The Subtle Balance of Market Dominance and Capital Reallocation

The capital allocation strategies exhibited by institutional investors in this cycle show distinct phase characteristics. Bitcoin's dominance, accounting for 63% of the total cryptocurrency market capitalization, not only reflects institutions' firm belief in the digital gold narrative but also embodies a cautious investment logic under a risk management framework. However, this seemingly solid market structure is undergoing a quiet transformation.

Market attention is beginning to refocus on selected tokens, including ETH and SOL, partly because these tokens appear undervalued against the backdrop of BTC reaching new highs. In the context of BTC's continuous new highs, these tokens, which possess strong infrastructure attributes and ecological value, present undervalued investment opportunities. This repricing represents not just a return to technical analysis but also signifies a strategic shift in institutional investment logic from mere value storage to diversified ecological investment.

Three core driving factors influencing price trends in the upcoming quarter are forming a synergy: first, the SEC may approve new single-name spot ETFs, which will provide a more convenient and compliant channel for institutional funds to enter; second, the high likelihood of integrating staking features into ETF investment tools will provide investors with additional sources of returns, enhancing investment attractiveness; finally, an increase in institutional capital inflows from sources such as corporate funds reflects a new trend in diversifying corporate balance sheets.

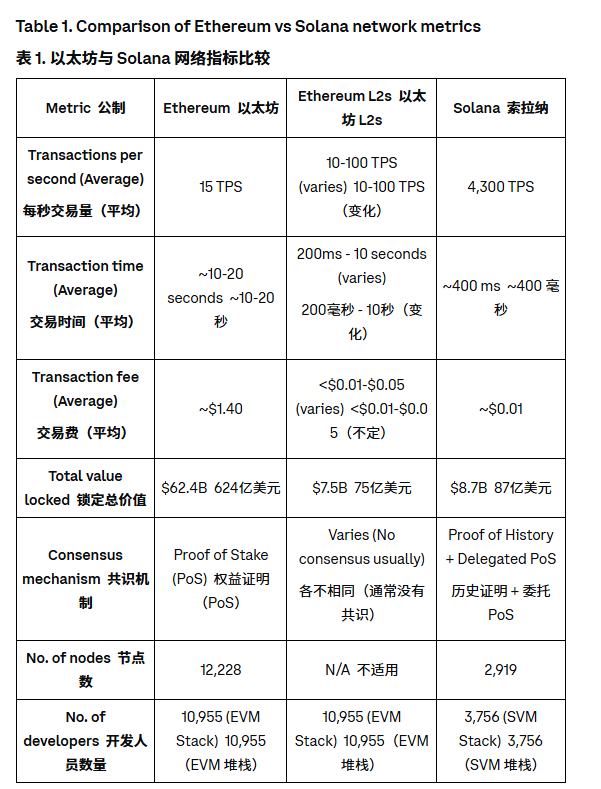

Despite this, the crypto community often frames the debate between Ethereum and Solana as a "choose one" investment option: fast or faster, modular or holistic. However, the community believes that the narratives and investment cases for ETH and SOL are becoming more differentiated and are not necessarily mutually exclusive.

In-depth analysis reveals that the narrative logic and investment value propositions of ETH and SOL are evolving in different directions, and the relationship between the two is no longer a simple zero-sum game but a parallel development model where each seeks optimal solutions in different subfields. This trend of differentiation provides investors with more precise allocation choices and lays the foundation for the diversified development of the entire crypto ecosystem.

Redefining Ethereum's Value: From Smart Contract Platform to RWA Infrastructure Hub

Ethereum is undergoing a profound identity transformation. In the eyes of institutional participants, ETH is increasingly being positioned as a core infrastructure investment target for the Real World Asset (RWA) theme. This shift in positioning encompasses the stablecoin ecosystem, payment system innovations, and broader asset tokenization application scenarios.

The strategic significance of this transformation lies in the fact that Ethereum is no longer merely a representative of a technical platform but a symbol of the bridge between traditional finance and decentralized finance. Institutional investors' recognition of Ethereum's security guarantees and decentralized characteristics makes it the preferred infrastructure for carrying high-value assets. In the wave of tokenizing real-world assets, Ethereum's first-mover advantage and ecological maturity establish its irreplaceable position.

Solana's Ecological Expansion Logic: From Performance Advantages to Application Breakthroughs

The investment argument for Solana focuses on the network's advantages in speed, user engagement, and revenue generation compared to competitors. Although its activity is primarily dominated by meme coin trading, it has also gained traction in other areas.

In the short term (Q3 2025), we believe that the market momentum of both tokens will be driven more by technical factors (i.e., supply and demand) rather than fundamentals, and the upcoming technical upgrades of both networks seem less relevant.

The debate between Ethereum (ETH) and Solana (SOL) has long been a focal point for many institutional investors when evaluating blockchain platforms for investment and/or operational use. This discussion is divisive for both camps.

Many traditional institutional participants cite Ethereum's security guarantees and decentralization as key advantages, making ETH the infrastructure investment for the thriving tokenization of real-world assets (RWA) theme. The opposing camp argues that Solana's faster transaction speeds and lower costs make it a superior alternative.

In-Depth Analysis of the Absence of Altcoin Season

A notable feature of the current cryptocurrency cycle is the absence of the traditionally defined "altcoin season," which reflects fundamental changes in market structure and participant behavior.

Behavioral Pattern Changes Among Retail Investors

Many retail investors have suffered significant losses over the past year from trading meme coins and long-tail altcoins, leading to two distinctly different outcomes: some investors lack the capacity to continue purchasing new altcoins due to capital losses; others, while still having funds, adopt an extremely cautious attitude towards re-entering the market.

This shift in market sentiment not only affects short-term capital flows but, more importantly, alters the market's risk preference structure. The traditional "buy high, sell low" speculative model is giving way to a more cautious value investment logic. While this shift may suppress short-term market volatility, it is beneficial for the long-term healthy development of the market.

The Formation Mechanism of Institutional Investors' Market Bias

This characteristic of price trends has led many institutional investors to develop a clear market bias, favoring investments in larger market capitalization and more liquid mainstream cryptocurrencies. Although some altcoins have recently outperformed ETH and SOL, the risk management frameworks and investment processes of institutional investors make it difficult for them to quickly adjust their portfolio allocations.

The formation of this bias has both rational factors and behavioral finance explanations. From a rational perspective, the liquidity and price stability of large-cap stocks better meet institutional investment requirements; from a behavioral perspective, collective investment decisions often have self-reinforcing characteristics, creating what is known as the "herd effect."

Technical Analysis and Trend Forecast of ETH Market Dynamics

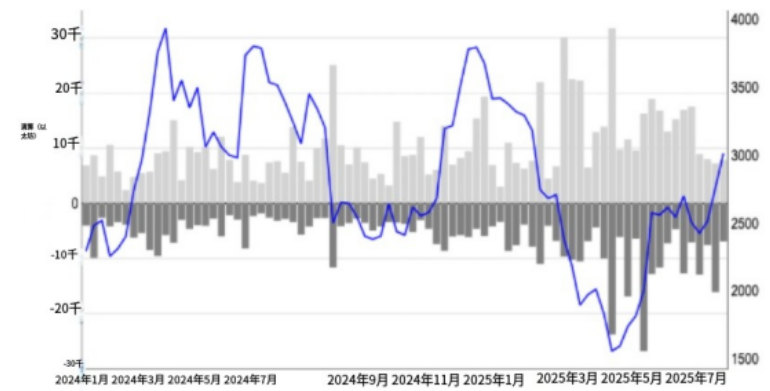

The large-scale short liquidation event of ETH that occurred in early May provided profound insights into the market. Data shows that approximately $897 million (374,000 ETH) of ETH short positions were forcibly liquidated in May, a significant increase compared to $575 million in April and $467 million in March. Shorts continued to be frequently liquidated until July.

The deeper significance of this event lies not only in revealing the market's large-scale mispricing of ETH but also in demonstrating the important impact of technical factors on the price discovery mechanism. The concentrated liquidation of short positions triggered a series of market reactions: first, short covering pushed prices up, followed by a re-gathering of bullish forces, ultimately leading to a shift in overall market sentiment.

Structural Changes in the Financing Currency Function

Another important consequence of this liquidation event is the limitation of ETH's use as a financing currency to hedge long-tail altcoins. Over the past 12-18 months, many market participants have adopted a strategy of shorting ETH and going long on small-cap tokens to achieve excess returns. However, the technical rebound in ETH prices disrupted the risk-reward balance of this strategy, forcing investors to reassess their portfolio construction logic.

The strategic significance of this change is that it may signal a fundamental shift in market structure. If ETH no longer plays the role of a financing currency, then the liquidity structure and price discovery mechanism of the entire altcoin market will face reconstruction.

The Return of Market Beta Coefficient and Its Investment Implications

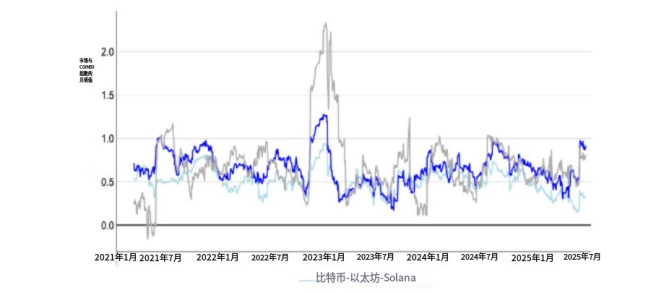

The changes in ETH's beta coefficient relative to the crypto market provide important allocation references for investors. Data shows that ETH's beta value relative to the crypto market rebounded to nearly 1 in mid-June, based on the COIN50 index covering the top 50 cryptocurrencies by market capitalization. Although this value moderately retreated to 0.92 in July, it remains significantly higher than SOL's 0.81 and BTC's 0.32.

This change in beta coefficient reflects an increased synchronization of ETH's performance with the broader crypto market. From the perspective of portfolio construction, this gives ETH unique value in a barbell strategy: investors can gain exposure to the overall crypto market by allocating ETH while enhancing the potential for returns by allocating other tokens with higher asymmetric upside potential.

Multidimensional Expansion Analysis of the Solana Ecosystem

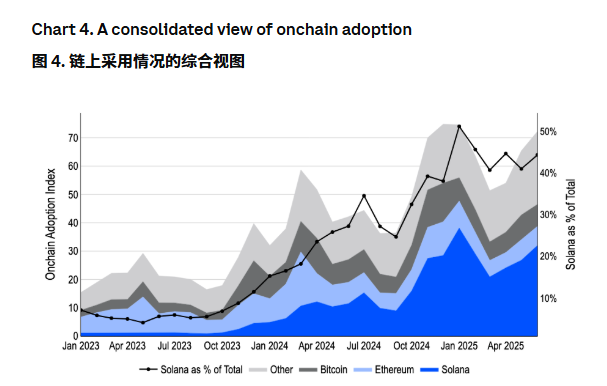

According to the latest Dune index data, a striking trend is emerging: Ethereum's share of on-chain activity has been continuously declining since the end of Q2 2024, while Solana now accounts for 44% of all meaningful blockchain activity.

This statistic is based on a comprehensive assessment of three key indicators: transaction fees (45% weight), USD transfer volume (45% weight), and transaction count (10% weight). The logic of weight distribution is that fees and transfer volumes better reflect real economic activity than mere transaction counts. This calculation method provides compelling quantitative evidence for the fundamental shift in blockchain adoption patterns over the past 12 months.

The Dual Nature of Meme Coin Economics

A significant portion of Solana's activity is indeed driven by meme coin trading, especially after the launch of the pump.fun platform in January 2024, making the meme coin ecosystem a major driver of Solana's network expansion. However, this phenomenon needs to be understood from a more balanced perspective.

From a positive angle, meme coin trading provides a real stress test for the Solana network, validating its technical stability and processing capabilities in high-frequency, large-scale trading scenarios. The value of this practical validation far exceeds theoretical testing, providing strong technical backing for Solana's expansion into other application scenarios.

From a risk perspective, the market appetite for meme coins may peak in early 2025, posing a risk of over-reliance on a single application scenario for Solana. More importantly, investors now have more ways to express their investment views on the meme coin industry without having to go long on SOL directly. Especially after the rapid development of the PUMP ICO (July 12) and the letsBONK.fun launch platform, over 60% of "graduated" meme coins now originate from these platforms, which weakens SOL's unique position as a meme coin investment proxy.

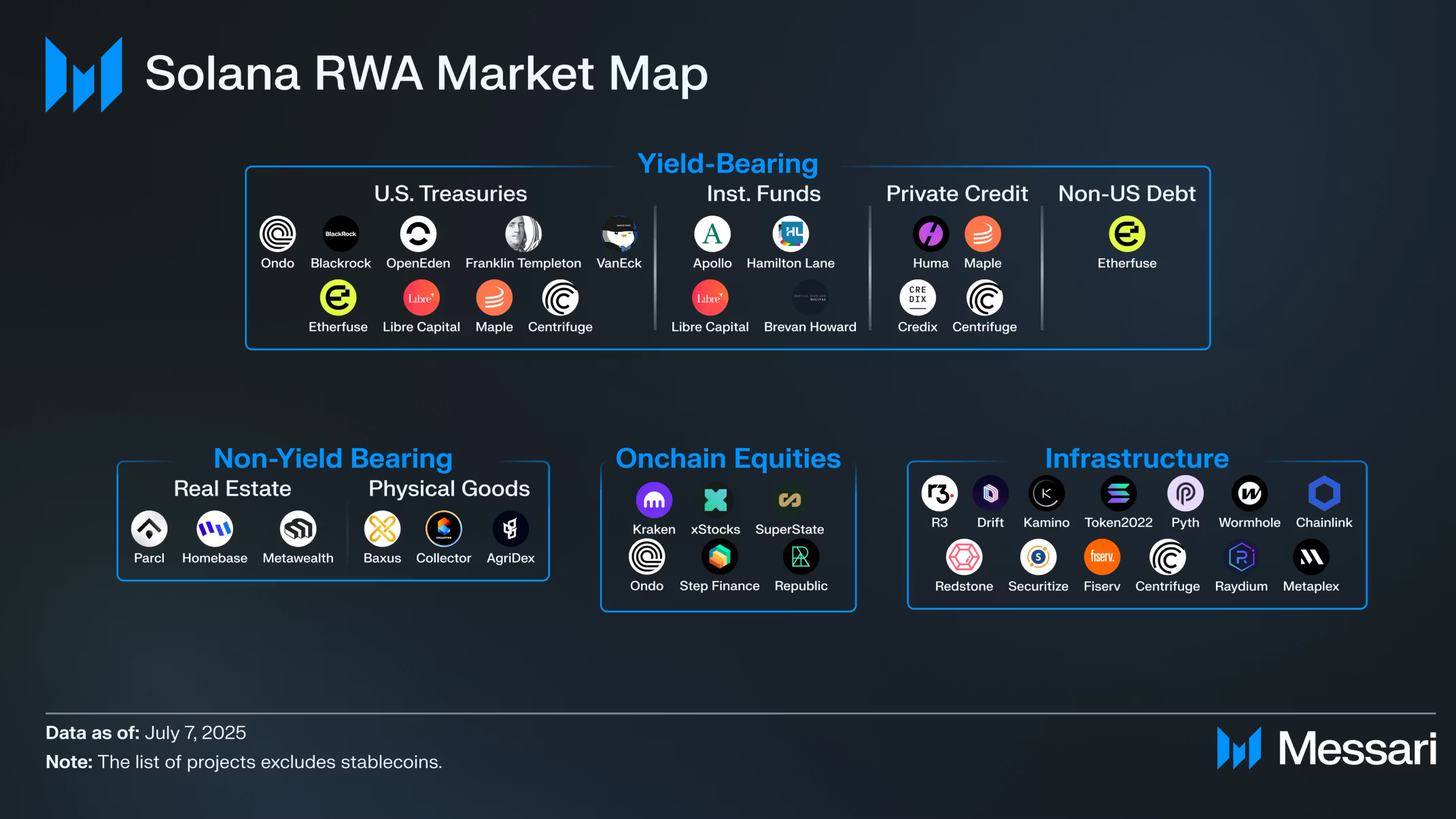

Strategic Layout of Institutional-Level Applications

Despite facing challenges from meme coin dependency, Solana is actively expanding into the institutional-level application field. The launch of Solana's certification service as a KYC/AML layer marks an important transformation towards compliance and institutionalization. This service aims to provide the necessary compliance infrastructure for capital market applications, clearing the way for traditional financial institutions to enter the Solana ecosystem.

At the same time, the Solana Foundation's white paper titled "Tokenized Stocks on Solana: A New Paradigm for Capital Markets," released in May, provides theoretical support and practical guidance for its ambitions in the capital markets sector. This white paper not only outlines the technical implementation path for tokenized stocks but, more importantly, proposes a complete regulatory compliance framework, laying the groundwork for large-scale institutional adoption.

Strategic Shift Trend in Corporate Capital Allocation

In 2025, corporate capital tools are showing an unprecedented positive trend in cryptocurrency allocation. Among 14 dedicated purchasing entities, over 825,000 ETH (valued at $3 billion as of July 18) and 2.95 million SOL ($531 million) have been cumulatively increased. This scale of capital inflow not only reflects a strategic shift in corporate recognition of crypto asset allocation but also embodies the maturation process of institutional investment logic.

Fundamental Changes in Investment Behavior Patterns

The investment behavior of these corporate capital tools shows significant characteristic changes: a transition from short-term speculative trading to long-term strategic asset allocation. Many companies not only hold ETH and SOL but also commit to staking them for additional returns, with some enterprises even locking in supply through DeFi protocol integrations, reflecting a firm belief in the long-term value of crypto assets.

This change in behavior patterns has profound market implications. First, it provides a more stable demand foundation for the market, reducing short-term volatility; second, staking and DeFi integrations increase the actual use cases for tokens, enhancing their intrinsic value; finally, the participation of corporate-level investors brings a more mature risk management and investment decision-making framework to the market.

Yield-Driven Investment Logic

The preference of corporate capital tools for ETH and SOL largely stems from the yield generation potential of these two assets. Unlike traditional value storage functions, ETH and SOL provide investors with stable cash flow returns through staking mechanisms, making them uniquely attractive in corporate financial management.

Driven by media attention on stablecoins and tokenized securities, this yield-driven investment logic has been further amplified. Corporate managers are beginning to view crypto assets as effective tools for cash management, rather than merely speculative investment targets. This cognitive shift injects strong momentum into the institutionalization process of the crypto market.

Solana's Breakthrough Progress in Real World Assets

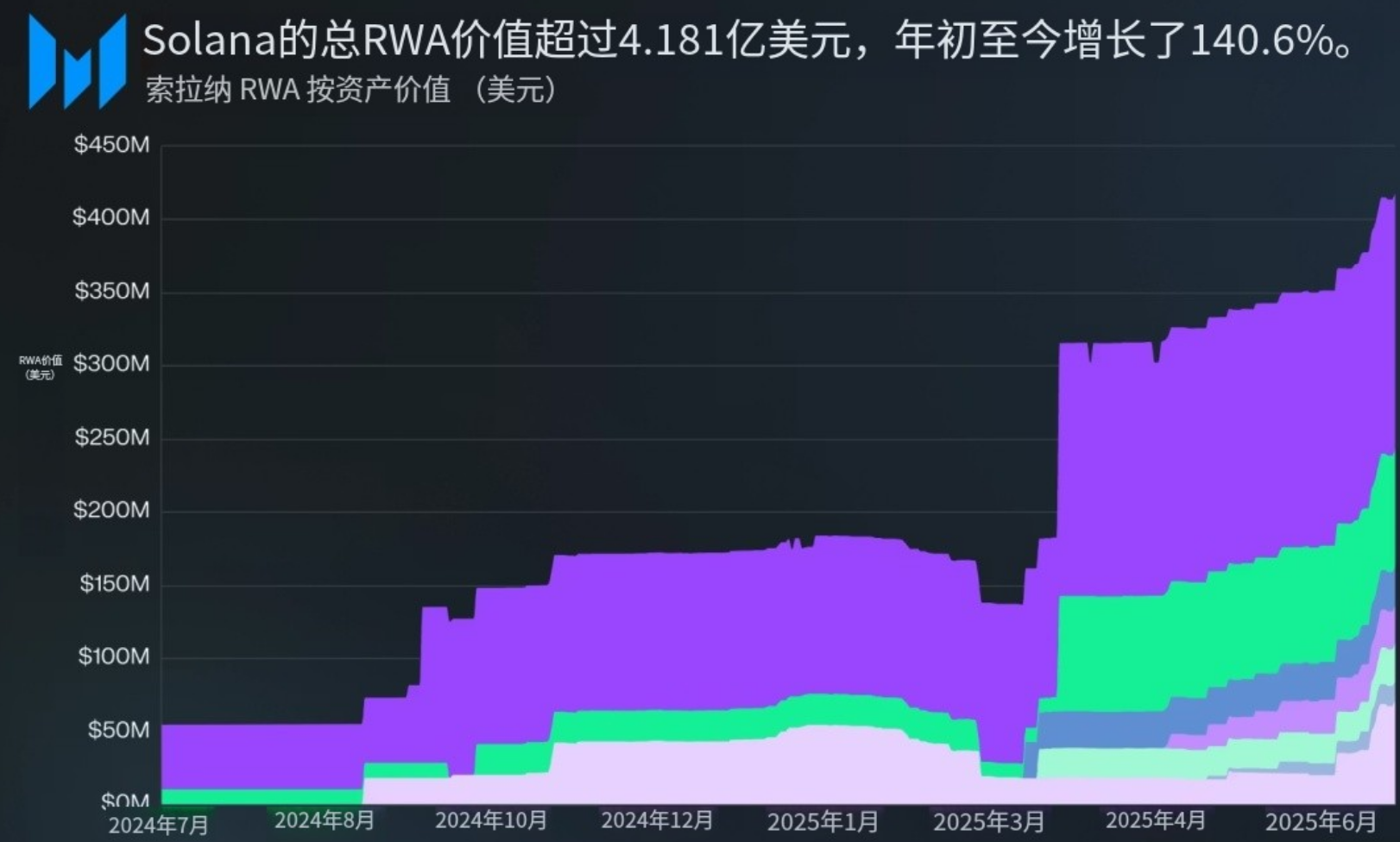

Explosive Growth of the RWA Ecosystem

Solana has made remarkable progress in the Real World Assets (RWA) sector. The total value of RWAs on the platform has surpassed $418.1 million, with a year-to-date increase of 140.6%, a growth rate that far exceeds the performance of traditional financial products.

In this rapidly developing ecosystem, Ondo's USDY holds a leading position with a scale of $175.3 million, accounting for 41.9% of the market share. Following closely are assets like OUSG, ACRED, and BUIDL, forming a diversified product matrix. This product diversity not only provides investors with rich choices but also lays a solid foundation for the long-term development of Solana's RWA ecosystem.

Innovative Breakthroughs in Tokenized Stocks

The strategic partnership between Backed and Kraken marks the official commercialization launch of tokenized stocks on Solana. The xStocks product, launched on June 30, 2025, attracted over 40,000 wallets holding xStock within just one week, demonstrating the strong market demand for tokenized stocks.

The success of this innovative product not only validates its technical feasibility but, more importantly, proves its market acceptance. Traditional stocks enabled by blockchain technology allow for 24/7 trading, global access, and programmability, providing investors with unprecedented convenience and flexibility.

Looking ahead, major platforms like Superstate, Ondo, and Step Finance plan to launch similar tokenized stock services later this year, and this industrial cluster effect will further accelerate Solana's penetration into the capital markets.

Strategic Introduction of Institutional-Level Infrastructure

The collaboration between R3 and Solana represents an important milestone in the migration of traditional financial infrastructure to blockchain. R3 plans to bring over $10 billion of tokenized assets from its permissioned distributed ledger technology (DLT) platform Corda to Solana, and this large-scale asset migration will bring unprecedented institutional-level asset volume to Solana.

As an infrastructure provider specifically supporting regulated financial institutions in the issuance and transfer of tokenized assets, R3's choice of Solana as a collaborative platform holds significant strategic importance. This not only reflects the advanced nature of Solana's technical architecture but also demonstrates recognition of its compliance and institutional service capabilities.

Innovative Practices in Yield-Generating Financial Products

Maple Finance's syrupUSDC represents an innovative attempt at a yield-generating stablecoin, showcasing Solana's strong potential in DeFi product innovation. This product has rapidly grown to a market value of $60.1 million, with 5.42 million syrupUSDC tokens issued since its launch in June 2025.

The success of syrupUSDC lies in its combination of the stability of traditional stablecoins with yield generation capabilities, providing DeFi users with low-risk, stable return investment options. More importantly, this product has high composability within the Solana ecosystem, allowing for seamless integration with other DeFi protocols to form more complex and diverse financial products.

In-Depth Analysis of the Tokenized U.S. Treasury Ecosystem

Ondo Finance's Dual Product Strategy

Ondo Finance demonstrates its deep understanding and strategic layout for the tokenized U.S. Treasury market through its two products, OUSG and USDY.

Launched in January 2023, OUSG is primarily built around BlackRock's BUIDL fund and is positioned as an institutional-level product for qualified investors. As of July 2025, OUSG has 7 holders on Solana, with a market value of $79.6 million, making it the second-largest yield-generating asset on the platform. Its limited number of holders reflects its institutional positioning, while its high market value proves the scale of funding from a single institutional investor.

USDY adopts a completely different strategy, designed as a yield-generating stablecoin with broader accessibility. The token's price appreciates with interest accumulation and utilizes LayerZero for cross-chain transfer functionality, exhibiting high composability in DeFi applications. As of July 2025, USDY has 6,978 holders and a market value of $175.3 million, making it the largest yield-generating RWA on Solana.

The Institutional Endorsement Effect of BlackRock BUIDL

BlackRock's BUIDL fund represents significant recognition of blockchain technology by traditional asset management giants. As a tokenized U.S. dollar money market fund, BUIDL holds cash and short-term U.S. Treasuries, maintaining a AAA rating and a stable value of $1 while distributing daily dividends.

The fund was initially launched on Ethereum in March 2024 and expanded to Solana in March 2025, marking the official deployment of the first major institutional RWAs on the network. BlackRock's choice of Solana as the target platform for multi-chain expansion not only acknowledges its technical capabilities but, more importantly, validates its reliability in institutional services.

As of July 2025, BUIDL has 3 holders on Solana, with a market value of $25.2 million. Although the number of holders is small, this reflects its strict qualified investor admission standards, with each holder's average investment exceeding $8 million, indicating deep participation from institutional investors.

Franklin Templeton's Retail Breakthrough

Franklin Templeton's BENJI fund represents an important attempt by traditional asset management companies to expand into the retail market. As a tokenized version of the FOBXX money market fund, BENJI invests in U.S. government securities, cash, and repurchase agreements, maintaining a stable value of $1 while providing daily interest accumulation.

The breakthrough significance of BENJI lies in its status as one of the first SEC-registered mutual funds aimed at retail investors, offering convenient access through the Benji mobile application. This innovative model combines the professional management of traditional mutual funds with the convenience of blockchain technology, providing ordinary investors with an institutional-level investment experience.

As of July 2025, BENJI has 2 holders on Solana, with a market value of $25.9 million, and an average individual investor size of $12.95 million, reflecting its popularity among high-net-worth individual investors.

Tokenization Exploration in Private Credit and Alternative Investments

Institutional Credit Tokenization by Apollo ACRED

Apollo Global Management's ACRED fund represents an important breakthrough in the tokenization of the private credit sector. As a tokenized version of a diversified private credit fund, ACRED encompasses a portfolio of corporate loans and other private credit instruments, issued as a regulated sToken under Securitize's compliance framework.

The innovation of ACRED lies in its deep integration with Solana's native DeFi platforms. By collaborating with platforms like Kamino and Drift Institutional, users can use their ACRED holdings as collateral to borrow stablecoins, implementing leverage strategies. This design effectively transforms traditionally illiquid private credit assets into composable DeFi collateral, significantly enhancing capital efficiency.

As of July 2025, ACRED has 8 holders, with a market value of $26.9 million, making it the third-largest yield-generating RWA on Solana. Its relatively high number of holders (compared to other institutional products) reflects its good acceptance among qualified investors.

DeFi Native Innovation by Maple Finance

Maple Finance's syrupUSDC represents an important innovation in the yield-generating stablecoin sector. As an on-chain yield-generating stablecoin, syrupUSDC invests user deposits into Maple's credit pool, lending to trading firms, market makers, and fintech companies, with a target annual yield of 6-7%.

The success of this product lies in its perfect fusion of the risk-return characteristics of traditional credit with the composability advantages of DeFi. syrupUSDC can seamlessly integrate with various DeFi protocols within the Solana ecosystem, including applications on DEXs like Orca and lending platforms like Kamino.

As of July 2025, syrupUSDC has issued over 63.6 million tokens, with a total market value of $70.7 million, of which $47 million is deposited in Kamino for further yield optimization. This reinvestment behavior showcases the strong composability and capital efficiency of the DeFi ecosystem.

Marginal Impact of Technological Upgrades and Market Expectation Management

Practical Impact Assessment of Ethereum's Technological Improvements

Technological upgrades in the Ethereum ecosystem, such as EIP-9698 (increasing the gas limit from 36 million to 3.6 billion) and EIP-7983 (setting a cap on gas usage for a single transaction), are primarily aimed at enhancing network transaction throughput and optimizing block execution efficiency. However, our analysis indicates that the direct impact of these technological improvements on ETH price performance is relatively limited.

This phenomenon reflects the current market's rational pricing mechanism regarding technological upgrades. Compared to marginal improvements in technical parameters, institutional investors are more focused on the ecological value and long-term strategic position of ETH as RWA infrastructure. The demand driven by the development of tokenized stocks, stablecoin issuance, and DeFi protocols far exceeds the simple enhancement of technical performance.

Strategic Significance of Solana's Performance Optimization

Solana's Alpenglow upgrade proposal represents an important innovation in the consensus mechanism field. This upgrade aims to replace the existing consensus mechanism with a native timer and off-chain voting mechanism, further accelerating consensus speed, improving network performance, and reducing validator operating costs.

Although the Alpenglow upgrade is significant at a technical level, we believe its impact on SOL's short-term price movements is limited. The primary drivers of the current SOL price are more related to the supply-demand relationship on the technical side, including incremental demand from corporate capital tools, expectations of ETF approvals, and the rapid development of the RWA ecosystem.

This phenomenon indicates that the market's perception of Solana's value has transcended purely technical performance, shifting towards a comprehensive assessment of its ecological value and application scenarios.

Multidimensional Analysis of Market Prospects and Investment Strategies

Technical Factors Dominating Short-Term Price Drivers

In the expected positive market conditions of the third quarter of 2025, we judge that the market momentum for ETH and SOL will primarily be driven by technical factors rather than fundamentals. This judgment is based on several key observations:

First, supply-side factors such as ETF approval expectations and increased corporate capital allocation will have a direct impact on prices; second, staking integration and yield optimization demand will create new sources of demand; finally, changes in market sentiment and investor risk preferences will amplify the influence of technical factors.

This technical-dominated price formation mechanism provides investors with a relatively clear analytical framework and serves as a reference for developing short-term trading strategies.

Strategic Value of Differentiated Investment Logic

The differentiated development of ETH and SOL investment cases offers investors more precise allocation choices. ETH, positioned as the infrastructure for real-world asset themes, is more suitable for investors seeking stable returns and long-term value growth; SOL, with its advantages based on high-performance networks and innovative application scenarios, aligns better with the investment needs of those pursuing growth and technological foresight.

This differentiation does not imply an adversarial relationship between the two; rather, it provides complementary choices for diversified portfolio allocation. Investors can make reasonable weight distributions between the two based on their risk-return preferences and investment horizons.

Key Points for Implementing a Barbell Strategy

The market beta coefficient of ETH being close to 1 gives it unique allocation value in a barbell strategy. Investors can gain exposure to the overall crypto market by holding ETH while allocating smaller market cap tokens with higher asymmetric upside potential to enhance return possibilities.

The core of this strategy lies in utilizing ETH's relative stability to anchor the risk exposure of the portfolio while pursuing excess returns through the allocation of high-risk, high-reward assets. The long position in ETH plays a dual role in this strategy as both a risk buffer and a return foundation.

Conclusion: Ecological Differentiation and Synergistic Development

While institutional investors have favored BTC for most of this cycle, there is a growing interest in select altcoins, particularly those that appear undervalued on a relative basis. The position of ETH as an agent for real-world asset themes is increasingly solidified, while Solana, despite facing challenges from a slowdown in meme coin activity, is demonstrating its high throughput processing capabilities and actively exploring new application areas.

Ultimately, the community believes that in the short term, the price performance of the two tokens will primarily be influenced by technical factors rather than fundamentals. This market landscape provides investors with opportunities for differentiated allocation based on varying risk-return characteristics, rather than a simple binary investment decision.

(Some data referenced from Coinbase, Messari)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。