Robinhood Gives 2% Bonus on Crypto Transfers as ETH Unstaking Rises

Robinhood has launched a new offer, matching 2% on cryptocurrency transfers to its platform. The move comes during a notable surge in Ethereum unstaking activity, attracting attention from both retail and institutional investors.

ETH Transfers Gain Momentum Amid Unlocks

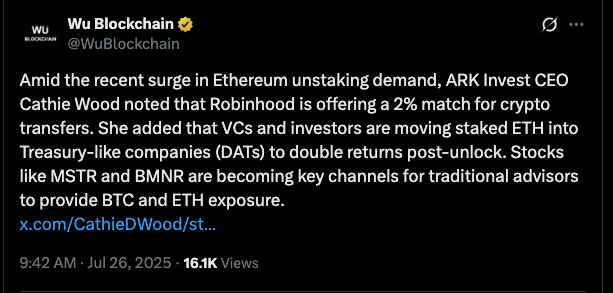

ARK Invest CEO Cathie Wood said the incentive is meant to make Robinhood an attractive substitution option to holders of cryptocurrency seeking yield.

Cathie Wood noted that venture capital firms and investors were transferring ether stakes in venture capitalists into Digital Asset Treasuries (DATs). These treasury sorts of firms target to benefit on price inefficiencies and thus have prospects of bringing two-digit yields. Such a post unlock strategy is becoming quite popular as the staking lock-ups run out.

Source: Tweet

Brett Winton, ARK’s Chief Futurist, raised questions about the rising demand for ETH unstaking. He suggested the behavior might reflect a wider shift in investor strategy, rather than a typical market correction.

Shadow Stocks Attract Institutional Investors

ARK Invest recently increased its exposure to Bitmine Robotics (BMNR), a company seen as a cryptocurrency proxy stock. Through ARKK, ARKW, and ARKF ETFs, ARK acquired nearly 4.4 million shares of BMNR. Based on recent prices, the investment nears $175 million. At the same time, ARK reduced its holdings in Coinbase and Robinhood.

Such changes indicate that ARK is changing its digital asset strategy, becoming less exposed to crypto exposure and more of companies related to crypto infrastructure. Such stocks as MicroStrategy (MSTR) and BMNR are becoming ways of financial advisors to provide their customers with the option of accessing BTC and ETH.

Wood explained that the shift is not a crypto retreat. Rather, it is a change in the interaction of the institutions with blockchain exposure. She also pointed out that acts such as the CLARITY Act and the GENIUS Act are facilitating the way towards widespread adoption.

Robinhood Incentive Reshapes Transfer Flows

Robinhood’s 2% transfer match could boost its role in the digital asset market. This reward system encourages users to treat their holdings as part of a yield-focused crypto strategy. Behind the scenes, institutional money is being dumped into corporate warehouses where staked ETH is fetching high premiums.

The recent shift in ETH movement suggests a recalibration of priorities by long-term holders. As lockups expire, many are choosing liquidity or higher-yield opportunities. Robinhood’s move comes at a time when platforms compete fiercely for user assets and long-term trust.

As crypto markets now stabilize following a temporary setback, these institutional cues may be the beginning of the next, more mature, investment cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。