In the second half of the year, attention will be focused on the Federal Reserve's policy shift, the advancement of U.S. cryptocurrency legislation, the wave of mergers between TradFi and crypto, the penetration of stablecoin payments, and RWA, among others.

Written by: Binance Research Institute

Translated by: Chopper, Foresight News

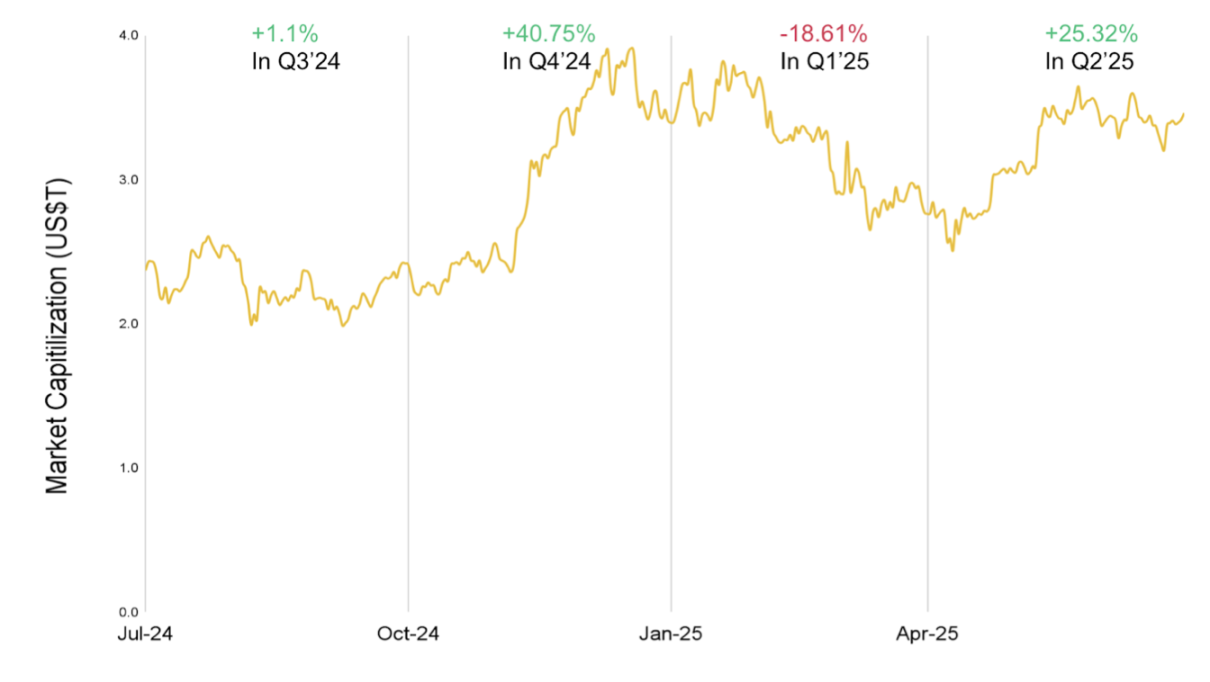

In the first half of 2025, the cryptocurrency market exhibited a "first suppression, then rise" oscillation pattern: the total market capitalization fell by 18.61% in the first quarter, rebounded by 25.32% in the second quarter, and ultimately saw a slight year-on-year increase of 1.99% in the first half.

Since the beginning of the year, the total market capitalization of the cryptocurrency market has increased by 1.99%.

This dynamic stems from multiple factors:

The expectation of interest rate cuts by the Federal Reserve in the second half of 2024 and regulatory easing after the U.S. elections pushed the market to a high of $3 trillion;

The sticky inflation, weak economic data, and the widespread tariffs implemented by the Trump administration in April 2025 suppressed market sentiment;

Recent tariff suspensions and increased clarity in the regulation of stablecoins and DeFi have driven market recovery.

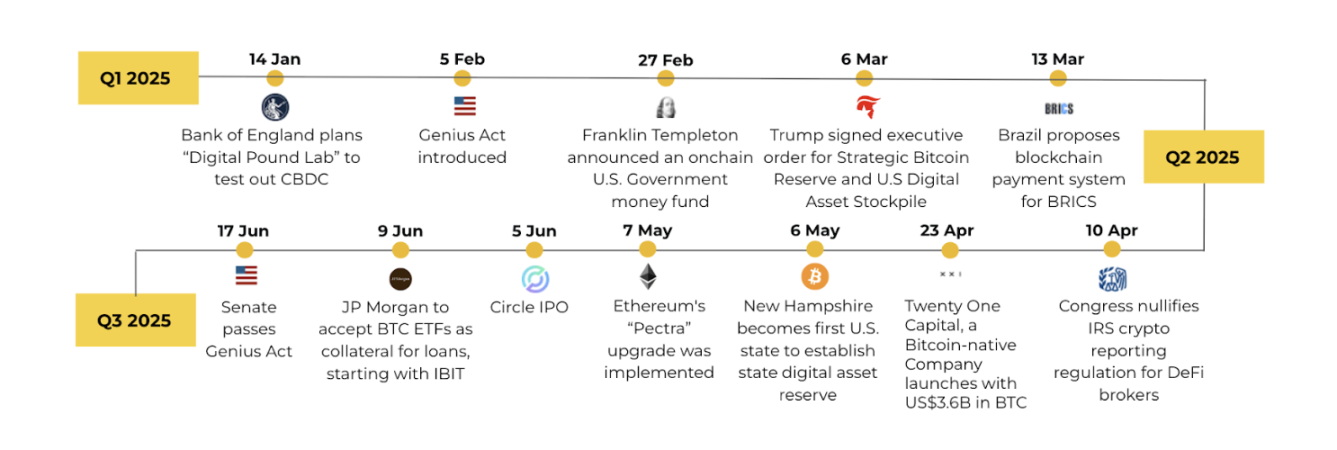

Timeline of important events in the first half of 2025.

The core narrative of the cryptocurrency market in the first half of the year focused on Bitcoin investment tools, stablecoins, AI agents, and tokenized real-world assets (RWA). Looking ahead, global monetary policy, trade tariff dynamics, institutional entry, the integration of cryptocurrency and AI, and a new round of cryptocurrency IPOs following Circle will become key points of interest.

I. Macroeconomic Background and Market Performance

Global Economic "Divergence"

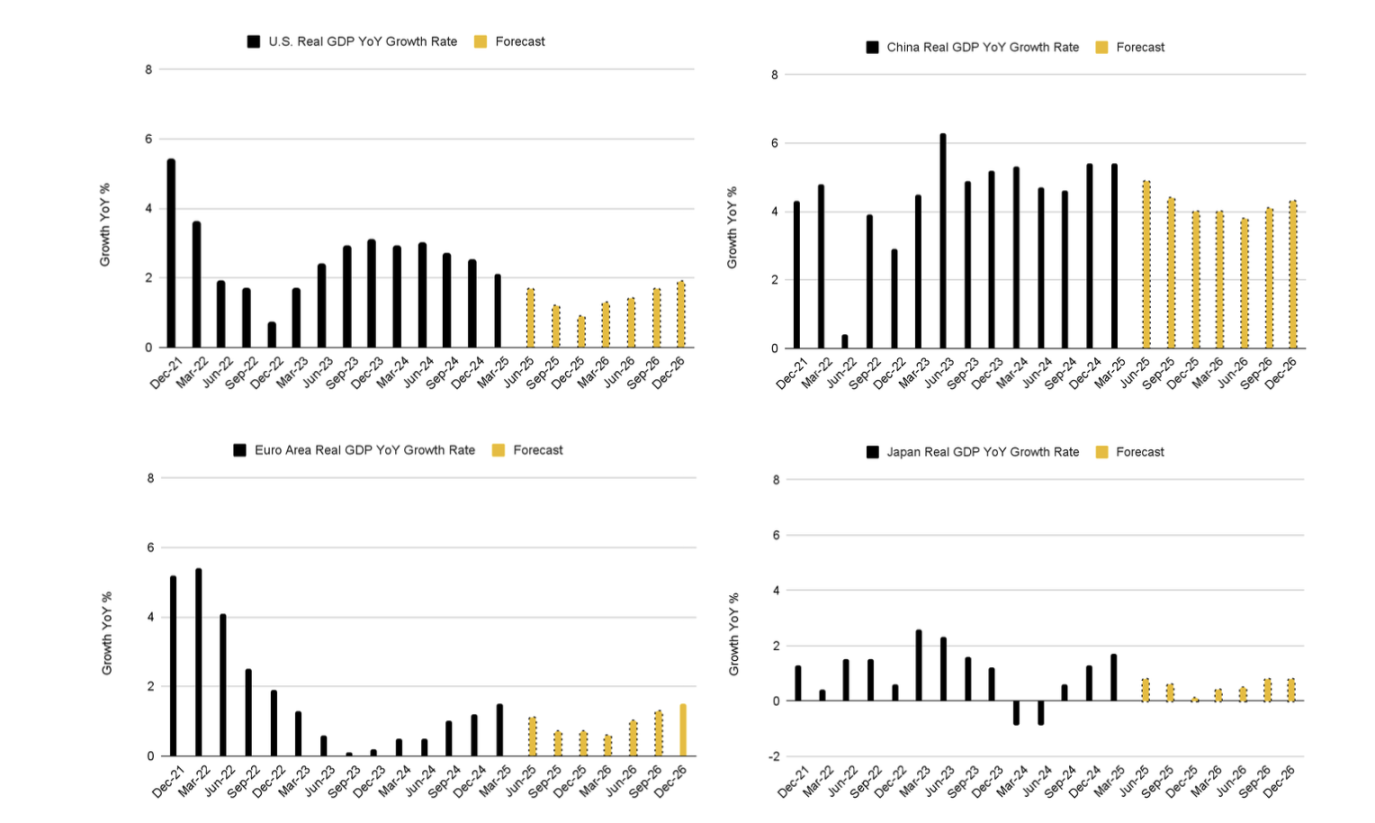

Economic trends are diverging: the U.S. economy is gradually slowing, with the unemployment rate stabilizing at 4.1% but the job market cooling; China's GDP grew by 5.4% year-on-year in the first quarter, exceeding expectations, benefiting from stimulus policies; the Eurozone and Japan are steadily recovering.

Quarterly GDP performance and market forecasts of G4 countries.

Liquidity easing: The total money supply of the four major economies (U.S., China, Europe, Japan) increased by $5.5 trillion, the largest half-year increase in four years, boosting sentiment for risk assets.

Geopolitical shocks: The brief trade war between the U.S. and China led to tariffs soaring to 145%, exacerbating market volatility.

Bitcoin's "High Beta Attribute"

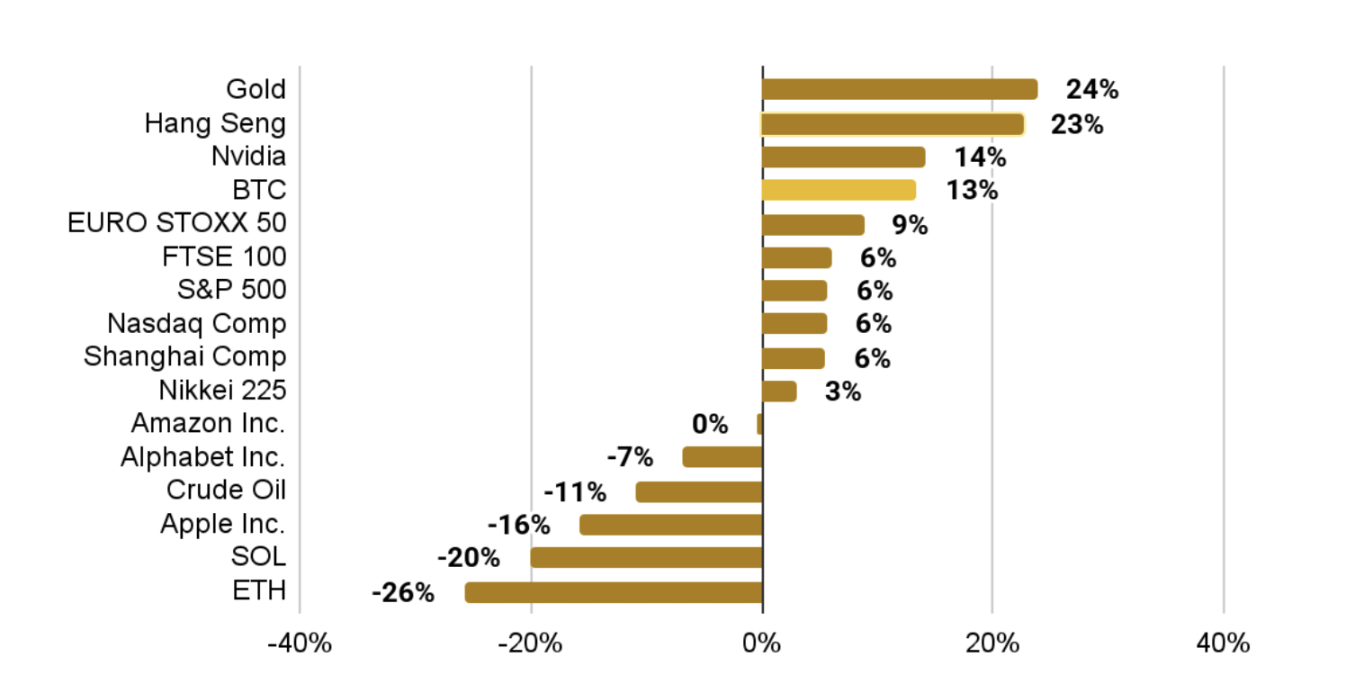

Bitcoin's return rate since the beginning of the year has reached 13%, outperforming most traditional stock indices, with a market capitalization consistently above $2 trillion. Its price cycle is seen as a leading indicator of the global manufacturing cycle (leading by 8-12 months), suggesting potential opportunities in the second half of 2025.

Return rates of major global assets since the beginning of the year.

II. Core Asset Performance: Bitcoin and Public Chain Ecosystem

Maturation of the Bitcoin Ecosystem

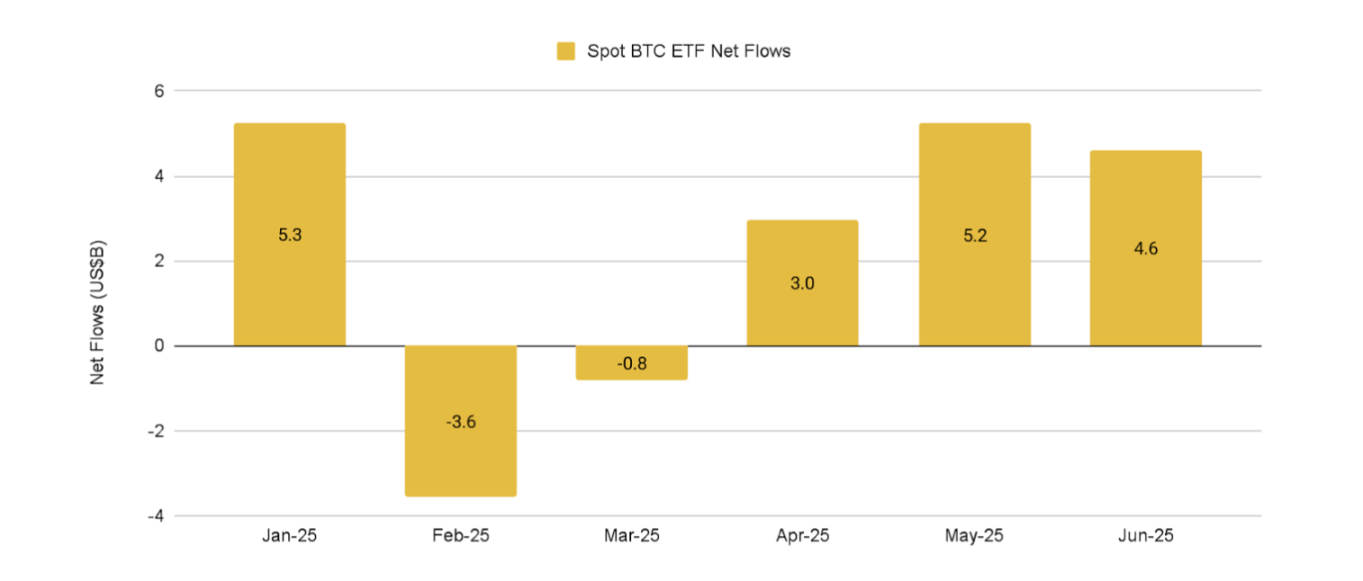

Accelerated institutional entry: Spot ETFs have seen a cumulative net inflow of over $13.7 billion, with BlackRock's IBIT dominating the market; over 140 listed companies hold 848,000 BTC, an increase of over 160% from last year.

Spot Bitcoin ETFs have attracted over $13.7 billion in net inflows since the beginning of the year.

Ecosystem innovation and differentiation: Layer 2 solutions (such as Stacks, BitVM) are advancing scalability, with the total value locked (TVL) in BTCFi reaching $6.5 billion, a year-on-year increase of 550%; however, speculation on Bitcoin-native assets like Ordinals and Runes has cooled, with daily trading volume dropping to an 18-month low.

Market dominance: Bitcoin's dominance peaked at 65.1%, a four-year high, highlighting its status as a core asset.

Mainstream Public Chain Dynamics

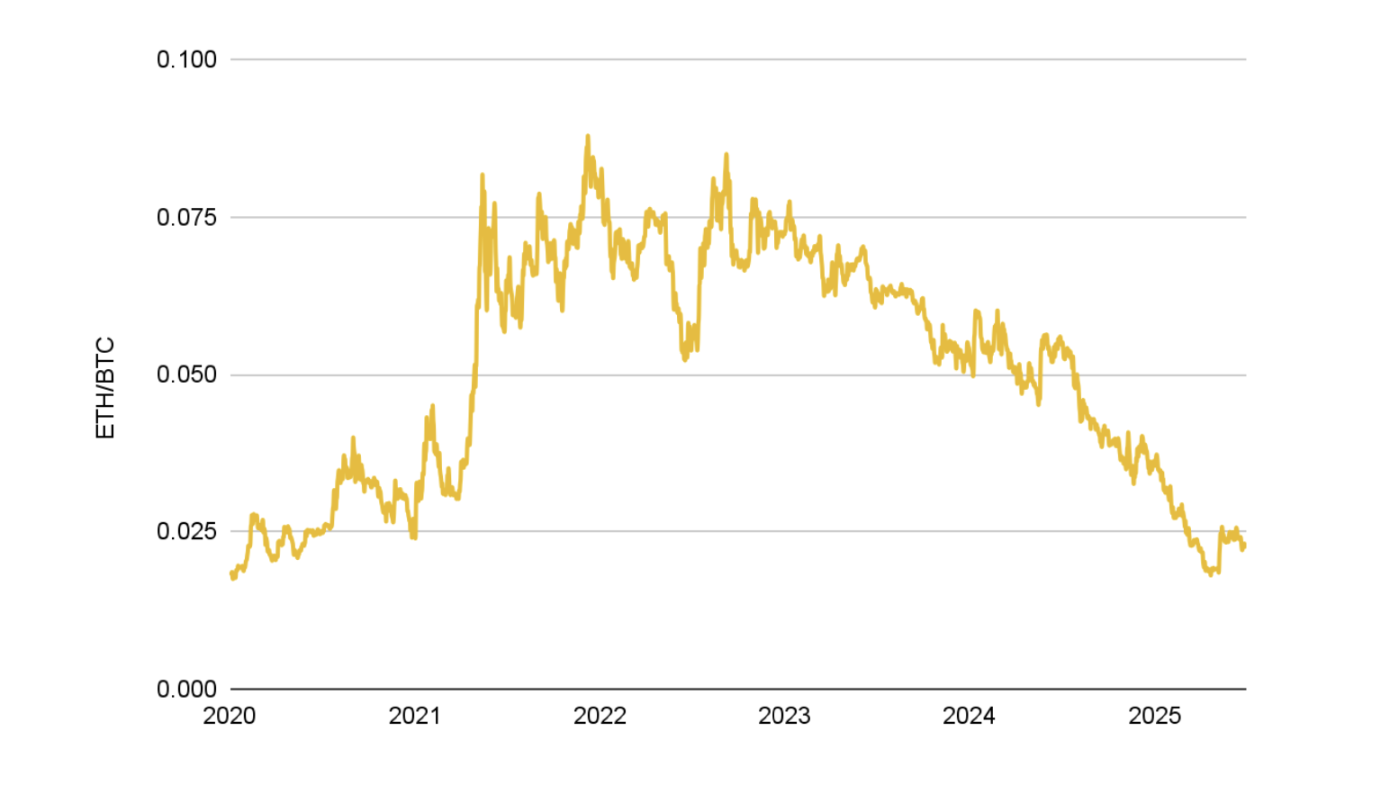

Ethereum: ETH price fell by 26%, but the ecosystem's resilience is evident. The Pectra upgrade improved staking efficiency (the maximum balance per validator node increased from 32 ETH to 2048 ETH), with staking volume reaching 35.4 million ETH (29.3% of circulating supply); Layer 2 (Base, Arbitrum, etc.) processed over 90% of transactions, becoming the main scalability vehicle.

The Ethereum to Bitcoin exchange rate fell to 0.023, reaching a multi-year low, data as of June 30, 2025.

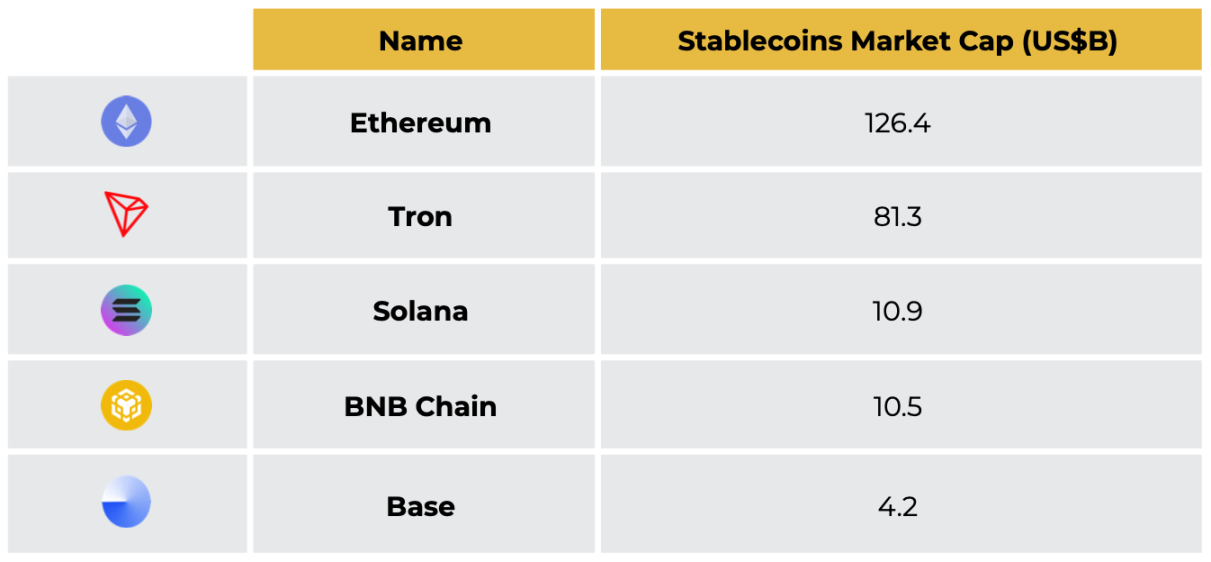

Solana: Continues to maintain high throughput (an average of 99 million transactions per day), with a stablecoin market capitalization of $10.9 billion, surpassing BNB Chain; institutional interest has increased, with several asset management companies applying for spot SOL ETFs, expected to be approved by mid-year.

Stablecoin market capitalization on major public chains, data as of June 30, 2025.

BNB Chain: DEX trading volume reached an all-time high, with PancakeSwap contributing over 90%; upgrades such as Pascal and Lorentz have reduced block time to 0.8 seconds, expanding the ecosystem into Memecoin, RWA, and AI fields, with daily active addresses reaching 4.4 million.

III. DeFi and Stablecoins: From Speculation to Practicality

DeFi Enters a Mature Stage

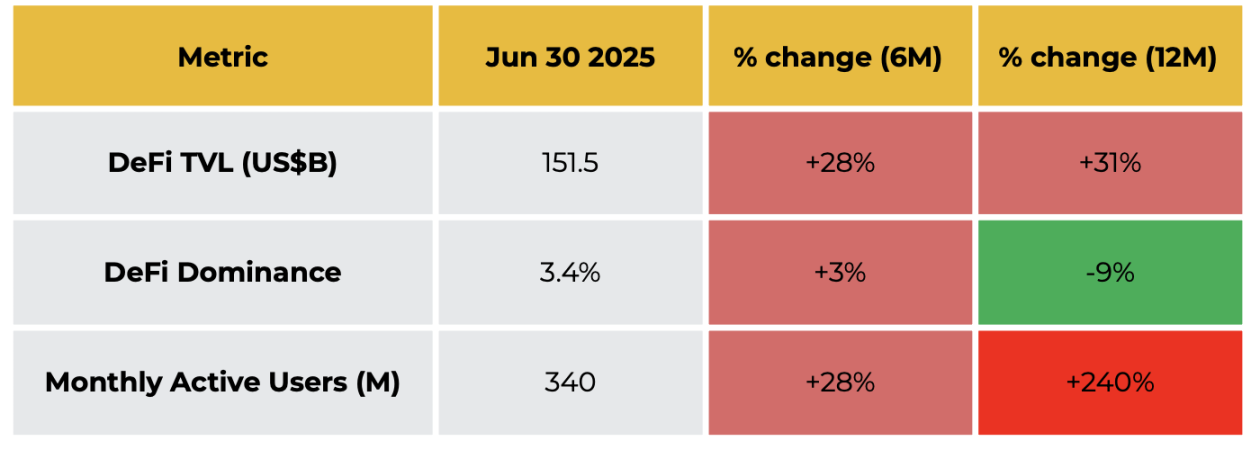

Core data: TVL stabilized at $151.5 billion, with monthly active users reaching 340 million (year-on-year +240%), and DEX spot trading volume share rising to 29%, reaching an all-time high.

Changes in major DeFi indices over six months and one year.

Key trends:

RWA explosion: The on-chain value of real-world assets reached $24.4 billion, with private credit accounting for 58%, becoming an important bridge connecting TradFi and DeFi.

Breakthrough in prediction markets: Polymarket partnered with social platform X, with June trading volume exceeding $1.1 billion and monthly active users at 400,000, becoming an information analysis tool.

Liquidity stratification: Ethereum dominates institutional-level assets (heavy staking, RWA), Solana focuses on retail trading, and BNB Chain attracts traffic through Memecoin and zero gas fee activities.

Acceleration of Stablecoin Mainstreaming

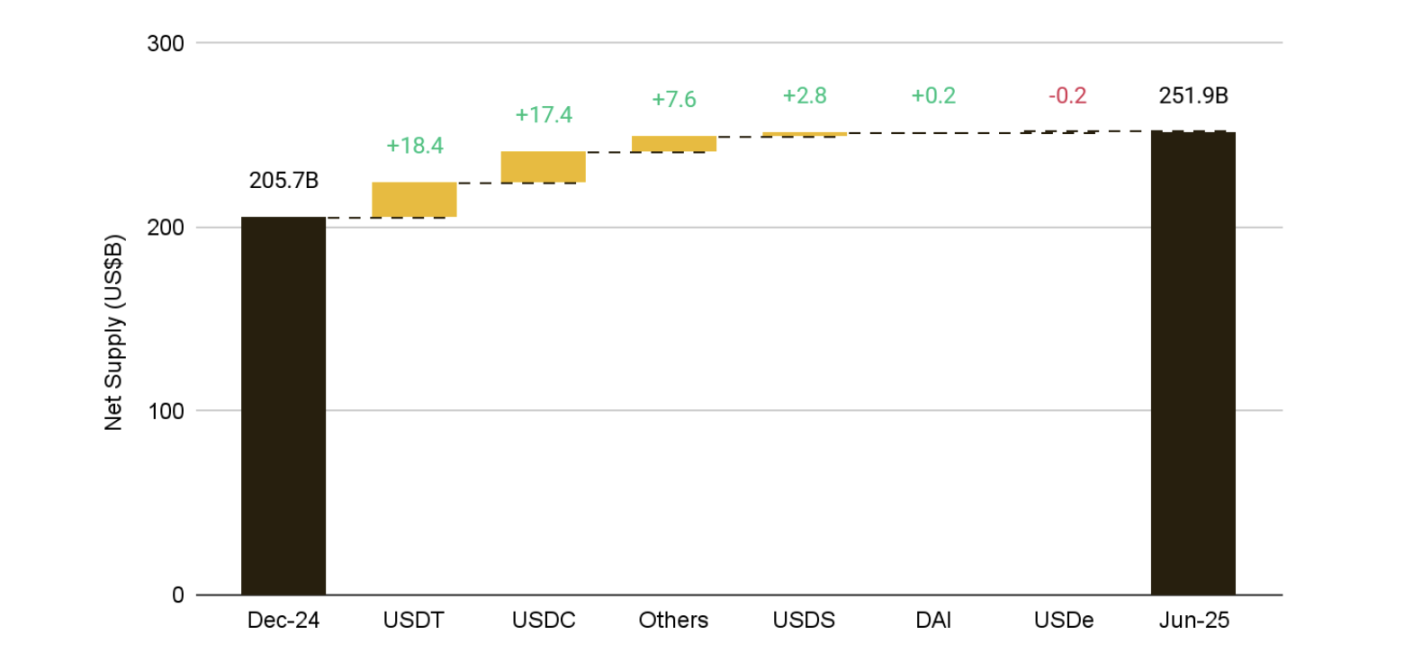

Market landscape: Total market capitalization surpassed $250 billion, with USDT ($153-156 billion) and USDC ($61.5 billion) forming a dual oligopoly, accounting for 92.1% combined.

This year's total supply of stablecoins has grown by over 22%, reaching a new high.

Key developments:

Institutional adoption: Circle went public on the NYSE through an IPO, raising over $600 million; JPMorgan, Société Générale, and others launched bank-backed stablecoins; Walmart and Amazon are exploring their own stablecoins to reduce payment costs.

Regulatory clarity: The U.S. "GENIUS Act" was passed, and the EU's MiCA was fully implemented, providing a compliance framework for stablecoins and promoting their use as cross-border payment and settlement infrastructure.

IV. Institutional Entry

TradFi integration: 60% of Fortune 500 companies are laying out blockchain strategies; JPMorgan launched the deposit token JPMD based on Base; Apollo Global Management tokenized $785 billion in credit funds to Solana.

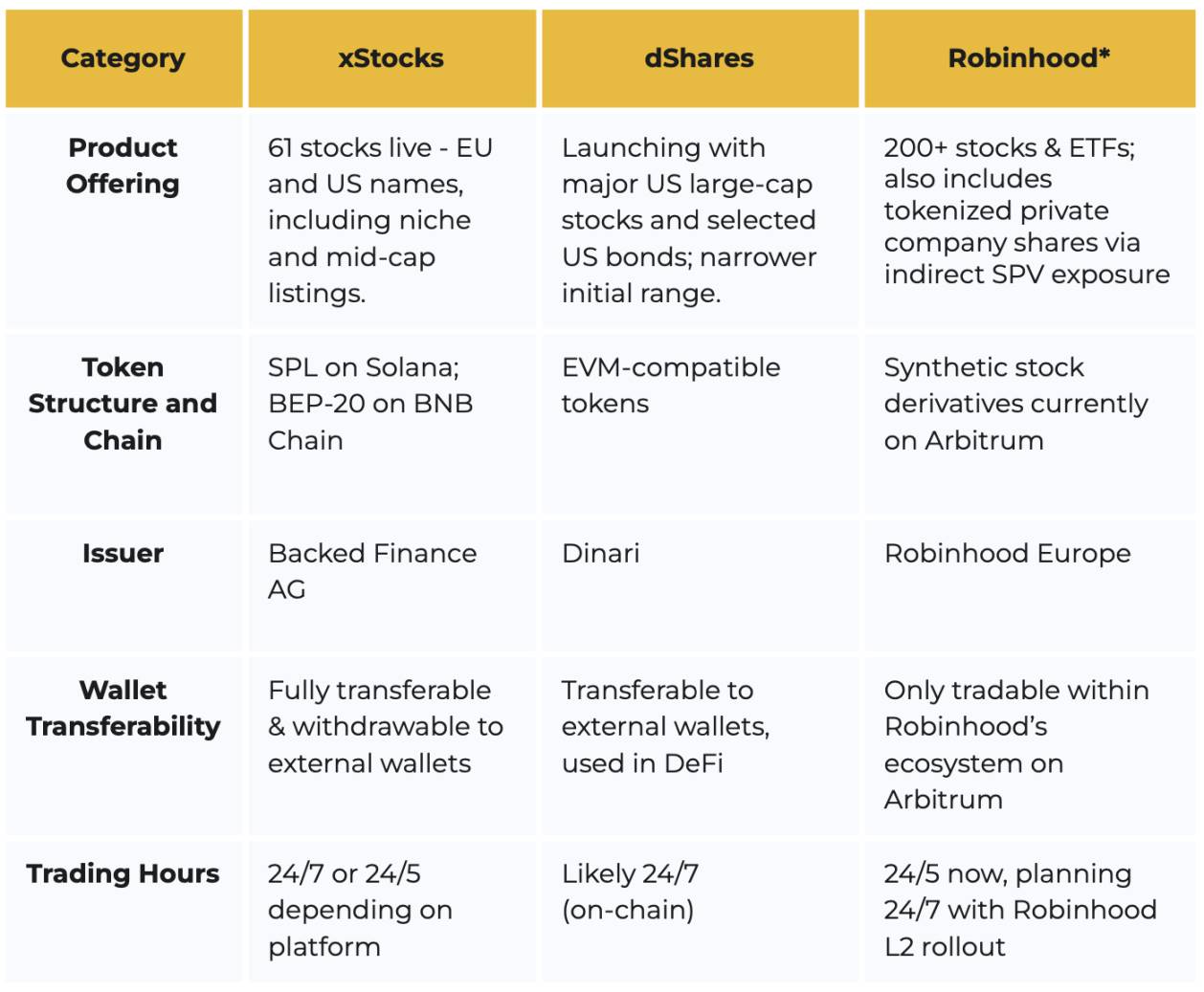

Asset tokenization: The on-chain acceleration of traditional assets like stocks and bonds, with Backed Finance's xStocks and Dinari's dShares supporting 24/7 trading, and Robinhood launching synthetic stock derivatives in the EU.

Comparative analysis of xStocks, dShares, and Robinhood's tokenized stock issuance.

V. Regulatory Landscape

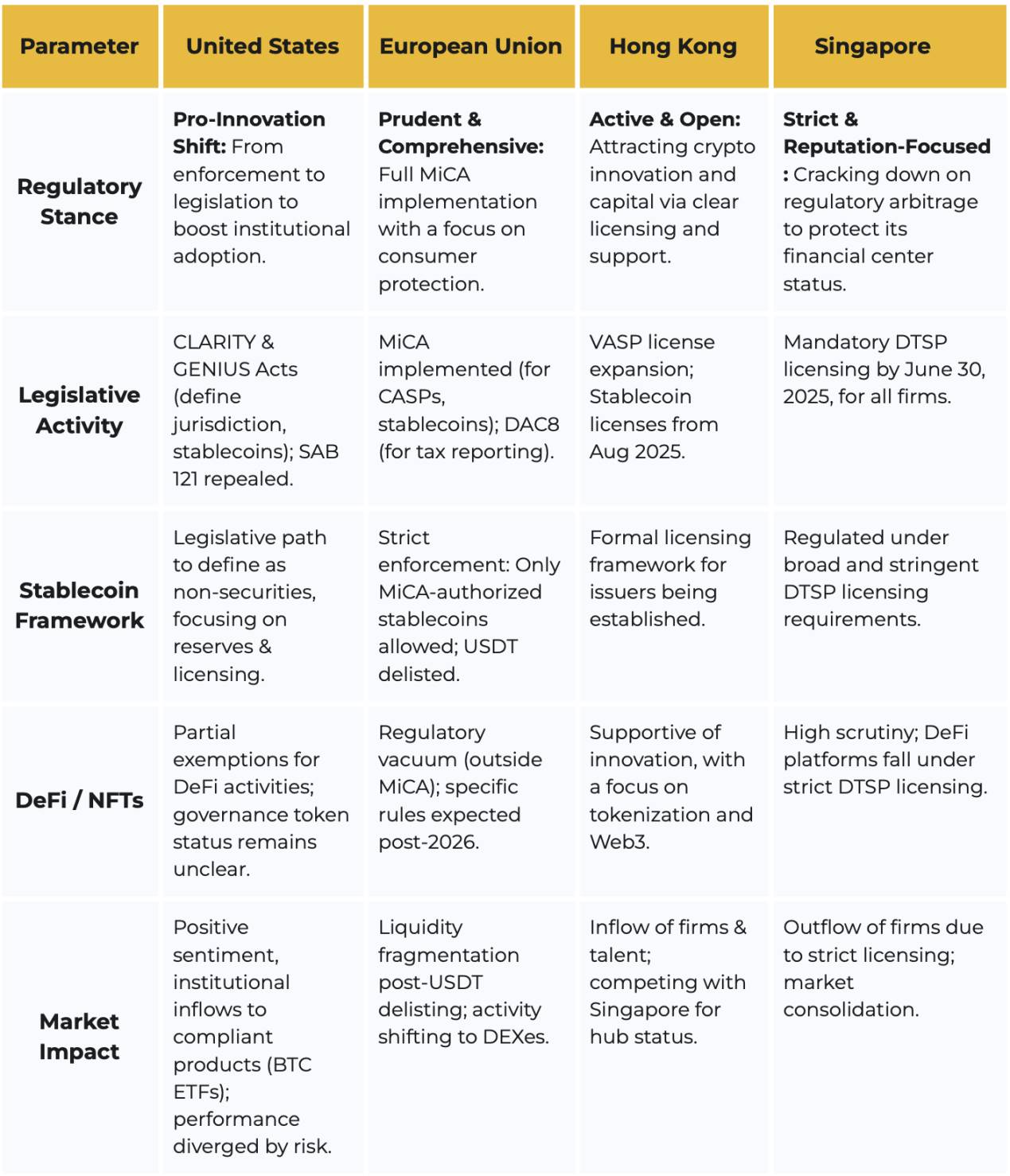

Major cryptocurrency regulatory policies in the first half of 2025.

U.S.: Shift from "enforcement regulation" to "legislative leadership," with the "CLARITY Act" and "GENIUS Act" clarifying digital asset classification and stablecoin rules, promoting institutional compliance.

EU: MiCA fully implemented, with USDT delisted by some exchanges for non-compliance, while compliant stablecoins like USDC gained market share.

Asia: Hong Kong attracted innovation through open licenses and tax incentives; Singapore cracked down on regulatory arbitrage, leading to corporate migration.

Outlook for the Second Half

The Federal Reserve's policy shift, the advancement of U.S. cryptocurrency legislation, the wave of mergers between TradFi and crypto, the penetration of stablecoin payments, and the explosion of RWA will dominate the direction of the cryptocurrency market in the second half of the year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。