Author: 1912212.eth, Foresight News

Original Title: On-chain Liquidity DeFi New Star? Understand the Newly Launched Spark in Three Minutes

On June 17, exchanges such as Binance, OKX, Bybit, Bitget, and Bithumb announced the launch of Spark (SPK) spot trading. In the current market where liquidity is becoming increasingly tight, it is rare for projects to quickly land on major exchanges. The next day, Coinbase also announced support for SPK trading. However, the excitement soon cooled down, and Bitget's market data showed that SPK once dropped to around $0.03. Recently, as the market warmed up, SPK embarked on a rally, achieving four consecutive daily gains, soaring from $0.04 to $0.1, more than doubling in just a few days. So, what exactly is Spark?

On-chain Liquidity Protocol

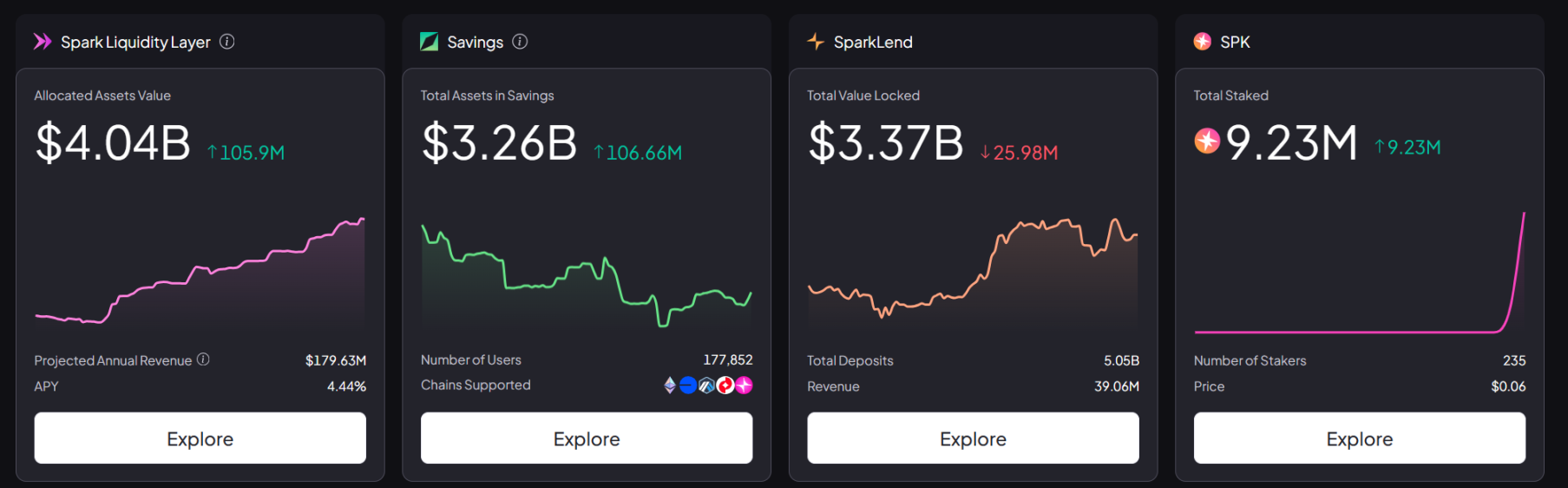

Spark is the liquidity and yield infrastructure layer of on-chain finance. Since the inception of DeFi, the crypto market has faced a persistent structural problem: liquidity is highly fragmented and yields are unstable. Although DeFi has developed over the years, this issue remains unresolved. Spark acts as an on-chain asset allocator, borrowing from Sky's stablecoin reserves valued at over $6.5 billion and deploying capital into DeFi, CeFi, and RWA. Spark provides stable liquidity to the market while achieving large-scale risk-adjusted returns.

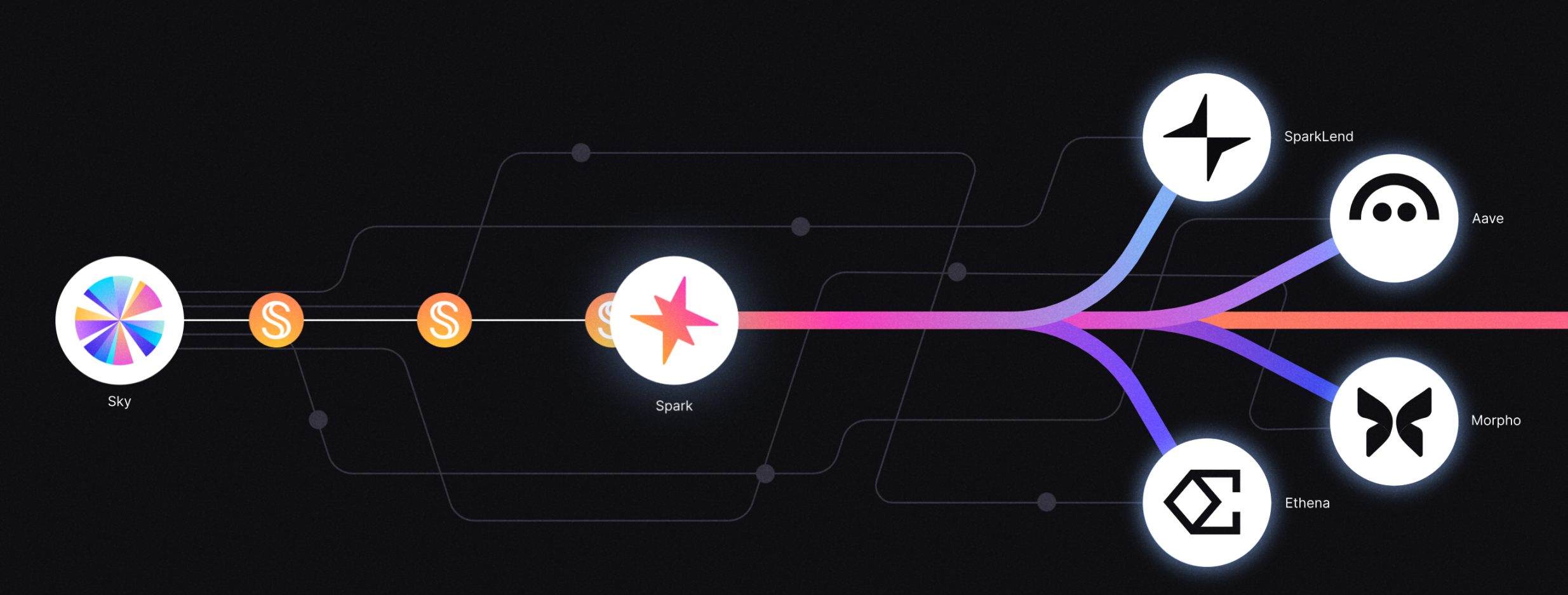

The core of Spark is its Liquidity Layer (Spark Liquidity Layer, abbreviated as SLL), which can automatically provide liquidity for USDS, sUSDS, and USDC directly from Sky across various blockchain networks and DeFi protocols. This allows users to easily earn Sky savings rates using sUSDS on their preferred networks. Additionally, it enables Spark to automatically provide liquidity to the DeFi market to optimize yields.

SLL utilizes the Sky Allocation System to provide liquidity for USDS, sUSDS, and USDC across various networks and DeFi markets. It mints USDS and sUSDS through Sky Allocator Vaults and bridges them to other networks using SkyLink. The minted USDS is also exchanged for USDC through the Sky Peg Stability Module and then bridged to other networks using Circle's cross-chain transfer protocol. The bridged USDS, sUSDS, and USDC can be deposited into liquidity pools, DeFi protocols, lending markets, or other yield strategies on the target chain.

Sky aims to keep 25% of USDS reserves in cash reserves, primarily USDC, to ensure the liquidity and stability of USDS. SLL brings this liquidity from the Ethereum mainnet to supported networks. Therefore, users can easily access ample liquidity, allowing them to convert USDC to sUSDS and vice versa. This ensures that the stability of USDS, the yield of sUSDS, and the liquidity of the Sky Peg Stability Module benefit the entire DeFi ecosystem across all supported networks.

Currently, the protocols supported by SLL include SparkLend, Aave, Morpho, and Curve, with supported chains including Ethereum mainnet, Base, Arbitrum, Optimism, and Unichain.

The core team of the Spark protocol has deep roots in the crypto space. The core member is Lucas Manuel, co-founder of Phoenix Labs, a research and development company specializing in DeFi protocol smart contract development. Previously, he was the SC technical director at Maple Finance. Another core contributor is Nadia, also a co-founder of Phoenix Labs, who was previously responsible for Sky ecosystem growth.

The last key member is Kris Kaczor, who is also a co-founder of the data website l2beat.com. Kris is also an engineer at Phoenix Labs, and in his Twitter bio, he describes himself as proficient in JavaScript and Klingon (a fictional alien language from the sci-fi series "Star Trek").

Token Economics

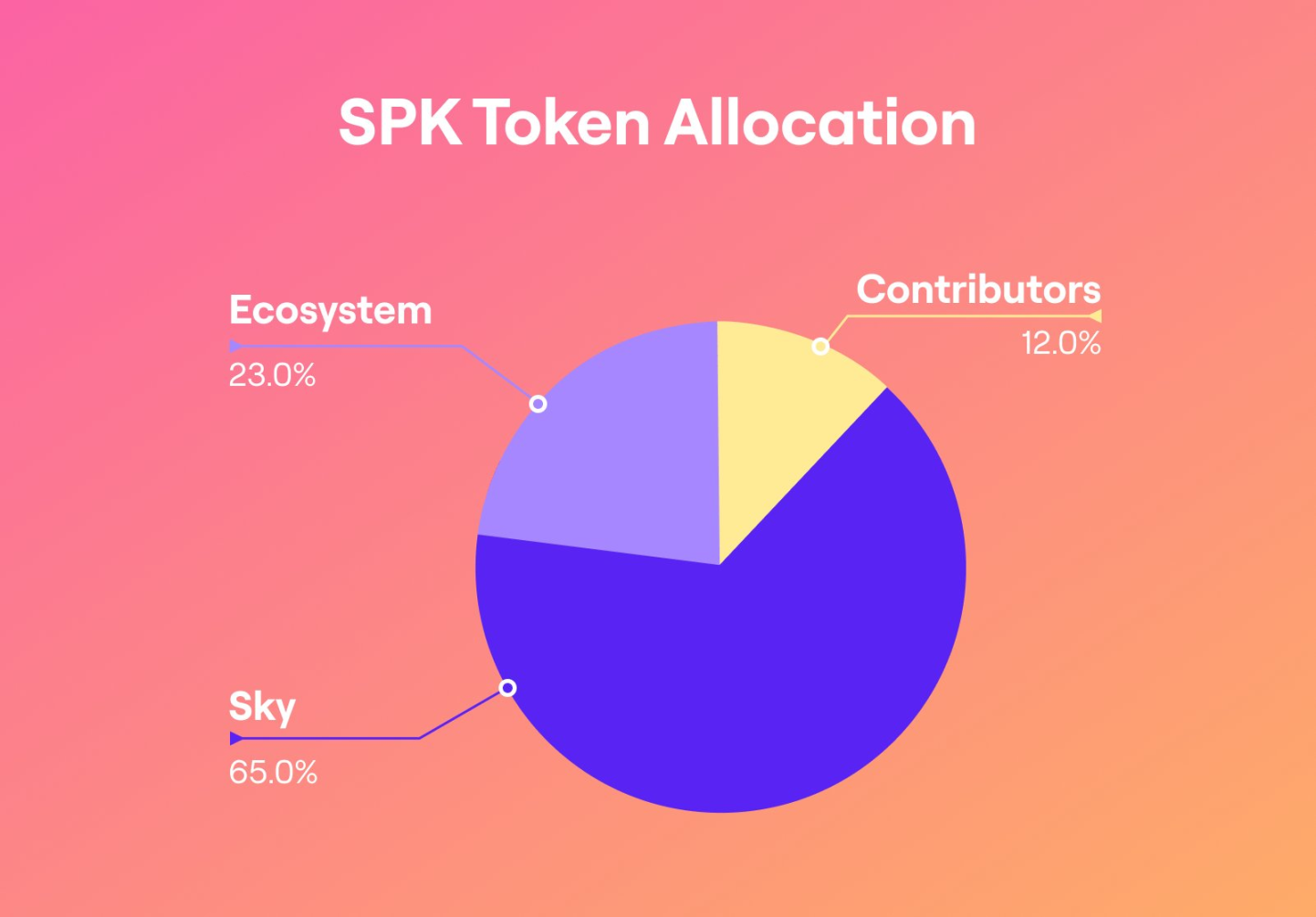

SPK is the native token of Spark, with a total supply of 10 billion tokens, which will be distributed over the initial 10 years.

The supply distribution of SPK is as follows:

- 65% allocated to Sky — for SPK mining over 10 years (for users);

- 23% allocated to the ecosystem;

- 12% allocated to contributors;

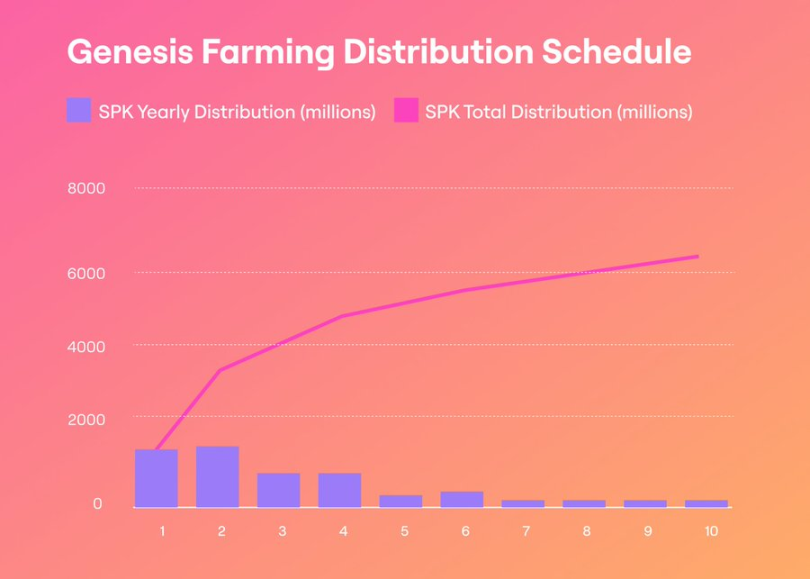

The 6.5 billion tokens allocated to Sky for mining (65%) will be distributed to users through genesis mining, with the distribution rate gradually decreasing over time.

- Year 1 - 2: 1.625 billion tokens per year;

- Year 3 - 4: 812.5 million tokens per year;

- Year 5 - 6: 406.25 million tokens per year;

- Year 7 - 10: 203.13 million tokens per year;

- Currently, the Sky mining feature has not yet been launched.

The 2.3 billion SPK tokens in the ecosystem (23%) are allocated to promote the growth of the Spark ecosystem. Of these, 17% of the tokens will be available at TGE, while the remaining portion will unlock after one year. A portion of this 23% allocation will also be distributed to the Spark community through the Ignition airdrop program. 1.2 billion SPK tokens are allocated to the core contributors of Spark to align their long-term incentives with the construction and support of Spark. These tokens will unlock 25% after a 12-month lock-up period, with the remaining portion unlocking over the next three years.

The official statement indicates that SPK holders will be able to participate in the future governance of Spark and stake SPK to earn Spark Points rewards. Staked SPK may be used to secure the protocol in the future.

Airdrop Eligibility

According to the official website, Spark has a total of four airdrop events: Pre-Farming, Ignition, Overdrive, and Layer3. The distribution for Pre-Farm users is as follows: Q1 2023 August 20 - 2024 May 20, with a total of 130,434,783 SPK allocated. The second funding pool (2024 May 20 - 2025 June 16):

SparkLend: 14,478,261 SPK per month

Aave: 7,239,130 SPK per month

This airdrop belongs to the Ignition airdrop portion, with a total of 300 million tokens. The first phase of tokens is now available for claiming, with a deadline of July 22 at 22:00 Beijing time. Tokens that remain unclaimed by the end of the Ignition claiming period will be distributed according to the Overdrive rules during the Overdrive airdrop event.

Stablecoin Holdings

Hold USDS, sUSDS, sUSDC, sDAI, or SAI

On any snapshot date, the total holdings of any of the above tokens must reach at least $1,000

Snapshot dates: April 15, 2023, April 15, 2024, April 15, 2025 - all at 23:59:59 UTC

Eligible chains: Mainnet, Base chain, Arbitrum chain

xDAI Holdings

On any snapshot date, hold at least 1,000 xDAI

Snapshot dates: April 15, 2023, April 15, 2024, April 15, 2025 - all at 23:59:59 UTC

Eligible chains: Gnosis

DAI Holdings

On any snapshot date, hold at least $10,000 in DAI

Snapshot dates: April 15, 2023, April 15, 2024, April 15, 2025 - all at 23:59:59 UTC

Eligible chains: Mainnet, Base, Arbitrum, Optimism, Polygon

SparkLend Activities

SparkLend Deposits

Deposit more than $100 into SparkLend in a single transaction

Deadline: On or before April 15, 2025, 23:59:59 UTC

Eligible chains: Mainnet, Gnosis

Lending Platform Activities

Aave Lending

Accumulate at least $5,000 in loans in USDS, sUSDS, USDT, USDC, USDe, sUSDe, DAI, or sDAI

Snapshot date: March 15, 2025, 23:59:59 UTC

Eligible chains: Mainnet, Base, Arbitrum, Polygon, Optimism, Gnosis

Morpho Lending

Accumulate at least $5,000 in loans in USDS, sUSDS, USDT, USDC, USDe, sUSDe, DAI, or sDAI

Snapshot date: March 15, 2025, 23:59:59 UTC

Eligible chains: Mainnet, Base, Polygon

Fluid Lending

In USDS, sUSDS, USDT, USDC, USDe, sUSDe, DAI, or sDAI, accumulate at least $5,000 in loans.

Snapshot date: March 15, 2025, 23:59:59 UTC

Eligible chains: Mainnet, Arbitrum, Base, Polygon

Other DeFi

Pendle PT, YT, or LP Holdings

On the snapshot date, accumulate at least $5,000 of Pendle PT, YT, or LP in the top three markets ranked by total locked value (TVL).

Snapshot date: March 15, 2025, 23:59:59 UTC

Eligible chains: Mainnet

Ethena Holdings

Hold at least $5,000 of Ethena sUSDe or USDe.

Snapshot date: March 15, 2025, 23:59:59 UTC

Eligible chains: Mainnet

Curve 3pool LP

As a liquidity provider (LP) for Curve 3pool, provide at least $5,000.

Snapshot date: March 15, 2025, 23:59:59 UTC

Eligible chains: Mainnet

Pendle vePENDLE

Hold at least $5,000 of Pendle vePENDLE.

Snapshot date: March 15, 2025, 23:59:59 UTC

Eligible chains: Mainnet

Backed by billions of dollars in asset reserves from the Sky (formerly MarkerDAO) ecosystem, with excellent performance in capital efficiency and liquidity, the future potential of Spark is worth paying attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。