By reviewing Binance's significant innovations over the past eight years and comparing the traditional paths of early crypto users to the new paths led by Binance, this article aims to help users grasp these wealth opportunities in a timely manner.

Author: Viee, Core Contributor of Biteye

In the crypto market of 2025, if one is looking for a definitive "Alpha," the Binance ecosystem is undoubtedly the answer that cannot be overlooked. Since the beginning of the year, Binance has constructed a new user path of "participation equals profit" through a series of initiatives from Megadrop to Alpha Points. Users can gain opportunities to participate in early projects and share dividends simply by being on Binance, significantly lowering costs and barriers.

Looking back over the past eight years, the ways in which crypto industry users have earned profits have undergone tremendous changes. Binance has evolved from initially providing a safe and reliable trading venue to pioneering the IEO model, then launching BSC to ignite on-chain mining, and subsequently popularizing the concept of "earning by holding" through Launchpool, leading to a frenzy of Alpha Points. It can be said that every major innovation by Binance has created entirely new profit opportunities for users, even sparking industry trends.

Therefore, this article will review Binance's significant innovations over the past eight years, comparing the traditional paths of early crypto users to the new paths led by Binance, and outline how users can seize these wealth opportunities in a timely manner. At the end of the article, we will also provide a practical guide for users to participate in innovative plays and look ahead to future trends.

I. Early Crypto Era: The Old Models of Speculation, Hoarding, and "Yield Farming"

Around 2017, the crypto market was in its first explosive phase. The main ways for users to earn profits were hoarding and speculating on coins, that is, buying mainstream coins like Bitcoin and Ethereum at low prices and holding them for appreciation, or frequently trading to profit from the volatile market. However, this method heavily relied on market conditions, with risks and rewards coexisting. At the same time, 2017 was also the peak of ICOs, with numerous projects globally raising funds through ICOs, some even raising hundreds of millions of dollars.

Binance rapidly rose during this period. In July 2017, Binance raised $15 million through an ICO to establish the exchange. With advantages such as high-performance matching, low trading fees, a variety of new coins, and a good user experience, Binance seized the market opportunity following the ICO boom. Although the Chinese government halted ICOs in the second half of 2017, Binance decisively went overseas and became the world's largest cryptocurrency exchange by trading volume in less than eight months.

From 2017 to 2018, the primary way for crypto users to make money was through high-risk speculation on coin prices, which overall lacked stability and sustainability in new models. It was against this backdrop that Binance began to explore new innovations to open up more transparent and efficient profit paths for users.

II. Binance IEO Sparks a Trend of New Listings on Exchanges

In 2019, the market introduced a brand new token issuance model—IEO (Initial Exchange Offering), and Binance launched its first IEO project, BitTorrent (BTT), allowing ordinary users to participate in early project subscriptions with low barriers, quickly attracting market attention. Compared to the mixed quality of ICO projects in 2017, IEOs are vetted by exchanges, which set subscription rules and complete subscriptions and trading directly on the exchange, greatly reducing participation difficulty and risk. Ordinary users only need to hold a certain amount of the platform's token BNB to gain a chance for a lottery or allocation.

The wealth effect of Binance's IEO was immediate, with the initial project BTT's price skyrocketing nearly tenfold (an increase of about 1000%) after its launch, attracting many exchanges to start IEOs, leading to a wave of new listings in the industry and a mini bull market for platform tokens. For users, the significance of the IEO model lies in enhancing profit certainty. For Binance, Launchpad not only attracted a large influx of users and trading volume but also brought considerable revenue to the platform, including listing fees, trading fees, and increased demand for platform tokens.

In summary, Binance has guided a new path for exchanges to empower users to earn primary market profits through Launchpad. Previously, ordinary investors found it difficult to access early-stage financing projects, but Binance's IEO made "everyone can participate in new listings" a reality, setting a benchmark in the industry. The emergence of this model expanded users' profit methods from merely speculating in the secondary market to participating in the initial launch of projects, further solidifying Binance's leading position in the industry.

III. Launching BSC Chain, Lowering Barriers for On-Chain "Mining"

In 2020, the "DeFi Summer" brought a wave of on-chain mining, with many participants earning considerable profits by providing liquidity and mining. However, the high Gas fees and network congestion on the Ethereum network kept many ordinary users out; for instance, a single transaction could cost dozens of dollars in fees, making it difficult for small funds to participate, and many could only watch from the sidelines. At this time, Binance launched the Binance Smart Chain (BSC) in September 2020, lowering the barriers for ordinary users to engage in DeFi interactions.

BSC Chain is compatible with Ethereum, with the standout advantage of extremely low transaction fees, fast confirmation speeds, and low deployment barriers. The Gas fees on BSC Chain are only a fraction of those on Ethereum, allowing users who were previously deterred by high Gas fees to afford frequent on-chain operations, leading to a massive influx of developers and users from Ethereum to BSC by the end of 2020 and early 2021.

In the low-cost environment of BSC Chain, the ways to earn on-chain profits quickly diversified, with numerous projects rapidly iterating on BSC Chain, such as the rise of PancakeSwap and the emergence of various chain games (like CryptoBlades) and meme coins (like Safemoon), allowing many small investors to reap rewards by capturing the price surges of new project tokens. By May 2021, the total locked value (TVL) on BSC Chain had once exceeded $20 billion, making it the second-largest public chain globally, only behind Ethereum.

The launch of BSC Chain changed the way users earn profits by expanding from centralized exchanges to decentralized on-chain methods. Binance Smart Chain lowered the barriers for ordinary users to participate in DeFi, allowing them to provide liquidity, mine tokens, and participate in airdrops at lower costs. This once again demonstrated Binance's foresight in innovating user profit models—when the industry environment changes, it quickly provides new paths to help users lower costs and seize opportunities.

IV. Launchpool Introduces New Ways to Earn by Holding Tokens and Airdrops of New Coins

Also in 2020, Binance launched the Launchpool feature for users' idle assets, creating a low-risk way to earn profits. By simply locking their BNB or other designated tokens in Launchpool, users can earn new project token rewards based on their holdings, akin to "earning by holding," while also receiving free new coin airdrops.

The emergence of Launchpool transformed the previously complex process of participating in liquidity mining on-chain into a convenient experience of one-click staking on the exchange to earn rewards, quickly becoming a highlight of the crypto market that year. According to official Binance data, within just six months of Launchpool's launch, 15 quality projects were successfully launched, with a total locked value (TVL) reaching $4.64 billion, distributing new project tokens worth $529 million to 408,783 users. These users who received airdrops largely achieved considerable profits due to the surge in the DeFi sector.

The profit model of Launchpool is relatively stable and transparent, significantly changing users' understanding of holding tokens—assets are no longer idle but can continuously generate profits as productive tools. Statistics show that the average annualized return of projects launched on Binance's new coin mining platform from 2020 to 2021 was about 24%. Even more strikingly, some new coins distributed for free through Launchpool experienced explosive growth in the secondary market, such as ALPHA, which increased by 86 times, and airdropped tokens from projects like BTCST and LIT also rose by over 30 times. This proves that participating in new projects through Launchpool was almost a zero-cost way for users to obtain high returns, preserving their original assets while acquiring high-potential tokens for free. It can be said that Binance's Launchpool has promoted the concept of "earning by holding tokens" and led other exchanges to follow suit by launching similar staking products, thereby changing the industry's rules of the game.

V. The "Alpha" Era: A New Model of "Participation Equals Profit" Driven by Task Points

In early 2020, the airdrop model began to rise, with many projects offering very friendly "newcomer rewards" through task-based airdrops, where users only needed to connect their wallets, follow social media, or complete simple tasks to receive tokens worth tens to hundreds of dollars. Although there were occasional risks of scams and phishing sites, 2020 was still the most active, diverse, and inclusive phase for the airdrop ecosystem.

Entering 2024-2025, the airdrop model continues to evolve and upgrade, entering a complex phase driven by tasks. More and more new projects require users to complete a series of specified tasks (such as interacting with testnets, following social media, inviting friends, etc.) to qualify for airdrops. While this has increased user engagement, it has also made airdrops cumbersome and time-consuming, often requiring ordinary users to invest significant effort without guaranteed rewards.

Against this backdrop of increasing competition, Binance launched the Alpha section and its accompanying Alpha Points system to discover promising early projects within the Binance Web3 wallet ecosystem and guide users to actively participate through a points mechanism, thus qualifying them for project token presales (TGE) or airdrop rewards. Therefore, 2025 is also referred to as the "Year of Binance Alpha Airdrops," as this model achieves a win-win for both the platform and users: users exchange points for project token profits, while project teams leverage Binance's massive traffic to enhance liquidity and exposure.

By June 2025, Binance Wallet innovatively introduced the "Pre-TGE + Booster" mechanism, further enhancing the Alpha era's "participation equals profit" experience. The Pre-TGE model allows retail investors to experience similar benefits to institutional investors by subscribing to tokens at very favorable prices and obtaining high certainty returns through staking; the Booster mechanism allows retail investors to continuously receive free token airdrops through simple interactions, covering the entire lifecycle from testnet to exchange listing.

It is foreseeable that in the future, airdrops and initial distribution will increasingly focus on user behavior data, potentially even integrating AI algorithms to dynamically adjust rewards to improve incentive efficiency. Exchanges may also enhance user stickiness through such points systems and promote the development of their public chains and multi-chain ecosystems, with Binance likely continuing to lead this transformation as an industry benchmark.

VI. User Practical Guide

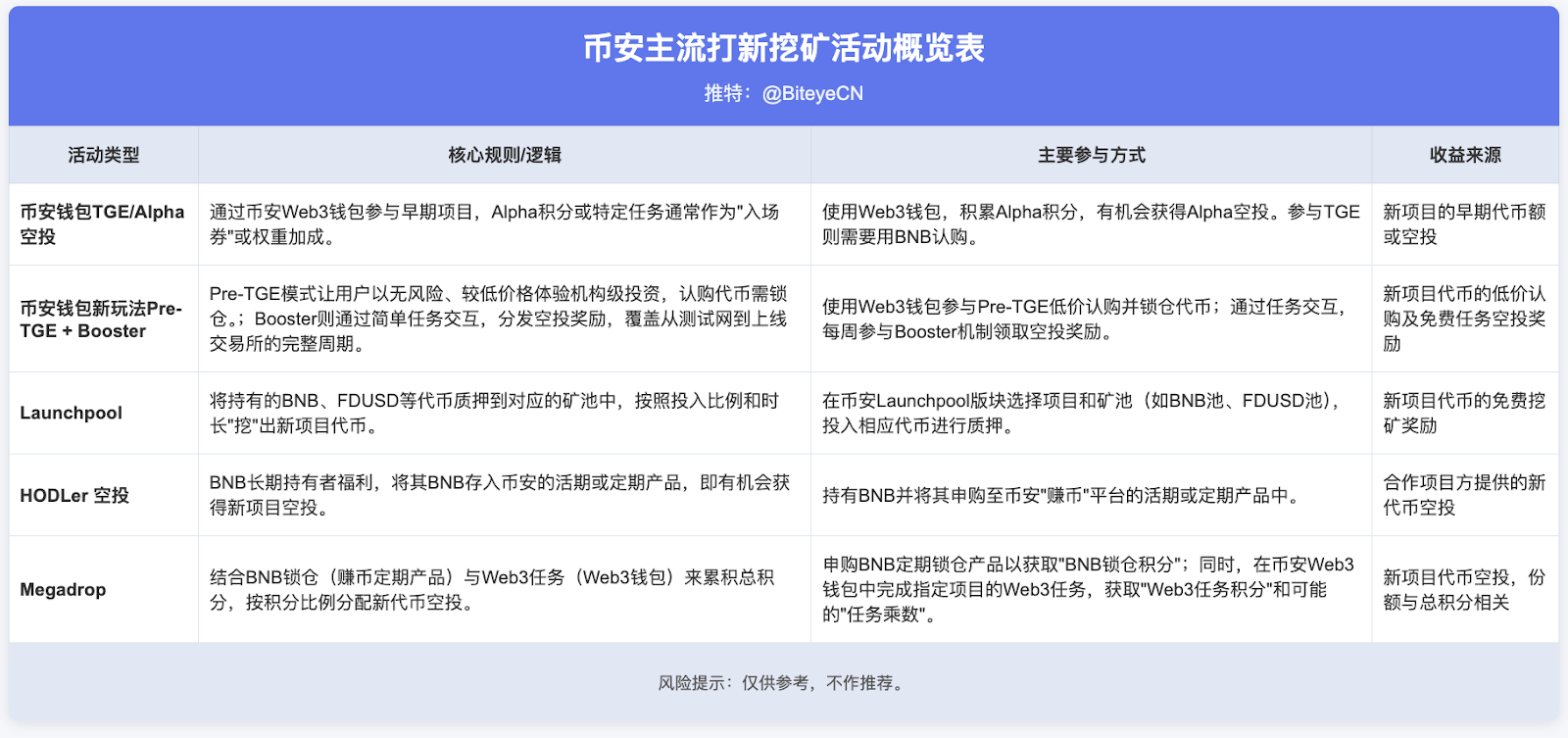

After reviewing the above, we can see that Binance has launched various innovative profit models over the past eight years, each with its characteristics, suitable for different types of users. The table below summarizes several mainstream new listing and mining activities on Binance, helping everyone choose the appropriate profit path based on their situation.

Overall, Binance's current main profit activities can be summarized as the types mentioned above: Wallet Alpha Airdrop/TGE (task-based points for early projects), Pre-TGE + Booster, Launchpool new coin mining (earning by holding for airdrops), HODLer airdrops (holding specific tokens to receive new coins periodically), and Megadrop. Users can choose suitable strategies based on their capital size and time investment:

Conservative Holding Type: If you have substantial funds but do not wish to spend too much effort, you can adopt the "BNB Holding Party" strategy. This involves holding a certain amount of BNB long-term and actively participating in Launchpool and periodic HODLer airdrop activities. This strategy focuses on earning through holding, with profits coming from both the appreciation of BNB and new coin airdrops. As the foundation of the Binance ecosystem, the long-term performance of BNB is closely related to Binance's innovations. Holding BNB serves as a stepping stone to participate in various Binance activities and has investment value in itself. However, it is essential to control your position and be wary of market volatility risks.

Active Participation Type: If you have limited funds but ample time and strong hands-on skills, you can try the "Alpha Points Party" route, aiming to reach the points threshold for airdrops/TGE, Pre-TGE, and Booster. You can coordinate multiple accounts to earn points at a low cost rather than incurring high costs with a single account. After completing tasks, exit promptly to lock in profits. It is crucial to calculate costs with this strategy to avoid losses due to excessive trading fees and slippage.

Balanced Combination Type: Most users can appropriately combine the above strategies. For example, use primary funds to participate in Launchpad and Launchpool for stable returns while allocating a small portion of idle funds to try Alpha airdrops, TGE, Pre-TGE, etc., for a chance at gains. This way, you ensure that the bulk of your funds appreciates steadily while also not missing out on any potential growth opportunities.

VII. Summary and Future Outlook

From hoarding and speculating on coins, yield farming airdrops, to exchange new listings, on-chain mining, and now the task-based points system, Binance has witnessed nearly every significant innovation in how crypto users earn profits over the past eight years, with each step aligning with user pain points. Whenever a new trend emerges in the industry, Binance is always quick to launch innovative features, creating windows of opportunity while also spawning new industry waves that other platforms rush to imitate.

Looking ahead, platform-led participatory profit models are likely to become mainstream in the industry. The success of the Binance Alpha Points system indicates that exchanges can more closely align the interests of users, project teams, and themselves, achieving a win-win for all parties. In the future, we may also see exchanges integrating social and content (SocialFi/InfoFi) task incentives or introducing AI assistants to help users customize optimal profit strategies.

Regardless, the development of the crypto industry has just passed a little over a decade, and new opportunities are emerging continuously. As ordinary users, it is essential to closely monitor the new trends of leading platforms like Binance and actively learn about new products and innovative plays to seize opportunities when they arise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。