近日,美国《GENIUS Act》稳定币法案正式通过,标志着美国首次为稳定币制定全面监管框架,推动了Web3生态的进一步规范化。法案要求稳定币发行人持有1:1的流动资产(如美元或短期国债)作为储备,并每月公开披露储备构成,同时引入反洗钱规则以防范非法活动。据报道,该法案得到两党支持,并得到特朗普政府的背书,其家族企业World Liberty Financial发行的USD1稳定币(尽管市场份额较小)也将受益于此。

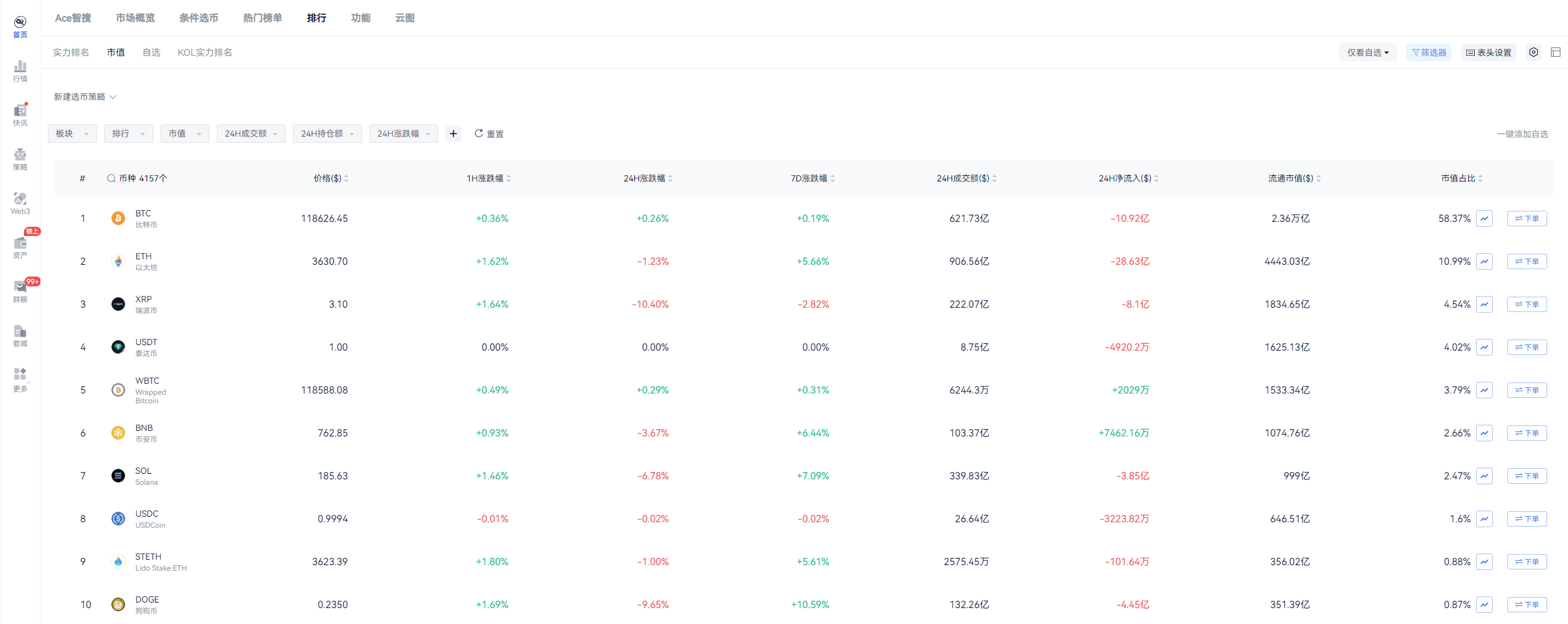

稳定币作为加密市场的重要支柱,2025年市场总市值已突破2700亿美元,其中Tether(USDT)以1625亿美元的市值占据主导,USD Coin(USDC)以646.54亿美元紧随其后。 法案的通过不仅增强了投资者对稳定币的信心,还为Web3应用(如去中心化金融DeFi和跨境支付)提供了合法性保障。

AiCoin现货成交额选币法通过多维度指标筛选高潜力币种,为投资者提供科学依据。筛选标准包括:1H成交变化排名:前10、4H成交变化排名:前10、24H成交变化排名:前10、24H涨跌幅:≤ +10%,24H成交额:≥ $500万

- 24H涨跌幅:≤ +10%,避免追高风险。

- 24H成交额:≥ 500万美元,确保高流动性。

筛选结果包括LINK、SUI、DOGE、SOL、ETH、XRP、BNB和BTC。这些币种在市场表现中展现出强劲的交易活跃度和潜力:

LINK:$17.89

LINK作为去中心化预言机网络的代币,在Web3生态中扮演关键角色。2025年,Chainlink的跨链互操作协议(CCIP)持续推动DeFi和NFT应用的发展,稳定币法案的通过为DeFi生态提供了更稳定的交易环境,LINK作为DeFi基础设施的支柱有望进一步受益。

SUI:$3.69

SUI是高性能Layer 1区块链Sui网络的原生代币,专注于低延迟和高吞吐量交易。2025年7月,Sui网络的DeFi总锁仓量(TVL)快速增长,吸引了机构资金的关注,Sui的快速发展和稳定币在跨境支付中的应用为其提供了增长空间。

DOGE:$0.235

DOGE作为迷因币的代表,凭借高流动性和社区支持保持市场活力。Strategy公司的公告指出,DOGE在DeFi领域的应用潜力正在被挖掘,尤其在去中心化支付场景中。稳定币法案的通过可能推动DOGE与USDT/USDC的交易对活跃度,短期内关注0.22美元阻力位。

SOL:$185.12

Solana以高性能和低交易成本著称,2025年其生态在DeFi和NFT领域持续扩张。Coinbase报道,Solana链上USDC的供应量占比从2024年的53%增至74%,显示其在稳定币交易中的重要性。

XRP:$3.11

XRP作为Ripple网络的原生代币,专注于跨境支付。2025年7月,Ripple与多家金融机构的合作进一步深化,稳定币法案的通过可能加速XRP在全球支付中的应用,短期关注0.80美元阻力位。

BNB:$764.18

BNB作为Binance生态的核心代币,受益于交易所的高交易量和DeFi应用。

BTC:$118453.48

比特币以118,246.3美元的价格稳居榜首,24小时微跌0.13%。稳定币法案的通过增强了BTC与USDT/USDC交易对的流动性,机构资金(如BlackRock的ETF增持1190枚BTC)进一步巩固其“数字黄金”地位。短期关注120,000美元突破点。

投资启示与风险提示

稳定币法案的通过为加密市场注入了确定性,推动了Web3生态的规范化发展。AiCoin的选币法通过成交额和涨跌幅筛选,精准捕捉了市场热点币种,为投资者提供了科学的参考。以下是投资建议:

短期策略:关注LINK、SUI、DOGE的高成交变化,利用支撑位和阻力位进行波段交易。

长期配置:SOL、XRP和BNB因其在Web3和DeFi中的应用潜力,适合长期持有。BTC作为避险资产,适合机构和稳健型投资者。

风险管理:加密市场波动性高,建议设置止损点,关注监管动态(如MiCA对USDT的限制)。

本文章仅供信息分享,不构成对任何人的任何投资建议。

加入我们的社区讨论该事件

官方电报(Telegram)社群:t.me/aicoincn

聊天室:致富群

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。