Analyzing the Impact of Ancient Whales Transferring Bitcoin on $BTC Price

Regarding Bitcoin, there have been events suggesting that ancient whales are selling, which is considered one of the factors behind the drop in $BTC price on Tuesday during Asian hours. So how much selling pressure has this portion of BTC actually generated?

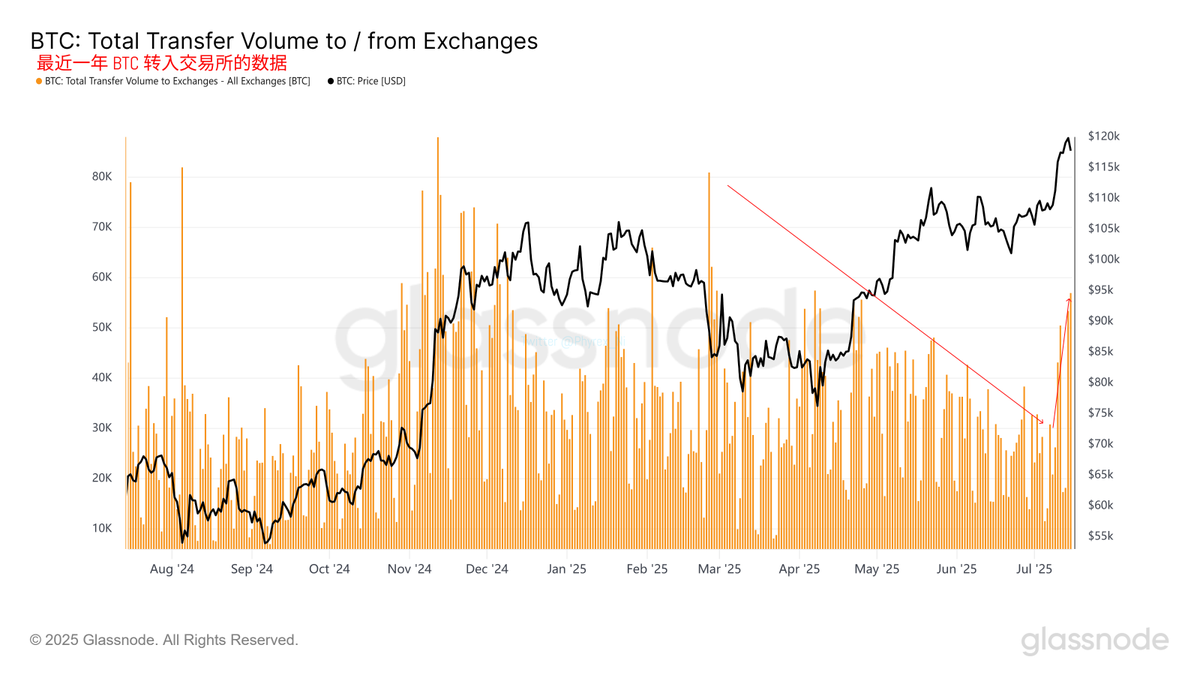

From the data of Bitcoin transferred to exchanges, it can be seen that after the price of BTC broke through $115,000, investors who had previously maintained a small amount of selling began to increase their activity. There was a significant rise in the amount of BTC transferred to exchanges, increasing from an average of 30,000 BTC per day to 50,000 BTC.

This means that before the ancient whales reacted, the selling had already intensified because BTC's rise exceeded many investors' expectations. After the news of the ancient whales selling emerged, the actual increase in the amount transferred to exchanges was over 3,000 BTC, indicating that even if ancient whales were reducing their holdings, the primary method was not through selling on exchanges.

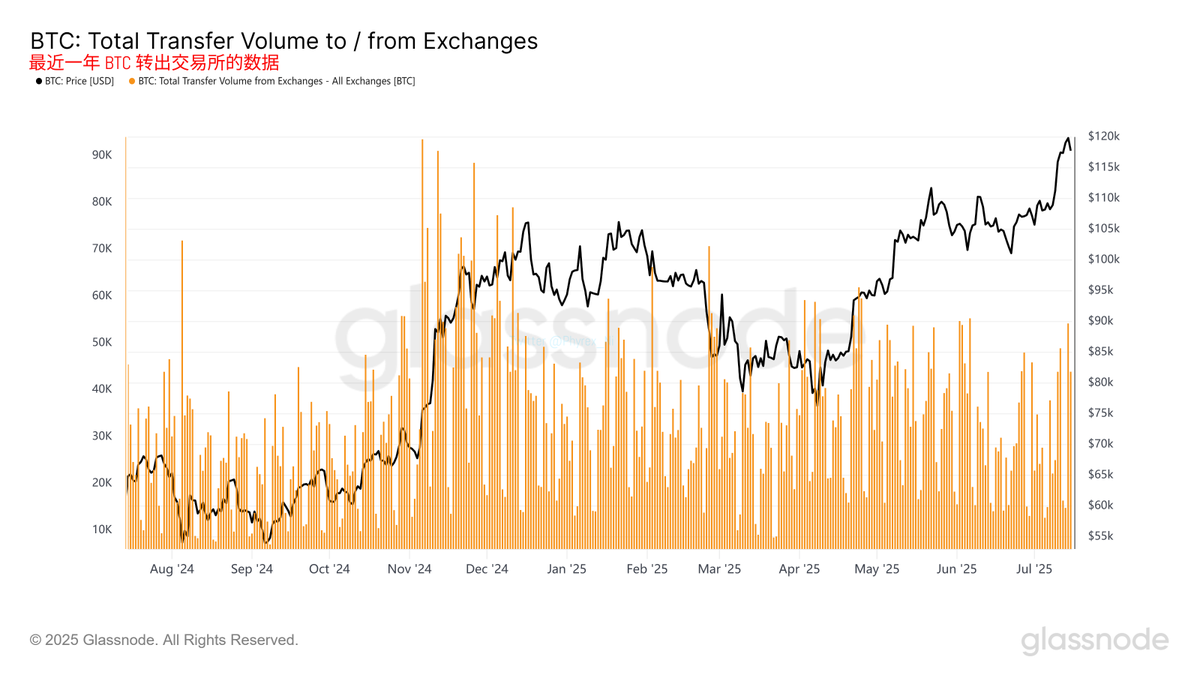

From the data on withdrawals from exchanges, it can also be seen that the withdrawal volume did not increase due to the increased selling pressure from transfers. This supports our ongoing explanation that maintaining BTC price stability is not due to a significant increase in purchasing power, but rather a decrease in investor selling. Once investor selling increases without a corresponding rise in purchasing power, it becomes difficult for BTC's price to stabilize.

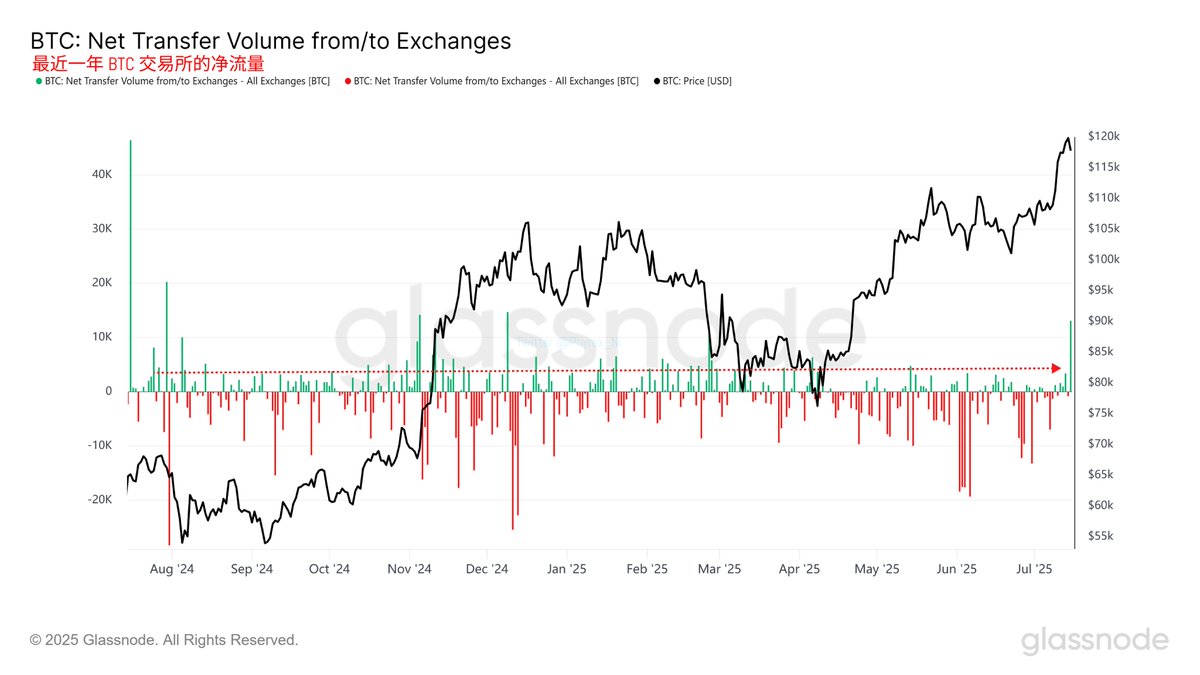

Further analysis of the net flow data from exchanges shows that as of 8 AM Beijing time, over 13,000 newly transferred BTC remained on the exchanges. These represent "excess" transfers that have not yet been digested, indicating that more BTC entering the exchanges suggests that more BTC wants to exit.

Although the backlog of BTC does not necessarily mean that the price will drop, negative news could lead to concentrated selling. Recently, the transfer of whales and the failure of the stablecoin bill to pass have been triggers for selling.

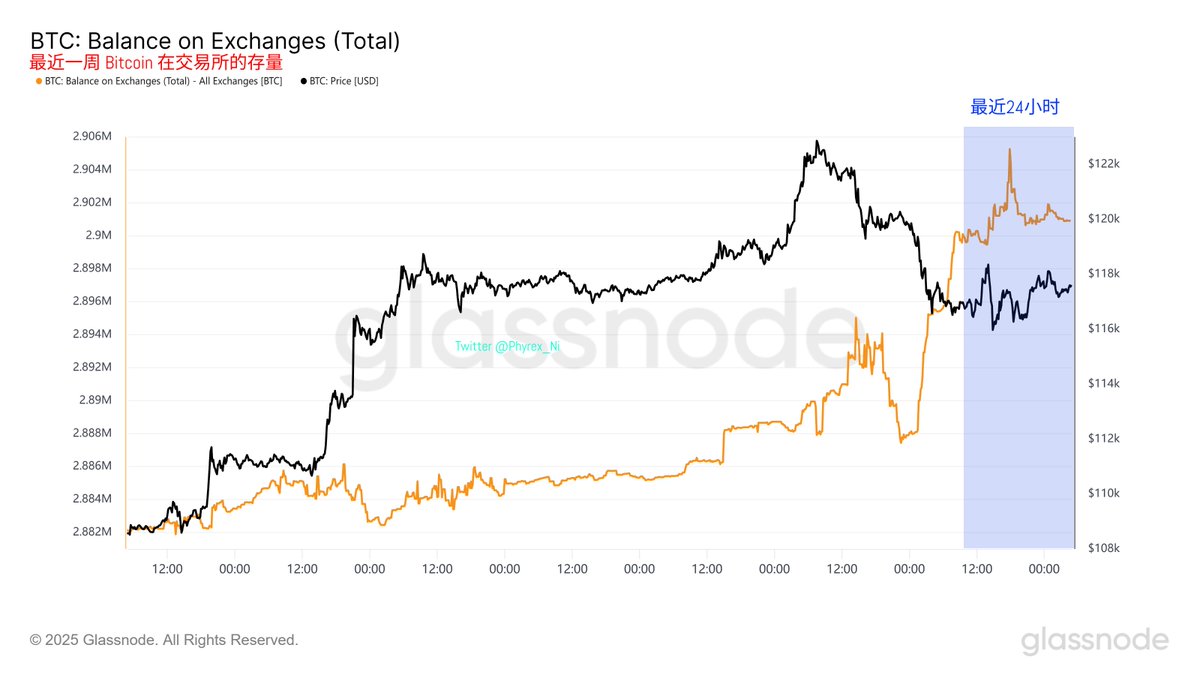

This morning, there were reports of communication between Trump and the opposing lawmakers, leading to a reversal of information, prompting investors to speculate that the vote early tomorrow morning would pass, resulting in a price rebound. However, from the detailed data, there has not been a significant trend of reduced inventory on exchanges. It is likely that liquidity in the Asian time zone remains low, and a small amount of buying has pushed up the price while selling has decreased.

As of now, the inventory of BTC on exchanges has increased by 18,000 BTC compared to last week's low, which has not yet been digested. This portion of BTC is likely waiting for price stabilization before exiting.

For the BTC held by ancient whales, the impact on BTC price should be relatively limited, with more influence stemming from investors' panic mentality.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。