Author: Prathik Desai

Translation: Saoirse, Foresight News

Three months ago (the outlook for Ethereum ETFs was not optimistic due to significant capital outflows, low market attention, and insufficient yield advantages), even for the most fervent supporters of Ethereum, celebrating the one-year anniversary of Ethereum exchange-traded funds (ETFs) in the U.S. seemed like a pipe dream.

However, today, Ethereum ETFs are experiencing their moment in the spotlight—marking one year since they first began trading on July 23, 2024.

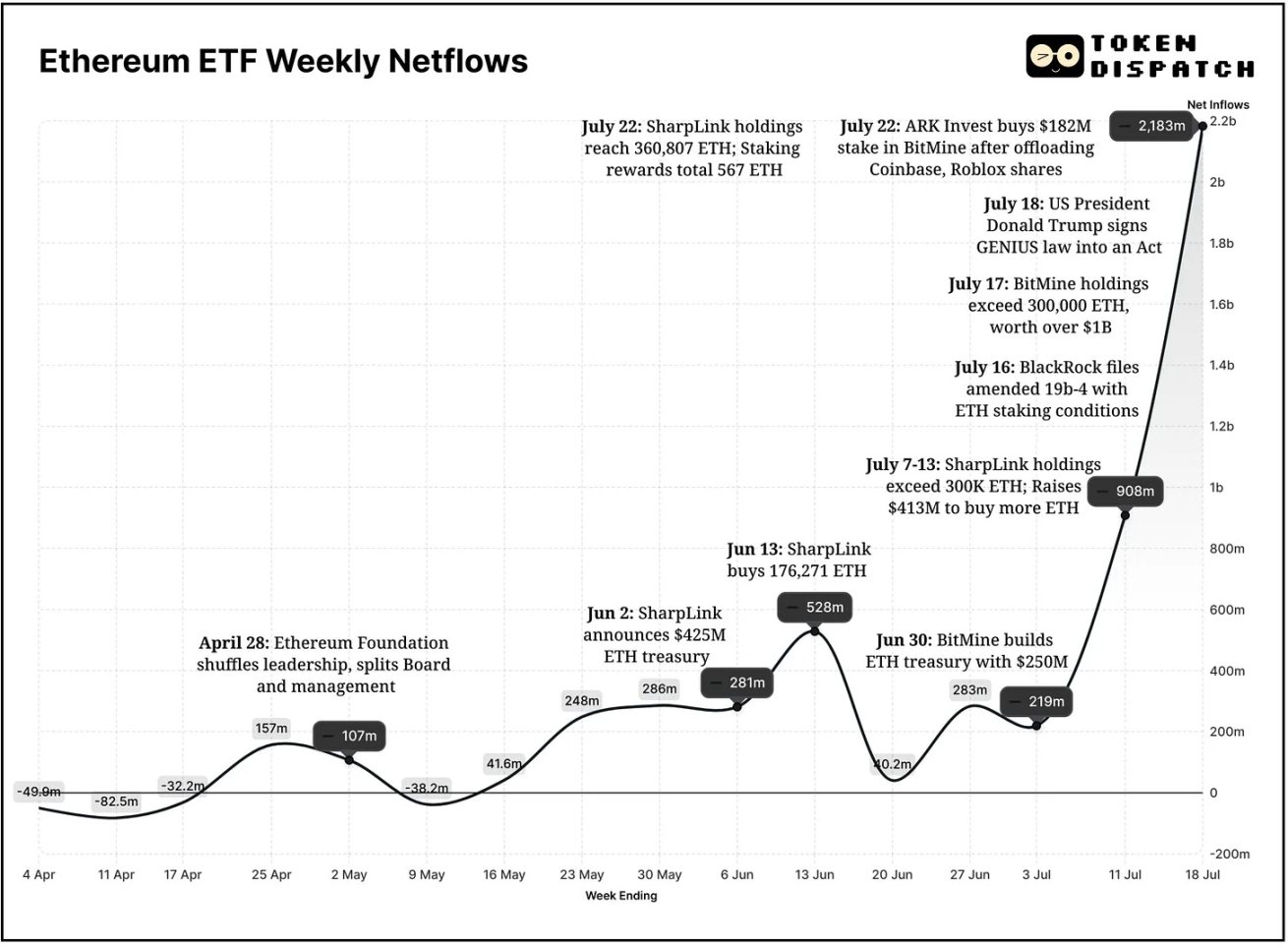

In June 2025, Ethereum ETFs achieved their best monthly performance ever, with inflows exceeding $3.5 billion, a 70% increase from the previous peak of $2.08 billion on December 20, 2024. The inflow momentum in July has been even stronger, surpassing $3 billion to date, with expectations to exceed June's figures. The past two weeks leading up to July 18 have seen the best net inflow performance, with no net outflows for ten consecutive weeks, a first in its 52-week existence.

The "hockey stick" growth curve in the chart below vividly illustrates this trend.

However, the development of Ethereum ETFs has not been smooth sailing.

In May 2024, U.S. regulators approved Ethereum ETFs, which officially began trading on July 23 of the same year, receiving mixed reactions from the market. After all, Bitcoin ETFs had already captured all the spotlight earlier in the year, making the debut of Ethereum ETFs seem uneventful: price trends were sluggish, attention gradually waned, and there was consistently no large-scale capital inflow during the initial launch.

In fact, some early capital flows even showed a net outflow.

In the first 39 weeks of trading, Ethereum ETFs only saw net inflows in 15 weeks; in contrast, the past 14 weeks have shown net inflows in 13 weeks, highlighting the significant shift in momentum over the last three months.

As of July 21, 2025, the total assets under management (AUM) of all Ethereum ETFs in the U.S. have surpassed $19 billion, doubling from about $9.6 billion two months ago.

Not only ETFs, but institutional interest in Ethereum has also accelerated through the form of "Ethereum reserve assets."

On June 2, 2025, SharpLink Gaming became the first U.S. publicly traded company to announce the inclusion of Ethereum in its strategic reserves. While the crypto community was still focused on various public companies incorporating Bitcoin into their balance sheets, Joe Lubin had already brought Ethereum into the "reserve asset party."

As a co-founder of Ethereum and founder and CEO of Consensys, Lubin joined the board of SharpLink Gaming as chairman, leading the company's $425 million Ethereum strategic reserve.

Since the launch of this reserve asset plan, SharpLink has become the world's largest corporate holder of Ethereum, holding 360,807 ETH, valued at over $1.3 billion at current prices. Additionally, the company raised an extra $413 million and earned rewards of 567 ETH through staking its held Ethereum.

Moreover, in a supplemental prospectus submitted to the U.S. SEC, SharpLink requested to increase its public offering limit from the initially declared $1 billion to $5 billion.

However, a newly emerging company focusing on Ethereum reserve assets is fiercely competing with it.

Bitcoin mining company BitMine Immersion is also betting on Ethereum, holding over 300,000 ETH, valued at over $1 billion at current prices. Its chairman, Tom Lee, a veteran on Wall Street, has even bigger goals:

"We are steadily advancing our goal of acquiring and staking 5% of the total supply of Ethereum." Currently, the total amount of Ethereum held by SharpLink and BitMine has surpassed that of the Ethereum Foundation.

Overall, the flow of funds into Ethereum reserve asset companies and ETFs reflects institutional confidence in viewing Ethereum as an infrastructure layer investment, and this confidence continues to grow.

Cathie Wood's ARK Invest recently reduced its holdings in Coinbase and Roblox significantly, instead increasing its stake in BitMine Immersion to $182 million. Previously, ARK had insufficient exposure to Ethereum, restructuring its three flagship ETFs to allocate 1.5% of its portfolio to BitMine.

Billionaire Peter Thiel also holds a 9.1% stake in the company.

A new company formed through the merger of existing firms, Ether Machine, aims to create a publicly traded platform that provides institutional investors with professional access to Ethereum infrastructure and Ether yields.

The company was co-founded by Andrew Keys, a former board member and head of Consensys, and David Merin, a former executive at Consensys and current CEO of Ether Machine. After the merger, Ether Machine plans to list on NASDAQ, at which point it will hold over 400,000 ETH, valued at over $1.5 billion.

What changes have occurred in the past few months? The recent leadership changes at the Ethereum Foundation may be one reason.

At the end of April 2025, the Ethereum Foundation underwent a leadership adjustment, separating the board from the management team. The new leadership has clarified three core priorities: expanding the Ethereum base layer, optimizing Layer 2 Rollup solutions, and enhancing user experience.

The practical value and yield potential of Ethereum also make it an attractive target for investors.

Currently, there are no ETFs in the U.S. offering staking rewards, as the U.S. Securities and Exchange Commission (SEC) has not approved them. If Ethereum ETFs can eventually launch staking features, ETH is expected to become a "digital bond" in institutional portfolios.

ETFs supporting staking could offer 3%-5% native yields. Based on the current $19.6 billion Ethereum holdings, even at an average yield of 4%, ETF issuers could earn over $750 million in staking income.

BlackRock is exploring product structures that include staking, explicitly mentioning in its submitted 19b-4 amendment that staking is a "potential future feature pending regulatory approval," and the market is watching closely.

Experts predict that the staking feature for Ethereum ETFs is likely to be approved in the fourth quarter of this year.

@JSeyff

For many investors, staking may be the key distinction between "shallow allocation" and "deep participation." Passive income obtained through compliant investment tools may attract pension funds, endowment funds, and sovereign wealth funds to enter the market.

Market maker and trading firm Wintermute noted in a report released during the launch of Ethereum ETFs last year that the lack of a staking mechanism was a significant shortcoming that could "diminish Ethereum's appeal as an ETF vehicle."

If the macro environment changes, such as interest rate cuts, stabilized inflation, or capital seeking higher yields, Ethereum will become a highly competitive choice: it combines the scarcity of supply deflation, the yield from staking, and the accessibility achieved through ETFs and custodians.

Ethereum's price has shown a correlation with institutional activity. Further price breakthroughs may trigger market optimism, attracting more capital inflows. Regardless, after a long period of dormancy, Ethereum's evolution will be welcomed by both retail and institutional investors.

In the past two weeks, Ethereum's price has surged over 50%, reaching a new high for 2025; the cumulative increase over the past three months has reached 150%.

When new shares of ETFs are issued, ETH must be purchased, which locks in supply. The reduction in circulating ETH will create upward pressure on prices.

It is expected that Ethereum reserve asset companies will also firmly hold ETH. Registered investment advisors (RIAs), wealth management firms, and publicly traded companies typically do not pursue short-term gains and are unlikely to panic sell.

Reserve asset builders are positioning ETH as programmable collateral, an asset that can generate yields, provide security, and maintain stability.

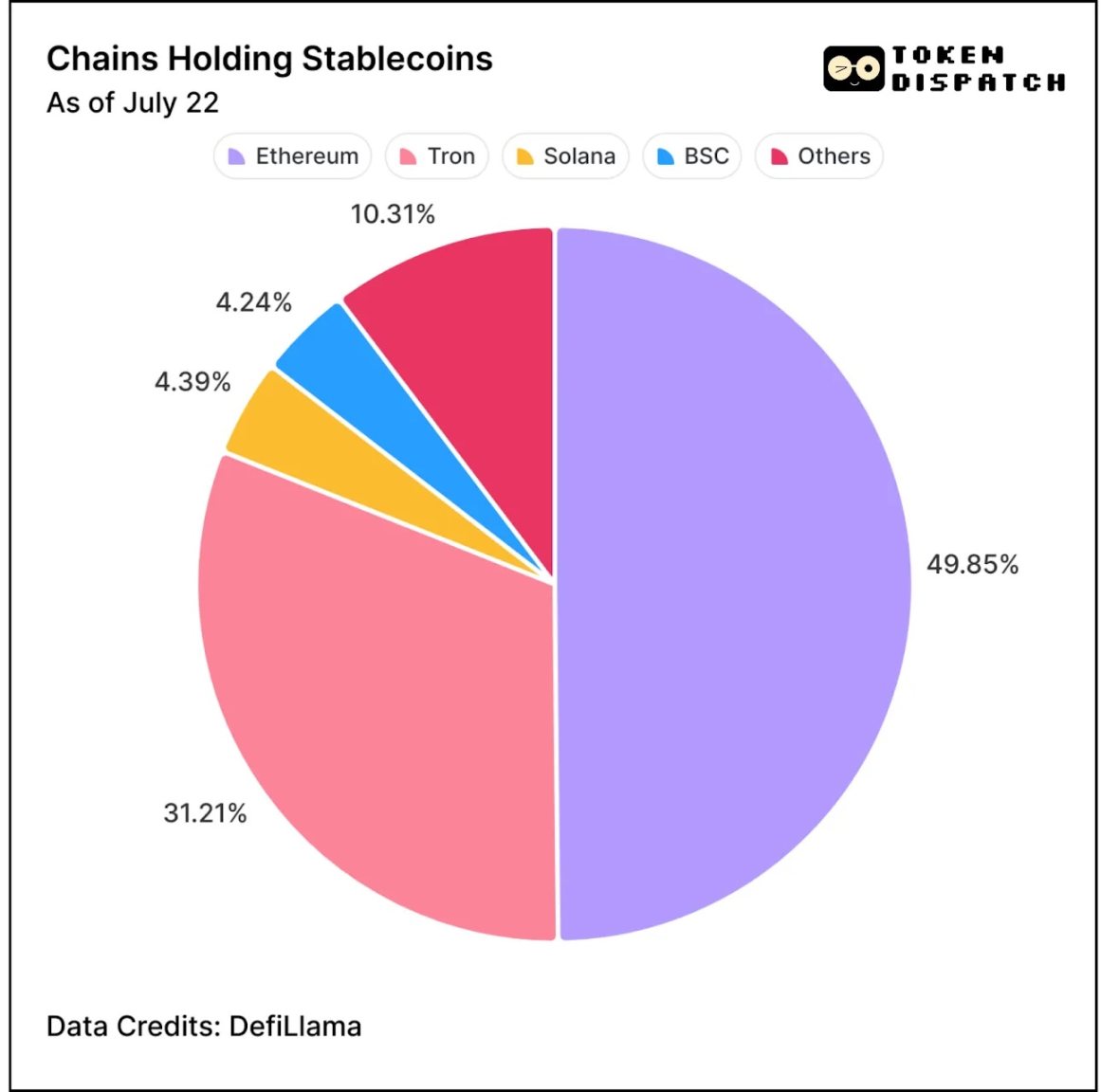

Additionally, the macro backdrop is also favorable: the recent signing and enactment of the "GENIUS Act" will legalize stablecoins as digital cash. As the dominant network holding 50% market share, Ethereum will be the biggest beneficiary.

So, what will the future hold?

Once the SEC approves the staking feature for ETFs, institutional interest is expected to continue to rise. More companies may establish Ethereum reserve assets due to the staking feature, and asset management firms like BlackRock will further increase their investment allocations to Ethereum.

For traditional investors, they may now realize that Ethereum has two powerful channels for circulation—ETFs and reserve assets. Both lock in supply and extend Ethereum's influence into the traditional economic sphere.

Those who directly compare Bitcoin and Ethereum's reserve assets and ETFs actually overlook the core differences:

Bitcoin is viewed as a value storage tool, the "digital gold" in macro strategies; whereas Ethereum is endowed with practical uses. Fund issuers and reserve asset builders buy and support ETH because they value its added benefits: staking rewards, infrastructure framework, and its role as a programmable layer for financial applications.

Bitcoin is a "hold" asset, while Ethereum is an "application" network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。