Challenges

The primary challenge of spot tokenized stocks lies in regulatory compliance and the need for a robust legal framework. As the market evolves, the following issues must be addressed:

Regulatory Uncertainty: The legal status of tokenized stocks remains ambiguous in many jurisdictions, which can deter potential investors and issuers. Clear regulations are essential to foster trust and encourage participation in the market.

Custodial Risks: Tokenized stocks often rely on custodians to hold the underlying assets. If a custodian fails or is compromised, it could jeopardize the value of the tokenized stocks and the rights of the token holders.

Market Liquidity: While tokenized stocks can enhance liquidity, the actual trading volume may be limited, especially in the early stages. This can lead to price volatility and slippage for larger trades.

User Education: Many potential users may not fully understand how tokenized stocks work or the associated risks. Educational initiatives are necessary to inform users about the benefits and challenges of engaging with tokenized assets.

4. The Future of Tokenized Stocks

The future of tokenized stocks is promising, driven by technological advancements and the growing acceptance of blockchain in the financial sector. Key trends to watch include:

Increased Adoption: As more platforms and financial institutions explore tokenization, the market for tokenized stocks is likely to expand, attracting a broader range of investors.

Integration with DeFi: The convergence of tokenized stocks and decentralized finance (DeFi) could create innovative financial products and services, enhancing liquidity and accessibility.

Regulatory Developments: Ongoing discussions around regulation will shape the landscape for tokenized stocks. Clear guidelines will be crucial for fostering a safe and compliant environment for investors.

Global Market Expansion: Tokenized stocks have the potential to democratize access to global markets, allowing users from emerging economies to participate in investment opportunities that were previously out of reach.

In conclusion, while tokenized stocks present unique opportunities and challenges, their evolution will play a significant role in the future of finance, bridging traditional markets with the innovative potential of blockchain technology.

Significant obstacles still exist in the development path:

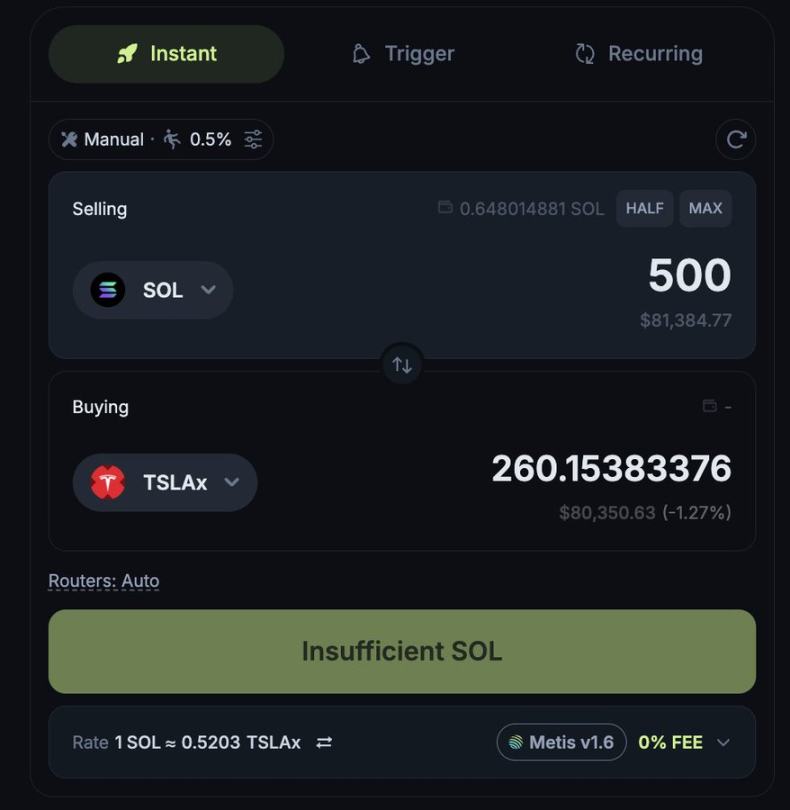

Fragmented Liquidity. This is the most pressing issue. Currently, the liquidity of tokenized stocks is far from sufficient to support large transactions. Traditional markets can easily handle million-dollar orders, while a $100,000 transaction on-chain can lead to slippage of over 1%.

Oracle and Market Closure Issues. DeFi relies on oracles to obtain asset prices, but how is the "real price" determined when traditional markets are closed? For example, during geopolitical turmoil, the price of Pax Gold (PAXG) surged by 20% due to low trading volume. If the oracle considers this temporary fluctuation as the "real price," it could trigger a chain liquidation in the lending market and perpetual DEX, creating systemic risk.

Smart Contract and Technical Risks. From token contracts to cross-chain bridges to DeFi protocols, every layer of the technology stack presents new potential failure points. Even historically secure protocols like GMX v1 could be attacked years later.

Counterparty and Custodial Risks. Even fully collateralized spot tokens require users to trust the issuer (such as Backedfi or Robinhood) and their custodians. While these institutions are regulated, they are not risk-free; if issues arise, users may have to undergo lengthy legal processes to reclaim asset value.

Corporate Action Handling. Events such as stock splits, dividend payments, and mergers cannot be autonomously executed on-chain and require intervention from centralized operators.

Tokenization of Perpetual Contracts: Utility and Challenges

Perpetual contracts do not seek to provide asset ownership but focus on offering purely capital-efficient price exposure, making them the preferred tool for active traders.

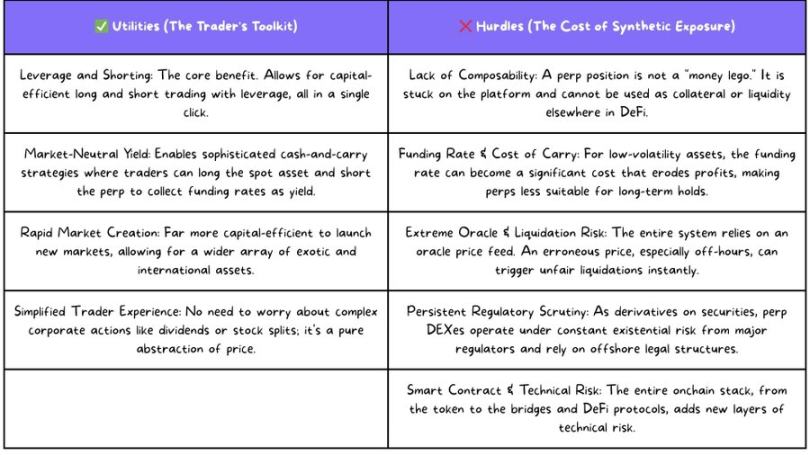

Utility

The core advantages of perpetual DEX are concentrated in trading scenarios:

Advanced Trading Features (Leverage and Shorting). One-click long and short operations facilitate high-frequency trading.

Capital Efficiency and Rapid Market Creation. Unlike spot tokens that require custodians to hold millions of dollars in underlying stocks, a perpetual DEX only needs a sufficiently funded AMM liquidity pool to launch a market, allowing for more flexible asset onboarding.

Simplified Trading Experience. The absence of underlying assets means no need to handle dividends, stock splits, or other corporate actions, allowing traders to focus solely on price fluctuations.

Delta-Neutral Yield Strategies. When spot tokens and perpetual contracts coexist, market-neutral yield strategies can be constructed. For example, when the funding rate is positive, buying the spot and shorting the perpetual contract can achieve capital-efficient "cash arbitrage" (similar to Ethena's strategy).

Challenges

The unique risks of perpetual contracts cannot be overlooked:

Lack of Ownership and Composability. Perpetual positions are typically not withdrawable, lendable, or usable as collateral for other DeFi protocols, sacrificing composability for trading efficiency.

Complexity of Funding Rates and "Holding Costs." When market sentiment is heavily skewed, longs must continuously pay fees to shorts. For stocks with low volatility, funding rates may exceed daily price fluctuations, eroding profits, making perpetual contracts more suitable for short- to medium-term trading or delta-neutral strategies.

Extreme Oracle and Liquidation Risks. The system relies entirely on oracle prices. If oracles obtain anomalous prices from illiquid sources when traditional markets are closed, it could lead to instant chain liquidations.

Ongoing Regulatory Pressure. As securities derivatives, perpetual DEXs are often registered in offshore jurisdictions and evade U.S. and European regulations through geographic blocking, but they always face existential risks from sudden policy changes.

4. The Future of Tokenized Stocks

Robinhood's entry has pushed this field from a niche experiment to the mainstream track. In the coming year, we will see:

Liquidity Wars. Various platforms will compete for market makers and trading flow through incentives like yield and token airdrops to solve the "chicken and egg" problem.

Exploration of Regulatory Pathways. More issuers will emulate the Liechtenstein model, and regulatory frameworks in places like Hong Kong may also become templates. Tentative collaborations between traditional financial institutions and compliant crypto companies will emerge.

Composability Practices. Mainstream lending protocols may accept "blue-chip" tokenized stocks as collateral, leading to the rise of automated yield vaults and basis trading strategies.

Maturation of the Perpetual Market. Listed assets will expand from U.S. tech stocks to Hong Kong stocks and commodities, with upgrades to oracles and risk management systems becoming technical focal points.

If the vision of crypto is to put everything on-chain, stocks will undoubtedly be an important piece of the puzzle, and this experiment is worth looking forward to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。