The growth of stablecoin supply is not just a numerical increase, but a massive migration of funds from emerging market bank deposits to U.S. Treasury bonds and globally systemically important banks.

Author: William Nuelle

Translation: Deep Tide TechFlow

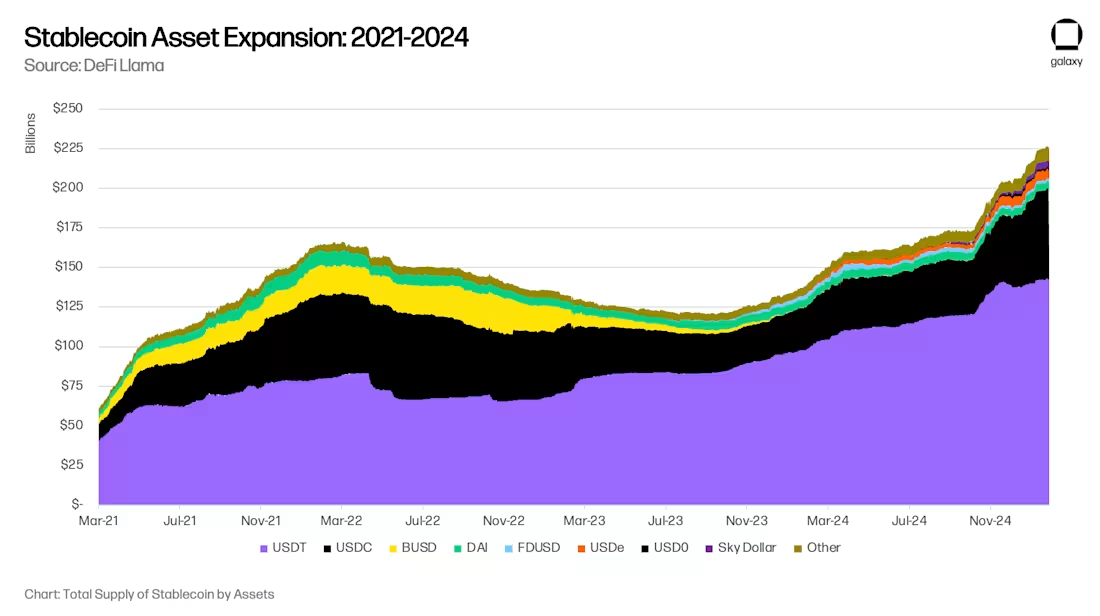

After a significant decline in the global stablecoin asset scale over the past 18 months, the adoption of stablecoins is accelerating again. Galaxy Ventures believes that the renewed acceleration of stablecoins is driven by three long-term factors: (i) the adoption of stablecoins as a savings tool; (ii) the adoption of stablecoins as a payment tool; and (iii) DeFi as a source of above-market returns, which absorbs digital dollars. Therefore, the supply of stablecoins is currently in a rapid growth phase, expected to reach $300 billion by the end of 2025 and ultimately $1 trillion by 2030.

The growth of stablecoin assets to $1 trillion will bring new opportunities to financial markets and also lead to new transformations. Some changes we can currently predict, such as the shift of bank deposits from emerging markets to developed markets, and regional banks moving towards globally systemically important banks (GSIB). However, there are also changes that we cannot foresee at this moment. Stablecoins and DeFi are foundational, not peripheral innovations, and they may fundamentally change credit intermediation in entirely new ways in the future.

Three Major Trends Driving Adoption: Savings, Payments, and DeFi Returns

Three adjacent trends are driving the adoption of stablecoins: using them as savings tools, using them as payment tools, and using them as sources of above-market returns.

Trend One: Stablecoins as Savings Tools

Stablecoins are increasingly being used as savings tools, especially in emerging markets (EM). In economies like Argentina, Turkey, and Nigeria, structural weaknesses in their local currencies, inflationary pressures, and currency devaluation have led to an organic demand for dollars. Historically, as noted by the International Monetary Fund (IMF), the circulation of dollars in many emerging markets has been restricted and has become a source of financial stress. Argentina's capital controls (Cepo Cambiario) further limit the circulation of dollars.

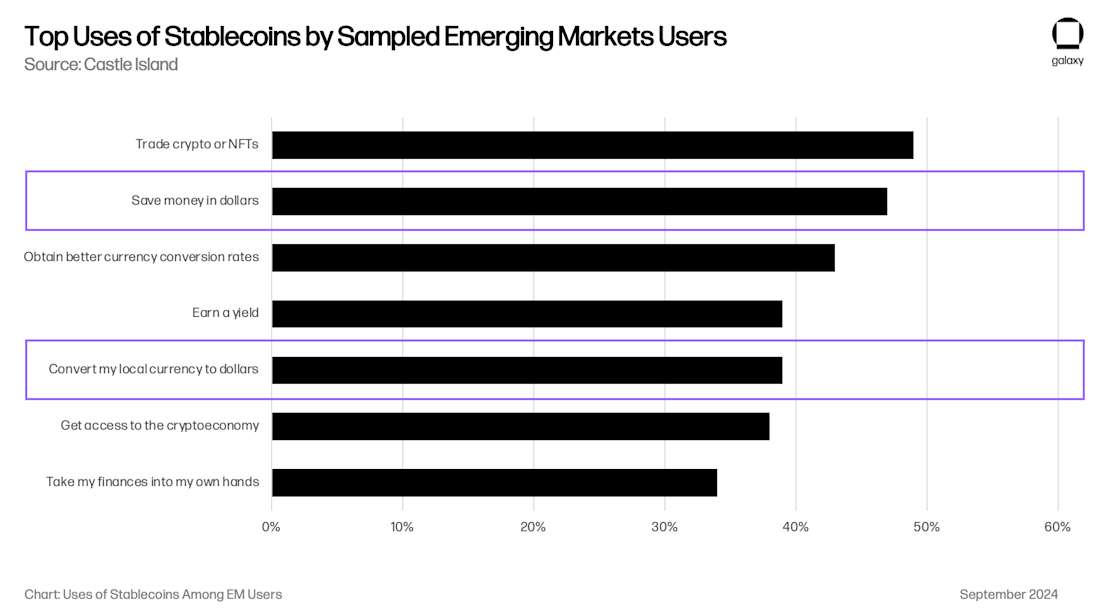

Stablecoins bypass these restrictions, allowing individuals and businesses to easily access dollar-backed liquidity directly via the internet. Consumer preference surveys indicate that obtaining dollars is one of the primary reasons for emerging market users to use cryptocurrencies. A study by Castle Island Ventures shows that two of the top five use cases are "saving in dollars" and "converting my local currency to dollars," with 47% and 39% of users citing these as reasons for using stablecoins, respectively.

While it is difficult to gauge the scale of stablecoin-based savings in emerging markets, we know that this trend is growing rapidly. Stablecoin settlement card businesses like Rain (a portfolio company), Reap, RedotPay (a portfolio company), GnosisPay, and Exa are capitalizing on this trend, allowing consumers to spend their savings at local merchants through Visa and Mastercard networks.

Specifically in the Argentine market, the fintech/crypto app Lemoncash reported in its 2024 Crypto Report that its $125 million in "deposits" accounts for 30% of the market share of centralized crypto applications in Argentina, second only to Binance's 34%, outperforming Belo, Bitso, and Prex. This figure implies that the asset under management (AUM) of Argentine crypto applications is $417 million, but the actual stablecoin AUM in Argentina may be at least 2-3 times the stablecoin balances in non-custodial wallets like MetaMask and Phantom. While these amounts may seem small, $416 million represents 1.1% of Argentina's M1 money supply, and $1 billion accounts for 2.6%, and it is still growing. Considering that Argentina is just one of the emerging market economies where this global phenomenon applies, the demand for stablecoins among emerging market consumers may horizontally expand across various markets.

Trend Two: Stablecoins as Payment Tools

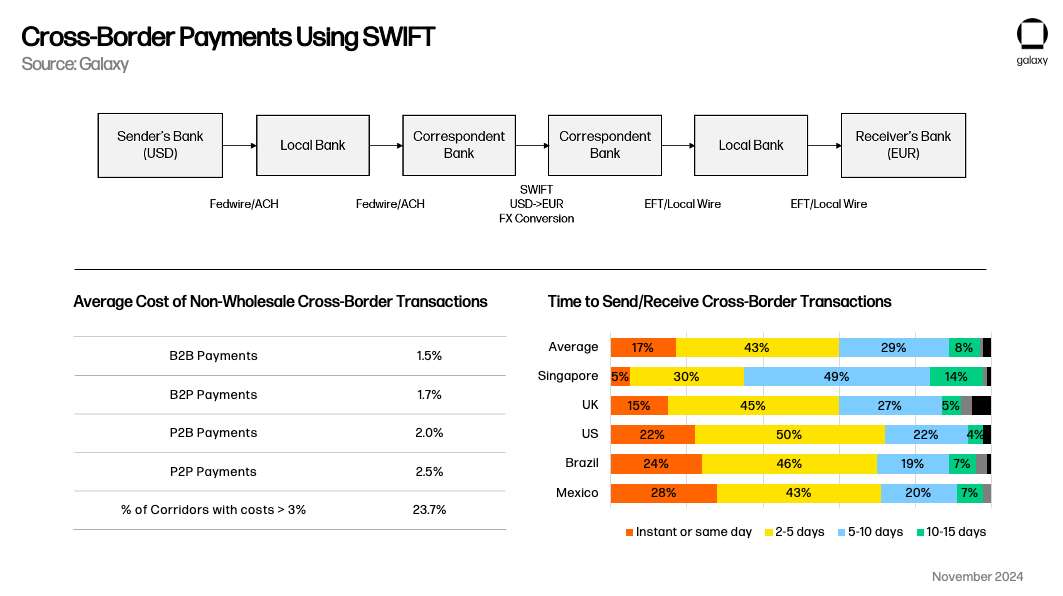

Stablecoins have also become a viable alternative payment method, particularly competing with SWIFT in cross-border use cases. Domestic payment systems often operate in real-time domestically, but compared to traditional cross-border transactions that take more than one business day, stablecoins have a clear value proposition. As Simon Taylor pointed out in his article, over time, the functionality of stablecoins may resemble a meta-platform connecting payment systems.

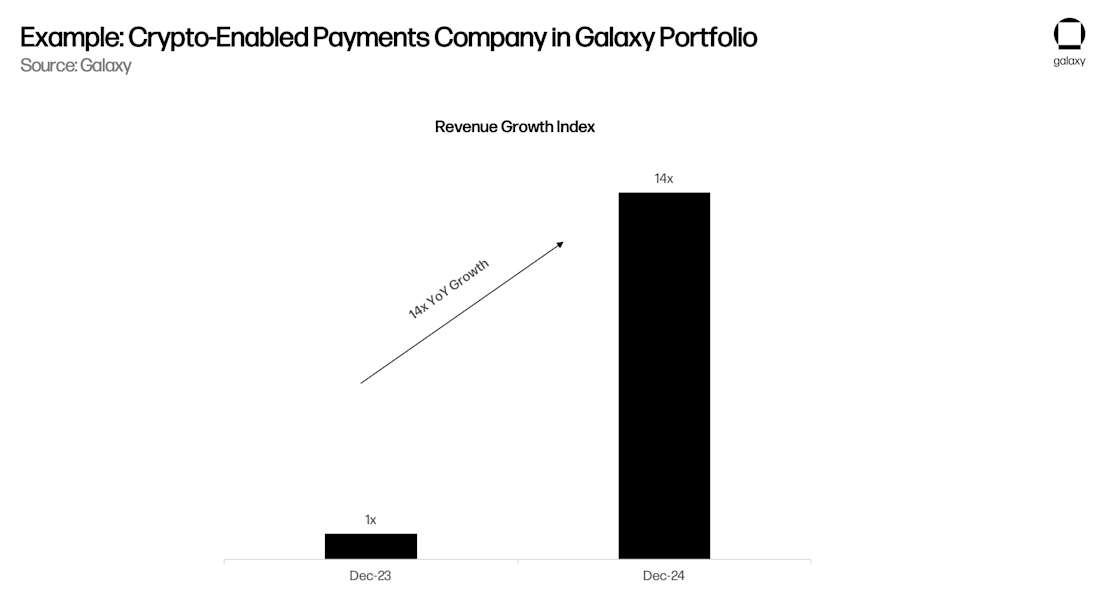

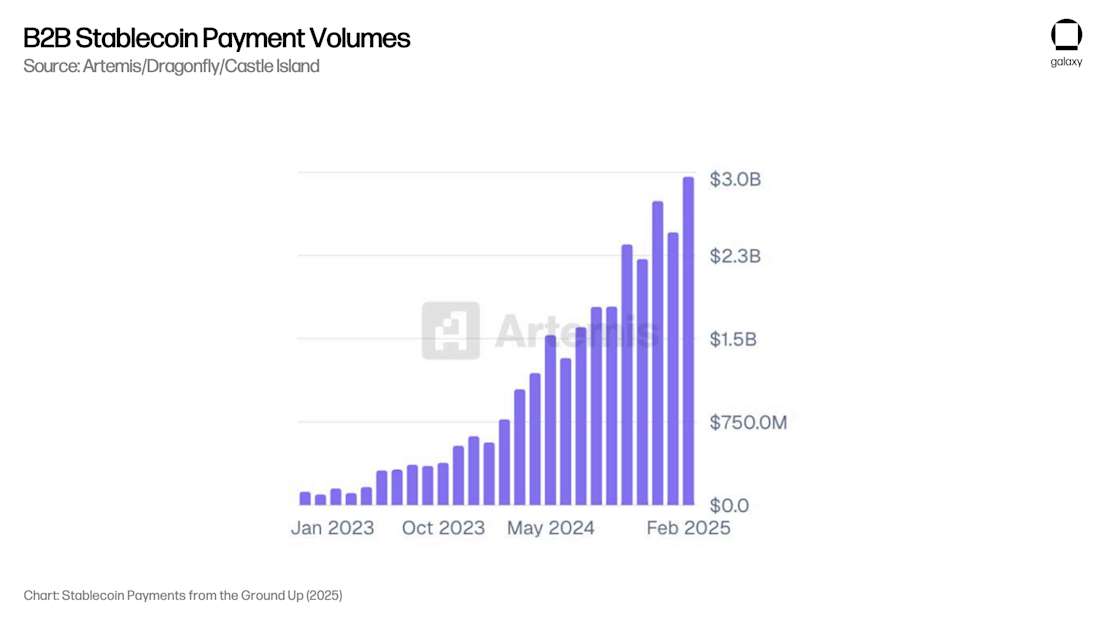

Artemis released a report showing that B2B payment use cases contributed $3 billion in monthly payments (annualized $36 billion) among 31 surveyed companies. Through communication with custodians handling most of these payment processes, Galaxy believes that this figure annualizes to over $100 billion among all non-cryptocurrency market participants.

Crucially, Artemis's report found that B2B payment volumes grew fourfold from February 2024 to February 2025, demonstrating the scale growth needed for sustained AUM growth. There has yet to be a study on the velocity of money for stablecoins, so we cannot directly correlate total payment volumes with AUM data, but the growth rate of payment volumes suggests that AUM is also growing correspondingly due to this trend.

Trend Three: DeFi as a Source of Above-Market Returns

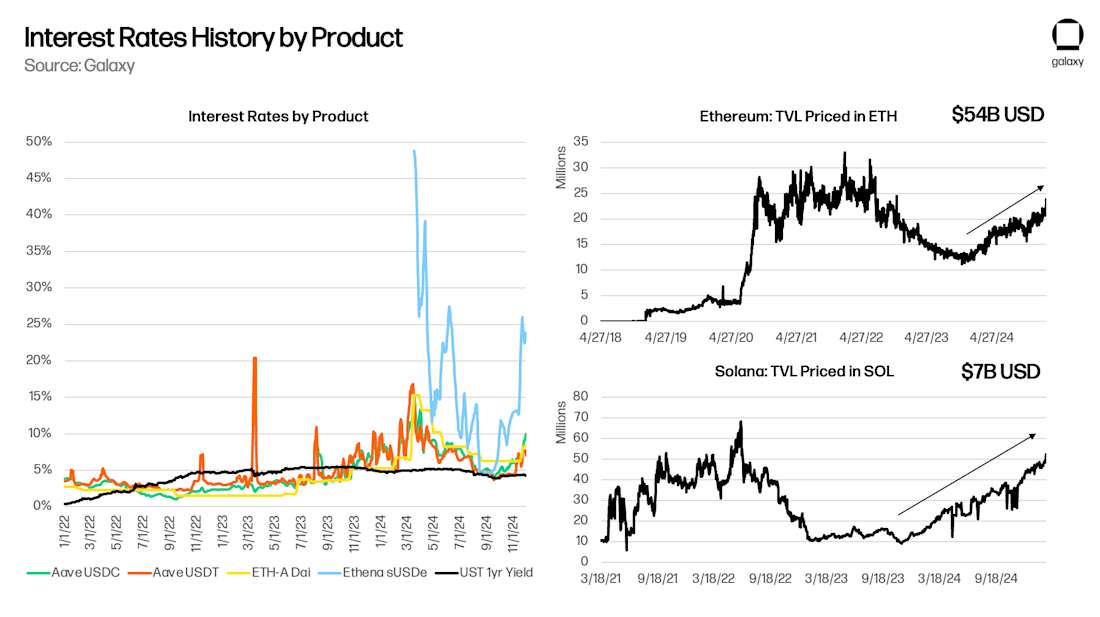

Finally, for most of the past five years, DeFi has been generating structurally above-market dollar-denominated yields, allowing technically savvy consumers to achieve returns of 5% to 10% with very low risk. This has already driven and will continue to drive the adoption of stablecoins.

DeFi itself is a capital ecosystem, one of its notable features being that the underlying "risk-free" rates from platforms like Aave and Maker reflect the broader crypto capital markets. In my 2021 paper, "The Risk-Free Rate of DeFi," I noted that the supply rates from Aave (a decentralized lending protocol allowing users to deposit crypto assets to earn interest or borrow assets), Compound (one of the DeFi lending protocols that uses algorithms to automatically adjust interest rates), and Maker (one of the earliest DeFi projects, with its core product being the DAI stablecoin, a decentralized stablecoin pegged 1:1 to the dollar) are responsive to underlying trading and other leverage demands. As new trades or opportunities arise—such as yield farming on Yearn or Compound in 2020, basis trading in 2021, or Ethena in 2024—the foundational yields of DeFi rise as consumers need collateralized loans to allocate to new projects and uses. As long as blockchains continue to generate new ideas, the foundational yields of DeFi should strictly exceed U.S. Treasury yields (especially in cases where tokenized money market funds providing foundational layer yields are launched).

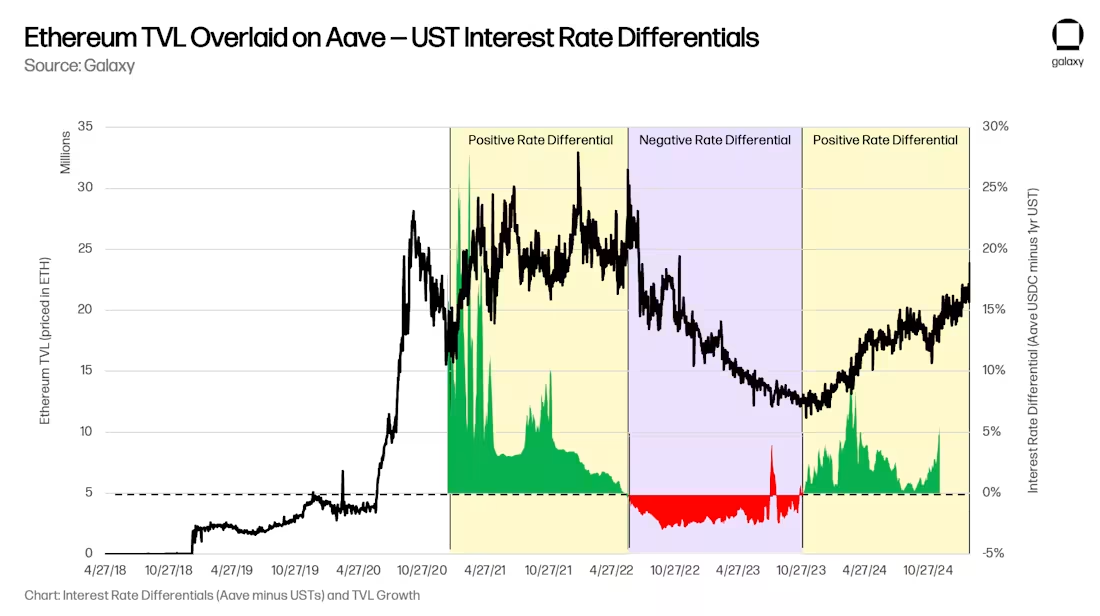

Since the "native language" of DeFi is stablecoins rather than dollars, any "arbitrage" attempts to provide low-cost dollar capital to meet this specific micro-market demand will have the effect of expanding the supply of stablecoins. Narrowing the spread between Aave and U.S. Treasuries requires stablecoins to expand into the DeFi space. As expected, during periods when the spread between Aave and U.S. Treasuries is positive, the total value locked (TVL) will grow, while during periods when the spread is negative, TVL will decline (showing a positive correlation):

The Issue of Bank Deposits

Galaxy believes that the long-term adoption of stablecoins for savings, payments, and yield generation is a major trend. The adoption of stablecoins may lead to the disintermediation of traditional banks, as it allows consumers to access dollar-denominated savings accounts and cross-border payments directly without relying on bank infrastructure, thereby reducing the deposit base that traditional banks use to stimulate credit creation and generate net interest margins.

Alternatives to Bank Deposits

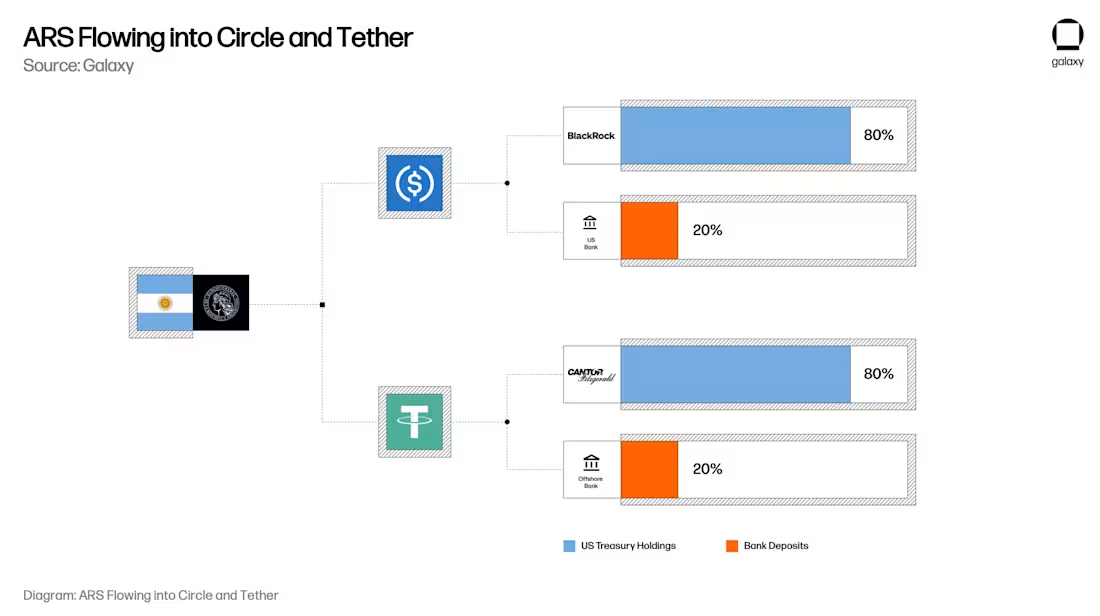

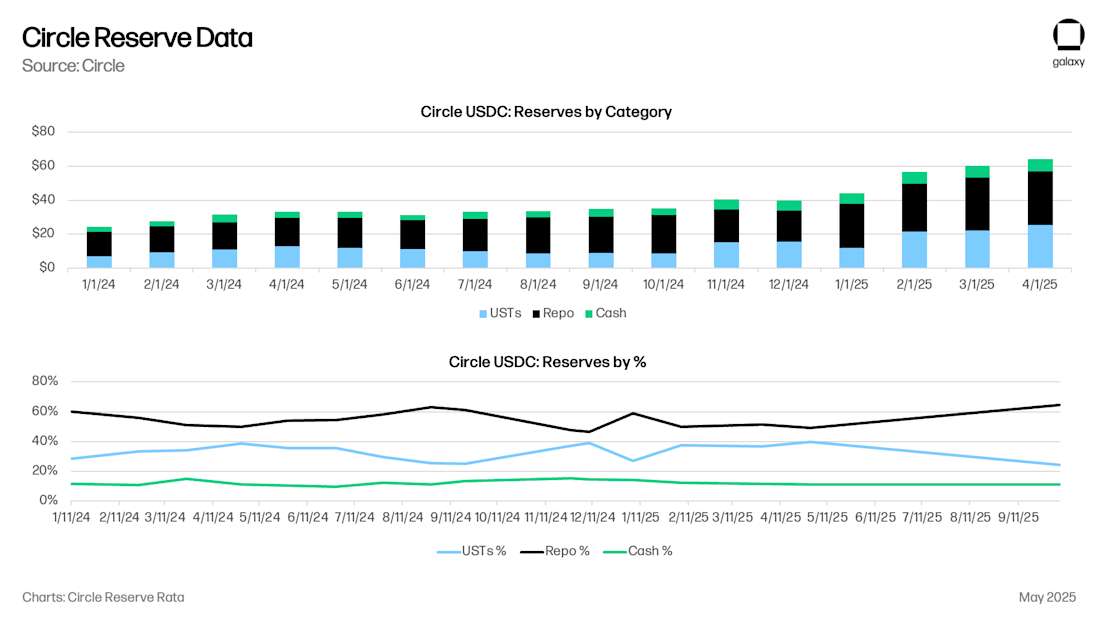

For stablecoins, the historical model is that every $1 actually corresponds to $0.80 in Treasury bonds and $0.20 in bank account deposits of the stablecoin issuer. Currently, Circle holds $8 billion in cash ($0.125), $53 billion in ultra-short-term U.S. Treasury securities (UST) or Treasury repurchase agreements ($0.875), while USDC totals $61 billion. (We will discuss repos later.) Circle's cash deposits are primarily held at Bank of New York Mellon, along with New York Community Bank, Cross River Bank, and other leading U.S. financial institutions.

Now, imagine that Argentine user in your mind. This user has $20,000 worth of Argentine pesos deposited in Argentina's largest bank, Banco de la Nación Argentina (BNA). To avoid inflation of the Argentine peso (ARS), the user decides to increase their holdings to $20,000 in USDC. (Since the specific mechanisms for disposing of ARS may affect the USD to ARS exchange rate, this is worth considering separately.) Now, with USDC, the user's $20,000 in Argentine pesos at BNA is effectively $17,500 in U.S. government short-term loans or repurchase agreements, and $2,500 in bank deposits, which are distributed among Bank of New York Mellon, New York Commercial Bank, and Cross River Bank.

As consumers and businesses shift their savings from traditional bank accounts to stablecoin accounts like USDC or USDT, they are effectively transferring deposits from regional/commercial banks to U.S. Treasury bonds and deposits at major financial institutions. The implications are profound: while consumers maintain dollar-denominated purchasing power by holding stablecoins (and through card integrations like Rain and RedotPay), the actual bank deposits and Treasury bonds backing these tokens will become more concentrated rather than dispersed throughout the traditional banking system, thereby reducing the deposit base available for lending by commercial and regional banks, while making stablecoin issuers significant participants in the government debt market.

Forced Credit Contraction

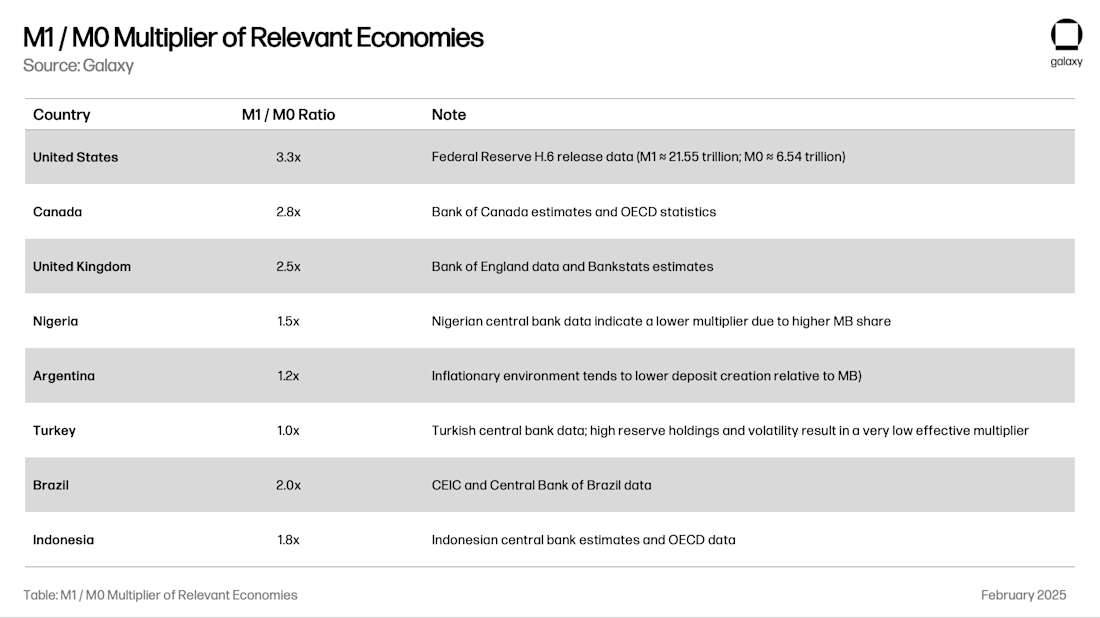

One of the key social functions of bank deposits is to lend to the economy. The fractional reserve system—where banks create money—allows banks to lend multiples of their deposit base. The total multiplier in a region depends on factors such as local bank regulation, foreign exchange and reserve volatility, and the quality of local lending opportunities. The M1/M0 ratio (money created by banks divided by central bank reserves and cash) tells us the "money multiplier" of a banking system:

Continuing with the example of Argentina, converting a $20,000 deposit to USDC would transform the local $24,000 in credit creation into $17,500 in UST/repurchase bonds and $8,250 in U.S. credit creation ($2,500 x 3.3 times the multiplier). When M1 supply accounts for 1%, this effect may be hard to notice, but when M1 supply accounts for 10%, the impact may become apparent. At some point, regional bank regulators will be forced to consider shutting off this faucet to prevent credit creation and financial stability from being compromised.

Over-Allocation of Credit to the U.S. Government

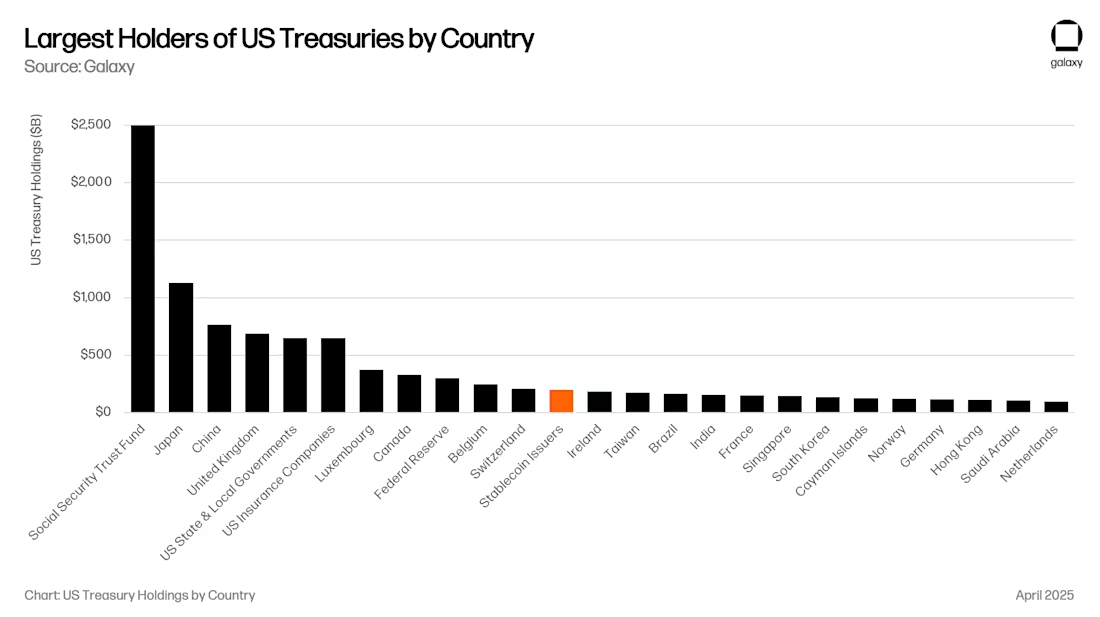

For the U.S. government, this is undoubtedly good news. Currently, stablecoin issuers are the twelfth largest buyers of U.S. Treasury bonds, and their assets under management are growing at the same rate as stablecoin assets. In the near future, stablecoins may become one of the top five buyers of U.S. Treasury bonds (UST).

New proposals similar to the "GENIUS Act" require all Treasury bond support to be in the form of either Treasury bond repurchase agreements or short-term Treasury bonds with maturities of less than 90 days. Both methods would significantly enhance the liquidity of key segments of the U.S. financial system.

When the scale is large enough (e.g., $1 trillion), this could have a significant impact on the yield curve, as U.S. Treasury bonds with maturities of less than 90 days would have a large buyer that is insensitive to price, distorting the interest rate curve on which U.S. government financing relies. That said, Treasury repos do not actually increase demand for short-term U.S. Treasury bonds; they merely provide a liquidity pool for secured overnight borrowing. The liquidity in the repo market is primarily borrowed by major U.S. banks, hedge funds, pension funds, and asset management companies. For example, Circle actually uses most of its reserves for overnight loans secured by U.S. Treasury bonds. This market is valued at $4 trillion, so even if $500 billion of stablecoin reserves are allocated to repos, stablecoins are still a significant player. All this liquidity flowing into U.S. Treasury bonds and U.S. bank borrowing benefits U.S. capital markets while harming global markets.

One hypothesis is that as the value of stablecoins grows to over $1 trillion, issuers will be forced to replicate bank loan portfolios, including a mix of commercial credit and mortgage-backed securities, to avoid over-reliance on any single financial product. Given that the "GENIUS Act" provides a pathway for banks to issue "tokenized deposits," this outcome may be inevitable.

New Asset Management Channels

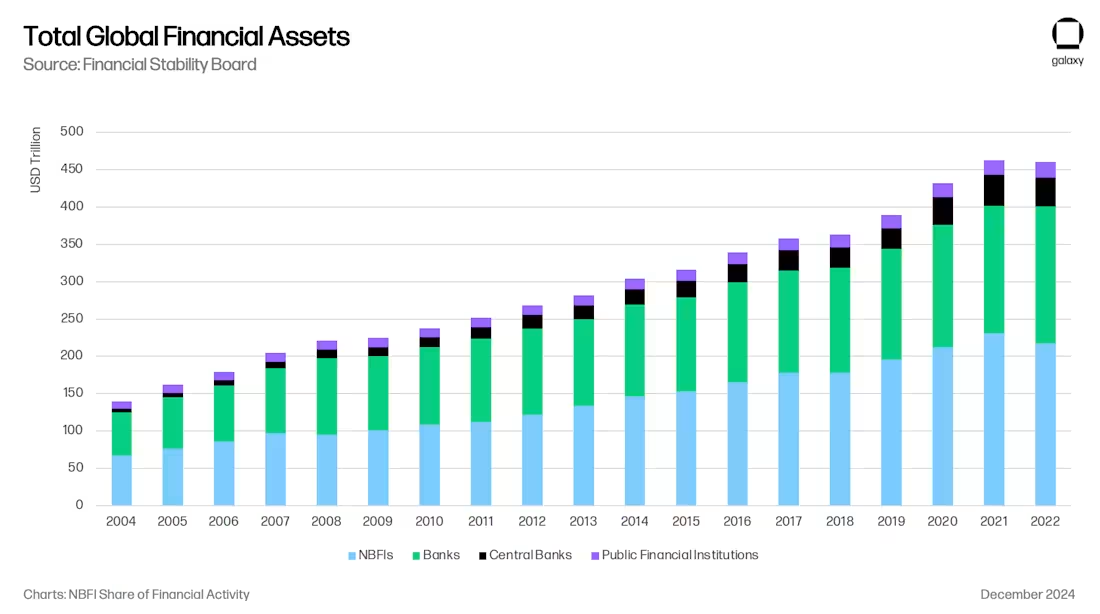

All of this creates an exciting new asset management channel. In many ways, this trend mirrors the ongoing transformation from bank loans to non-bank financial institution (NBFI) loans following Basel III (which limited the scope and leverage of bank lending after the financial crisis).

Stablecoins siphon funds from the banking system, effectively drawing funds from specific areas within the banking system (such as emerging market banks and regional banks in developed markets). As noted in Galaxy's "Crypto Lending Report," we have already seen the rise of Tether as a non-bank lender (beyond U.S. Treasury bonds), and other stablecoin issuers may also become equally important lenders over time. If stablecoin issuers decide to outsource credit investments to specialized firms, they will immediately become LPs in large funds and open up new asset allocation channels (e.g., insurance companies). Large asset management firms like Blackstone, Apollo, KKR, and BlackRock have achieved scale expansion in the context of the shift from bank loans to non-bank financial institution loans.

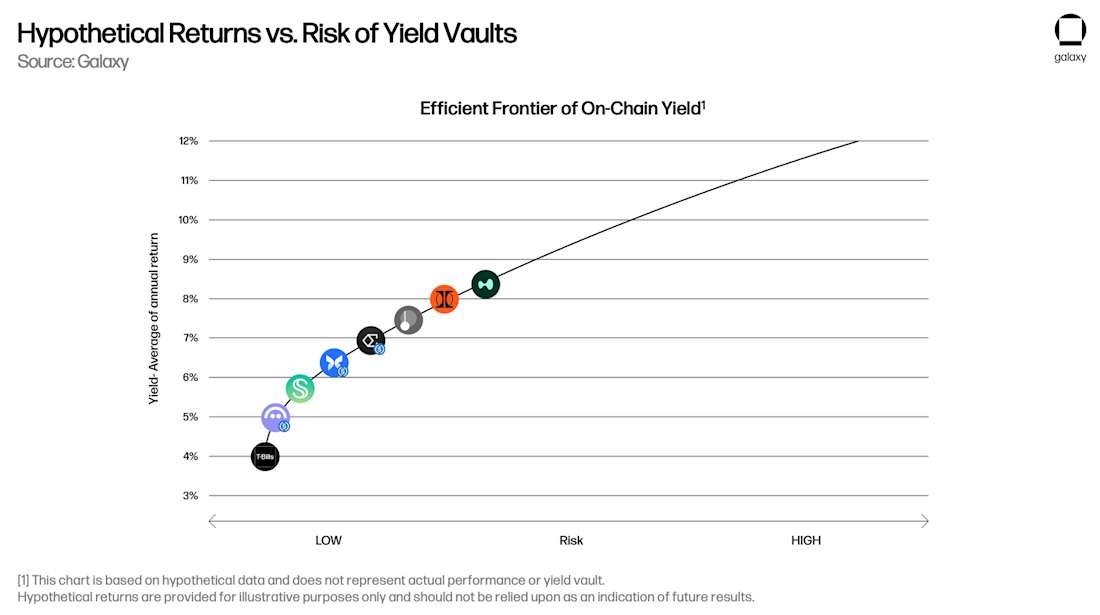

Effective Frontier of On-Chain Yields

Finally, what is available for lending is not just the underlying bank deposits. Each stablecoin is both a claim on the underlying dollar and a unit of on-chain value itself. USDC can be lent on-chain, and consumers will need yields denominated in USDC, such as Aave-USDC, Morpho-USDC, Ethena USDe, Maker's sUSDS, Superform's superUSDC, and so on.

The "treasury" will offer consumers on-chain yield opportunities at attractive rates, thereby opening another asset management channel. We believe that in 2024, portfolio company Ethena will open the "Overton Window" for dollar-denominated on-chain yields by integrating basis trading into USDe. New treasuries will emerge, tracking different on-chain and off-chain investment strategies, competing for USDC/T holdings in applications like MetaMask, Phantom, RedotPay, DolarApp, DeBlock, and others. Subsequently, we will create an "effective frontier of on-chain yields," and it is not hard to imagine that some of these on-chain treasuries will specifically provide credit for regions like Argentina and Turkey, where banks are at risk of losing this capability on a large scale:

Conclusion

The integration of stablecoins, DeFi, and traditional finance not only represents a technological revolution but also signifies a restructuring of global credit intermediation, reflecting and accelerating the shift from bank to non-bank lending post-2008. By 2030, the assets under management of stablecoins will approach $1 trillion, driven by their use as savings tools in emerging markets, efficient cross-border payment channels, and above-market DeFi yields. Stablecoins will systematically siphon deposits from traditional banks and concentrate assets in U.S. Treasury bonds and major U.S. financial institutions.

This transformation brings both opportunities and risks: stablecoin issuers will become significant participants in the government debt market and may emerge as new credit intermediaries; while regional banks (especially in emerging markets) face credit contraction as deposits shift to stablecoin accounts. The ultimate result is a new asset management and banking model, where stablecoins will serve as a bridge to the efficient frontier of digital dollar investments. Just as shadow banking filled the void left by regulated banks after the financial crisis, stablecoins and DeFi protocols are positioning themselves as the dominant credit intermediaries of the digital age, which will have profound implications for monetary policy, financial stability, and the future architecture of global finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。