Today's homework feels like a farce. First, the PPI data came in better than expected, and the market reacted positively. Then, suddenly, news from the White House emerged that Trump was going to fire Powell, with details that sounded credible, even mentioning that Trump was drafting a dismissal statement. The market reacted immediately, as some investors seemed to believe it was true.

However, it is important to note that while the Federal Reserve Chair can be dismissed, it has never happened in U.S. history. The conditions for firing the Fed Chair are extremely stringent, yet the market took the rumors seriously, wondering if Trump had some leverage over Powell.

Ultimately, during an interview, Trump publicly stated that he was very conservative about firing Powell, unless Powell showed misconduct at the Federal Reserve building. He also mentioned that any replacement would occur within eight months, which coincides with the end of Powell's term. He openly stated that White House senior advisor Hassett was being considered as a candidate for Fed Chair.

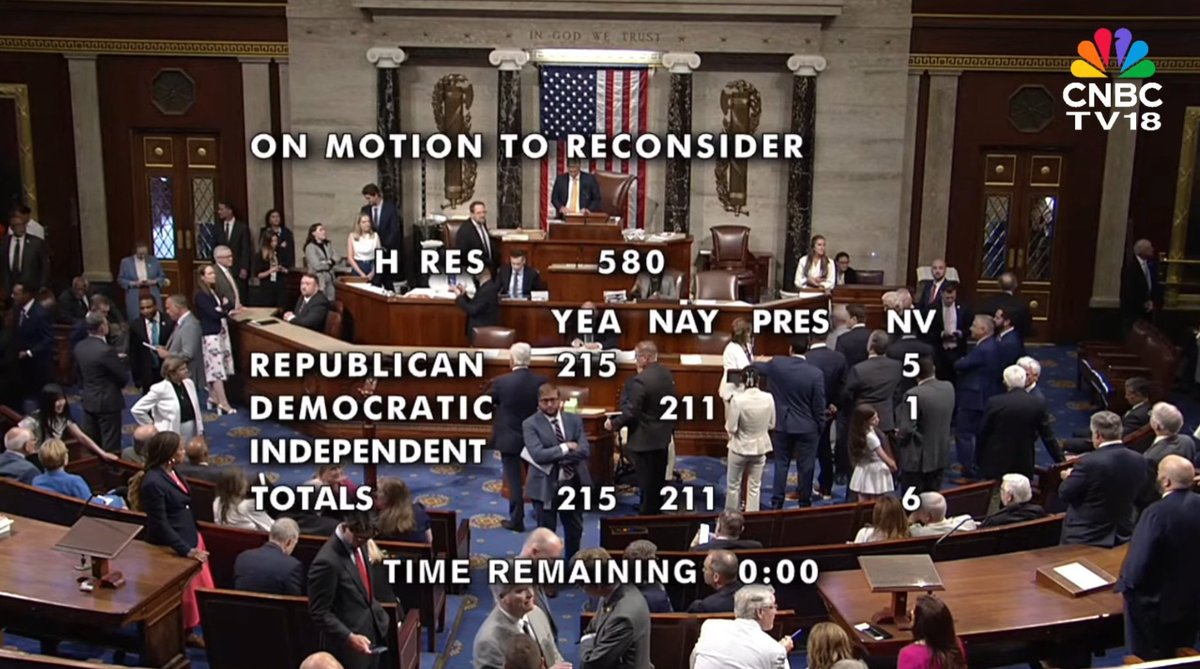

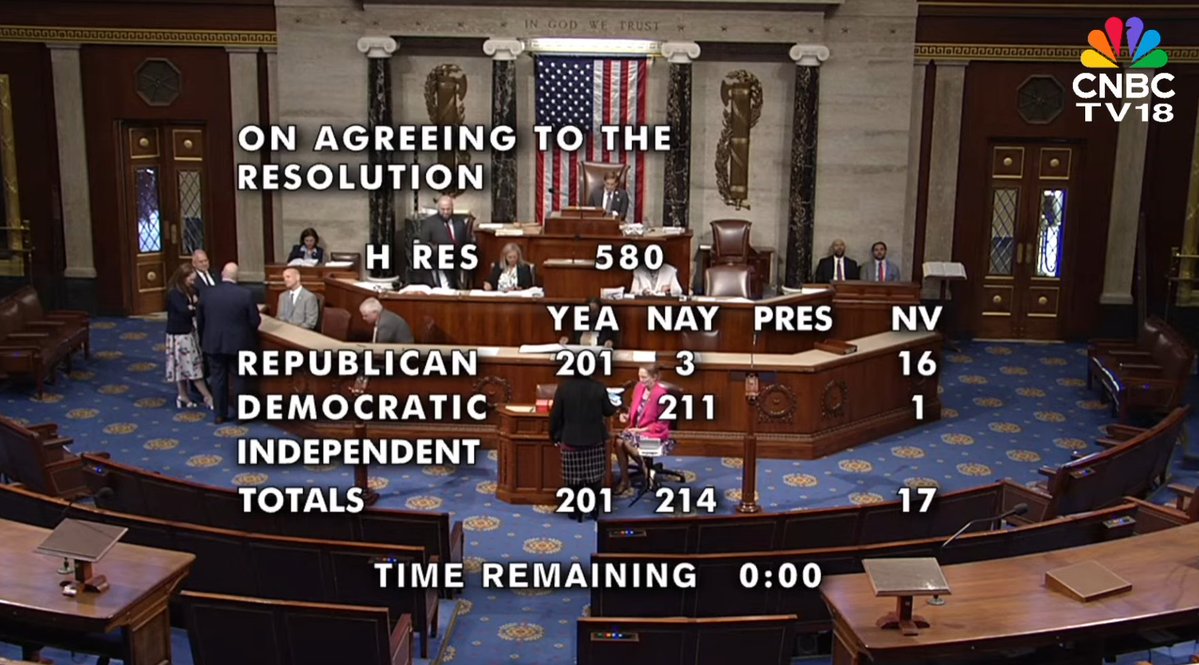

Trump specifically clarified that the rumors about firing Powell were untrue. Thus, the farce ended, followed by a re-vote on the previously rejected package bill early Wednesday morning. The first key procedural vote passed, allowing these bills to enter the formal debate and voting process.

Next up are the final votes and sequential voting on four key bills. Once passed, they will be sent to the Senate for review. It is worth noting that the stablecoin bill has already passed in the Senate. If the House does not amend any provisions of the stablecoin bill and passes it as is from the Senate, the bill will be sent directly to the President for signing.

However, if the House makes amendments, representatives from both chambers will need to coordinate a unified version, and then both chambers must vote separately. Only if passed can it enter the President's signing process. If not passed, further negotiations will be required. Currently, Trump has stated that the stablecoin bill will pass tomorrow and that he has communicated with all dissenters today.

Additionally, it is worth mentioning that the proposal initiated by the WLFI community, "Should WLFI tokens be freely traded," has officially concluded and passed with overwhelming support.

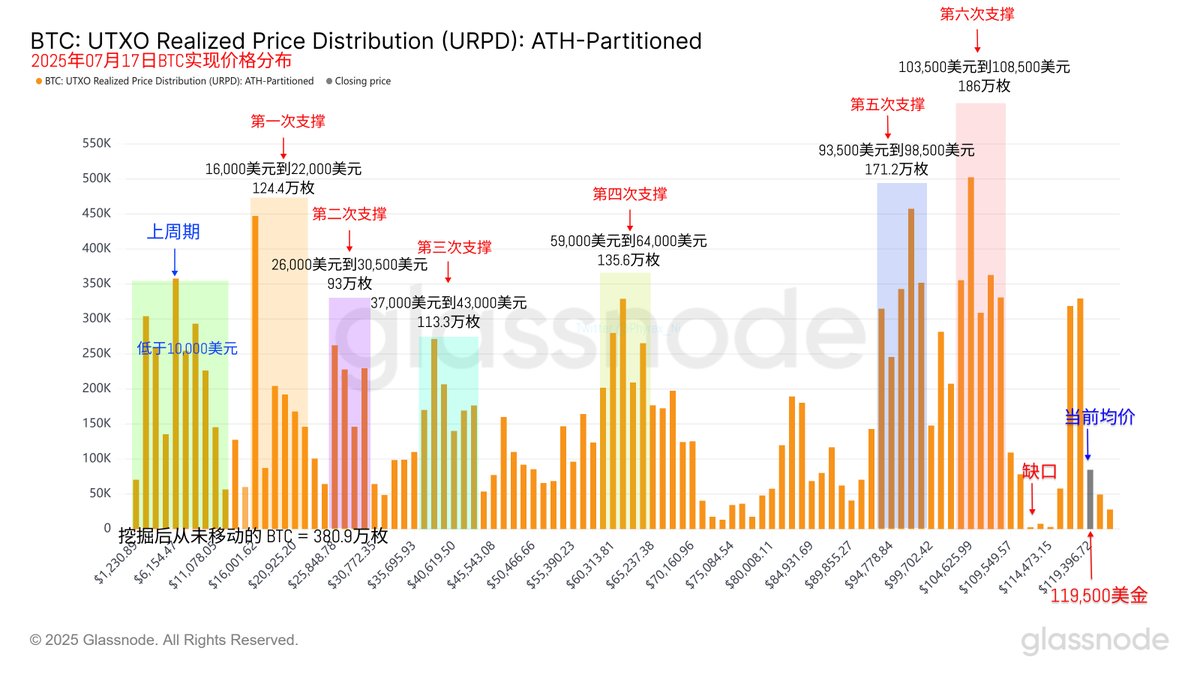

Returning to Bitcoin data, we can finally update the URPD data today. I have also redefined the support levels for URPD, as there are still many variables today, so I will explain it in detail tomorrow. The latest effective support is between $103,500 and $108,500, which is currently the most concentrated position. Whether it can become a solid support level still requires further observation.

Additionally, there is a URPD gap between $112,000 and $114,000, and the probability of this gap being filled is 100%. Historically, there has never been a URPD gap that was not filled; however, when it will be filled is still unknown.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。