Three pieces of legislation focus on different aspects, but all point to a common theme—“compliance.”

Written by: Deep Tide TechFlow

In July, the crypto market surged again.

BTC broke historical highs, and ETH spot ETFs maintained a net inflow for nine consecutive weeks; last week, the net inflow for ETH spot reached a staggering $850 million, setting a record. The flow of funds has never ceased, and the market feels like it is improving.

However, the real catalyst may not lie in the price curve but in the U.S. House of Representatives in Washington, D.C.

From July 14 to 18, the House announced “Crypto Week,” focusing on three landmark bills: the GENIUS Act, the CLARITY Act, and the Anti-CBDC Act, which address stablecoins, digital asset classification, and central bank digital currencies (CBDCs), respectively.

This intensive legislative feast is not only a turning point for the U.S. crypto industry but may also influence the direction and asset changes of the entire crypto market.

Let’s take a look at the progress of the three major bills this week and capture the market pulse of Crypto Week.

Overview of the Bills: Core Content and Progress

As of July 16, Crypto Week is in full swing.

The three bills under consideration by the House cover the core tracks of the crypto market, involving stablecoin payments, decentralized finance (DeFi), and the decentralized narrative of Bitcoin.

Each piece of legislation focuses on different content, but all point to a common theme—“compliance.”

The GENIUS Act: The Legal Foundation for Stablecoins

The full name of the GENIUS Act is “Guiding and Establishing National Innovation for U.S. Stablecoins.” It aims to establish a federal regulatory framework for stablecoins, clarifying the qualifications for stablecoin issuers, 1:1 dollar or U.S. Treasury reserve requirements, and transparent auditing mechanisms. By implementing regulations such as the 1:1 reserve requirement, the act seeks to ensure that stablecoins are genuinely “stable,” preventing incidents similar to the Terra collapse in 2022.

In terms of legislative progress, the Senate passed the bill on June 2025 with a vote of 68 to 30. During Crypto Week, the House originally planned to vote on the bill this Thursday (July 17, U.S. time). On July 15, the House Rules Committee approved the discussion rules, but the procedural vote (to decide whether the bill enters formal debate) failed with a vote of 196 to 223, as 12 Republican hardliners opposed organizing the bill for debate.

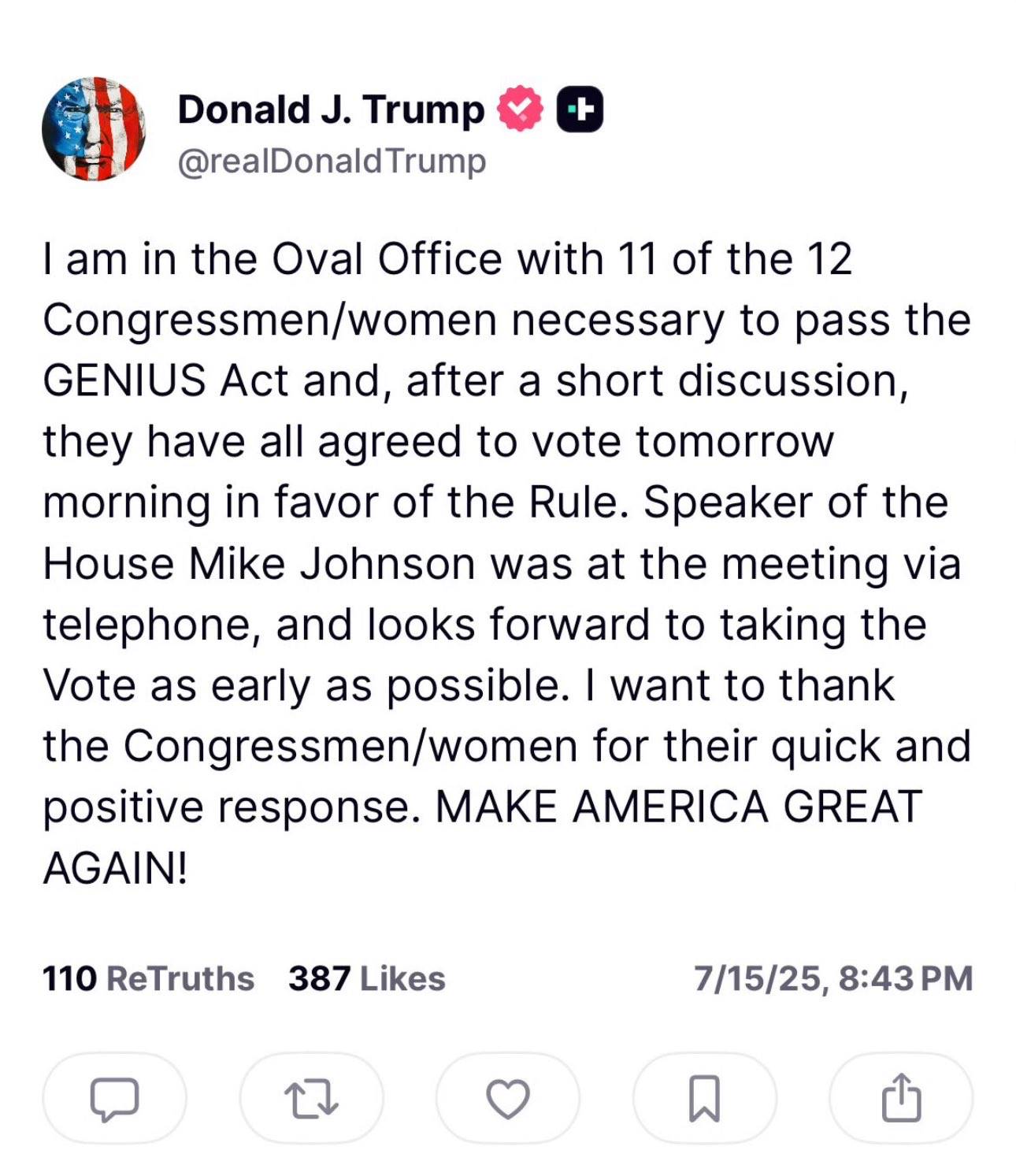

On the evening of July 15, Trump posted on Truth Social that he would meet with 11 opposing Republican lawmakers, stating they had agreed to vote again on the morning of July 16 (U.S. time) to support the rules. House Speaker Johnson expressed hope to attempt a procedural vote on the cryptocurrency bill again on Wednesday.

Despite some unexpected twists, the probability of the GENIUS Act passing remains high. If the vote goes smoothly, it could become the fastest bill to be enacted during Crypto Week, paving the way for stablecoins to integrate into mainstream finance.

The CLARITY Act: The Innovation Engine for Exchanges and DeFi

The full name of the CLARITY Act is “Digital Asset Market Clarity Act of 2025.” It focuses on defining digital assets and their regulatory jurisdiction. If passed, it will end the long-standing confusion regarding the regulation of digital assets by the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission).

This act clarifies which crypto assets are considered securities under SEC regulation or commodities (under CFTC regulation) and establishes a “mature blockchain” category for decentralized networks, exempting some developers from compliance obligations as fund transmitters.

In terms of legislative progress, this bill was introduced by the House Financial Services Committee and the Agriculture Committee on May 29, 2025, and was originally scheduled for a vote today. However, due to the procedural vote failure on July 15 (U.S. time), it, along with the GENIUS Act, has been stalled and has not yet entered formal debate.

Trump has indicated that he has persuaded opposing lawmakers to support the bill, and a vote may take place on July 16 (U.S. time) afternoon, with a high probability of passing. If successful, it will reduce compliance costs for exchanges like Coinbase and DeFi protocols like Uniswap, unleashing innovation potential.

The Anti-CBDC Act: Decentralization Left to the Market, Not the Government

The full name of the Anti-CBDC Act is “Anti-CBDC Surveillance State Act.” Its main content is to prohibit the Federal Reserve from issuing central bank digital currencies (CBDCs), arguing that CBDCs could lead to excessive government surveillance of personal finances. This act caters to crypto market users' concerns about privacy, strengthens the position of decentralized assets like BTC, and clears “competitive” obstacles for the subsequent development of crypto assets.

In terms of legislative progress, while the voting timeline for the Anti-CBDC Act has not yet been clarified, the House Financial Services Committee has explicitly placed the Anti-CBDC Act on the agenda for discussion during this week’s Crypto Week. If the U.S. government releases related passing information, it will significantly enhance confidence in the crypto market and may indirectly promote the development of privacy coins and anonymous technologies.

Legislative Outlook and Market Expectations

The U.S. legislative process requires bills to pass the House (total 435 votes, need 218 votes) and the Senate (total 100 votes, need 51 votes) before being sent to the President for signature.

This week’s Crypto Week serves as the voting window for the House. Overall, the GENIUS Act is the closest to becoming law, while the CLARITY and Anti-CBDC Acts will require more time.

We can also quickly clarify the progress and details of the three bills with a table:

How the Three Pieces of Legislation Reshape the Crypto Landscape

It is clear that the final voting results of Crypto Week will directly impact market sentiment.

The more profound impact lies in the fact that this not only provides a compliance framework but also pushes the industry from “barbaric growth” towards maturity and mainstream acceptance. Let’s take a closer look at the specific impacts of the legislation on different crypto tracks.

Stablecoins: Step by Step to the Center Stage

Stablecoins are undoubtedly one of the “mainstream narratives” in the global financial market this year. From the 900% stock price increase of stablecoin issuer Circle three weeks after its IPO, to JD.com and Ant Group launching Hong Kong dollar stablecoin plans, and today, Citigroup's CEO announcing that Citigroup is exploring the possibility of issuing stablecoins, every step indicates that the stablecoin sector, once scorned due to the Terra collapse, is gradually stepping into the spotlight.

The GENIUS Act clarifies the regulatory framework for stablecoins, granting them legitimacy and stability. The $2.38 trillion stablecoin market has become the core of global payments and DeFi, and the chain reaction from this action has already begun to manifest, with banks and retail giants (Walmart, Amazon, etc.) integrating stablecoin payments, accelerating their application in cross-border remittances and payments. Moreover, DeFi protocols (Aave, Curve) that rely on stablecoins for liquidity will also see an increase in TVL as a result.

Exchanges and DeFi: Catalysts for Innovation and Institutional Funds

The CLARITY Act, by clarifying the regulatory jurisdiction of digital assets, removes compliance barriers for exchanges and DeFi, unleashing tremendous potential. Centralized exchanges like Coinbase and decentralized exchanges like Uniswap have long suffered from repeated penalties from the SEC and CFTC due to unclear regulations. After the bill passes, reduced compliance costs will drive a surge in trading volume, attracting more retail and institutional users.

The opportunities in the DeFi space will be particularly significant: regulatory easing may encourage developers to launch new protocols, leading to significant growth in Web3, NFTs, and decentralized identities (DIDs).

Hidden opportunities include institutional fund inflows and a startup boom: financial institutions may accelerate the push for more cryptocurrency ETFs, while developer protection clauses will spark a wave of blockchain startups, attracting venture capital. Compared to the strict regulations in the EU, the U.S. lenient policies will provide investors with ample opportunities for cross-border arbitrage.

Decentralized Assets: Building a Moat for “Privacy”

The Anti-CBDC Act defends the concept of decentralization, solidifying BTC's status as “digital gold” and opening new avenues for privacy technologies. Bitcoin's gains are tied to institutional investment and community belief; the passage of the act will further strengthen its anti-censorship narrative, attracting long-term holders. Privacy coins (Monero, Zcash, etc.) and anonymous technologies will also rise due to increased demand for privacy protection.

Unlike the CBDC processes in other countries, proponents of the Anti-CBDC Act believe that government-issued CBDCs will act as “monitors” of user assets, directly conflicting with the core decentralized philosophy of Web3. The U.S. taking the lead in opposing CBDCs will undoubtedly make people and funds in the crypto space more inclined to choose the U.S. as their “base,” and if the U.S. becomes a “safe haven” for decentralized assets, it will further solidify its attractiveness in the global crypto market.

Crypto Week Sets the Tone for the Industry's Future

Since the “crypto president” Trump took office, the U.S. government's attitude towards the cryptocurrency sector has undergone a significant shift.

Behind this change, many Wall Street institutions and publicly listed companies have sensed the U.S. government's shift in attitude towards cryptocurrencies. The government's push for industry compliance undoubtedly breaks the last concerns of these giants. A “rule-less” market can only accommodate a limited amount of capital, while a market with “rules” can accommodate massive capital inflows, which will undoubtedly lead to a significant influx of funds into mainstream cryptocurrencies like BTC and ETH, as well as more crypto sectors.

Legislative Winds of Change: Structural Opportunities for Investors

In this trend of transformation, what other opportunities might there be from the perspective of crypto market investors?

Note that all the following text is the author's personal thoughts and experiences and does not represent any investment advice. The crypto market is highly volatile; although legislation brings positive news, it is still necessary to conduct your own research.

- ### GENIUS Act (Stablecoins)

The most critical aspect of the GENIUS Act is that it injects compliance momentum into the stablecoin market, promoting its application in payments and DeFi, with the market size expected to grow rapidly.

Compared to the EU's MiCA, the more lenient regulatory environment of the bill may further attract global stablecoin issuers to register in the U.S., creating opportunities for regulatory arbitrage.

Not just Circle and Tether, but as more companies are able to issue their own stablecoins and operate in compliance in the future, these companies will benefit from the positive crypto narrative, and their stocks may also perform well.

At the same time, as the front-end for the use and carrying of stablecoins, the wallet sector will have far more opportunities than before. By integrating KYC/AML functions, compliant wallets will attract more institutional and retail users.

In terms of specific assets, crypto assets like USDC and USDT (expanding market share), DeFi protocols like Aave and Compound (lending), Curve (stablecoin exchange); U.S. stocks like Circle (CRCL), Coinbase (COIN, high stablecoin trading volume), PayPal (PYPL, exploring stablecoin payments), Visa/Mastercard (V/MA, payment integration) are all worth further attention.

(Reading reference: Stablecoin Bill GENIUS Act Passed, Which Crypto Assets Will Benefit?)

- ### CLARITY Act: Growth Potential for Exchanges and DeFi

The CLARITY Act reduces compliance costs for exchanges and DeFi projects by clarifying asset classification and developer protections, driving trading volume and innovation. Both centralized and decentralized exchanges will benefit from user growth.

Beneficial assets include: crypto assets like ETH (core of DeFi), SOL (high-performance blockchain), UNI (Uniswap); U.S. stocks like Coinbase (COIN), Robinhood (HOOD, supports crypto trading), Grayscale (GBTC, Bitcoin/Ethereum trust); DeFi protocols like Uniswap, SushiSwap, Chainlink (cross-chain).

- ### Anti-CBDC Act: Long-term Value of Decentralized Assets

The Anti-CBDC Act prohibits the Federal Reserve from issuing CBDCs, reinforcing Bitcoin's appeal as a decentralized store of value, attracting long-term holders and institutional funds. At the same time, the act emphasizes privacy protection, which will also create narrative space for privacy coins (like Monero, Zcash) and the development of anonymous transaction technologies.

Beneficial assets include: crypto assets like BTC, ETH, XMR, ZEC; U.S. stocks like MicroStrategy (MSTR), Bitwise (BITW, crypto asset management), and more companies with ETH asset reserves; DeFi protocols like Tornado Cash (anonymous transactions), etc.

(Reading reference: ETH Reserve Companies Become New Favorites in U.S. Stocks, Reviewing the Businesses and Backers of 4 Star Companies)

Overall, the three major bills are driving three trends: accelerated inflow of institutional funds, integration of crypto with traditional finance, and the rise of Web3 startups.

If there must be a strategy and steps for investment, then short-term focus on stablecoin-related assets and companies, mid-term layout of DeFi blue chips, and long-term holding of BTC, while paying attention to privacy coins and new Web3 startup projects that meet version requirements under the new regulatory environment would be a good choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。