As the Web3 technology stack continues to evolve, smart contract languages are gradually migrating from Ethereum-dominated Solidity to the more secure and resource-abstracting Move language. Move was originally developed by Meta for its cryptocurrency project Diem (formerly Libra) and features first-class resources and formal verification friendliness, making it an important language option for the next generation of public chain underlying architecture.

In this evolutionary context, Aptos and SUI have become the dual core representatives of the Move ecosystem. Aptos was launched by the original Diem core team, Aptos Labs, continuing the native Move technology stack and emphasizing stability, security, and modular architecture. SUI, built by Mysten Labs, inherits the Move security model while introducing object-oriented data structures and parallel execution mechanisms, forming a SUI Move branch that offers performance breakthroughs and innovative development paradigms, reconstructing on-chain resource management and transaction execution models. It can be said that SUI is a Layer 1 that has truly reconstructed the smart contract operating mechanism and on-chain resource management from first principles; it is not competing for "high TPS," but rewriting how blockchains should operate. This makes SUI not only powerful in performance but also leading in paradigm, serving as a technological foundation for complex on-chain interactions and large-scale Web3 applications.

1. Breaking Through, Reshaping the Public Chain Landscape

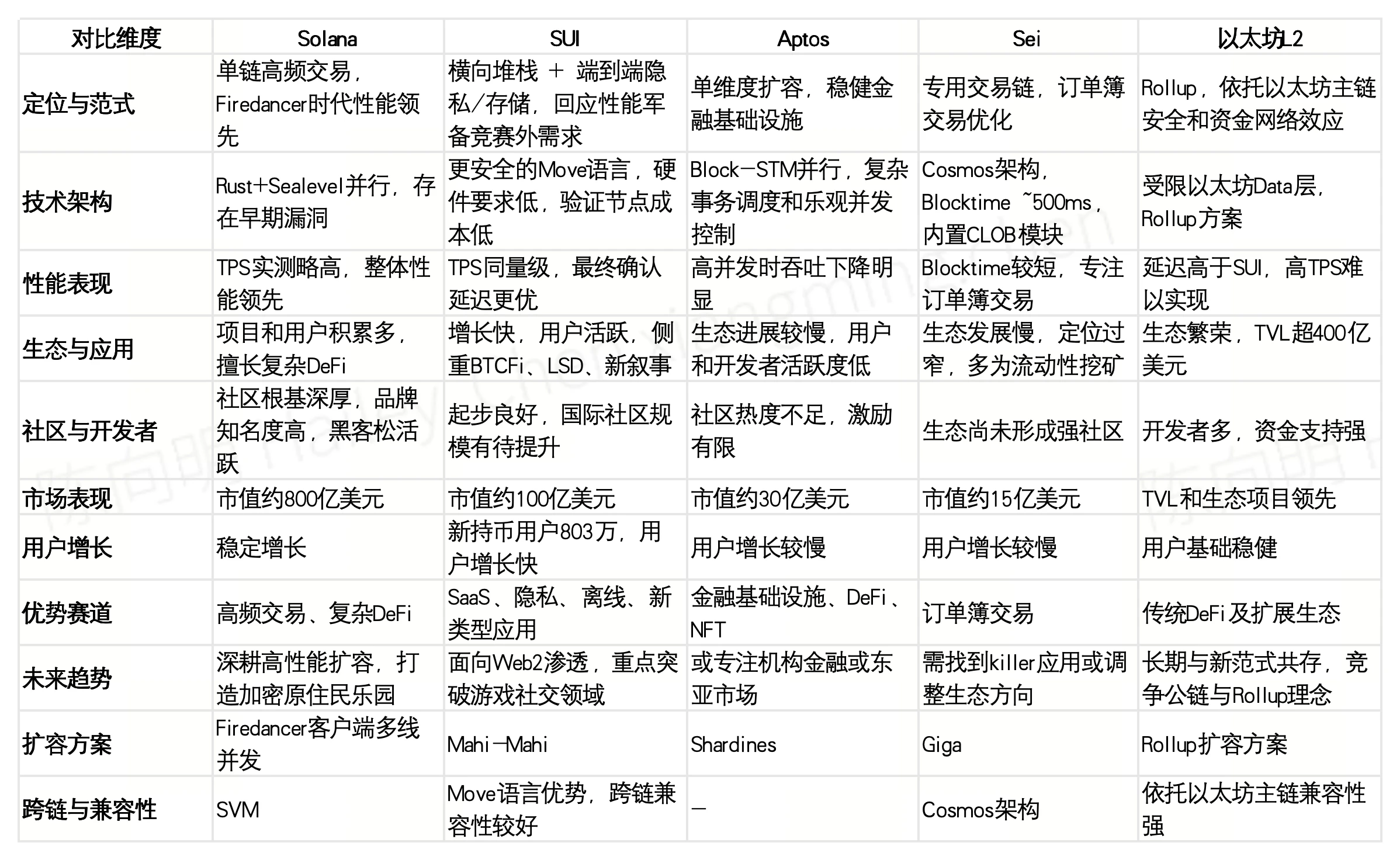

After Solana entered the Firedancer era, its performance curve may remain ahead; however, it still follows the "single-chain high-frequency trading" paradigm. SUI attempts to respond to demands beyond the performance arms race with a horizontal stack + end-to-end privacy/storage. This significantly differs from Aptos (also Move, but still one-dimensional scaling) or Sei (specialized chain, liquidity depth concentration). For investment institutions, this means:

• If focusing on high TPS + continuous transaction fees, Solana & specialized chains may yield faster returns;

• If focusing on "new types of applications" and horizontal interface control, SUI's alpha comes from the unsaturated SaaS/privacy/offline track;

• Aptos and SUI overlap significantly in DeFi and BTCFi, requiring caution against internal competition.

Comparison with Solana: Solana has undergone multiple bull and bear market cycles, resulting in a large ecosystem. As a newcomer, SUI has clear advantages: it uses the more secure Move language, avoiding vulnerabilities caused by Solana's Rust + Sealevel parallelism, and has lower hardware requirements, resulting in lower costs for validating nodes, which is beneficial for decentralization. In terms of performance, both are comparable, with Solana having slightly higher TPS, while SUI has lower confirmation delays. In terms of ecosystem, Solana has more projects and users, focusing on complex DeFi (such as Serum, Drift), while SUI is growing faster, with user activity once reaching parity, differentiating itself through new fields like BTCFi and LSD. The Solana community is mature, while SUI's international community still needs to expand. In the future, both may coexist, with Solana leaning towards a crypto-native ecosystem and SUI focusing more on Web2 penetration and gaming social aspects. Both pursue performance limits: Solana relies on Firedancer's multithreading, while SUI depends on Mahi-Mahi upgrades.

Comparison with Aptos: Aptos and SUI both originate from Libra/Diem, with Aptos launching first and gaining the "first Move chain" halo and high valuation. Over the past year, Aptos's ecosystem has developed slowly, with user and developer activity lower than SUI. Reasons include: Aptos uses a complex Block-STM parallelism, with performance significantly dropping under high concurrency, while SUI's object model is more efficient; Aptos positions itself as a robust financial infrastructure, focusing on DeFi and NFTs, with a style similar to Ethereum clones; SUI attempts a diverse narrative, with rapid user growth (new holding users reaching 8.03 million, far exceeding Aptos), but with higher risks. In terms of incentives, Aptos has had airdrops but lacks continuous incentives, while SUI, despite no airdrops, has strong foundation support, with monthly active addresses and on-chain transaction volumes both surpassing Aptos. The Aptos team and funding strength are strong, and it may focus on institutional finance or East Asian markets in the future, but the market currently favors SUI.

Comparison with Sei: Sei is a dedicated trading chain that emerged in 2023, based on Cosmos, focusing on order book trading, with a block time of about 500ms. It attempts to capture the market share lost by Solana during outages, enjoying high short-term popularity, but its TVL and user growth have not been sustained, and ecosystem development is limited. Its narrow positioning and reliance on liquidity mining make it difficult to form a complete ecosystem. In contrast, SUI follows a general L1 route, supporting diverse applications and demonstrating stronger risk resistance. Sei's cross-chain compatibility and language advantages are inferior to SUI's, and while it may transform or fully integrate into the EVM ecosystem, it is unlikely to threaten SUI in the short term. More noteworthy is Linera, incubated by Mysten, which is positioned for high-frequency micropayments and may serve as a sidechain for SUI expansion, differing from SUI's positioning.

Comparison with Ethereum L2: The Ethereum L2 (such as Arbitrum, Base) ecosystem is thriving, with TVL exceeding $2 billion. SUI's advantages lie in ultra-low latency and high concurrency, which Rollups cannot match, and it has low gas fees, making it suitable for high TPS games and other applications. However, Ethereum L2 enjoys strong capital network effects and security backing. The competition between SUI and L2 is essentially a contest between a new paradigm (public chain) and a traditional paradigm (Rollup), which may coexist in the long term, while in the short term, it depends on who can better meet application demands.

2. Rapid Progress, Impressive Ecosystem Data

Since the SUI mainnet launched in May 2023, user growth has shown an exponential trend: by April 2025, over 123 million user addresses have been created on the SUI chain. This number is nearly approaching the cumulative address count of established public chains like Tron. In the second half of 2024, SUI's monthly active addresses averaged around 10 million; however, starting from mid-February 2025, this metric experienced a dramatic leap, steadily exceeding 40 million by mid-April, with monthly activity quadrupling. In terms of new users, a "turning point" occurred at the end of 2024—average daily new wallet addresses surged from 150,000 to a sustained level of over 1 million.

Notably, the rise of new public chains is often accompanied by a significant influx of cross-chain funds. SUI welcomed its first wave of traffic through third-party bridging in the latter half of 2024: As of November 2024, approximately $944.8 million has been bridged in. By mid-2025, SUI's total cross-chain locked amount (bridged TVL) is about $2.55 billion. This indicates that in addition to the internal TVL of DeFi, there are also substantial assets remaining as bridged assets, supporting liquidity needs on SUI. Furthermore, as DeFi activities heat up, the supply of stablecoins in the SUI ecosystem has risen significantly: by mid-April 2025, the market capitalization of SUI stablecoins reached a historical high of over $800 million. This scale is already comparable to the stablecoin levels of established public chains like Tron, highlighting the increasing trust users have in the SUI network for value storage and transfer. In terms of stablecoin composition, USDC remains the absolute leader, consistently accounting for over 60% of the market cap. USDT was also issued on SUI at the end of 2024, maintaining a certain level of activity.

Although still lagging behind Solana in throughput, SUI has fully covered high-frequency scenarios such as on-chain order book DEX, real-time PvP, and social interactions, and due to its rapid finality + DAG parallel execution, it naturally fits into tracks like micropayments, in-game asset exchanges, and social "likes/comments." With the upcoming Mahi-Mahi upgrade targeting >400,000 TPS, SUI is continuously solidifying its scalability moat, but the 150-minute downtime incident on November 21, 2024, serves as a warning that the core protocol's stability under high concurrency boundary conditions still needs ongoing validation. Additionally, low average gas fees are a core selling point for SUI in attracting developers for "on-chain real-time applications"; however, if peak fee rates repeatedly surge, user attrition may occur in gaming and social scenarios. Holders/stakers need to pay attention to storage fund parameters and L2 solution rhythms to assess the long-term cost curve.

Currently, SUI's ecosystem data is quite impressive: First, its funding structure's resilience is forming. The stable TVL in Q2 2025 is approximately $1.6 to $1.8 billion, with stablecoins + LSD accounting for about 55%, indicating that it can retain funds even without incentive subsidies—showing that "sticky capital" has begun to settle after the hot money cycle. Additionally, the proportion of institutional addresses has increased from 6% to 14% (doubling within six months, according to Artemis's standard), while the proportion of retail funds has decreased but activity has risen, indicating that funds are more concentrated yet more active, providing a safety cushion for the next round of leverage/derivatives expansion.

Second, the developer retention rate is higher than that of peer public chains. According to Electric Capital, the 24-month survival rate (devs continuously submitting on GitHub for two years) is SUI = 37% > Aptos 31% > Sei 18%. The key incentives include: the object model + Walrus/Seal native SDK reduces the mental cost of "rewriting on-chain structures"; most teams prefer to write their first contract on SUI rather than porting it.

Third, the user structure is bimodal (DeFi + content entertainment), driving diverse on-chain interactions. DeFi contracts account for about 49% of on-chain calls; content applications like FanTV, RECRD, and Pebble City contribute about 35% of call volume. Social and consumer applications have yet to truly launch, representing a potential blue ocean. The Web3 transformation of content creation (music, video) is already showing signs on SUI, but there is room for further development. Notably, SUI has a significant number of users in Southeast Asia, and social products tailored to the habits of users in that region could be considered. Localized on-chain short videos and on-chain fan tipping may have market potential. As these products grow, they could generate businesses such as advertising and data analysis, creating a positive cycle for the ecosystem's economy. Social products have a longer growth period, but once successful, they exhibit strong stickiness.

For instance, by March 2025, the locked amount of BTCFi on the SUI chain surpassed 1,000 BTC; by April, BTC-like assets accounted for 10% of SUI's total TVL, covering forms like wBTC, LBTC, and stBTC. In other words, there are approximately $250 million worth of Bitcoin actively utilized on SUI. These Bitcoin assets are fully utilized on SUI: users can collateralize BTC-pegged assets to lending protocols in exchange for stablecoins, achieving "holding coins for interest," or provide BTC/stablecoin liquidity to earn transaction fees. One-stop liquidity protocols like Navi quickly supported BTC as collateral and launched yield aggregation strategies such as "BTC Plus."

Fourth, Potential Growth Curve: Two Major Gaps in RWA and Native Derivatives. In terms of RWA, Seal/Nautilus provides compliant privacy + verifiable computation, serving as a natural foundation for issuing bonds and fund shares; collaborations have been established with Open Market Group (planning to issue RWA yield certificates on SUI) and 21Shares (which has an existing SUI ETP scale of approximately $300 million) to test the tokenization of physical assets/bonds. The opportunities arising from this include creating RWA issuance SaaS, compliance identity as a service, on-chain secondary exchanges, and valuation oracles. Regarding native perpetuals/options, the current on-chain perpetual open interest is about $20 million, with Bluefin accounting for approximately 70%. The difference between Hyperliquid-style application chains and SUI is "performance vs liquidity aggregation." If SUI decides to implement composable/cross-protocol matching at the consensus layer (like DeepBook 2.0), there is an opportunity to develop a unified derivatives infrastructure, with a potential growth ceiling of 10x.

3. Forward-Looking Layout: SUI Foundation, OKX Ventures, and Mysten Labs as Key Ecological Forces

A thriving ecosystem relies on the catalytic and empowering role of strategic capital. In the process of SUI's ecosystem evolving from its nascent stage to rapid rise, OKX Ventures has played a crucial role. Its investment strategy is not merely a financial bet but a forward-looking, systematic layout based on a profound understanding of SUI's technical architecture and ecological potential, thereby catalyzing the prosperity of the SUI ecosystem.

The Sui application ecosystem currently revolves around financial sectors (DeFi + BTCFi) as the absolute main axis, followed by entertainment sectors (GameFi/NFT/social), while AI-native tools and derivatives are still in their early stages. The real gaps are concentrated in RWA lending and on-chain derivatives: the former awaits the implementation of Seal/Nautilus's privacy compliance solutions, while the latter requires stronger matching depth and risk hedging tools.

OKX Ventures is recognized by the market as one of the earliest discoverers and strategic builders of the SUI ecosystem. Shortly after the SUI mainnet went live, while the ecosystem was still in its early stages, OKX Ventures decisively invested in several core projects such as Cetus, Navi, Momentum, and Haedal, demonstrating its keen judgment. These projects cover key tracks in the DeFi space, including decentralized exchanges (DEX), lending, and liquid staking (LST), laying a solid foundation for the subsequent explosive growth of SUI's financial ecosystem. For example:

•Momentum: An innovative DEX deployed on the SUI blockchain, co-founded by former Meta Libra core engineer ChefWEN. Since its launch in 2025, its trading volume has rapidly surpassed $1 billion, with over 200,000 active users, making it one of the fastest-growing liquidity platforms on SUI. It adopts a ve(3,3) model, returning 100% of token emissions, trading fees, and rewards to users, achieving deep alignment of interests among traders, voters, and liquidity providers. Momentum currently manages over $500 million in TVL, supports stablecoin and multi-asset trading, and is gradually establishing its position as the core liquidity engine in the SUI ecosystem with its low fees and high efficiency.

•Haedal: Haedal is a leading liquid staking protocol on the SUI blockchain, allowing users to stake SUI or WAL to obtain certificates like haSUI, enabling participation in governance while remaining active in DeFi applications. Since its launch in early 2025, its TVL has surpassed $200 million, with daily active wallets exceeding 44,000, making it a leader in the LSD track. Its Hae3 technical architecture includes HMM market makers, HaeVault yield optimization, and HaeDAO governance system, enhancing base staking yields to over 3.5% and collaborating deeply with several core SUI protocols. With high security and capital efficiency, Haedal aims to become a Lido alternative within the SUI ecosystem, leading the restructuring of the LSD market.

•Cetus: Cetus is a decentralized exchange and liquidity protocol deployed on Sui and Aptos, supporting various liquidity algorithms such as CLMM, RFQ, and DMM, catering to both retail and institutional needs. Its multi-curve strategy design and efficient Tick pricing mechanism significantly enhance capital efficiency and establish the primary clearing and aggregation layer on SUI. Despite facing a security incident in 2025, the team quickly patched vulnerabilities, recovered funds, and launched a compensation plan, becoming a model for security governance. After restarting, trading volume rapidly rebounded, with daily peaks exceeding $300 million and TVL stabilizing above $120 million, as Cetus builds critical infrastructure for Move ecosystem liquidity with high performance and composability.

•Navi: The first Sui-native one-stop liquidity protocol, integrating lending, liquid staking, automatic leverage, and isolated markets, with a TVL of $200 million and over 830,000 users in 2025. It launched a $10 million NAVX ecological fund to support incubation and deeply integrates with mainstream DEXs, providing underlying liquidity and clearing for DeFi projects.

OKX Ventures' investments are not isolated "points" but connect to form a "plane," creating a powerful ecological synergy. The DEXs it invests in provide clearing venues for lending protocols, while lending and LST protocols create new asset and liquidity sources for DEXs, collectively building a self-reinforcing DeFi closed loop. More importantly, OKX Ventures' contributions extend far beyond capital. As a top global crypto platform, the industry resources, market insights, and technical support it brings have greatly accelerated the product iteration, market promotion, and user acquisition of these early projects, thereby driving the maturity and prosperity of the entire SUI ecosystem. This "investment + empowerment" model is one of the key catalysts that enable the SUI ecosystem to stand out rapidly among numerous public chains.

At the same time, the investments made by the SUI Foundation and Mysten Labs at the infrastructure level have also established deep competitive barriers for the ecosystem. Mysten has raised over $300 million from 2023 to 2024 for SUI development. A significant portion of this funding has been directed towards the development of "thick infrastructure" such as Walrus, Seal, and Nautilus. This strategy differs from ecosystems like Solana that focus on terminal applications: SUI chooses to first address foundational shortcomings and then incentivize application innovation through grants and hackathons (for example, the 2024 Overflow hackathon attracted over 350 projects). The richness of the infrastructure also brings technical stickiness within the ecosystem: once developers become accustomed to and reliant on these unique services provided by SUI (such as Seal's secure storage and Nautilus's trusted computation), their willingness to migrate to other chains decreases, as other platforms may lack equivalent functionality or require rebuilding. Furthermore, this infrastructure enhances SUI's capacity to support emerging fields. For instance, the combination of Walrus and Seal gives SUI a unique advantage in supporting DApps that require privacy and massive data, while Nautilus may attract cutting-edge developers looking to implement AI inference and secure multi-party computation on-chain.

4. Value Positioning: From "Fastest L1" to "Programmable Internet Stack"

Over the past year, the public has often referred to Sui as a "high-performance parallel chain." However, at a recent event, Mysten Labs co-founder Evan Cheng provided a significantly more ambitious statement: "Blockchain is not just trading; Sui is a global coordination layer that weaves compute, liquidity, and data into the programmable foundation of the next generation of the internet."

The team aims to integrate traditional internet components—computing power, storage, identity, liquidity, and privacy computing—into a single native protocol stack, allowing each layer to be accessed and utilized by external applications. Six components (Sui mainnet, DeepBook, SuiNS, Walrus, Seal, Nautilus) are already operational on the mainnet or public testnets, all adopting open licenses or on-chain governance to host source code. They provide a new path: Sui's true differentiation lies not in single-point TPS but in "horizontal composability."

Currently, this infrastructure has entered the production phase. The Mysticeti consensus engine brings sub-second finality (P50 latency of about 0.39 seconds), with no congestion even during peak times; the DeepBook public matching layer has reduced matching latency to 390 milliseconds, with daily orders exceeding one million, accounting for over 40% of total chain transactions; in terms of identity layer, SuiNS has minted 280,000 domain names, and zkLogin has completed over 12 million social logins within three months, covering nearly one-third of daily active users; since the launch of the Walrus native storage mainnet, 580 TB of data has been written, with fragmentation utilization rising from 8% to nearly 12%; Seal provides secret management services for MPC/TSS, covering over 40 enterprise applications; Nautilus supports verifiable computation, allowing TEE inference results to be uploaded on-chain as Move objects, with seven AI projects currently in testing, three of which have disclosed a total fundraising of $17 million.

Based on these capabilities, Sui has opened multiple growth directions. The first is the migration of Web2 SaaS. The team has listed over 30 Web2 services, including Dropbox, GitHub, eBay, and YouTube, as potential cases that could be "rebuilt on top of Sui's six layers" in the future. Currently, non-financial interactions such as content distribution, social networking, and identity verification account for about 42% of the call frequency on the mainnet but contribute only 11% of the fees, indicating that a large number of "low gas high-frequency" Web2-SaaS transactions have begun migrating to the main chain. The B2B middleware that is still lacking around these applications (such as billing, permission management, content acceleration, DevOps registries) constitutes a high-uncertainty, high-odds new blank area—high business thresholds, substantial subsidy space, and enormous potential.

Another overlooked direction is offline networks and extreme scenarios. The Sui team is testing non-IP networks such as SMS, LoRa, HAM, satellites, and underwater acoustics, and is attempting to package transactions as "offline shards," aggregating them back to the chain through enclave-token and zero-latency zk-tunnel. This technological path targets real needs in weak network scenarios such as India, Southeast Asia, and post-disaster rescue, which are currently not covered by mainstream L1/Rollup. Once implemented, it will stimulate a batch of lightweight hardware/client entrepreneurial opportunities such as LoRa POS, SMS wallets, and zk-tunnel SDKs.

Moreover, in the blockchain × AI narrative, Sui does not emphasize "model on-chain," but instead focuses on "AI verifiability." Evan Cheng categorizes the combination of AI and blockchain into four quadrants, with Sui concentrating on enabling on-chain auditability of AI weights, inference logs, and data sources through Seal + Nautilus. This capability aligns more closely with regulatory and institutional needs. Currently, there are entrepreneurial projects that include "AI inference as a service + auditable ledger" in their pitch decks, with MechColony achieving a verifiable NPC behavior tree in just six weeks. The core value of such projects lies not in computing power, but in trust distribution—once Sui establishes a reputation in "trusted AI," downstream applications such as data markets, copyright distribution, and model NFTization will naturally converge.

In terms of technological progress, the Sui ecosystem is also continuously improving. Breakthroughs have been made in foundational consensus, protocol upgrades, development experience, and user tools. The protocol supports dynamic version control and on-chain/off-chain hot updates, allowing for multiple seamless upgrades, reducing hard forks, and enhancing stability. Mysticeti introduces a DAG asynchronous pipeline, achieving sub-second finality and a throughput capacity of 12,000 TPS; the Move language incorporates generic specialization, macro expansion, and debugging tools, significantly improving development efficiency; wallet integration with Phantom, Slush, and others optimizes user interaction experience and asset security. In terms of ecological philosophy, Sui emphasizes decentralization (broad resource distribution), composability (flexible module collaboration), and true ownership (users control data and identity), aiming to build a universal infrastructure that serves the large-scale implementation of Web3.

At the beginning of 2025, Sui achieved smooth upgrades across multiple networks through protocol version control and hot update mechanisms, enhancing network compatibility and consistency. After the deployment of the Mysticeti consensus engine, consensus latency was compressed to sub-second levels, maintaining stable throughput under high load. The Move language also completed upgrades such as generics and macro expansion, significantly optimizing the developer experience and user interaction processes in conjunction with wallet integration.

In terms of ecological components, the Sui ecosystem has built a full-stack architecture covering storage, encryption, and privacy computing through underlying protocols like Walrus, Seal, and Nautilus, significantly improving on-chain and off-chain data processing efficiency and data sovereignty. Among them, Walrus achieves low-cost, high-concurrency, and multi-chain compatibility in decentralized storage and data availability through its layered architecture and Red Stuff encoding, adapting to big data scenarios such as NFT, AI, and DeFi; Seal provides threshold encryption and programmable access control, promoting the implementation of on-chain privacy and digital rights management; Nautilus enables verifiable off-chain computation based on TEE, natively supports Move, and expands applications in AI inference, oracles, and blockchain games. Additionally, the Sui ecosystem gathers middleware and development tools such as SUIPlay, Move, DeepBook, zkLogin, and SUIBridge, forming a "decentralized full stack" covering modules for computing, communication, identity, payment, and security.

In terms of security governance, Sui has also demonstrated a rare ability to respond quickly. After the Cetus theft incident, Sui coordinated with the on-chain governance mechanism to freeze the hacker's address through validation nodes, recovering $162 million in assets and achieving "keyless transfers" for the first time. The foundation, in collaboration with project parties, provided a $30 million loan, combining recovered funds with a gradual token release compensation mechanism, resulting in a recovery rate for affected users of 85%-99%. Subsequently, Sui launched a $10 million security fund, promoted protocol open-sourcing, strengthened audit incentives, and optimized governance processes to enhance transparency and community participation. Although this has sparked discussions about the concentration of decentralized power, it undoubtedly showcases Sui's comprehensive capabilities and experimental spirit in crisis response and community governance.

These developments indicate that Sui is transitioning from the high-performance chain narrative of being the "fastest L1" to a higher positioning as a "programmable internet stack."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。