Source: Blockworks

Translation and Compilation: BitpushNews

In just 11 days since the second half of 2025 began, Bitcoin (BTC) has repeatedly set new historical highs, with the most recent surge breaking the $118,000 mark. As Bitcoin achieves the goal of "setting a new historical high" first on the "cryptocurrency market prediction list" for the second half of the year, what surprises can we expect in the next six months?

The current surge in Bitcoin is driven by a continued wave of institutional Bitcoin purchases, and industry observers expect that more institutional platforms will open investment channels for Bitcoin assets to their clients.

Ledn's Chief Investment Officer John Glover has gained attention for his accurate predictions regarding Bitcoin's price movements. He remains optimistic that Bitcoin could reach $136,000 and believes this target will be achieved faster than previously expected, likely within this year.

However, John Glover also cautions that after reaching this high point, Bitcoin's price may experience a correction, expected to be in the range of $91,000 to $109,000, but will ultimately continue to rise.

Regulatory Clarity: A "Green Light" for Institutional Funds?

In addition to price trends, Benchmark analyst Mark Palmer believes that the most significant catalyst for the future of the crypto ecosystem will be the formal enactment of the CLARITY Act. This act aims to establish a clear framework to define whether crypto tokens are commodities or securities.

Mark Palmer pointed out: "Once the significant regulatory uncertainty is removed, institutional investors will receive a true 'green light' to confidently invest heavily in the crypto space." This means that if this act can be successfully implemented, the vast institutional funds that have previously taken a wait-and-see approach due to regulatory fog may trigger a new wave of entry.

Mergers and Acquisitions Boom: Traditional Finance Accelerates Its Layout in the Crypto Field

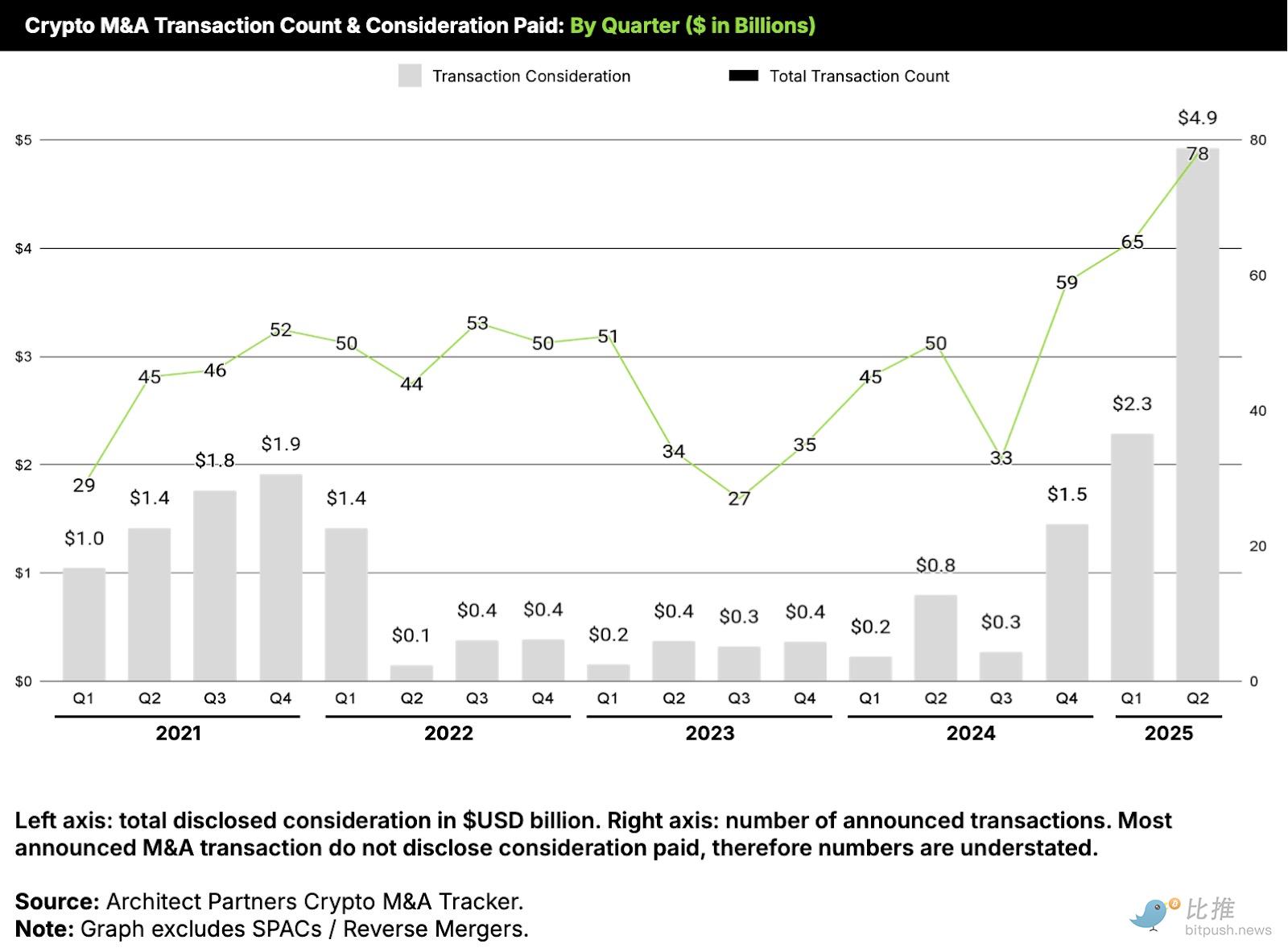

Notably, M&A activity in the crypto industry is heating up at an unprecedented pace.

A report from Architect Partners shows that there were 78 M&A transactions in the crypto sector in the second quarter, setting a new historical high. Among these, there are some notable "marriages," such as Ripple's acquisition of Hidden Road, which further evidences the trend of integration between crypto and traditional finance (TradFi).

In the crypto-native space, large transactions are also frequent, such as Coinbase's acquisition of derivatives giant Deribit.

Architect Partners founder Eric Risley believes that as the value proposition of crypto/blockchain gains broader recognition, we are at the beginning of a long-term upward trend in crypto M&A. He stated: "While quarterly data may fluctuate, the fundamental strategic drivers of M&A are now very clear."

Eric Risley further pointed out that future M&A participants will include existing crypto companies, and more importantly, traditional financial service institutions—including banks, traditional brokers, and payment companies—will also actively participate.

However, Risley raised a key question: What will the next generation of decentralized applications (dApps) look like? Will their focus extend beyond mere price speculation and payment functions? This undoubtedly leaves ample room for imagination in the industry.

Crypto Investment Products Reach New Heights: Wall Street's "New Favorite"?

Meanwhile, the assets under management (AUM) of crypto investment products have also reached a historical high. CoinShares data shows that around mid-year, the AUM of crypto investment products reached $188 billion. This was before the market strengthened further this week.

Since the debut of the U.S. spot Bitcoin ETF 18 months ago, cumulative net inflows have reached $51 billion (with nearly $1.2 billion flowing in yesterday alone, setting a new record). The U.S. spot Ethereum ETF also recorded a single-day inflow of $383 million yesterday, marking its second-highest record.

Industry insiders expect that more crypto ETFs (including single-asset and index-based) will emerge this year, although the specific timeline remains uncertain. Grayscale has also expressed its views to the SEC, indicating strong market expectations for new products.

For investors looking to gain crypto exposure through the stock market, they are closely monitoring the listing dynamics of more crypto companies, such as Gemini and Kraken, following Circle's IPO.

Asset Tokenization: A Trillion-Dollar Race Accelerating

Additionally, the wave of asset tokenization continues to advance.

Executives from Bitwise and VanEck previously predicted that by 2025, the market size for tokenized securities would reach $50 billion, and this goal has already been halfway achieved.

Bitwise Chief Investment Officer Matt Hougan wrote in a memo this week: "If Robinhood is launching tokenized trading, you can be sure that companies like Charles Schwab are also actively researching." He anticipates more related announcements will emerge this fall.

Although a spokesperson for Charles Schwab did not disclose specific plans, they stated that the company is "actively tracking and exploring numerous opportunities in the digital asset space, including tokenization."

Clearly, for crypto players, the second half of 2025 will continue to be exciting, and boredom will be far from the experience. Various data and expert expectations point to a more mature and mainstream-recognized crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。