Strategy STRC Stock Offering: The New Plan for Bitcoin Buy

Strategy Unveils Preferred Stock Offering to Expand Bitcoin Holdings

Microstrategy, previously, (Nasdaq: MSTR, STRK, STRF, STRD), has launched a bold financial move aimed at strengthening its influence in the Crypto markets. The firm announced a proposed public offering of 5 million shares of a new class of share, Strategy STRC Stock (registered under Securities Act 1933), to raise funds for further BTC acquisitions and deepen its working capital.

Source: X

Core Objective: Fuel Bitcoin Buying Power

The purpose is very clear for the crypto-obsessed firm; this IPO is to raise funds for more Bitcoin purchases, securing its position as the largest public golden asset holder. Just days before the offering, it added 6,220 BTC for almost $740 million, contributing to a $21 billion increase in crypto holdings during the second quarter of 2025.

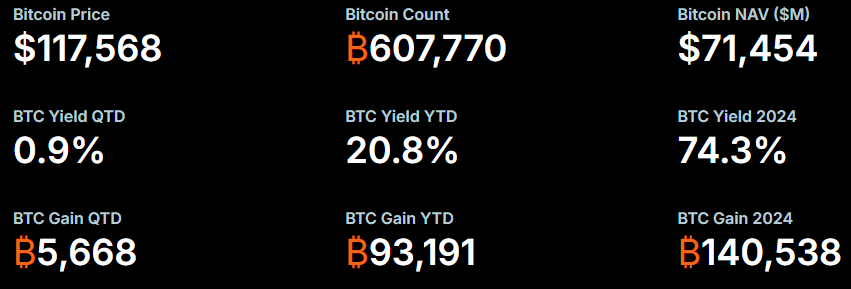

As on date the virtual asset giant holds 607,770 coin worth approximately $71 billion in its accounts.

Source: Strategy

The company has clearly positioned itself not just as a software and analytics firm but as a crypto financial force. The strategy STRC Stock offering is central to funding this aggressive accumulation plan.

Market Impact: Bridging Traditional Finance and Crypto

The IPO adds a new layer to how institutional and retail investors can access virtual currency exposure. In contrast to ETFs or futures, Strategy STRC Stock provides a dividend paying, equity security that indirectly follows Bitcoin’s performance through company's actions.

While Crypto markets are still growing, organisation’s move could pressure other digital asset-preserving companies like Tesla (11,509 BTC of ~$1.36 billion value) or Block Inc. (8,584 BTC of $1.01 billion of value), to explore similar tools, boosting liquidity options and shareholder engagements.

Top Investment banks like Morgan Stanley, Barclays, Moelis & Company, and TD Securities, are managing the offering as lead arrangers. Their involvement shows major financial backing and increases the credibility of in both equity and crypto investor circles.

Conclusion: A Blueprint for BTC-Linked Equities

With the Strategy STRC Stock offerings, the company continues to merge digital assets with standard equity tools. The organisation continues to be leader of corporate Bitcoin adoption, giving investors a fresh way to gain exposure to digital capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。