.

At the same time, the Shaolin Temple and Shaolin Intangible Asset Management Company shared a financial system, and a certain "overseas propagation expense" of 12 million yuan in 2024 was actually used to pay property management and utility fees for the London apartment, without being separately listed in the temple's accounts.

All of the above conforms to the characteristics of embezzlement, which typically involves fraudulent means such as falsifying accounts and fabricating transactions.

In contrast, the crime of misappropriation of funds is typically characterized by unauthorized fund mobilization without concealing the facts of use, such as directly using the funds for personal consumption.

The Special Attributes of Religious Property

Legal Flaws and Commercial Abuse?

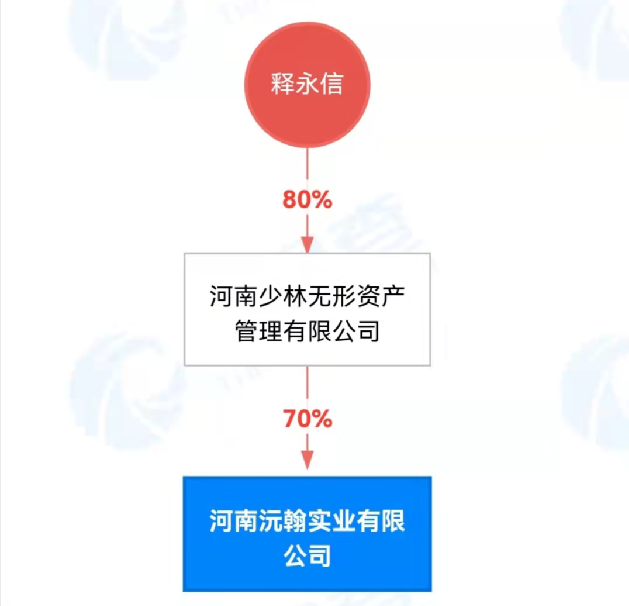

The abbot of Shaolin Temple, Shi Yongxin, who presents a facade of poverty, is actually the CEO holding 80% of the shares in Henan Shaolin Intangible Asset Management Co., Ltd. Although he claims to be a "nominee," the agreement was not filed with the Henan Provincial Religious Affairs Bureau, and the company's articles stipulate that "shareholders must sign a commitment letter, promising no ownership, disposal rights, or income rights," but in practice, he transferred company profits to personal accounts through related transactions.

Clearly, this constitutes an abuse of power. Religious leaders must adhere to the "Financial Management Measures for Religious Activity Venues," which require strict separation of personal property and religious property.

Trademarks witness the continuous expansion of Shaolin Temple's commercial footprint. The registered trademark "Shaolin" covers 706 categories of goods, but Shi Yongxin authorized its use to "Shaolin International Holdings Ltd.," controlled by his nephew Liu, without the temple management committee's consent, with an annual licensing fee of 50 million yuan not included in the temple's financial accounts.

This violates the "Regulations on Religious Affairs" and the "Management Measures for Religious Personnel," as the powers of religious leaders (such as abbots) are limited to the management of religious affairs, and significant asset disposals require collective decision-making by religious groups or management committees.

PART .03 Bay Valley Interpretation: From Financial Penetration to the Legal Path of International Asset Recovery

The Triple Evidence Chain Construction of Embezzlement

First Layer of Evidence Chain—Financial Penetration Audit

It must be proven that Shi Yongxin transferred temple funds to personal accounts through "fictitious transactions." In this case, a certain "overseas propagation expense" was actually used to pay property management fees for the London apartment. By combining on-chain data analysis tools to trace USDT transaction flows to overseas casino accounts, a complete financial lineage map can be formed.

Second Layer of Evidence Chain—Evidence of Financial Confusion

Looking back at this case, the accounts of Shaolin Temple and Henan Shaolin Intangible Asset Management Co., Ltd. were mixed. Between 2016 and 2024, the "International Propagation" sub-account remitted 130 million yuan monthly to a British Virgin Islands company, yet there were no corresponding service contracts or records of fund returns, fitting the elements of "illegally possessing the property of this unit" as per Article 271 of the Criminal Law.

Third Layer of Evidence Chain—Presumption of Subjective Intent

If Shi Yongxin cannot provide a repayment plan or evidence of actual repayment, and the funds were used for high-risk investments (such as Bitcoin) and personal asset acquisitions (with the London apartment registered under his nephew), the court may presume he had the intent to illegally possess.

The Defense Space and Dilemmas of Misappropriation of Funds

Based on the current information available, Shi Yongxin's claim of misappropriation of funds may be beneficial for his current situation, but he needs to provide the following evidence:

Written documents of repayment plans, such as IOUs or repayment agreements, to reflect his subjective intent to repay.

Proof of the reasonableness of fund usage, such as actual expenditure vouchers for the "International Propagation" project.

Evidence that the funds were not misappropriated for more than three months, demonstrating that his misappropriation did not exceed three months and was not used for profit or illegal activities.

However, the investigation team has already discovered that he concealed the flow of funds through a Bitcoin money laundering loop, and the duration of fund misappropriation spans as long as 8 years, leaving very limited room for defense.

Challenges of Judicial Cooperation in International Asset Recovery

The London apartment worth 130 million yuan purchased by Shi Yongxin through a British Virgin Islands company involves another key issue: international asset recovery.

According to the "International Criminal Judicial Assistance Law," the investigation team must follow these steps: First, they need to obtain documents such as property information from the UK Land Registry and bank statements, and have them certified by The Hague; Second, coordinate with Interpol to request wallet address association information for USDT transactions from cryptocurrency exchanges; Third, apply to freeze the involved property in the UK court based on the "United Nations Convention against Corruption"; Finally, through judicial cooperation procedures, return the assets to the temple.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。