Author: Zz, ChainCatcher

Editor: TB, ChainCatcher

Ethereum is undergoing a profound capital restructuring.

Four forces are quietly converging: institutions are entering through ETFs, banks are beginning to offer ETH trading services, publicly listed companies are using ETH as a reserve asset, and large holders are continuously buying on-chain.

The era of retail-driven speculation is coming to an end, and a transformation driven by institutions has already begun.

Data Source: RootData

ETF Capital Wave: $2.72 Billion Net Inflow in One Week, BlackRock Buys $300 Million in a Day

Wall Street's attitude is undergoing a fundamental shift.

SoSoValue data shows that last week, Bitcoin spot ETFs had a net inflow of $2.72 billion, marking five consecutive weeks of inflows. This indicates a changing perception of crypto assets in traditional finance. BlackRock's Bitcoin ETF IBIT saw a net inflow of $1.76 billion in one week, with a historical cumulative net inflow reaching $55.2 billion.

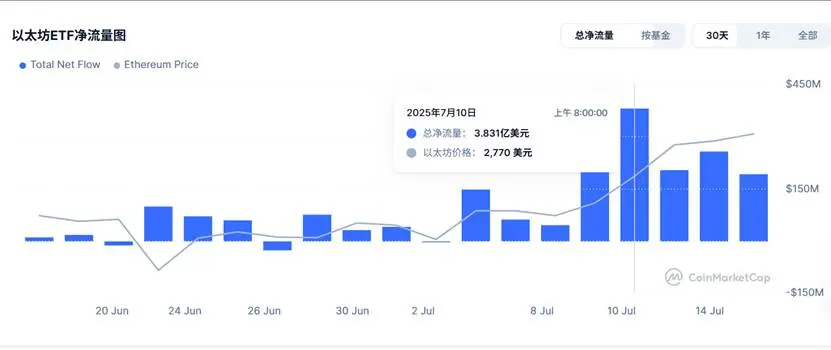

Data Source: CoinMarketCap

Ethereum's performance is even more remarkable. On July 10 alone, the total net inflow for U.S. Ethereum spot ETFs was $383 million, with BlackRock's ETHA contributing $300.9 million, followed by Fidelity. As of the time of writing, the total assets managed by all ETFs have reached $14.22 billion, accounting for 3.87% of ETH's total market capitalization. The historical cumulative net inflow has reached $5.757 billion.

Data Source: SoSoValue

These ETH are locked in institutional cold wallets such as Coinbase Custody. Each ETF purchase requires a real purchase of ETH in the spot market, creating continuous buying pressure.

A larger transformation is brewing. EMJ Capital analyst Eric Jackson points out that once ETH can be staked in ETFs to generate returns, conservative institutions like pension funds and insurance companies will also be able to participate. The market expects that staking ETFs will be approved before October 2025.

Standard Chartered Opens ETH Trading, JPMorgan's 180-Degree Turn

Traditional banks, once cautious about cryptocurrencies, are quietly turning around.

In July 2025, Standard Chartered announced the launch of a digital asset trading platform for institutional clients. This makes it the first major bank in the world to offer physical ETH trading to clients.

Institutional traders can now buy and sell ETH directly through a familiar forex trading interface, enjoying bank-level security. Standard Chartered plans to launch Ethereum forward contracts, treating ETH as a mainstream asset equivalent to the U.S. dollar and euro.

An even more dramatic signal comes from JPMorgan. According to CNBC host Jim Cramer, JPMorgan CEO Jamie Dimon, who once called Bitcoin a "fraud," is now "fully embracing cryptocurrencies." This shift in attitude speaks louder than any data.

Companies Hoarding ETH: SharpLink Increases by 23% in a Month

A number of publicly listed companies are starting to use ETH as a corporate reserve.

SharpLink Gaming (SBET) holds 280,706 ETH, with 99.7% staked to generate returns. In one month, ETH holdings increased by 23%, with approximately $257 million allocated for further purchases of Ethereum.

PayPal co-founder Peter Thiel acquired a 9.1% stake in BitMine Immersion Technologies. This company has transitioned from mining to becoming an ETH reserve company, holding 163,142 ETH, valued at over $500 million.

Traditional mining companies are also shifting towards ETH. Bit Digital has converted all its Bitcoin reserves into Ethereum, now holding 100,603 ETH. BTC Digital has established a $1 million ETH reserve fund.

The stock prices of these companies are highly correlated with ETH prices. From early July to mid-July, when Ethereum rose by 22%, BitMine Immersion's stock price surged over 1100%, while SharpLink Gaming rose by 180%.

Whales Hoarding On-Chain, $89.5 Million Withdrawn in One Week

On-chain data shows that large holders are continuously buying.

Glassnode data indicates that the number of addresses holding at least 10,000 ETH has increased from 37.56 million to 41.06 million over the past nine months, a growth of 9.31%, reaching the highest concentration since 2020.

Specific movements tracked by Lookonchain include:

A suspected Cumberland withdrew 34,883 ETH from Binance in one week, valued at $89.5 million; a large holder bought 20,300 ETH within ten days, all deposited into DeFi protocols for long-term holding; another address withdrew 50,255 ETH from Binance over three weeks, valued at $114 million.

These actions of withdrawing from exchanges to cold wallets or DeFi indicate that large holders are preparing for long-term holding.

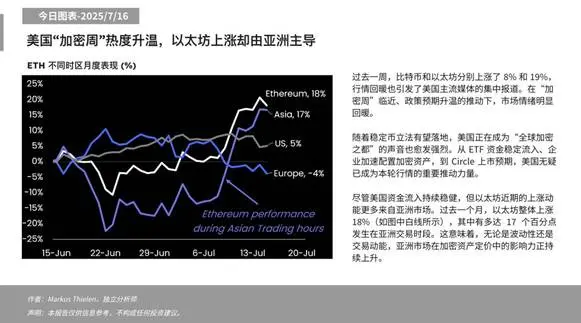

Matrixport research shows that Ethereum's 18% increase in July is attributed to the approaching "crypto week" and policy expectations. Corporate allocations and the anticipation of Circle's listing have become dominant forces. Among these, 17 percentage points of the increase came from Asian trading hours.

Wintermute founder and CEO Evgeny Gaevoy stated on July 17 that there is almost no ETH available for sale on their OTC trading platform!

It is noteworthy that when BlackRock's ETF sees inflows, you can observe institutional addresses simultaneously withdrawing large amounts of ETH from exchanges. The behaviors of institutions and large holders are highly consistent.

What Institutions Value: A Huge Stablecoin Ecosystem and Zero Downtime Record

Vitalik Buterin stated in an interview with CNBC in Cannes: "People think institutions only care about scale and speed. On the contrary, many institutions have directly told us that what they value about Ethereum is its stability and reliability, as well as its record of never having downtime in nearly a decade."

More importantly, Ethereum is at the core of the $230 billion stablecoin market. The higher the ETH price, the more secure the network. Each expansion of on-chain dollar scale requires more ETH to purchase and stake.

Regulation is also becoming clearer. The "GENIUS Act" will establish a federal regulatory framework for stablecoins, while the "CLARITY Act" clarifies regulatory responsibilities. Each time policies become clearer, it is an invitation for institutions to enter.

Transformation is Happening

Four buying forces are working together: institutions are continuously buying through ETFs, banks are incorporating ETH into their service systems, publicly listed companies are using ETH as a reserve asset, and large holders are hoarding on-chain.

These forces promote each other: the compliance of ETFs encourages corporate allocations, the active adoption by companies drives banks to improve services, and all positive signals are validated on-chain.

Ethereum is transitioning from an experimental platform to financial infrastructure. At the current price of $3,200, the market is re-pricing this long-term trend.

When traditional finance begins to shift, inertia is often stronger than expected.

Recommended Reading:

After a 70% Crash, Still at a 100% Premium? The Mystery of SharpLink's ETH Bet Continues

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。