In just three days, the TVL reached $40 million, and the founder of the largest market cap Meme on the former Blast network has arrived in the fertile ground of Hyperliquid.

Written by: Nicky, Foresight News

Hyperliquid, as one of the most outstanding trading platforms in this cycle, has a daily trading volume exceeding $15 billion, capturing over 74% of the on-chain Perps market share. The native token HYPE currently ranks 12th in the cryptocurrency market cap rankings. Hyperliquid's ambition is not just to become a single on-chain trading platform but to build an ecosystem network centered around itself, Hyper EVM.

Recently, a new project within the Hyper EVM ecosystem, Project X, has attracted community attention, with its DEX surpassing a TVL of $40 million just three days after launch. As an emerging project, the ecological position and team background of Project X are worth noting.

To understand the birth of Project X, one cannot overlook its founding team's "previous work" — Pacmoon.

As a social Meme project on the Blast chain, Pacmoon became a representative project of the Blast ecosystem with a maximum FDV exceeding $200 million, thanks to its "Yap model" (driving token value through social fission and community consensus). However, the current FDV of the project token PAC is only $35,000, nearing zero. This is partly due to the gradual silence of the Blast network and also indicates the ephemeral nature of the project.

According to official documents, the identity of the project founder has not yet been clarified, but the team consists of 7 main members, including Lamboland responsible for growth, BOBBY responsible for product operations, hisho responsible for product design, and Ali responsible for creative direction. Additionally, there is a CTO with a YC background and two native DeFi backend developers.

Among the four publicly known nicknames, it can be inferred from the published tweets that all four have participated to varying degrees in the construction of Pacmoon or the Blast network. Among them, Lamboland and BOBBY are the founders of Pacmoon.

Now, the team is turning its attention to DeFi infrastructure: AMM DEX (Automated Market Maker Decentralized Exchange). In the planning of Project X, the team hopes to break out of the "imitating Uniswap" framework and change the competitive logic of trading platforms through "distribution mechanisms, incentive design, and user experience." As stated on the official website: "Technology is converging, and the next round of DeFi will depend on how efficiently value is allocated, incentives are designed, and how willing users are to stay."

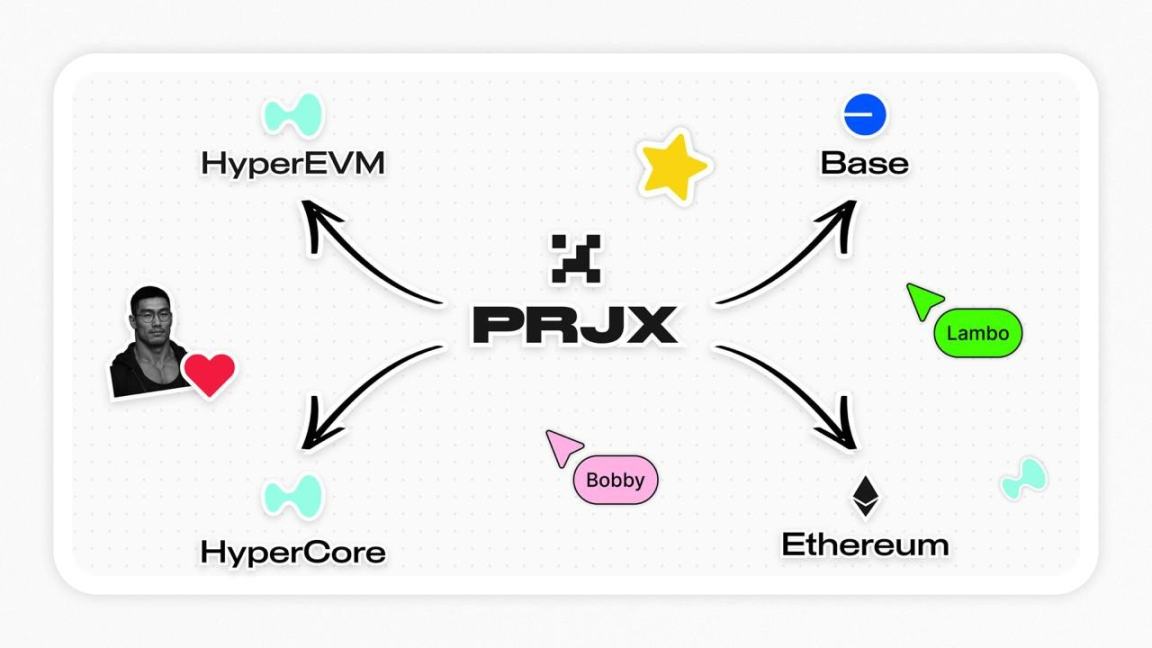

The development of Project X adopts a phased approach, currently focusing on the first phase "HyperEVM DEX," with plans to gradually expand to "EVM Aggregator" and an undisclosed third phase, with the ultimate goal of becoming "the preferred trading platform for crypto traders."

As the current core product, it is positioned as a "Uniswap-style AMM DEX," but with differentiated designs in user experience and incentive mechanisms:

Fee Distribution: In the V3 version, 86% of trading fees are directly distributed to liquidity providers (LPs), with the remaining portion used for protocol operations. This ratio places it in the "high LP return" tier among similar AMMs, with the website explicitly stating "to allow LPs to earn more on Project X";

V2 Pool Preparation: Although the V2 version has not yet launched, the team has signaled that it will further enhance LP earnings through more complex market-making strategies (such as dynamic fees and cross-chain liquidity aggregation).

After completing the construction of the first phase HyperEVM DEX, the second phase "EVM Aggregator" will focus on cross-chain trading aggregation, allowing users to access liquidity from multiple EVM chains with one click through Project X, addressing the current pain point of "multi-chain DEX fragmentation."

Participation Method

The Project X points mechanism is key to activating user growth. Currently, points serve as the core credential for user participation in the ecosystem and may be directly linked to token airdrops or ecological rights in the future.

The current paths to earn points clearly point to "user contributions":

Liquidity Provision (LP): Users can deposit assets into the liquidity pool of HyperEVM DEX (such as the currently promoted kHYPE pool) and earn points based on the trading fees generated. The official website emphasizes that "most points will go to LPs," and point calculation is strongly correlated with "fee generation" — for example, a user who deposits $1 million into the liquidity pool and generates $100 in fees will earn fewer points than a user who deposits $10,000 but generates $1,000 in fees;

Trading: Users earn points based on the scale and frequency of their spot trades on the platform (which require paying fees);

Inviting Friends: By sharing a unique invitation code, users can earn double rewards: first, they earn 10% of the points generated by their friends as a referral reward; second, their friends' base point earning efficiency is increased by 10% (for example, if a friend originally earned 100 points daily, they would earn 110 points after the invitation).

To quickly bootstrap the ecosystem, Project X has set up short-term incentives:

Daily 1 Million Points Pool: In the current phase, the platform releases a fixed 1 million points daily, and all users' point earnings come from this pool;

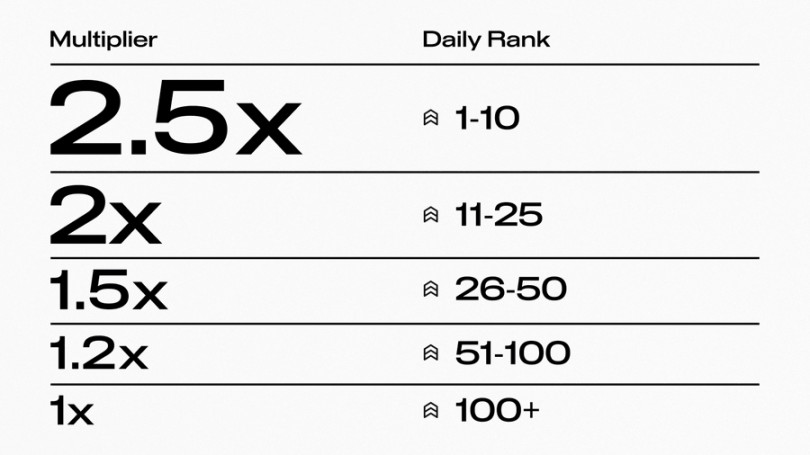

First Month Points Multiplier: In the first 30 days, the top 100 users in daily points ranking will receive a minimum of 1x points multiplier reward.

It is important to note that the project team has recently adjusted the points system UI, and current point earnings are reflected in real-time on the user interface. However, specific airdrop rules (such as the exchange ratio of points to tokens and airdrop timing) have not yet been announced and will be subject to future official announcements.

Risk Warning

Unlike most DeFi projects that rely on VC funding, Project X's funding source appears to be more "grassroots": the official website clearly states "100% self-funded, no VC, no angel investment, no private placement." The advantage of this model is that the team has stronger control over the project and is more inclined towards "long-termism."

However, this also comes with potential risks; the lack of external financing means the project has a weaker risk resistance capability. In the event of extreme market conditions or smart contract vulnerabilities, it may face the dilemma of "being unable to compensate user losses."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。