Under the catalysis of projects like Robinhood, xStocks, and Republic, a large number of on-chain "stocks" have emerged in the Solana ecosystem, marking an unprecedented experiment in "coin-stock linkage." Upexi, after continuously increasing its holdings of SOL over the past few months, has surpassed 730,000 SOL, becoming the Nasdaq-listed company with the largest SOL holdings. Recently, it announced that it would tokenize its SEC-registered stock on Solana through the Opening Bell platform under Superstate.

Another "SOL micro-strategy company," SOL Strategies, plans to launch "tokenized stocks" on the same platform. Both are attempting to build a three-tier circular structure: using traditional equity (or debt) financing to purchase SOL assets, unlocking liquidity through on-chain tokenization, and ultimately leveraging DeFi protocols to amplify capital circulation.

The success or failure of this model will directly impact the integration process between traditional finance and on-chain finance.

Are companies buying SOL really making money?

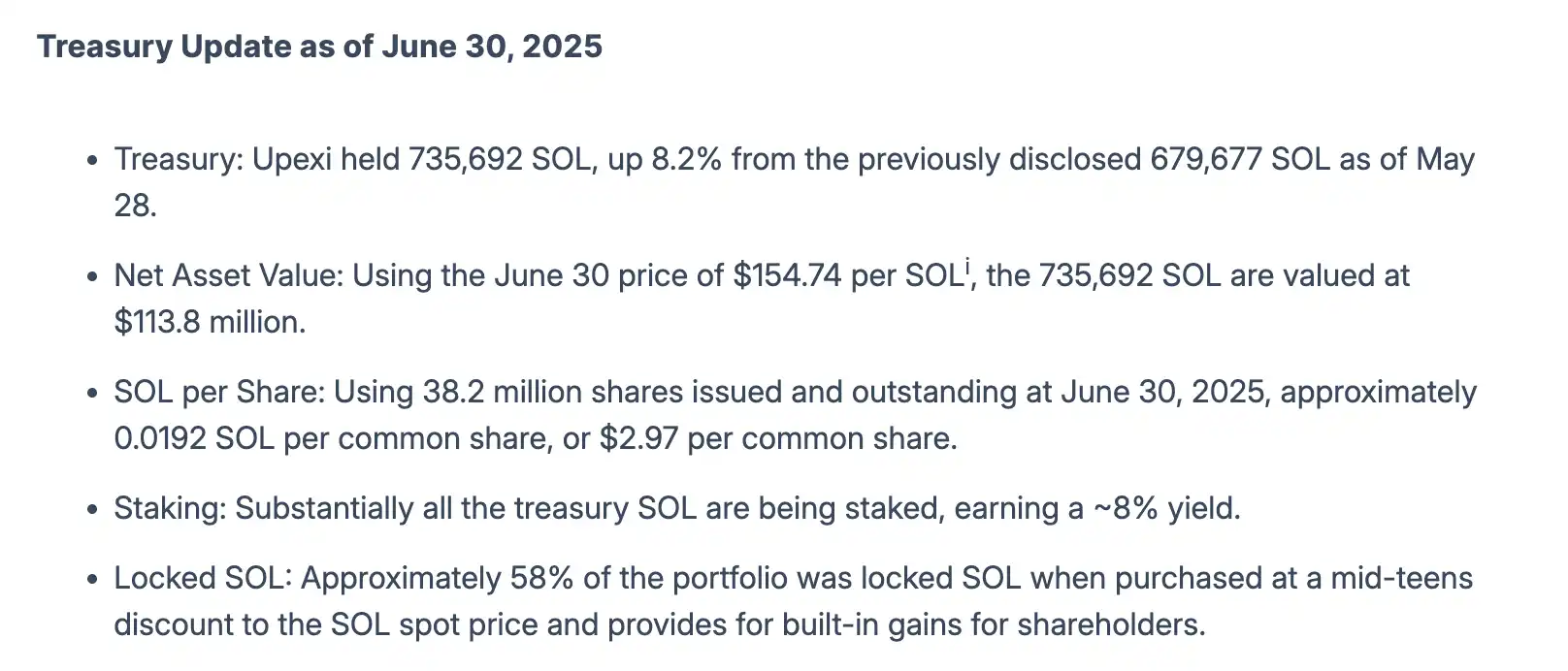

Both companies set to launch on Opening Bell are centered around SOL as their core asset, but their financing models and holding strategies differ. In terms of financing scale and execution, Upexi has chosen a more aggressive path. On April 21, 2025, Upexi announced it would raise $100 million through a PIPE private placement, led by the well-known crypto market maker GSR. It issued 43,859,649 shares of common stock at a price of $2.28 per share. After deducting operational costs, approximately $530 million will be used for debt repayment, with the remaining funds specifically allocated to establish a SOLana treasury and increase SOL assets. According to company executive Arif Kazi, the pricing of this financing was above the market price at the time, and no lock-up or token additional terms were set. Upexi then quickly purchased SOL assets, and as of June 30, its holdings had reached approximately 735,692 SOL, valued at about $110 million at market price. The average purchase prices for the three main acquisitions were $135.22, $141.10, and $151.50, with a comprehensive average cost of about $142 per SOL. This portion of SOL assets has about a 10% premium compared to the current price ($157).

In a recent announcement, the company plans to stake SOL to achieve an annual yield of about 7%–9% and will expand into mining, nodes, staking, and DeFi within the SOL ecosystem. If, as stated in the announcement, most SOL has already been staked, then without reducing holdings and with minimal fluctuations in SOL's average price, Upexi's annual yield from SOL staking will reach $8.8 million. These earnings are not directly shared with company shareholders but are added to the treasury, directly increasing the net asset value per share (NAV per share), which is the "SOL content" per share. Based on 38.2 million circulating shares, each share corresponds to approximately 0.0192 SOL (valued at about $2.97). The accumulation of staking earnings may further increase the value of each SOL, thereby supporting the rise in stock price.

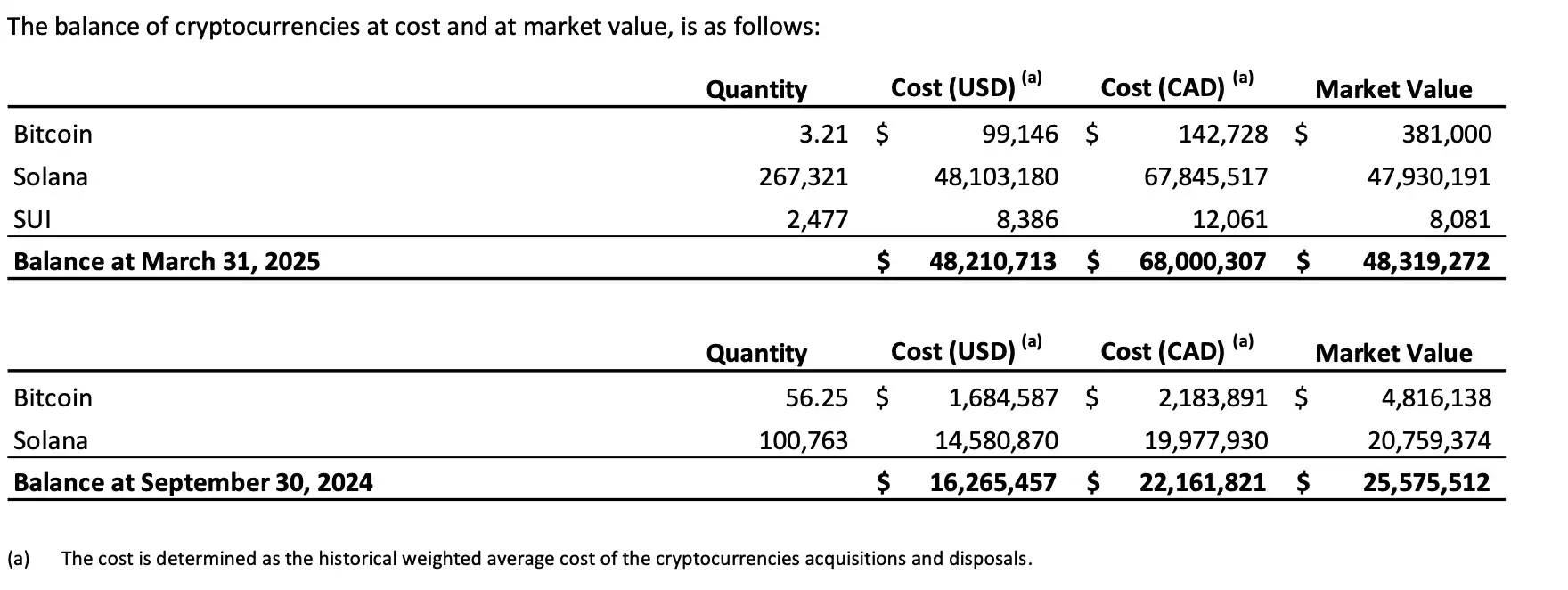

SOL Strategies, on the other hand, adopted a convertible bond financing method. On April 23, 2025, the company announced a $500 million convertible bond arrangement with ATW Partners, specifically for purchasing and staking SOL. The initial $20 million was received around May 1, used to buy SOL and stake it on its validator node, with the remaining up to $480 million to be withdrawn in batches depending on market conditions. The convertible bonds can be converted into company stock at market price, with interest paid at an 85% staking yield of the SOL received.

As of June 30, SOL Strategies' holdings of SOL have increased from approximately 267,321 SOL (valued at about $40 million) to 392,667 SOL, with an average purchase cost of about $153.53 per SOL, showing almost no significant loss or gain in terms of coin price.

The reported average staking yield for SOL is about 7.53%. Although some of the earnings, similar to Upexi, are reinvested into the treasury or node staking to enhance NAV per share, the agreement with ATW Partners stipulates that 85% of the staking earnings generated from the SOL purchased and staked will be paid to creditors in SOL form. This model creates a relatively self-sustaining financial cycle, generating returns from the first dollar of capital invested. Additionally, the convertible bonds can be converted into company stock at market price on the day before conversion. This arrangement is exempt from registration under Canadian and U.S. securities laws, complying with Ontario Securities Commission Rule 72-503, and does not require a statutory holding period under Canadian securities law.

Will the stock prices of listed companies that buy altcoins collapse, and can on-chain assets maintain their net asset value premium?

Whether through PIPE or convertible bond financing to purchase SOL, both Upexi and SOL Strategies have validated the feasibility of functional returns from assets like SOL. However, this is only the first two steps, and there have indeed been some systemic risks reflected in stock prices.

For instance, after Upexi reported its PIPE financing on April 21, 2025, its stock price surged from about $2.3 to a peak of $16.8 during the day, an increase of 630%. However, following the unlocking of PIPE shares on June 23 and the registration of resale by investors, the stock price plummeted by about 60% in a single day, and further declined to about $3.26 on the 25th, halving by over 77% in just two days, nearly erasing the price increase prior to the strategy. After the financing was completed, Upexi's NAV premium per share quickly rose from about 4 times to over 7 times, but after the PIPE shares were unlocked, it rapidly fell back, now approaching the NAV level per share.

SOL Strategies' initial financing form and acquisition method were not as aggressive as Upexi's, but they encountered similar issues. After announcing convertible bond financing on April 23, the stock price rose over 18%, and the next day closed up 7%. By early June, when the Q2 financial report and on-chain pilot were disclosed, the stock price had risen from CAD 1.8 to CAD 2.42, an increase of about 34%. However, by July 2025, the stock price had retraced about 60% from its peak, leading to a decrease in its NAV premium from about 5 times during Q2 to around 4.5 times.

The next channel for listed companies buying coins—Opening Bell

In fact, most listed companies with a "coin-stock concept" have encountered similar dilemmas, while Upexi and SOL Strategies have taken the lead in transforming their on-chain stock strategies and market structures, riding the recent wave of "U.S. stocks on-chain." After Superstate launched Opening Bell, SOL Strategies, a Canadian listed company, announced plans to list on Nasdaq, but before ringing the bell on Nasdaq, they chose to "ring the bell" on Superstate first, announcing on May 8, 2025, that they would launch their stock on the platform. Once regulatory approval is obtained, SOL Strategies' stock will trade on Solana this summer. Following this, Upexi announced on June 26, 2025, that it would tokenize its shares through the Opening Bell platform, making both companies the first participants on the platform.

Opening Bell currently chooses to establish itself on Solana first (with plans for Ethereum and other chains later), interacting with USTB and USCC issued by Superstate, and the company's shares will be recorded and tokenized by Superstate's SEC-registered, blockchain-enabled share registration agency. Unlike other "mirror tokens," this form will not be a synthetic exposure or wrapped token, but the company's actual shares will be genuinely on-chain for the first time. Notably, similar to Nasdaq, Superstate stated that when a company lists on Opening Bell, it will ring the bell simultaneously at Superstate's headquarters in New York.

For already listed companies, Opening Bell provides a "virtual cross-chain bridge" from reality to crypto, while for companies yet to be listed, Opening Bell resembles a "Pre Market" like Nasdaq or the New York Stock Exchange, offering the ability to open shares to crypto users in the crypto-native market, providing different funding exposures for future "official listings."

Can Opening Bell Really Save "Coin-Stock Concept Stocks"?

Currently, whether it is Upexi, SOL Strategies, or other companies buying coins, the core support for their NAV per share almost entirely comes from the market value of the SOL they hold. Many in the community are concerned about whether they will use a nested approach to create a "coin-stock bubble," financing the purchase of SOL through PIPE or convertible bonds, then tokenizing the company's stock on-chain, and using the stock as collateral in DeFi for lending, thereby releasing new investable capital and achieving a "buy SOL—collateralize—reinvest" flywheel structure.

However, the stock issuance and trading on the Opening Bell platform are still under a strict regulatory framework. The platform requires investors to complete KYC certification and relevant education before they can store "on-chain shares" (Token Shares) in pre-approved whitelisted wallets. Currently, only existing shareholders, investors who have completed Superstate KYC certification, and compliant "KYC" partner wallets have whitelist rights. In other words, on-chain stock trading is currently limited to approved accounts, and investors cannot freely use tokenized stocks as collateral for any DeFi protocol for lending.

At the same time, Superstate, along with institutions like the Solana Policy Research Institute, has submitted a pilot proposal to the U.S. Securities and Exchange Commission (SEC) called "Project Open." This proposal envisions allowing certain U.S. companies to natively issue, register, and trade their stocks on public chains like SOLana within a limited range of issuers. The trading process also needs to be completed in approved whitelisted wallets, with regulatory authorities having the power to intervene and modify at any time. If the SEC ultimately approves this, it means stocks could achieve global, around-the-clock, real-time settlement like cryptocurrencies; if not, traditional trading models will continue.

The Radical Experimenter Superstate

Robert Leshner, founder of Compound and Superstate, stated in an interview that he is betting on a new generation of cryptocurrency-first investors. "This is a massive wave of capital; they don't care about brokerage accounts, only blockchain wallets. They want to trade in the way they are accustomed to. I truly believe this is a whole new capital market, ready to welcome businesses." He added, "Hedge funds and venture capital firms around the world have become enamored with crypto-native channels, and Superstate has 150 institutional clients globally, including well-known firms like Arrington Capital, BitGo, CoinFund, Flowdesk, and ParaFi."

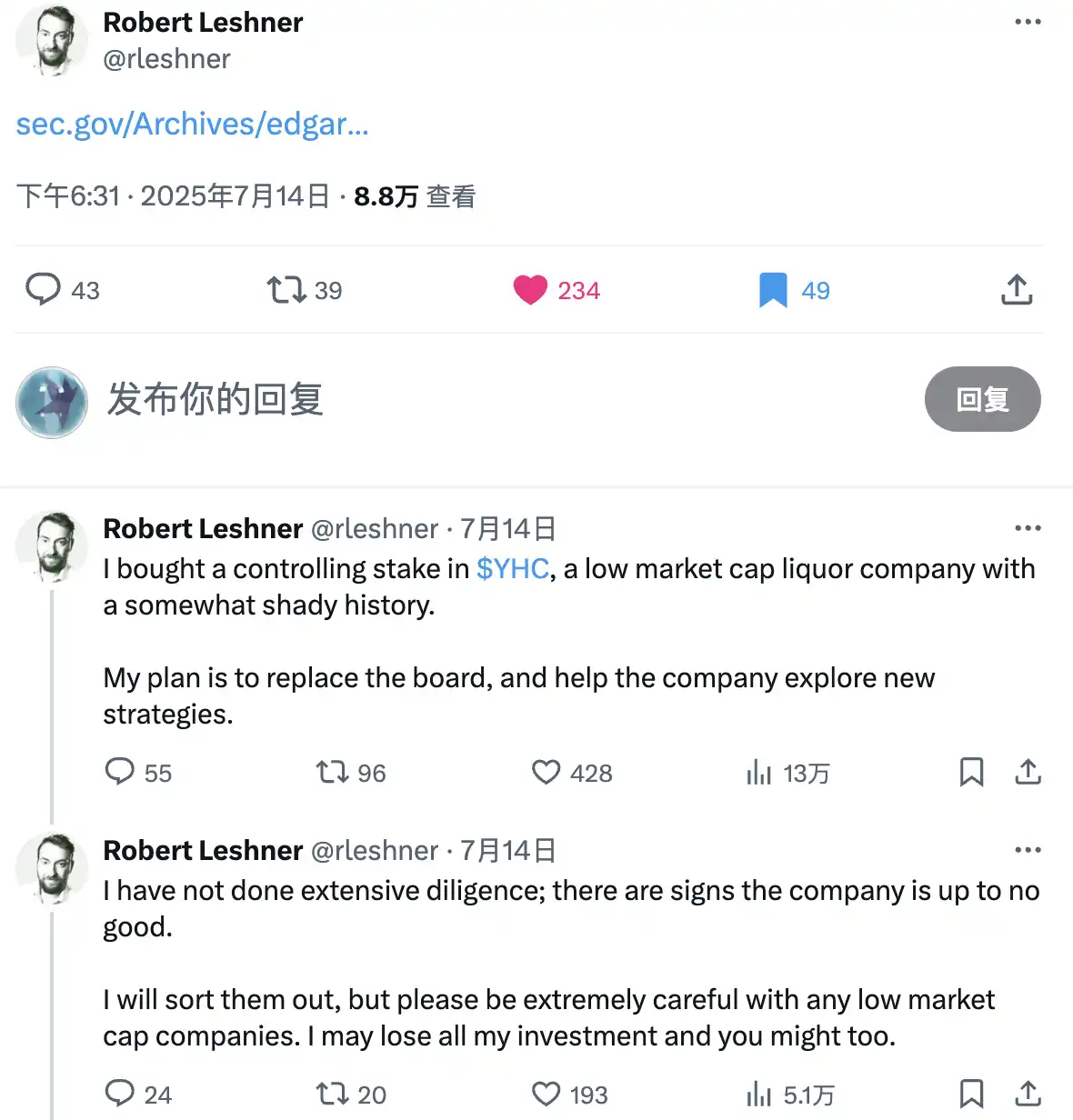

He not only said this but also acted on it. On July 14, Superstate's founder Robert Leshner shared a link to an SEC 13D form on X, indicating his plan to acquire 57% of YHC's shares (most shares acquired at $3.77 per share, roughly estimated at about $2 million), a low-market-value company with a somewhat dubious history in the liquor industry. He further stated that the next step would be to change the board and help the company explore new strategic directions.

Upon the news, this initially $2 million market cap listed company surged over 300% in just one week, reaching a market cap of $1.1 billion.

Just four days after the acquisition announcement, on July 18, Robert Leshner announced he would abandon the control contest for LQR, stating that the company's continuous issuance of new shares diluted shareholder rights, rendering his holdings ineffective for control. Leshner then indicated he would not initiate a proxy or legal battle but would recommend community experts to LQR to help establish a cryptocurrency treasury. He emphasized that this matter highlights the opacity of traditional markets in share tracking and believes this is precisely the problem that cryptocurrency technology can solve. Following this announcement, the company's market cap evaporated by another 40%.

Some community members speculate that while acquiring a "shell company" to build a cryptocurrency treasury is common, this matter may not be so simple. Jason Kam, founder of Folio Ventures, believes there is a high probability that Robert bought this cheap shell company to retain some "optionality" while advancing the Superstate business he is building.

He speculates on a few possible development paths: "Robert Leshner and certain partners in discussion will inject a business into YHC and then force it through Superstate's process, making it a demonstration case for stock tokenization," or "Robert Leshner directly merges Superstate into YHC," or it could be "Robert Leshner uses this company as his holding platform, promoting his investment activities through physical contributions or matching methods while advancing Superstate's business development."

Jason Kam also added, "Of course, it is also possible that nothing will happen, and he just keeps this shell company in hand."

Conclusion

This path undoubtedly provides institutional investors with more entry channels. However, whether it can sustainably support asset net value premiums still depends on the sustainability of the underlying assets. Unlike Bitcoin, which has strong consensus, SOL, as a yield-oriented asset, relies more on staking, DeFi usage, and other scenarios to maintain its value anchor. If on-chain stocks cannot be quickly absorbed and embedded into the DeFi ecosystem, such as effectively entering the lending market or becoming foundational assets for market making, these companies will be more easily viewed by the market as "knockoff MicroStrategies," and their valuation system will quickly revert to the old path of "SOL position discount + traditional business discount," rather than entering a new paradigm of "asset tool enterprises."

Upexi has already listed its stock on Webull Corporate Connect and initiated Nasdaq derivative trading, while also laying out the tokenization path on Opening Bell. Its dual market trading structure means that its stock volatility depends not only on the company's fundamentals and SOL price but also on factors like on-chain liquidation and leverage squeezes. This high-leverage structure may attract the attention of crypto arbitrageurs and professional DeFi users in the short term, bringing in temporary capital inflows and valuation jumps, but it also means that stock prices will become "coinized," with volatility potentially far exceeding what traditional market investors can bear.

Once excessive leverage and severe asset price fluctuations occur on-chain, the reverse liquidation mechanism may quickly turn "stock price surges" into "liquidation crashes." For companies attempting to achieve NAV premium continuation through "on-chain longevity," this is a double-edged sword; if a real on-chain financial closed loop is not formed, the pricing of these companies is more likely to revert to the model of "crypto positions + revenue discount," compressing the originally hoped-for valuation imagination space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。