Against the backdrop of delayed interest rate cuts and geopolitical turmoil, nearly all assets trembled in the first half of 2025. However, Bitcoin led the entire crypto world in a remarkable comeback, demonstrating strong resilience and growth potential. As the second half of the year approaches, what key momentum is brewing in the market?

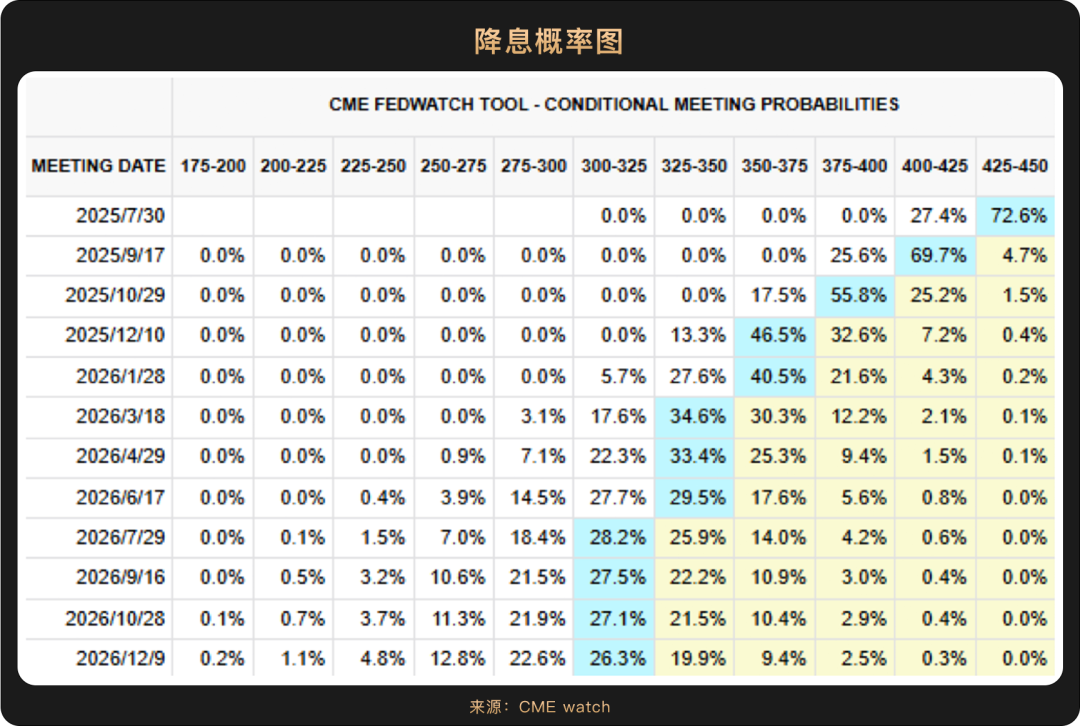

At the beginning of this year, there was widespread expectation that the U.S. economy would take a sharp dive, but so far, it has shown a steady decline, resembling a "soft landing." The job market has maintained a certain level of resilience, with 139,000 new non-farm jobs added in May, an unemployment rate of 4.2%, and a year-on-year wage growth of 3.9%, indicating that while the labor market has slightly slowed, it remains robust. Meanwhile, inflation data has come in below expectations, with the core CPI rising 2.7% year-on-year in June, slightly down from the previous value, and not yet clearly reflecting the impact of the Trump administration's tariffs. The market generally expects the Federal Reserve to initiate interest rate cuts in September rather than July.

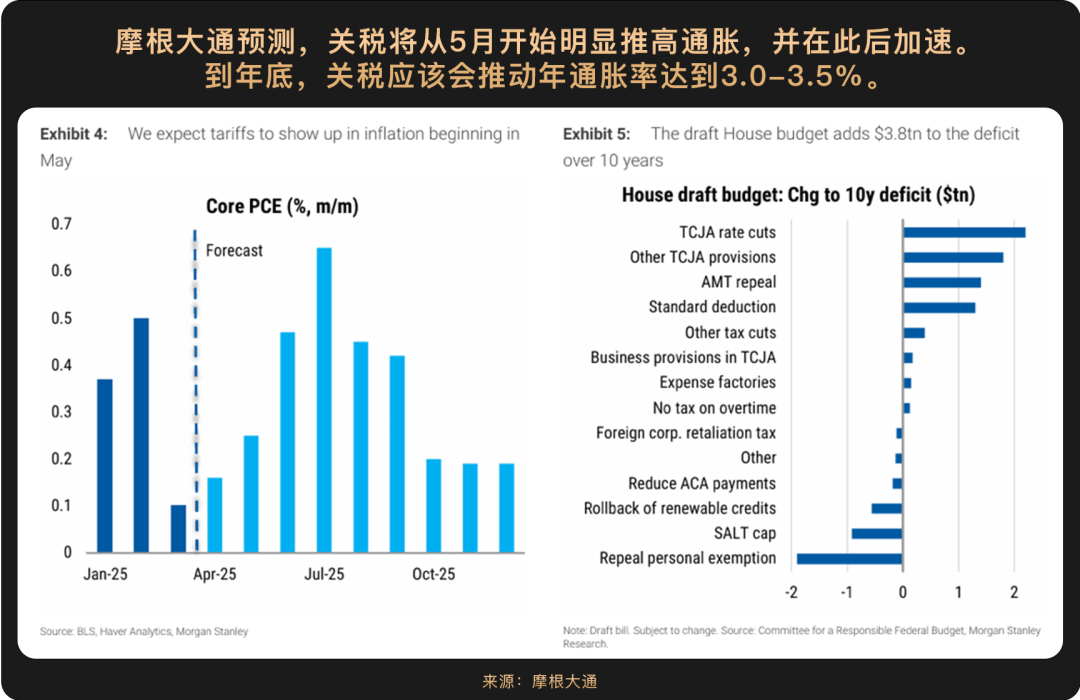

However, the risk of stagflation is intensifying. JPMorgan has warned that the U.S. GDP growth forecast for 2025 has been downgraded from 2% to 1.3%, and tariff policies may push up inflation while suppressing growth, trapping the economy in a "stagflation" dilemma. There is a clear division within the Federal Reserve regarding the path of interest rate cuts—Chairman Powell emphasizes that there is "no rush to ease policy," while some officials, like Waller and Bowman, advocate for early rate cuts (in July) to guard against economic downturn risks. Behind this policy game is the contradiction between inflation and growth: if the Federal Reserve cuts rates too early, it may exacerbate inflation; if it acts too late, it may accelerate economic recession.

A key variable is the lagging impact of tariffs. Powell pointed out that the transmission of tariffs to prices may become apparent in the coming months, with inflation data for June to August potentially showing "significant increases." One possible explanation is that companies previously stocked up to mitigate short-term shocks, but as inventories are depleted, rising import costs will gradually push up end prices. If inflation rebounds, the Federal Reserve may be forced to delay rate cuts or even pause the easing cycle, further reinforcing stagflation expectations.

Looking ahead to the second half of the year, the policy path remains highly uncertain. July's non-farm employment and CPI data will be key decision-making references. If the data confirms that inflationary pressures are manageable, the Federal Reserve may proceed with rate cuts in September as planned; if inflation rises unexpectedly, the market may face a "hawkish delay" impact, potentially even revisiting the stagflation dilemma of the 1970s. In this game of rate cuts and stagflation, every decision made by the Federal Reserve will profoundly influence the direction of global markets.

Despite weak U.S. economic data, the market remains focused on expectations of policy easing. However, the Federal Reserve's rate cut expectations in June 2025, breakthroughs in stablecoin regulation, and rebounds in tech stocks have driven the U.S. stock market to show an overall upward trend: the S&P 500 rose 4.96% for the month, and the Nasdaq increased by 5.93%, repeatedly hitting historical highs during this period.

Notably, the performance of crypto stocks, represented by stablecoin giant Circle (CRCL), has been outstanding: Circle went public on the NYSE on June 5, and its stock price soared over 600% afterward, making it undoubtedly one of the most eye-catching fintech IPOs of 2025; CoinBase (COIN) also saw a monthly increase of 43%.

Behind this surge is the passage of the first federal stablecoin regulatory bill, the "GENIUS Act" (Guiding and Establishing National Innovation for Dollar Stablecoins Act), by the U.S. Senate on June 17. This bill establishes a federal regulatory framework for stablecoins for the first time, requiring issuing institutions to hold reserves of 1:1 U.S. dollars or short-term U.S. Treasury bonds, and banning algorithmic stablecoins and interest-bearing stablecoins. Circle's USDC is the second-largest stablecoin globally (with a market cap of $61 billion), and its significant compliance advantages have made it the preferred choice for institutions, with the post-IPO surge reflecting strong market expectations for "regulatory dividends."

The table above shows the "stress test" of different assets during a downturn cycle. In each downturn cycle, cryptocurrencies have a larger decline than U.S. stocks and bonds (the higher the risk, the sharper the decline), but in 2025, Bitcoin's decline has narrowed, and volatility has been minimal, indicating that the entry of institutions has improved the maturity of the crypto market.

The trend of "issuing stocks to purchase coins" on the corporate side further reinforces this coin-stock linkage logic. According to the "Monthly Outlook: Three Themes for 2H25," as of April 2025, 228 listed companies globally held a total of 820,000 Bitcoins, with Strategy (MSTR) holding nearly 600,000 Bitcoins (accounting for 2.5% of the total Bitcoin supply), with an average cost of about $68,000, yielding a floating profit of over 200%.

Tech giants like Tesla are increasing their Bitcoin holdings through convertible bond financing, incorporating digital assets into the structural allocation of their balance sheets, forming a new capital operation model of "issuing stocks to purchase coins." This trend of corporate entry is shifting from "strategic deployment" to "institutional acceptance," which not only supports Bitcoin prices (which rose 10.6% in the first half of 2025) but also enhances the legitimacy and market recognition of crypto assets. Strategy CEO Michael Saylor stated, "Bitcoin has become a core asset for companies to combat inflation, and we are pushing for it to become the global reserve standard." Data from Deutsche Bank shows that stablecoin settlement volume reached $28 trillion in 2024, surpassing the combined total of Visa and Mastercard, validating the business potential of institutions like Circle and revealing the ability of blockchain payments to reshape the global clearing system.

Looking ahead to the second half of the year, if the "GENIUS Act" passes in the House and is signed by Trump, it will officially usher in a new era of stablecoin regulation. Compliance will accelerate institutional capital inflow, and the boundaries between traditional stock markets and the crypto world will further merge, reinforcing the "coin-stock linkage," with crypto stocks likely to continue their strong performance and become a core driver of structural trends in the U.S. stock market.

In June, Bitcoin prices demonstrated resilience amid complex circumstances: when the Israel-Palestine conflict escalated suddenly in mid-June, Bitcoin briefly fell below the $100,000 mark but quickly rebounded above $100,000, showing an independent trend and gradually decoupling from traditional risk assets. Recent research from the Gemini exchange and on-chain analytics firm Glassnode indicates that institutional investors are continuously increasing their holdings through ETFs and other channels, and the structural changes in the market are reshaping its volatility characteristics.

Reflecting on the first half of 2025, although the factors influencing short-term prices are still primarily driven by capital supply and geopolitical conflicts, on a more fundamental level, the crypto market may be undergoing the most profound paradigm shift since its inception. Its development trajectory can no longer be simply defined by market sentiment or technical indicators, but is presenting new vitality under the combined forces of technology, capital, regulation, and ecology. The market performance in June clearly reveals that this industry is gradually transforming into a mature digital asset infrastructure.

In June, the wave of institutionalization reached new heights, with the global crypto ETF scale surpassing the milestone of $1.1 trillion, and BlackRock's Bitcoin ETF alone attracting a net inflow of $4.9 billion in one month. More notably, the level of participation from traditional financial institutions is undergoing a qualitative change; for example, Goldman Sachs has begun offering Bitcoin collateralized loan services in partnership with CoinBase, a level of involvement that far exceeds Wall Street's tentative layouts during the 2021 bull market. Meanwhile, the Federal Reserve's shift in monetary policy expectations has injected new variables into the market, with historical data indicating that the Federal Reserve's rate-cutting cycles are typically accompanied by significant increases in Bitcoin prices.

In terms of regulation, the passage of the aforementioned "GENIUS Act" in the U.S. and the establishment of a stablecoin licensing system in Hong Kong mark the initial construction of a compliance framework for digital assets in major financial centers, and this policy certainty is attracting more traditional capital to enter the market.

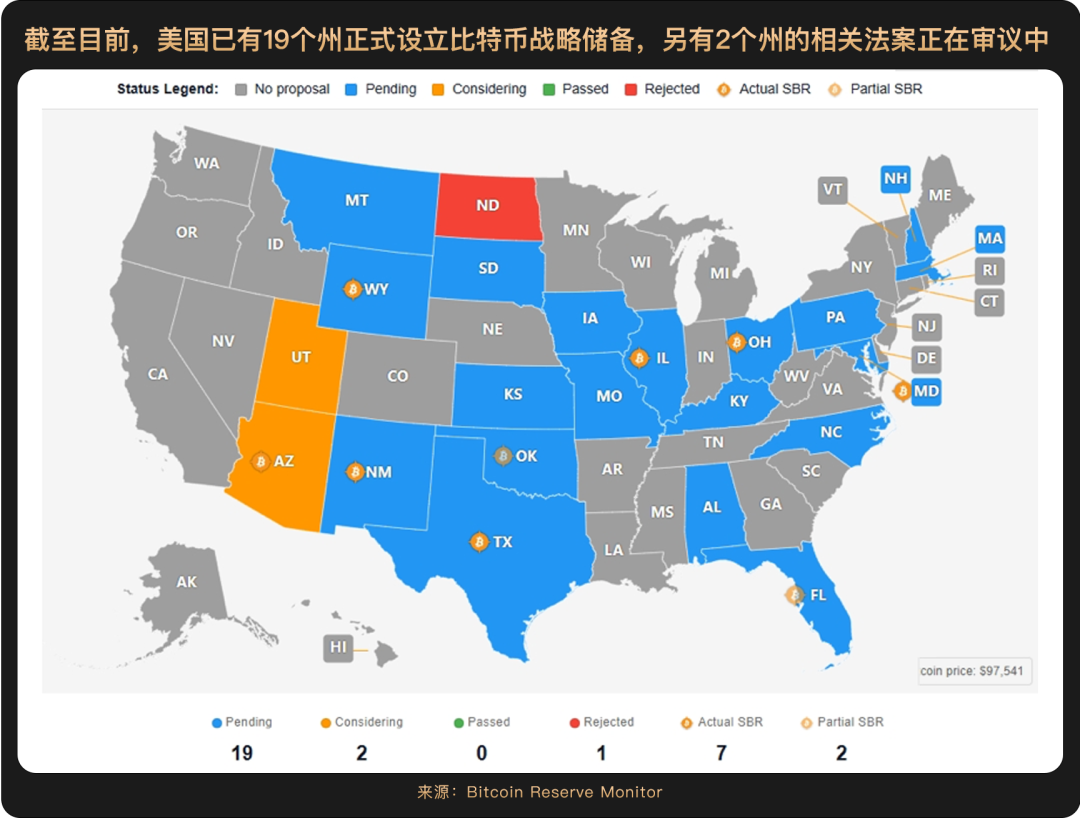

Additionally, a digital asset policy advisor at the White House revealed that the U.S. is working to build a strategic Bitcoin reserve infrastructure. The executive order issued by Trump in March of this year did not mandate the Treasury to disclose the government's Bitcoin holdings, and we can expect it to proactively disclose relevant information in the second half of the year. The advisor also added that the U.S. government is "highly inclined" to increase its Bitcoin holdings in a budget-neutral manner. This means that the U.S. government will provide funding support for Bitcoin purchases through internal fund restructuring or cost savings without increasing the fiscal deficit or taxpayer burden.

In short, looking back from the midpoint of 2025, the development trajectory of the crypto market has fundamentally differed from the early stage of pure speculative-driven phases.

Geoffrey Kendrick, head of digital asset research at Standard Chartered Bank, has predicted a target price of $200,000 for Bitcoin by the end of 2025. The dominant narrative behind this market cycle has shifted from being linked to risk assets to being driven by capital flows, with funds pouring in through various forms. Bitcoin is becoming a tool for reallocating capital away from U.S. assets, indicating that this rise is not just about price fluctuations but also reflects global capital allocation and macroeconomic trends. In this sense, the second half of 2025 is likely to be a historical turning point for the deep coupling of the traditional financial system and the digital currency ecosystem.

Currently, Bitcoin prices are maintaining a high range of $100,000 to $120,000. Looking ahead to the second half of the year, with the potential for a Federal Reserve rate cut, continued growth in corporate crypto adoption, and clearer regulatory policies, a new phase of steady development is expected to emerge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。