RWA, as a highly anticipated sector in the market, has yet to demonstrate its ability to connect trillions of assets in traditional markets. According to data from rwa.xyz, the total market value of RWA assets in the crypto industry is only $24 billion, which is still a result of a 56% surge in the first half of this year. Therefore, it can be understood that the narrative of RWA has not ended but has yet to begin. As more categories of assets are tokenized with the future on-chain of U.S. stocks, RWA will truly enter the next stage. At this dawn before the daybreak, Aptos has already achieved a significant lead, with a 56.4% increase in on-chain RWA TVL over the past 30 days, reaching $538 million, rising to the third position among public chains. With the arrival of Aave, RWA assets on Aptos are likely to see more investment opportunities, placing Aptos in a favorable position for the next stage of competition in RWA.

Source: on-aptos

Private credit remains the mainstream path

Private credit accounts for 58% of RWA assets, making it the most关注的 asset class, followed by U.S. Treasury bonds. Private credit assets mainly exist in on-chain form, often lacking trading liquidity; meanwhile, U.S. Treasury bonds face competitive pressure from interest-bearing stablecoins, which use Treasury bonds as collateral to provide similar yield characteristics.

What is private credit? Private credit refers to loans provided by non-bank institutions or investors to businesses or individuals in the non-public market. In traditional finance, private credit attracts a large number of institutional investors due to its flexibility and high returns. However, it also faces pain points such as high costs, low efficiency, and access restrictions. For example, the auditing process for traditional private credit is cumbersome, transaction costs are high, and small and medium-sized enterprises often struggle to obtain financing due to a lack of credit history.

Crypto protocols act as intermediaries, issuing and managing assets on-chain as their core business model, reducing costs by eliminating multiple layers of intermediaries and increasing transparency by providing real-time performance of loan pools and underlying assets.

Tokenization process of private credit assets

1. Generation of off-chain credit assets

The asset issuer (Originator) is responsible for generating off-chain credit assets. Private credit institutions (such as BSFG), small and medium-sized enterprise financing platforms, or regional credit market operators establish loan agreements (specifying principal, interest rate, and term), set collateral assets (such as accounts receivable or real estate, which need to be assessed for value and liquidity), formulate repayment plans and default terms, and review the borrower's financial status (including cash flow, debt ratio, and credit rating, such as S&P rating BB+). For example, a $1 million loan is issued to a logistics company for a term of 12 months at an annual interest rate of 12%, secured by $1.1 million in accounts receivable. This step ensures that the asset meets traditional financial standards, laying the foundation for subsequent tokenization.

2. Building on-chain token structure

Through RWA protocols (such as Pact), single or multiple loans are mapped to on-chain tokens. Token forms include: NFT (each loan generates a unique indivisible token, recording complete asset ownership), SFT (asset fractionalization, allowing investors to hold partial rights, such as a 10% share), or ERC-20 type (loan pools packaged as tradable fund shares, suitable for institutional investors). Token metadata includes anonymous identifiers for borrowers (compliant with GDPR), principal amount ($1 million), interest rate (12% annual), repayment frequency (monthly), maturity date (July 2026), details of collateral assets, and default handling mechanisms. Smart contracts support repayment status management, automatic yield distribution, and early redemption or peer-to-peer transfer (subject to compliance verification).

3. Compliance packaging

The tokenization process must comply with regulatory requirements. Special purpose entities (SPVs) or virtual asset service providers (VASPs) are established in the Cayman Islands, British Virgin Islands, or Singapore as legal custodians, corresponding to on-chain tokens. All investors must complete KYC/KYB and AML reviews, with non-qualified investors restricted by regulations such as Reg D in terms of access and transfer rights. Off-chain disclosure documents (such as PDF format term sheets or issuance memorandums) clearly state that tokens are debt assets, without voting rights or equity attributes. This step combines on-chain hash verification and off-chain encrypted storage of personal identity information (PII) to ensure compliance with UETA.

4. Token issuance and financing

Tokens are displayed through user interfaces or protocol platforms, accepting on-chain investments. Investors must complete KYC verification and invest using USDC, APT, or USDT, receiving RWA tokens as proof, and collecting repayment principal and interest monthly or quarterly. For example, the expected annual yield of the Pact platform BSFG-EM-1 is 64.05%, covering the financing needs of small and micro enterprises in emerging markets.

5. Yield distribution and asset liquidation

Borrowers repay according to the plan, and funds collected by the issuer are transferred to the SPV, mapped to on-chain through oracles or smart contracts, and distributed to token holders. Smart contracts automatically split interest based on holding proportions (e.g., distributing 12% annual yield according to a 10% share), and upon loan maturity, automatically return principal or arrange for asset renewal. If the token structure (such as SFT) allows, it can be traded on decentralized exchanges (DEX) or RWA-specific markets, but typically has a lock-up period and only supports peer-to-peer transfers.

Aptos' competitive advantages in the RWA sector

Technical advantages: Financial application potential of high-performance blockchain

As a new generation Layer 1 blockchain, Aptos' technical architecture is a unique advantage in the RWA sector, especially in the tokenization of private credit. The following analysis focuses on core technical features:

- High throughput and low latency

Aptos employs a Block-STM parallel execution engine, achieving efficient transaction processing through optimistic concurrency control. Official testing data shows that Aptos' theoretical throughput can reach 150,000 transactions per second (TPS), with stable production environments maintaining 4,000-5,000 TPS, far exceeding Ethereum and Solana. In private credit scenarios, high throughput supports large-scale loan issuance, real-time repayment distribution, and on-chain auditing, ensuring transaction efficiency.

Additionally, Aptos' transaction final confirmation time is only 650 milliseconds. This sub-second confirmation speed is crucial for RWA assets that require instant settlement (such as yield distribution from loan pools). For example, the Pact protocol achieves T+0 settlement on Aptos, significantly reducing capital occupation costs compared to traditional finance's T+2 or T+3.

- Low transaction costs

Aptos' average transaction fee is less than $0.01. This low-cost feature is particularly critical for RWA scenarios, as tokenized assets involve frequent on-chain operations (such as loan issuance, repayment distribution, compliance verification). For instance, Pact's on-chain loan management requires real-time updates of repayment status, and low fees ensure controllable operational costs.

- Modular architecture and scalability

Aptos' modular design separates consensus, execution, and storage layers, allowing independent optimization of each layer, which is crucial for RWA asset management, as private credit involves complex metadata (such as borrower information and repayment plans).

Ecosystem layout: Institutional endorsement and regulatory friendliness

Aptos' ecosystem layout in the RWA sector significantly enhances its competitiveness through partnerships with traditional financial giants and the expansion of the DeFi ecosystem.

Institutional collaboration and endorsement

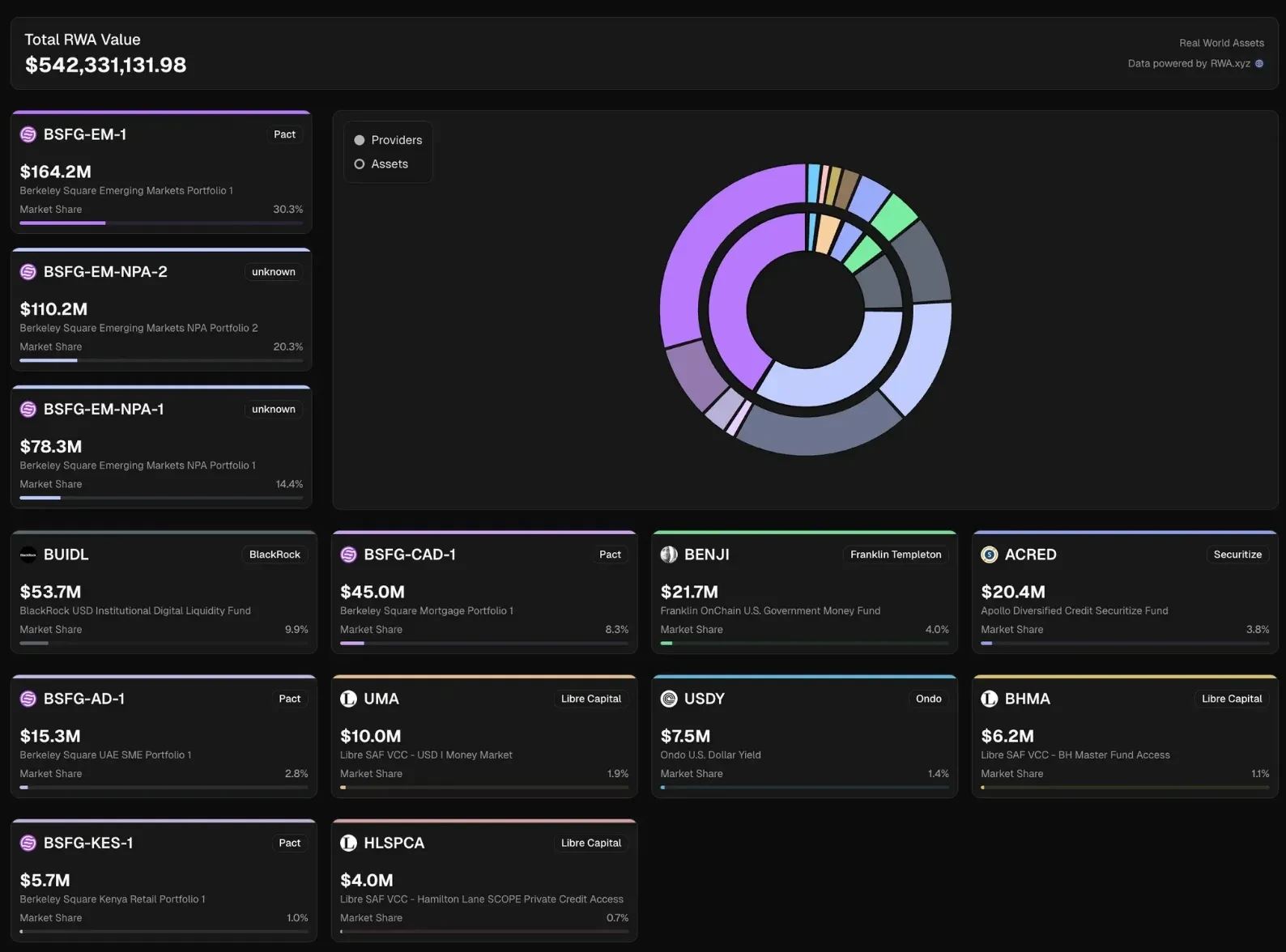

As of June 2025, Aptos' total locked value (TVL) in RWA reached $540 million, ranking third among public chains, only behind Ethereum and ZKsync Era. This achievement is attributed to the participation of several traditional financial institutions:

In July last year, Aptos announced the integration of Ondo Finance's USDY into its ecosystem, along with major DEX and lending applications. In October last year, Aptos announced that Franklin Templeton had launched a Franklin on-chain U.S. government money market fund (FOBXX) represented by the BENJI token on the Aptos Network. Additionally, Aptos has partnered with Libre to promote security tokenization.

These collaborations not only bring funding and technical support to Aptos but also enhance its credibility in the compliance field.

Regulatory friendliness

Tokenization of private credit involves complex compliance requirements, such as KYC/AML reviews and Reg D/Reg S compliance. Aptos has built in on-chain identity verification and asset tracking features through partnerships with compliance platforms. For example, the Pact protocol combines off-chain encrypted storage of personal identity information (PII) with on-chain hash verification to meet UETA requirements, ensuring the legal validity of loan tokens.

By 2025, the global regulatory environment is gradually becoming clearer. The MiCA regulations in Europe provide a clear framework for crypto assets, while the GENIUS Act in the U.S. creates favorable conditions for stablecoin and RWA projects. Aptos' low fees and fast confirmation features make it an ideal choice for a regulatory-friendly public chain. For instance, Aptos was selected by the state of Wyoming as the top technical scoring candidate chain for the stablecoin project WYST and plans to utilize Aptos to issue compliant stablecoins and loan tokens, expected to cover $100 million in assets by 2026.

Emerging market positioning

Aptos' RWA strategy focuses on emerging markets, particularly in regions with insufficient financial inclusion. BSFG, as the main asset issuer of the Pact protocol on the Aptos chain, provides diversified financing solutions for emerging markets and specific regions through tokenized private credit products, significantly promoting the development of Aptos' RWA ecosystem.

Its flagship product, BSFG-EM-1, targets individual consumers and small business operators in emerging markets, offering short-term, small consumer loans and revolving credit lines, with a scale of $160 million, individual loan amounts ranging from hundreds to thousands of dollars, terms of 3-12 months, and interest rates as high as 64.05%. BSFG-EM-NPA-1 and BSFG-EM-NPA-2 are special pools for bad debts or defaulted loans, with a scale of $188 million, limited to qualified investors, and returns not disclosed. BSFG-CAD-1 is a Canadian residential property mortgage loan, with a scale of $44 million, divided into senior and junior structures, with an interest rate of 0.13% (possibly low-risk senior loans), backed by real estate but in a locked state, with limited liquidity. BSFG-AD-1 targets small and micro enterprises in the UAE, providing operational loans with a scale of $16 million and an interest rate of 15.48%, serving high-growth markets. BSFG-KES-1 targets the retail credit market in Kenya, with a scale of $5.6 million and an interest rate of 115.45%.

These products achieve efficient issuance and transparent management through Pact's on-chain infrastructure, contributing 77% (approximately $420 million) to Aptos' RWA TVL.

Conclusion

Aptos' rapid rise in the RWA sector is attributed to its technological advantages and ecosystem layout. By June 2025, its RWA TVL reached $538 million, ranking third among public chains, primarily driven by private credit. The Pact protocol has contributed over $420 million in assets (accounting for 77% of Aptos RWA) by launching on-chain debt pools, significantly enhancing the ecosystem's competitiveness. As the growth engine for RWA, private credit achieves on-chain composability through tokenization, allowing credit tokens to participate in DeFi protocols' revolving loans, leverage strategies, and liquidity pools, generating annualized returns of 6%-15%. Compared to Treasury bonds (which face competitive pressure from interest-bearing stablecoins), private credit is favored by the market due to its high returns and clear cash flows. Aptos' low transaction fees (below $0.01) and a final confirmation time of 650 milliseconds support real-time lending and settlement, and future integration with Aave may further activate Pact's potential.

Currently, the tightening interest rate spreads in traditional financial markets are prompting institutions to turn to on-chain solutions. Aptos fills the financing gap for small and medium-sized enterprises by serving emerging markets. In the future, with the optimization of the regulatory environment and the expansion of the DeFi ecosystem, Aptos is expected to add $500 million in RWA TVL by 2026. Through the synergy of technology and ecosystem, Aptos is demonstrating sustained growth potential in the private credit sector.

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation, jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos ecosystem in the Chinese-speaking region. As the official representative of Aptos in the Chinese-speaking area, Movemaker is committed to building a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecosystem partners.

Disclaimer:

This article/blog is for reference only, representing the author's personal views and does not reflect the position of Movemaker. This article does not intend to provide: (i) investment advice or investment recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries high risks, with significant price volatility, and they may even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific questions, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling this data and charts, but no responsibility is accepted for any factual errors or omissions expressed therein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。