The votes in favor of the stablecoin regulatory "GENIUS Act" are 2.5 times the votes against it, with over 100 Democratic lawmakers switching sides to support it.

Written by: Li Dan, Wall Street Insights

The cryptocurrency industry is about to welcome the first official industry laws in the United States, which will help legitimize this digital asset and move it towards becoming a mainstream financial product.

On Thursday, July 17, during the late trading hours of the U.S. stock market, the U.S. House of Representatives passed three legislative proposals regarding the regulation of cryptocurrencies, including stablecoins, with an overwhelming majority, sending them to President Trump for signing into law.

Among them, the "GENIUS Act" related to stablecoin regulation received 308 votes in favor, which is 2.5 times the 122 votes against it. More than 100 Democratic lawmakers, including Senate Democratic Leader Hakeem Jeffries, switched sides to join the Republican camp and voted in favor.

Earlier, during the midday trading hours of the U.S. stock market, White House Press Secretary Levitt stated that Congress had enough votes to pass the legislative proposals regarding cryptocurrencies. He believes Congress will continue to legislate on cryptocurrency issues. Trump plans to sign the cryptocurrency legislative proposals, including the "GENIUS Act," into law during an event on Friday.

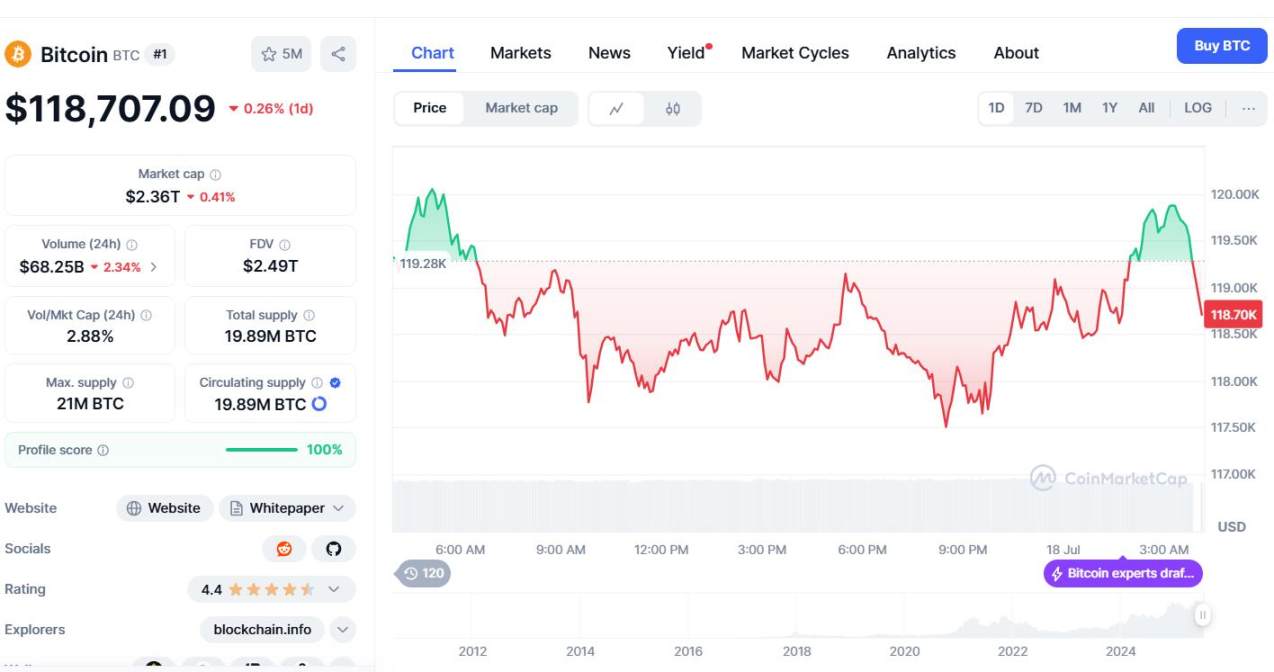

During Levitt's speech, Bitcoin saw a slight uptick. According to CoinMarketCap data, Bitcoin briefly rose above $119,800, nearing the $120,000 mark, gaining over $2,000, or nearly 2%, from the intraday low of $117,600 during European stock trading. After the House approved the bill, Bitcoin fell to $119,000 in after-hours trading, having previously dropped over 0.4% during the day.

Before Levitt's speech, on Wednesday evening, the "GENIUS Act" and other cryptocurrency bills narrowly passed a key procedural vote in the U.S. House of Representatives, with only five more votes in favor than against. A day earlier, due to a "civil war" within the Republican Party, these bills had just failed in the first round of procedural voting.

According to CCTV News, on the evening of the 16th local time, U.S. media reported that the U.S. House of Representatives passed the procedural vote on the cryptocurrency bill with a result of 217 votes in favor to 212 against, allowing the bill to enter the debate stage. The voting lasted over 8 hours, setting a record for the longest voting time since the electronic voting system was implemented.

The full name of the "GENIUS Act" is the "Guidance and Establishment of a National Innovation Framework for U.S. Stablecoins Act." The "GENIUS Act" was passed in a vote in the U.S. Senate on June 17 and submitted to the House for approval this week. The House also added two other major cryptocurrency industry bills—the "CLARITY Act" and the "Anti CBDC Act."

The three cryptocurrency bills were reviewed and voted on together in the House, leading to this week being referred to as "Cryptocurrency Week" in the House.

However, in the procedural vote in the House on Tuesday, the three bills failed to pass due to 13 Republican lawmakers "defecting" and voting against the related procedural motion alongside Democrats, resulting in 27 more votes against than in favor. The final vote count was 196 votes in favor and 223 votes against.

Wall Street Insights previously mentioned that House Speaker Johnson stated after the vote that hardline critics within the Republican Party wanted to merge several cryptocurrency bills into one, which was the reason they blocked the procedural vote.

Media reports indicate that after Trump's intervention to mediate, the previous legislative deadlock was alleviated. Republican lawmakers who opposed the bills met with Trump at the White House late Tuesday night, and after more than nine hours of private negotiations on Wednesday, the House Republican hardliners reached a compromise with party leadership on cryptocurrency legislation, allowing the three key cryptocurrency bills to advance to the procedural voting stage.

Passage of the cryptocurrency bills is expected to stimulate new demand for U.S. Treasury bonds

Currently, the three bills being pushed by House Republican leaders for legislation all have Trump's support. They aim to establish a clear regulatory framework for the digital asset industry and are seen as an important milestone in U.S. cryptocurrency policy.

Among them, the "GENIUS Act" establishes a regulatory framework for stablecoins "pegged" to the U.S. dollar, which is widely viewed as beneficial for strengthening consumer protection and enhancing the legitimacy of the cryptocurrency industry. Stablecoins are a type of cryptocurrency designed to maintain a relatively stable value against certain assets (usually currencies).

The "CLARITY Act" primarily addresses market structure issues, providing clear guidance for digital asset trading and regulation. The "Anti CBDC Act" aims to prevent the Federal Reserve from issuing central bank digital currency (CBDC) directly to individuals without congressional authorization and from using CBDC to implement monetary policy.

21st Century Economic Report points out that it is worth noting that the three cryptocurrency bills will bring about two systemic changes.

First, there will be a restructuring of regulatory responsibilities. The Commodity Futures Trading Commission (CFTC), the highest regulatory body for U.S. commodities, will become the main regulatory authority for digital commodities, while the Securities and Exchange Commission (SEC), known as the U.S. securities regulator, will only manage security tokens and initial offerings, which may indicate a partial relaxation of cryptocurrency regulation.

Second, global capital flows may be reshaped. The requirement for mandatory U.S. Treasury reserves may make stablecoin issuers the third-largest buyers of U.S. Treasuries, solidifying the on-chain circulation system of the dollar. U.S. Treasury Secretary Basant previously predicted that the demand for U.S. Treasuries resulting from the stablecoin bill could reach $2 trillion.

CCTV previously cited media commentary from earlier this month stating that as cryptocurrencies become more mainstream, they may impact the U.S. bond market. The "GENIUS Act" will require tokens to be backed by liquid assets such as the U.S. dollar or U.S. government short-term bonds and will require token issuers to disclose their token reserve details monthly. This means issuers must purchase more U.S. government short-term bonds.

Basant previously encouraged congressional members to pass the "GENIUS Act" on the grounds that it could stimulate market demand for U.S. Treasury bonds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。