Strategy Overtakes NVIDIA in Bitcoin Corporate Treasury Race

Michael Saylor’s Strategy Overtakes NVIDIA in funds rankings

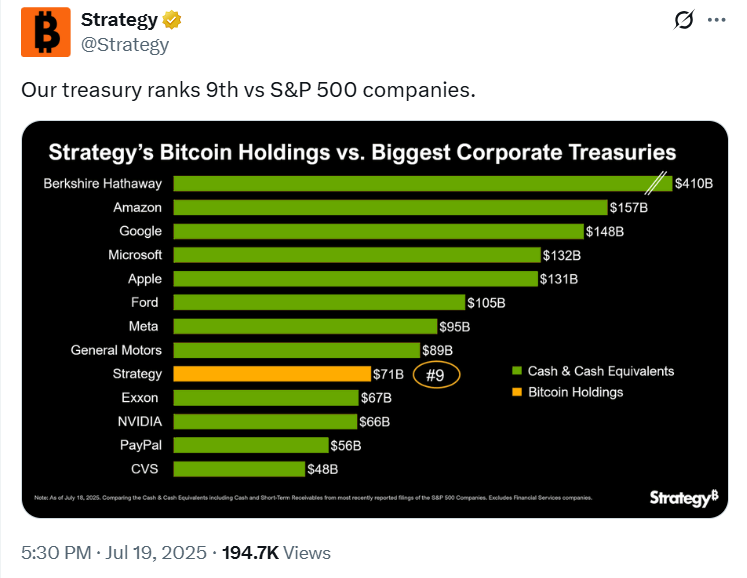

Michael Saylor’s firm Strategy has made headlines by entering in the top 10 list of the largest U.S treasuries. It is only because of the powerful Bitcoin corporate treasury rally through which the firm has surpassed tech giant NVIDIA by securing 9th position among S&P 500 companies with the biggest reserves.

As the company is focusing on increasing its Bitcoin corporate treasury, it may compete with bigger firms in the coming times. As the all time has shown a huge rise in the recent days , it is now trading at $118,003.41

$71B BTC corporate treasury leads in crypto holdings

According to the recent post of Strategy on X(formerly twitter) mentioned, the company now holds $71 billion in fund reserves. The firm sits behind the major players like Berkshire Hathaway, Amazon, Google, Microsoft, Apple, Ford, Meta and General Motors.

Source: X

What sets the company apart is that unlike these firms that mostly hold cash or equivalents, Strategy’s reserves are dominated by Bitcoin corporate treasury which is a bold move that is paid off handsomely.

This rise is directly linked to Bitcoin’s recent surge which touched a new all-time high of $123,000 earlier this week. The firm’s early and consistent asset accumulation gives it a unique edge especially when it is compared to firms sticking to traditional reserve assets.

Leading the pack in Golden asset Holdings

Saylor's comapany now holds the largest Bitcoin corporate treasury among all public companies with second place MARA holdings managing only 50,000BTC in comparison. Overall, it ranks third globally in golden coin ownership, behind only Satoshi Nakamoto and Blackrock.

Rival company Metaplanet has also joined the race, recently buying 2,205 BTC to bring its total to 15, 555 BTC. The firm has announced plans to accumulate 210,000 BTC by 2027 which signals how firm's success is inspiring others.

A bold bet that is paying off

Michael Saylor’s long term vision to hold golden asset as a reserve asset is now proving to be a game-changer. As asset adoption spreads and more firms follow this model, Strategy’s position may continue to strengthen , turning a risky bet into a historical financial plannings.

Also read: Crypto Exchange CoinDCX Hack: $44 Million Stolen in Server Breach免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。