Bonding Curve has not solved the liquidity creation problem, but rather artificially increased the number of candidates, colliding to produce the most likely Meme tokens.

Written by: Zuo Ye

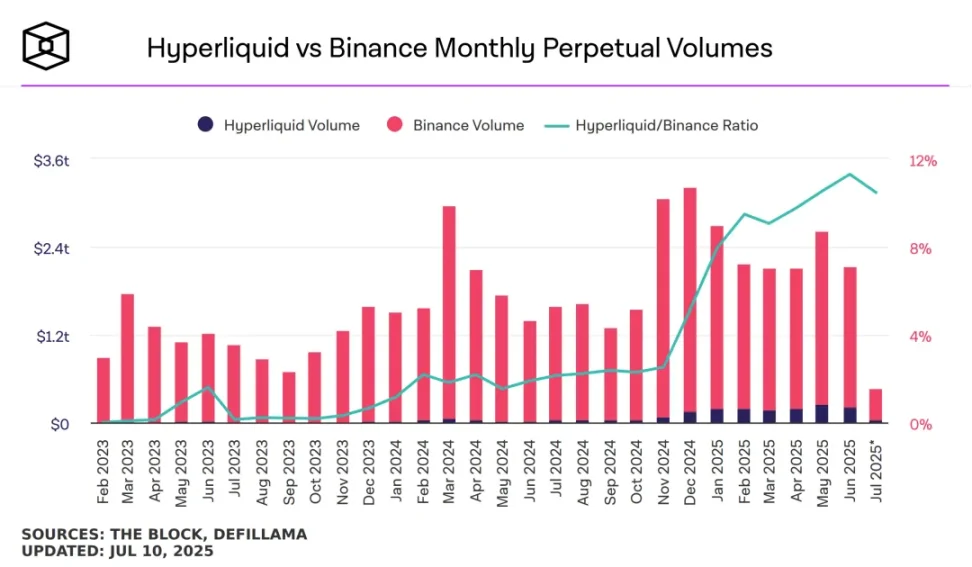

Consider a question: if Binance is destined to be unable to stop the rise of Hyperliquid, how should it maximize its benefits?

Image description: Comparison of contract trading volume between HyperLiquid and Binance, image source: @TheBlock__

At a time when $PUMP is performing far better than many CEXs on Hyperliquid, the most pressured Binance's response is to enhance the liquidity of Binance Alpha. Note that it is the liquidity within the Alpha market that is being enhanced, not the return rate for participants.

Listing on Binance used to mean listing on Binance spot, but now it more equates to listing on Alpha. To avoid the "disappearance of the Binance listing effect," it should guide towards Alpha, contracts, and the BNB Chain. However, it is quite strange for an exchange not to engage in trading, so it must enhance the trading attributes of Alpha.

Moreover, empowering $BNB is crucial for the entire Binance - YZi - BNB Chain system. The earnings of BNB holders are the daily liabilities of the Binance system. Beyond economic value, more utility value and even emotional value must be introduced.

In summary, the reasons for Binance Alpha to initiate trading are twofold:

- Counter the listing effect of Hyperliquid and increase the overall liquidity of Binance;

- Empower $BNB with more practical value to enhance the stability of the Binance system.

On these two points, it is easy to understand why Binance, in collaboration with FourMeme, initiated the Bonding Curve and TGE, even driving FourMeme to keep up with the PUMP token launch wave, after all, both Bonk and MemeCore can become popular.

For more details, refer to: Pump/Bonk/$M three-part Meme, two paths for asset issuance.

Choosing Bonding Curve to Promote Initial Liquidity

According to Binance's announcement, the token for this Bonding Curve TGE is Aptos DEX Hyperion.

We will not introduce this project further, and this article does not involve token prices or other content, but rather answers the logic behind why Binance chose Bonding Curve, for Founders to consider future listing plans.

Image description: @hyperion_xyz/center, image source: @BinanceWallet

After reading the announcement, it can be inferred that one needs to hold BNB, can resell after successful subscription within the Bonding Curve system, and after the event ends, enter the normal Alpha trading system. Essentially, this encourages trading within the market, as opposed to pre-market trading in Alpha.

After this, Binance's trading system has at least four layers: Bonding Curve trading -> Alpha trading -> contract trading -> spot trading, and it is a selection-based system, not necessarily leading to the main Binance trading system.

This conveniently masks or solves Binance's current biggest liquidity crisis by creating more initial liquidity mechanisms. Looking back in history, Bonding Curve has not solved the liquidity creation problem, but rather artificially increased the number of candidates, colliding to produce the most likely Meme tokens.

Reviewing the development history of DEX, LP Tokens are the true tools for solving liquidity supply. AMM/order book mechanisms need to cooperate with them to support their own operation. However, Binance's problem is a bit complex; it is not an early project but has encountered the biggest issue of early projects—liquidity is shrinking, and the value capture ability of $BNB is declining.

In comparison, PumpFun is an internal Bonding Curve + external AMM pool. The Bonding Curve itself has a paradox—greater demand leads to higher prices, similar to how increased demand for housing in Yanjiao raises property values. Once the market reaches a turning point, it can immediately collapse, with no room for a gradual decline.

PumpFun has not solved this inherent paradox but has drastically reduced launch costs to attract more attempts. Yanjiao may fall, but will Dubai rise? The global liquidity of the crypto circle and the possibility of any attempt make the internal market the cheapest launch pad, with 1,000 internal markets producing 10 that go to external DEX, and 1 that goes to CEX.

If the number of internal markets is increased to 10 million, the entire market's liquidity will instantly increase, bringing a flood of liquidity from internal and external DEX to CEX. Of course, it will ultimately collapse.

A prediction can be made here: the number of Binance Alpha Bonding Curve TGE events will increase in the near future; otherwise, it will not achieve the effects of liquidity creation and guidance to the main site and BNB.

Furthermore, Bonding Curve is more like a Rebase stability mechanism. The former is based on the premise that "the more demand, the higher the price -> the better the liquidity," while the latter's logic is "the more bought, the stronger the reserves + the more sold, the more profit -> the more stable the stablecoin price."

The issues of both are highly similar; they are both based on the "regular" part under the law of large numbers, meaning they do not consider the impact of extreme events. Using the 80/20 rule, they focus more on 80% of the situations and disregard the 20% exceptions. Ultimately, one perished due to the Luna-UST shock, while the other was drained of liquidity by $TRUMP.

Studying Psychological Momentum, Waiting for a Fatal Blow

There is a momentum phenomenon in the market, which tends to rise higher than we predict and fall deeper than the market's fair value.

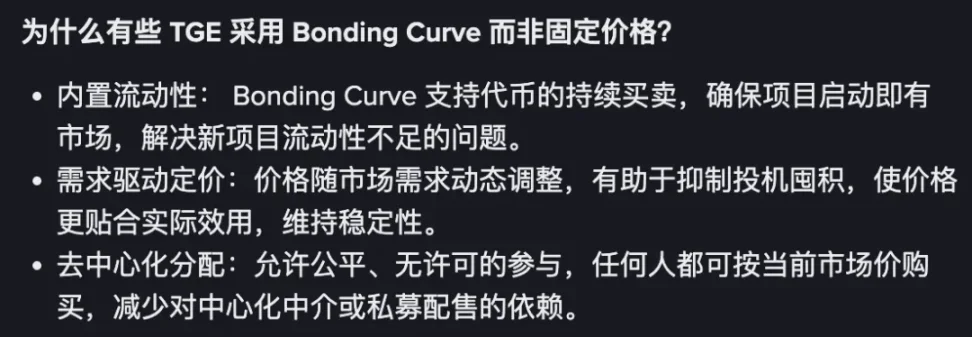

The assumptions on which Bonding Curve relies are inherently unreliable, but they align very well with Binance's real needs:

Create initial liquidity: Binance Alpha itself has a sufficient market foundation, so it is not "built-in liquidity," but rather liquidity pre-positioned, directing the liquidity of Alpha after it is opened and other DEX/CEX trading liquidity towards the Bonding Curve area;

Pricing expectations trigger demand: Just like Pre-Market (pre-trading) gambles on pricing, Bonding Curve will also trigger a pricing gamble, promoting demand trading. Users must sell tokens to avoid becoming watchers before the collapse of the Bonding Curve;

Digest the listing effect: Bonding Curve is a market gamble, allowing Binance to avoid the weakening of main site liquidity due to the decline of the listing effect, theoretically achieving a more fair pricing.

Image description: Reasons for choosing Bonding Curve, image source: @BinanceWallet

So, what is the cost?

As mentioned earlier, the PumpFun version of Bonding Curve relies on a sufficient number of internal markets to give birth to super products. The events of listing in the Alpha activity area are still too few; even if all project parties in the crypto circle are brought over, it is still not enough.

However, Binance Alpha will undertake the initial price discovery role for project parties. Referring to the joint effort of Binance and OKX to target Hyperliquid in $JELLYJELLY, I personally feel that CEXs will unite against Hyperliquid, with Binance being the first to act.

The ultimate trick to seize liquidity is price discovery. Retail investors hope to buy at the lowest cost and sell for the highest profit. If Binance directly boosts the listing effect, it will inevitably pay a higher price. However, by claiming to help retail investors discover the earliest prices, liquidity will naturally come.

Then, wait for an extreme black swan event to burst Hyperliquid, just like Bybit was severely impacted by a hack. CZ/Binance being fined 4.2 billion is inconsequential, just like Hyperliquid's extreme transparency being countered. Binance will then step in to poke, just like FTX was easily toppled, and CZ still comes out as the big brother.

Conclusion

Scale is Binance's biggest advantage, while flexibility is Hyperliquid's offensive strategy. Waiting for change and engaging in a war of attrition is a reasonable choice. Binance chooses price signals, while Hyperliquid moves towards the listing effect. Liquidity is the result of the competition between the two, not the cause.

It is just a pity for Alpha users, who are busy for whom, with such sweet sugar, how can those who cultivate it live so bitterly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。