Is a large-scale short squeeze in the crypto market about to begin?

Written by: The Kobeissi Letter (@KobeissiLetter)

Translated by: Ethan (@ethanzhang_web3)

Editor's Note: This is not just another round of a bull market; it is a "crisis market" for Bitcoin that has erupted amid a flood of deficits, dollar depreciation, and a restructuring of the financial order. When gold prices and BTC surge simultaneously, Wall Street ETF funds flood in, and even "conservative" funds no longer hesitate, we must admit: the market is entering an unprecedented new cycle. Why has Bitcoin become a winner in this "unconventional" macro context? Is this wave of increase a bubble, a safe haven, or a repricing of power? Odaily Planet Daily helps you see the true direction of capital bets.

The original text is as follows

The current market situation is far from "normal." Bitcoin's surge can only be described as insane, currently skyrocketing along a steep linear trajectory. Interest rates continue to rise, the dollar has depreciated by 11% in six months, and the total market capitalization of the crypto market has increased by a staggering one trillion dollars in just three months.

What exactly has happened? The answer is clear: Bitcoin has entered "crisis mode."

Bitcoin's momentum is so strong that it can set new all-time highs (ATH) multiple times in a single day. Since the U.S. House of Representatives passed President Trump's "Big and Beautiful Act" on July 3, the price of Bitcoin has surged by $15,000. If gold has not raised alarms, then Bitcoin's wild rise should be enough to sound the alarm.

Are there any clearer signals? Look at the comparison of Bitcoin and the U.S. Dollar Index ($DXY) from the beginning of the year to now, where two significant divergence points appear:

April 9 (after the 90-day tariff suspension period ended)

July 1 (when the "Big and Beautiful Act" was passed)

Everything is self-evident.

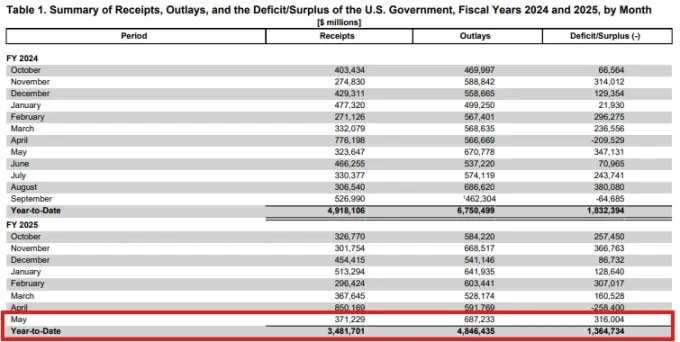

Entering July, market data shows that the U.S. recorded a fiscal deficit of $316 billion in May 2025 alone. This is the third-highest monthly deficit level in history. Initially, the market had some hope due to Musk's opposition to the spending bill.

However, this hope quickly faded in early July.

At that time, Bitcoin's rise seemed to benefit from market expectations for a trade agreement. But it turned out that regardless of whether a trade agreement was announced, the market results were remarkably consistent: bond yields rose, Bitcoin soared, the dollar fell, and gold increased.

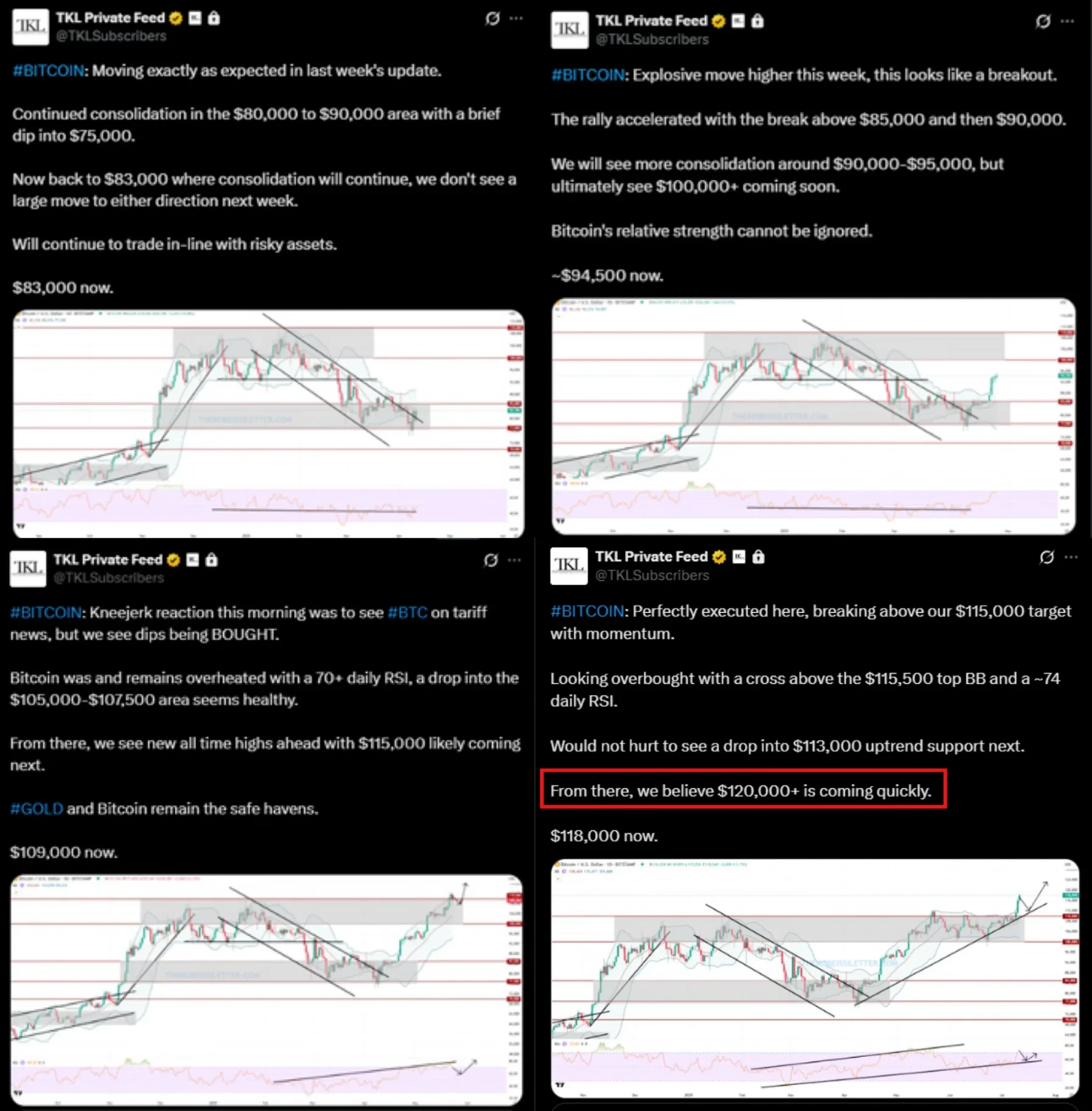

This is far from the so-called "normal" market condition. We had anticipated and captured this trend in advance: we decisively bought during the pullbacks at $80,000, $90,000, and $100,000, accurately predicting a target price of $115,000.

Last Friday, we further raised our target to above $120,000—this price level has just been reached.

This is undoubtedly a double boost for both gold and Bitcoin.

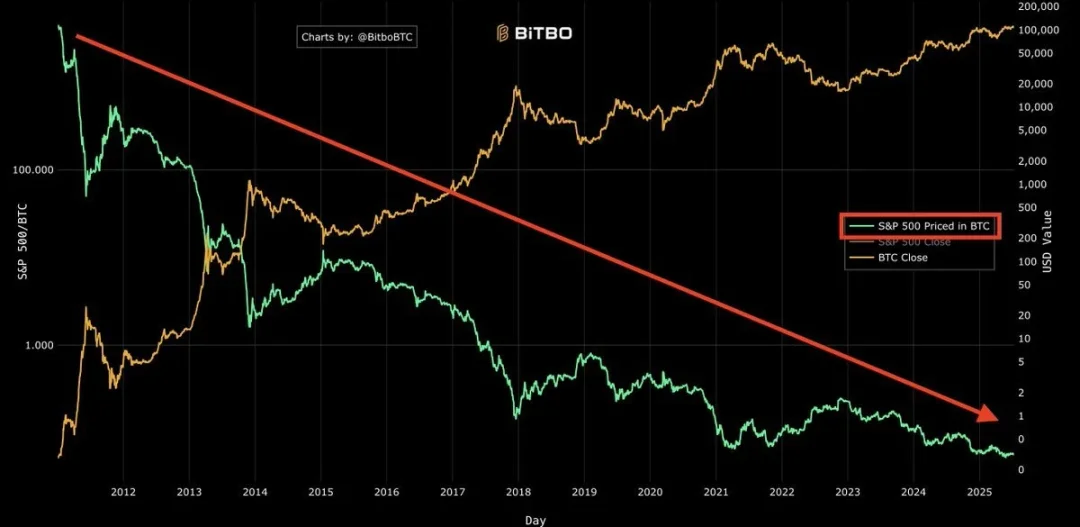

From the beginning of the year to now, the S&P 500 index has fallen by 15% when priced in Bitcoin. If we look back to 2012, the S&P 500 index priced in Bitcoin has plummeted by an astonishing 99.98%. The current situation is: Bitcoin's value is soaring, while the dollar's value is shrinking.

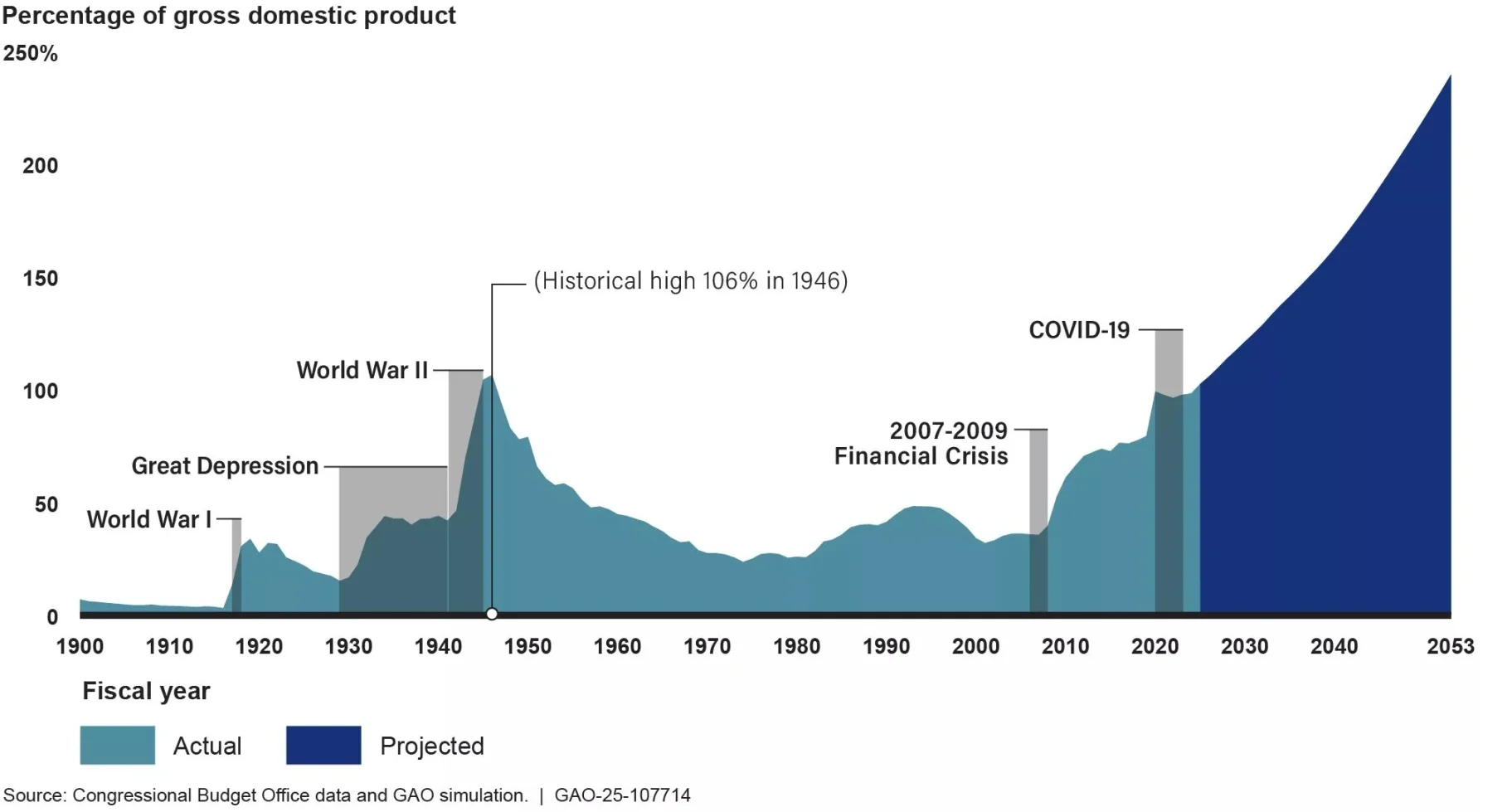

Once again, we emphasize the importance of closely monitoring the U.S. fiscal deficit.

More importantly, institutional funds seem to be rushing in, chasing this round of Bitcoin momentum.

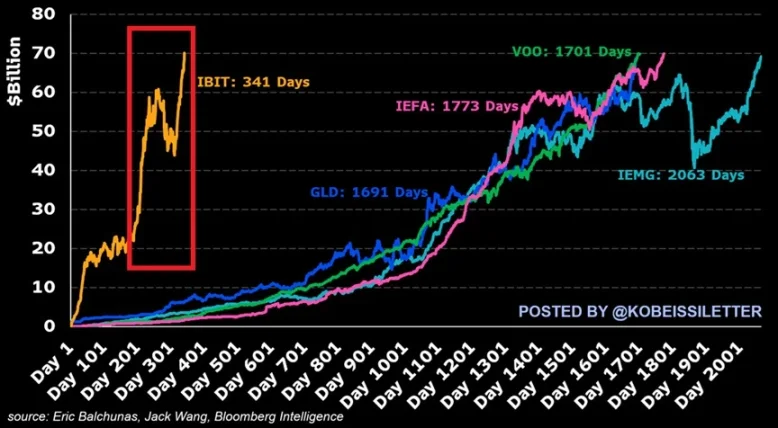

The assets under management (AUM) of the Bitcoin ETF IBIT have rapidly climbed to a record $76 billion in less than 350 days. In comparison, the world's largest gold ETF, GLD, took over 15 years to reach the same scale.

In our in-depth discussions with institutional investors, we noticed a recurring consensus: broadly speaking, family offices, hedge funds, and other institutional capital can no longer ignore Bitcoin. Even "conservative" funds are considering allocating about 1% of their assets under management (AUM) to Bitcoin.

It should be noted that when we say Bitcoin has entered "crisis mode," we do not mean to be bearish on other assets. In fact, the short-term "stimulus" effect of more deficit spending is "bullish," and risk assets may continue to rise in the short term.

Of course, the long-term negative impacts cannot be ignored.

Ironically, if the deficit issue is resolved, many of America's challenges would be easily addressed. It could lower interest rates, curb inflation, and boost the dollar. But Bitcoin "knows" that this is almost impossible—just look at how its momentum accelerated after the spending bill was passed.

The changes in the economic landscape are precisely where investment opportunities lie. As the market gradually digests this ongoing deficit spending crisis, capital is undergoing large-scale rotation, causing asset prices to fluctuate dramatically.

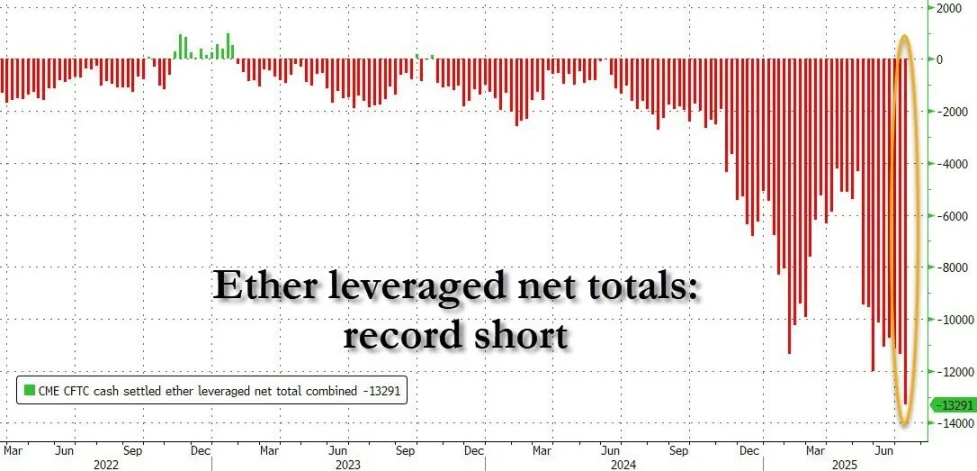

Finally, interestingly, according to ZeroHedge, Ethereum's leveraged short positions are currently at an all-time high. This mirrors what we observed before the market bottomed out in April 2025.

Is a large-scale short squeeze in the crypto market about to begin? Things may be brewing…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。