What Happened in Crypto Today: MSTR News, Airdrop And Arcadia Hack

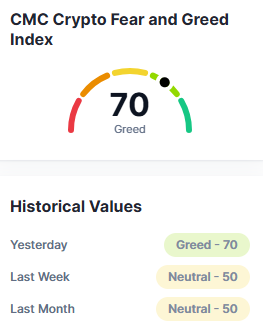

Source: CoinMarketCap

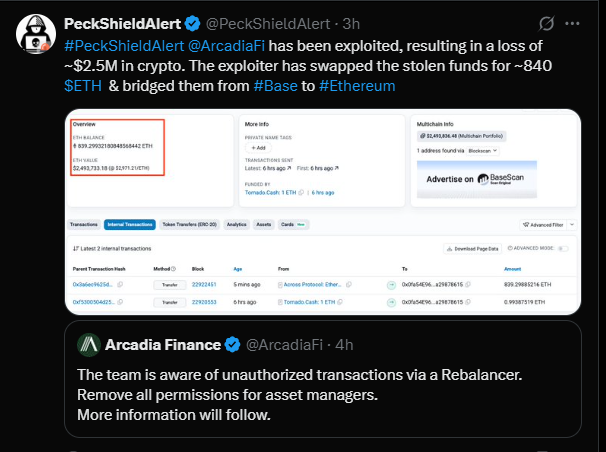

ArcadiaFi Stung by $2.5 Million Cross-Chain Hack

The DeFi industry has been shaken again by a security incident. Arcadia Finance , a DeFi protocol, lost around $2.5 million due to a cross-chain exploit on July 15, 2025. The exploitation was done through weaknesses in a cross-chain bridge, which enabled the attackers to shift assets to Ethereum.

Blockchain security company PeckShieldAlert disclosed that the attackers quickly exchanged the pilfered funds for 840 ETH, essentially washing the digitalassets. The attack contributes to the rising number of bridge-associated hacks within DeFi and reiterates concerns over the security architecture of decentralized protocols.

With increasing adoption within DeFi, so too increases the complexity of such attacks, reemphasizing the need for more robust cross-chain security measures and tightening of audits.

Source: X

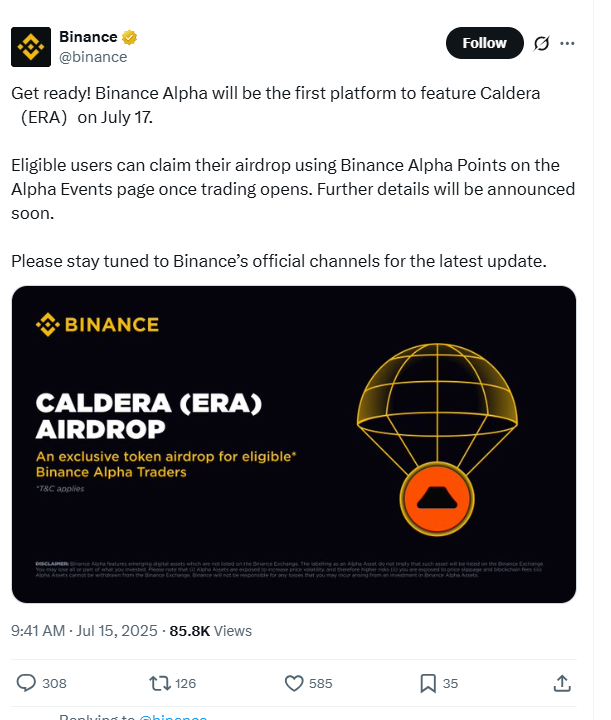

Caldera ERA Airdrop & Binance Alpha Listing Date on July 17

Before launch, the deserving users can receive free airdrops via the Alpha events page. Users who have gone through Binance marketing events or amassed points can exchange them once trading is launched. The full process of receiving airdrops will be available soon through the official platform.

As more developers and blockchain communities take notice, Caldera ERA's listing is likely to inject new energy into the Layer 2 ecosystem.

Source: X

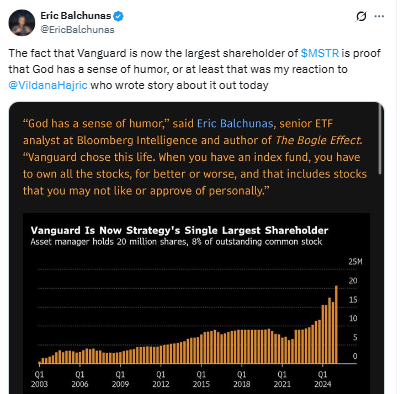

Vanguard Becomes Largest Owner of MicroStrategy (MSTR)

In a major institutional action, Vanguard has emerged as the largest owner of shares in MicroStrategy (MSTR), with over $9 billion worth of shares . This comes as a surprise especially considering the company's past reservations about Bitcoin and digital assets.

A former vocal critic of BTC, Vanguard had already turned down listing Bitcoin ETFs on its platform due to crypto's volatility and lack of intrinsic value. But now, by holding a significant interest in Strategy (former MicroStrategy), they're essentially sitting on exposure to more than 601,550 BTC, valued at $70.28 billion at today's prices.

Strategy, under the leadership of Michael Saylor, has been a proxy for exposure to Bitcoin in the stock market. Vanguard's shift signals not only a tactical move in indexing, but also a weakening position on crypto's place in contemporary finance.

Source: X

Headlines today echo the dual nature of the crypto world - adoption and innovation on one side, institutional contradiction and security flaws on the other. While investor greed propels the market, the crypto world continues to transform at breakneck speed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。