Author: Zz, ChainCatcher

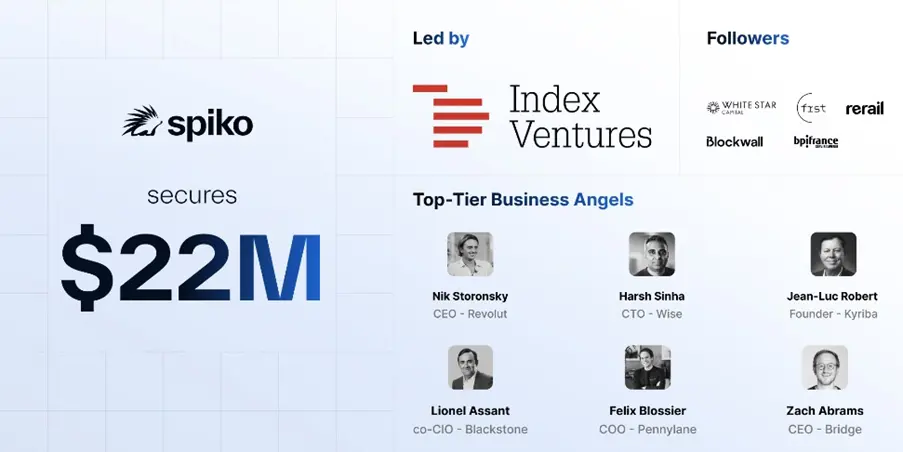

On July 17, 2025, Spiko, founded by a former deputy director of the French Ministry of Finance, completed a $22 million Series A financing round, led by Index Ventures, with participation from well-known institutions such as the French National Investment Bank Bpifrance and Revolut co-founders.

This company, established less than two years ago, is attempting to address a market pain point valued at over €21.5 trillion: "European corporate funds are largely idle in nearly zero-yield bank current accounts, while their American counterparts can easily obtain substantial risk-free returns through money market funds." Against the backdrop of global liquidity surpluses and dramatic changes in the interest rate environment, this structural arbitrage opportunity has been keenly captured.

Spiko has chosen a different path: wrapping cutting-edge blockchain tokenization technology within the most traditional and trusted UCITS regulatory framework in Europe, creating the EU's first compliant tokenized money market fund. This "Trojan horse" strategy is building an unprecedented bridge between traditional finance and decentralized finance in Europe.

Project Advantages and Innovations

At a critical turning point where blockchain technology is shifting from speculative frenzy to pragmatism, Spiko's core insight is: true disruption lies not in the technology itself, but in how to leverage technology to address real-world pain points.

The current global financial system faces a fundamental contradiction: on one hand, the Federal Reserve's interest rate hike cycle has driven risk-free yields above 5%, making money market funds a safe haven for capital; on the other hand, the inefficiency of the European traditional banking system has trapped corporate fund management in difficulties. Over €21.5 trillion in corporate cash is "sleeping" in current accounts, while the compliance costs and operational complexities of cross-border investments in U.S. Treasury bonds deter most small and medium-sized enterprises.

Spiko's solution stands out here, with its flagship products USTBL and EUTBL investing in U.S. Treasury bills and government bonds from major EU countries, respectively, issuing traditional money market fund shares in the form of ERC-20 tokens on the blockchain through tokenization technology. The core value of this innovation lies in breakthroughs across three dimensions:

Efficiency: Traditional cross-border investments require 3-5 business days for settlement, while Spiko enables 24/7 trading and near real-time settlement, allowing European companies to allocate global quality assets as simply as making a transfer.

Cost: By automating execution through smart contracts, intermediary costs are significantly reduced. The platform uses upgradeable smart contracts based on the UUPS model, compatible with extension standards such as ERC-1363, ERC-2612, and ERC-2771, allowing users to complete on-chain interactions without holding ETH.

Threshold: The cross-chain functionality integrated with Chainlink CCIP allows tokens to flow seamlessly across ecosystems like Ethereum, Polygon, and Arbitrum, while strict KYC/AML whitelisting ensures compliance. Small and medium-sized enterprises, often overlooked by traditional banks due to scale limitations, can now access institutional-level cash management services with just a mobile phone number.

Crucially, Spiko positions blockchain technology as infrastructure rather than a speculative tool, perfectly aligning with the maturation trend of the RWA (Real World Asset Tokenization) sector.

Project Progress and Financing

Amid the dual pressures of a financing winter and tightening regulations, Spiko's rapid growth stands out. Since its launch in June 2024, the project has surpassed $400 million in assets under management within just one year, serving over 1,000 European corporate clients.

Behind this achievement is the trust advantage built by its unique team gene. Founder Paul-Adrien Hyppolite previously served as the deputy director of the Financial Markets Department at the French Ministry of Finance, while co-founder Antoine Michon was a ministerial advisor for the digital transformation of public services in the French government, both graduates of École Polytechnique. This combination of "regulatory insiders" has endowed Spiko with a compliance DNA that is difficult for other projects to replicate from its inception.

Moreover, the deeper implications of the investor composition are noteworthy. Index Ventures, as a leading VC in Europe, validates the scalability of its business model; the participation of Bpifrance brings quasi-governmental endorsement. Most compellingly, Bpifrance is not only an investor but also a client of Spiko, directly using its own funds to subscribe to its tokenized fund—this is the ultimate validation of product safety and compliance.

Angel investments from European fintech unicorn founders such as Revolut co-founder Nikolay Storonsky and Wise CTO Harsh Sinha further indicate high recognition from industry insiders of its ability to address real market pain points.

With the completion of the Series A financing, Spiko is upgrading from a mere fund issuer to a cross-chain financial infrastructure provider.

This $22 million financing not only provides Spiko with expansion capital but, more importantly, labels it as a "compliance benchmark" in an increasingly stringent regulatory environment.

RWA Sector, Spiko's First-Mover Advantage

When we broaden our perspective to the entire RWA sector, an interesting phenomenon emerges: after experiencing the DeFi frenzy of 2021-2022, the market is returning to rationality, with regulatory compliance becoming a watershed for project survival.

A clear regional differentiation can be observed when comparing major global players: BlackRock's BUIDL primarily targets U.S. accredited investors with a high threshold of $5 million; Franklin Templeton's FOBXX is centered on U.S. regulations; Ondo Finance is regulated in Bermuda but does not serve U.S. users. While these projects are large in scale, they cannot directly serve the vast number of small and medium-sized enterprises in the European market.

Spiko's uniqueness lies in its choice of the most challenging yet defensively strong path: UCITS compliance. As the "gold standard" for investor protection in the EU, UCITS imposes extremely strict regulations on fund diversification, liquidity management, risk control, and asset segregation. Obtaining such certification requires deep regulatory expertise, a robust operational system, and significant time and financial costs.

The strategic value of this "regulatory moat" is becoming evident: many institutional investors, corporate finance executives, and family offices explicitly prohibit investments in unregulated products. As the first EU provider of a tokenized MMF to obtain UCITS certification, Spiko has successfully entered this high-value, risk-averse blue ocean market—a realm that most crypto-native projects find difficult to access.

Moreover, as global regulatory frameworks gradually improve, compliance will shift from being optional to mandatory. Projects that lay the groundwork for compliance infrastructure in advance will gain a first-mover advantage in this sector reshuffle. Spiko's choice is, in fact, a preemptive submission for the impending "regulatory exam."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。