作者:钛媒体

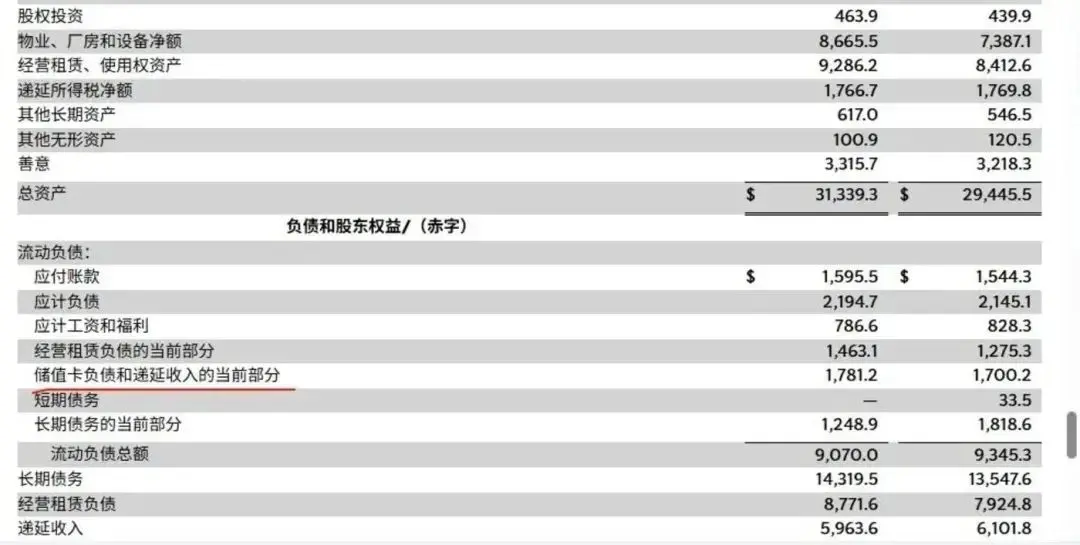

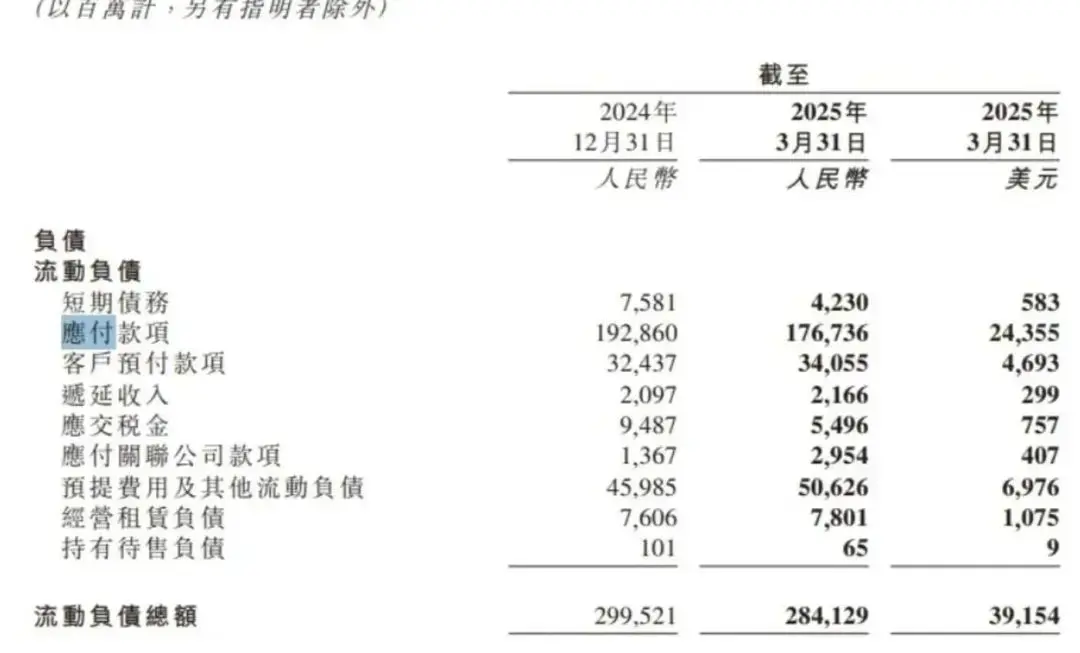

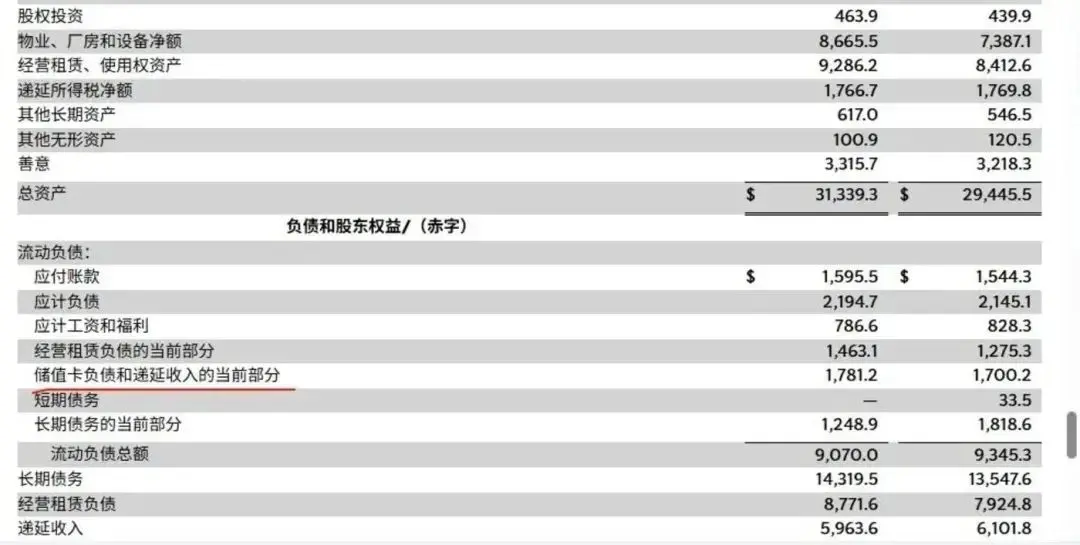

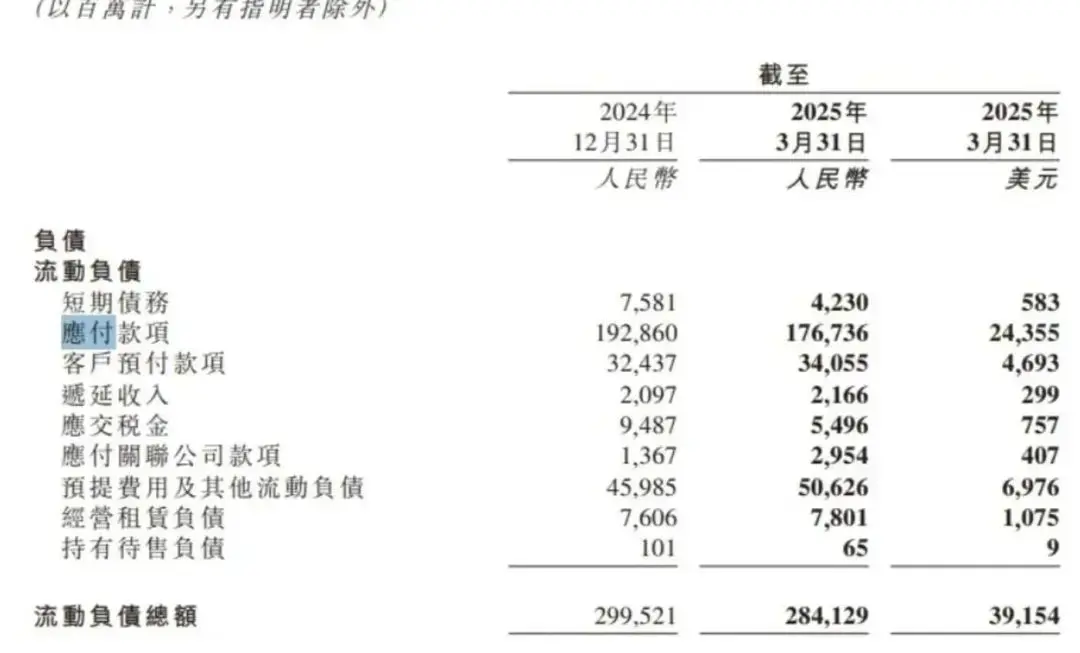

几天前,美团核心本地商业CEO王莆中透露了自家外卖的利润率:约4%。这正好是美元稳定币的“利润率”。因为稳定币的商业模式是把用户购买稳定币的钱购买国债,赚取利润,而当下的美元国债利率大约是4%。沃尔玛2024财年的净利率只有2.39%、京东2024年净利率为3.6%、亚马逊零售业务的利润率大约为5%。如果稳定币真的能像外界畅想的那样,成为他们生态内的主流支付方法,仅利息收入就可能每年上百亿元——这不只是一种理财方法,更是一种可以成为支柱的收入来源。很多低利润的生意,其商业模式都将发生永久改变。整个产业的商业模式都围绕这个数字展开,这个数字就是当下的美元国债利率。稳定币用户购买稳定币的费用,大多数被发行方用来购买这种无风险投资产品。假如能发行1亿美元的稳定币,那么发行方每年就能赚取约400万美元左右的营收。这就是Circle、Tether(泰达)这些稳定币厂商的商业模式。它只是一种利息,一家企业当然可以靠利息优化财务结构,怎么能全靠银行利息吃饭?并且它还具备波动性,一旦美联储大幅度降息,所有稳定币厂商的净利润都会暴跌。这种生意完全没有自己的利润定价权,是纯粹的周期性业务。但另一方面,4%又足够高,高到比很多企业的净利润还高。美团核心本地商业板块CEO王莆中在几天前接受了过去一年美团外卖利润率约4%。互联网巨头投入上千亿的战争,打来打去,最后只能挣个美元利率。互联网平台的利润率不都像拼多多一样优秀,滴滴2024年的利润率比美团的外卖业务更低,还不到1%。传统零售企业更是长期以低利润著称,沃尔玛2024年净利润率只有2.3%,沃尔玛的利润总额只有150亿美元左右,完全对不起它常年五百强第一的身份。网络零售商也没好多少,京东2024年的净利润率只有3.6%。亚马逊那边,2024年全年净利率低于10%——这还是高利润云服务撑起来之后的结果,按照外界预估,其零售业务只有5%左右。制造业更不用说,大量头部企业都处在亏损之中,别说4%,有些企业就连1%的利润率都没有。4%的利息对苹果可能只是锦上添花,但对这些企业来说,是足以支撑起主要利润的核心业务。——金融作为主要利润并非没有先例,理想汽车2024年上半年卖车陷入经营亏损,16.92亿元的净利润里,有14.39亿是投资理财收益。通用电气巅峰时制造业利润较低,但40%-50%的利润来自金融业务。可以说,利润率越低的企业,越需要稳定币这种金融手段优化商业模式。当然,不是每个企业都有能力发行大量的稳定币。稳定币的作用是交易,它需要足够的交易量来支撑——最适合的企业浮出水面:零售。他们拥有所有行业里几乎最大的交易额,发币能力极强。同时,他们利润率低,进入这个领域的收益会比高利润企业更丰厚。于是,零售企业成为进军稳定币领域最积极的一个群体。6月,媒体披露沃尔玛和亚马逊均计划推出稳定币。除了这两家零售巨头,OTA平台Expedia也在摩拳擦掌。大洋彼岸,刘强东亲自宣布京东希望在全球所有主要的货币国家申请稳定币牌照。他们的终极目标是显而易见的:发行大量稳定币,并用于自家商品的交易。最好是所有生态内的交易,都用自家稳定币来发行,就像理发店都通过会员卡支付一样。他们再把这些“预充值”费用存起来赚取利息。以沃尔玛为例,沃尔玛去年收入高达6800亿美元,除此之外沃尔玛还有部分第三方电商业务,总GMV可能超过7000亿美元。如果能发行GMV十分之一的稳定币,其稳定币市值就有可能超过Circle。如果能发行GMV相等的稳定币,那沃尔玛将成为稳定币行业的巨无霸。当然不能。毕竟钱是流动的,7000亿的GMV不需要7000亿的稳定币。沃尔玛们能发行的稳定币数量,实际上是“市场上能沉淀多少未被消费的余额”。这个数字有一个参考:星巴克的未消费会员金额。星巴克2024年财报显示,其账上沉淀的储值卡金额高达17亿美元。要知道,星巴克的年度净营收只有360亿美元,沃尔玛是其20倍左右。如果沃尔玛能靠稳定币达到星巴克预充值比例,即接近5%的收入都沉淀在会员卡预充值里,其账上将沉淀接近400亿美元。图注:这17亿美元,是会员充值,但还没消费的钱。星巴克可以将其用来购买国债,赚取每年7千万美元左右的利润此外,星巴克是一种高频消费,而无论是沃尔玛的超市购物,还是京东和亚马逊的线上购物,其频率要远低于“喝杯咖啡”,购物频率越低,资金流转就越慢,卡上未消费的金额就会越多——就能发更多的币。零售业的单次消费金额也远高于星巴克——美国人去趟超市动辄几百美元,喝杯咖啡才5美元。消费金额高,意味着账上需要的余额冗余也更大,零售商可以用“充1000送100”的方式来吸引消费者多充值——又能发更多的币。从天赋上看,沃尔玛的沉淀资金能力是强于星巴克的。如果其稳定币的支付比例能够达到星巴克的会员卡支付比例,其发币量很可能超过500亿美元,每年的利息收入超过20亿美元。对年利润150亿美元沃尔玛来说,这绝对不是一笔小钱。这还没完,沃尔玛、亚马逊等零售商还要支付VISA、万事达、美国运通等卡组织每年数十亿美元的手续费。如果支付体系能大幅度被稳定币替换,这又将省下来大幅度利润。此外,如果所有流动性都沉淀在自己的链上,这又能诞生出海量的金融理财服务。——更不切实际的畅想是,作为终端零售商,沃尔玛、亚马逊、京东们甚至可以将稳定币用于支付上游货款和员工奖金这部分的潜力可以直接参考企业的应付账款。沃尔玛的应付账款常年在500亿美元以上,京东最新财报里的应付账款高达1767.36亿人民币。如果这些账款都通过稳定币支付,上游厂商收到稳定币,到稳定币被赎回中间的时间差里,发行方还能赚一段时间利息。图注:零售商作为产业链的最下游,沉淀着大量上游资金只要以上畅想可以部分实现,对于这些收入极高,但利润率极低的企业来说,来自稳定币的收入甚至有可能比主业更高。消费企业的商业模式或许也会完全改变,他们完全可以像Costco一样:卖东西不赚钱,就交个朋友,再通过稳定币(会员卡)赚取利润。当然,在金融的世界里,光挣得多没有用,还得活到最后。事实上,在稳定币之前,想靠金融改善低利润的企业一点不少。但最终大多数都失败了。比如制造业巨头GE(通用电气)。相比于制造业微薄的利润,金融的钱显得又多又好赚。这成为了GE“改善烂生意”的利器,其巅峰时超过一半的利润都来自金融行业。但危机也是显而易见的。因为绝大多数企业做金融,资金来源其实只有一个:借。比如GE就是历史上最能发债的公司之一,到金融危机前,GE的商业票据规模已经超过了1000亿美元。这些短期借款被GE再发出去,赚取一进一出的利息差——这也曾经是国内许多互联网金融公司的商业模式。今天的人们一眼就能发现其中的问题:这本质是“以贷养贷”或“拆东墙补西墙”。它不能承受任何波动,但整个链条只要有一点不确定因素,企业就可能还不上钱。结果的确如此,金融危机时,GE就直接崩盘,股价蒸发80%。正是金融这种极高的风险,使得GE这套玩法几乎销声匿迹。今天的度小满等互联网金融公司,也是更多起到平台作用,资金来自银行等合作方。而不是自己去借债赚取利息差,毕竟一个波动,整个链条就有可能断掉。相比传统金融,稳定币的融资模式堪比耍流氓:企业发债券需要支付高额利息,哪怕是银行,也得给储户支付利息。但稳定币发行方不必支付任何利息。甚至在提现的时候收取一定的手续费,比如稳定币第一股Circle在去年10月上调了赎回手续费,最高可达0.1%。融资不支付利息就算了,还钱的时候竟然还能收一笔钱?就算收费,稳定币也不是谁都能赎回的。比如Tether(泰达)就规定,某些经过KYC认证的受信任实体才能直接铸造或赎回USDT。简而言之,只有大机构才能赎回稳定币。更加霸道的是,泰达还保留了自己不给用户赎回的权利,真正把“欠钱的是大爷”这句话落到了实处。这极大地降低了稳定币的赎回频率,使得稳定币厂商并不需要太多的准备金就足够应付流动性需求。又由于极低的融资成本,外加上监管的要求,稳定币厂商不必像GE一样寻找各种高回报但高风险的贷款,只需要购买无风险的理财产品——国债。眼下,四大美元稳定币发行商一共已持有约1800亿美元的美国国债。当然,稳定币公司也可以投资其他产品,比如最大的稳定币发行方Tether就持有了部分黄金和比特币。如果GE、雷曼兄弟、高盛有这样的金融工具,那么它在2008金融危机中就不会暴雷——国债是一种无风险投资,金融危机期间国债非但不降,反倒会上涨。即便用户大规模赎回,把稳定币一卖,也能顺利还债。事实上,银行和保险公司之所以能赚钱,其核心就是拥有一个极低成本、也相对低风险的资金来源。但在稳定币的加持下,沃尔玛、京东、亚马逊这种拥有大量交易额的企业,很可能成为未来融资成本最低的玩家。他们不是保险公司,但他们可以像保险公司一样享受负成本的杠杆。当然,企业发币稳定币还处在探索之中。到底是会大规模发行,还是只作为跨境贸易等少数场景的补充,各家还没有给答案。即便大规模发行,它能否成为一种通用性强的货币?如果不能,其对消费者来说就是换了个皮的“预充值购物卡”。如果过去消费者不接受在沃尔玛预存几千美元,那么有了币以后,他们仍然未必能接受。免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。