Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

ETH has finally strengthened!

With the continuous rise of "altcoin leader" ETH, there are signs of recovery in the altcoin market. Mainstream Ethereum ecosystem projects like Ethena (ENA), Lido (LDO), Curve (CRV), and Frax (FRAX) have seen even greater increases, with ENA briefly breaking through $0.5 in the short term, achieving a weekly increase of nearly 50% (this is based on the fact that ENA had already experienced a surge over a week ago due to its listing on Upbit), standing out among several so-called "ETH beta" projects.

The reasons behind ENA's strong rise can be summarized into four main points based on comprehensive analysis from various sources.

Reason 1: ETH Boost

Firstly, the vast majority of Ethena's business is still focused on the Ethereum ecosystem (a small portion of USDe has flowed into ecosystems like Solana through cross-chain means), and Ethena is one of the few star projects that have emerged from the Ethereum ecosystem in the past two years, so it is not an exaggeration to call it "Ethereum's own."

Similar to the previously mentioned currencies like LDO and CRV, the rise of ETH will inevitably boost such mainstream ecosystem projects, which is a necessary prerequisite.

However, this does not explain why ENA has been able to lead among "Ethereum concept coins" recently; the real reasons are the following three points.

Reason 2: Business Model Returns to Positive Flywheel

To understand this reason, one must first grasp Ethena's business model.

In short, Ethena is a yield-generating stablecoin project focused on "spot-futures arbitrage," where its stablecoin USDe is backed by an equal amount of spot long positions and contract short positions. Its revenue mainly comes from "staking rewards from spot long positions" and "funding fee income from contract short positions," where the first type of revenue is relatively stable, while the second type is key to the operation of the protocol.

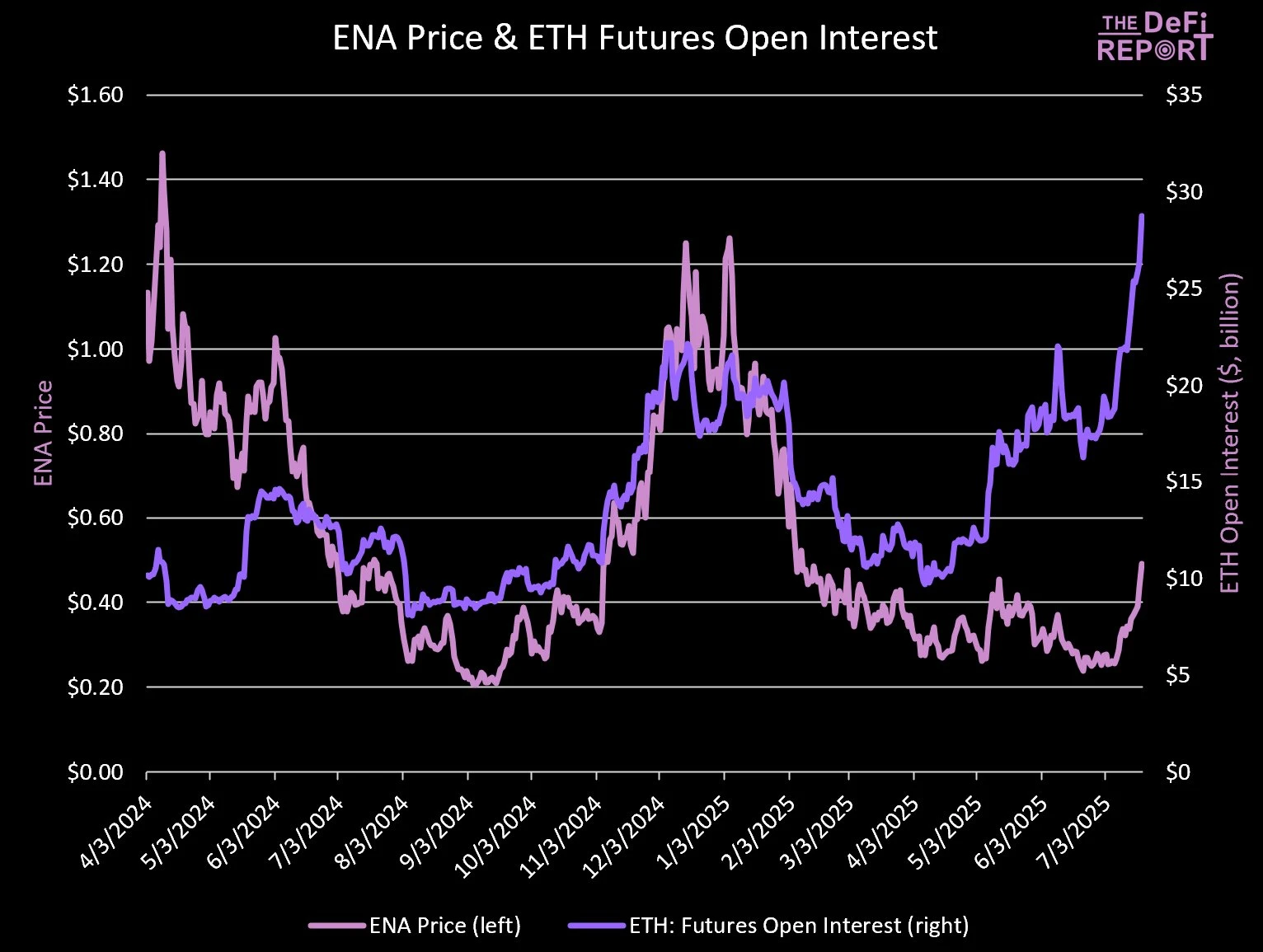

The funding fee of the contracts depends on the market's long and short dynamics, which inherently carries a significant degree of uncertainty. Although, in the long run, the time when the funding fee is positive will dominate (meaning that overall, contract shorts will earn positive fee income), when market sentiment is pessimistic, the fee will continuously decline or even turn negative—this will severely impact Ethena's protocol revenue capacity and may even lead to short-term losses.

- Odaily Note: For basic concepts about Ethena and the impact of fee fluctuations, refer to “An Analysis of Ethena Labs: Valued at $300 Million, the Stablecoin Disruptor in Arthur Hayes' Eyes” and “After the Crash, How Does Ethena (USDe) Perform Under Negative Fees?”.

For a long time, due to the overall pessimistic market sentiment, the funding fees in the contract market remained low, which also led to Ethena's protocol revenue levels and sUSDe (the yield-bearing version of USDe after staking) yields being less than ideal for an extended period.

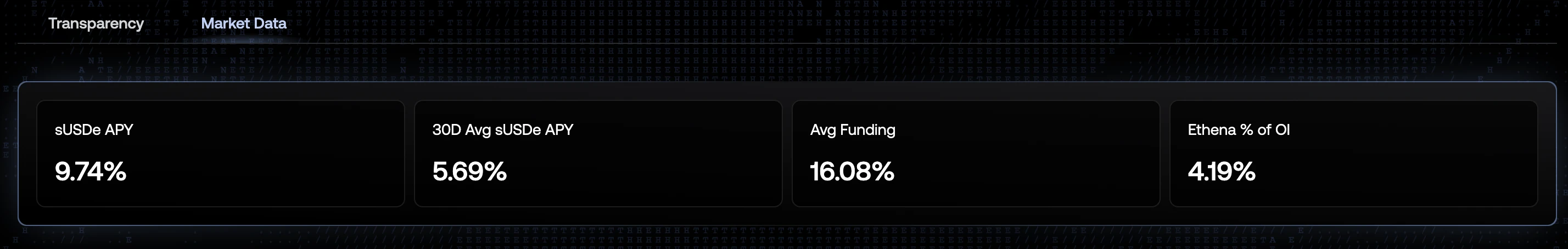

However, recently, with the rapid recovery of the market (especially as ETH's price rises, since ETH is the main target for Ethena's term arbitrage), the level of contract funding fees has been continuously climbing—Ethena's page shows that the current average annualized fee for the protocol is around 16%.

The yield in the fee market directly affects the yield of sUSDe, and in the past two weeks, the average yield of sUSDe has increased from around 5.59% to 9.74%, which has directly attracted more capital inflow—on-chain data shows that the issuance scale of USDe has grown to about $6.1 billion, setting a new historical high.

In short, this is a positive flywheel: Market recovery ➡️ Long sentiment rises ➡️ Fee income increases ➡️ Stablecoin yields improve ➡️ More capital inflows ➡️ Growth in stablecoin issuance scale ➡️ Improvement in protocol fundamentals ➡️ Stronger support for coin price…

The following chart visually presents this logic, showing a clear synchronization between ENA's price fluctuations and the changes in ETH's contract scale.

Reason 3: Stablecoin Bill Passed, Overall Sector Boost

Another major positive for Ethena recently has been the passage of the stablecoin bill.

In the early hours of July 19, Beijing time, U.S. President Trump officially signed the “GENIUS Act” in the East Room of the White House, meaning that this bill focused on the development of the stablecoin industry has completed all legislative processes and has officially become a law awaiting enactment.

- Odaily Note: See “Historic Moment: Trump Officially Signs the GENIUS Act”.

Although USDe's collateral structure may not meet the requirement in the “GENIUS Act” that “stablecoins must be fully backed 1:1 by U.S. dollars or other highly liquid assets,” Ethena has already made corresponding preparations—at the end of last year, Ethena launched a new stablecoin product USDtb supported by BlackRock BUIDL, which will utilize cash or cash-equivalent reserves to support a 1:1 ratio, and as of the time of writing, the issuance scale of USDtb has also grown to $1.46 billion.

In simple terms, Ethena is now walking on two legs: USDe focuses on the crypto-native market, while USDtb targets the compliant institutional market.

Reason 4: Expectations for ENA's "Fee Switch"

The potential activation of the "fee switch" is another reason for ENA's recent rise. The so-called "fee switch" is a common term in DeFi protocols, referring to whether the protocol's income will be distributed to the protocol's native token (in this context, ENA). If this switch can be turned on, it will directly enhance ENA's value capture ability.

In previous community votes, Ethena has clearly defined five conditions for activating the "fee switch," as follows.

✅USDe Circulation: Must exceed $6 billion, currently at $6.1 billion, met.

✅Cumulative Protocol Revenue: Must exceed $250 million, currently at $431.31 million, met.

❌Exchange Adoption: Requires USDe to be listed on 4 of the top 5 exchanges by derivatives trading volume, currently at 3, not met.

✅Reserve Fund: Must exceed 1% of USDe supply, met.

❌Yield Spread of sUSDe and Benchmark Rate: Requires 5.0-7.5%, currently the spread with Aave USDC is 3.03%, with U.S. Treasuries is 2.48%, and with sUSDS is 2.05%, not met.

From the above, it can be seen that three of the five requirements have been met. Considering the recent upward trend in funding fees, the yield of sUSDe is also rising in tandem, which will help meet the fifth condition, and only one more exchange needs to integrate for the third requirement.

It seems that the activation of the "fee switch" is not far off, and the market may choose to bet on this in advance.

Could ENA be the biggest Beta for ETH?

In addition to the aforementioned reasons, another noteworthy point is that previously, when ENA was above $1 and facing selling pressure, BitMEX founder Arthur Hayes seems to be quietly replenishing his position. On-chain analyst Yu Jin detected last week that Arthur purchased ENA worth $1.505 million through multiple channels in one day.

What Arthur says cannot be fully trusted, but what he does still holds some reference significance…

- Odaily Note: For further reading, see “When Arthur Hayes Suddenly Supports the Coin You Bought, You Should Be Cautious”.

Considering the above reasons, it can be anticipated that in the coming period, ENA's fundamental growth trend and value capture expectations will continue, which may support its current price trend. As ETH gains momentum, ENA may be a potential Beta choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。