Technical performance is the key point at present, while economic design is the fundamental factor in creating lasting value.

Author: Saurabh Deshpande

Translation: Deep Tide TechFlow

Hello,

At the beginning of the year, I hinted that we would establish liquidity positions from the balance sheet. Over the past few weeks, we have been steadily building positions in Hyperliquid.

This aligns with our ongoing explorations of speed, profit margins, revenue, and business models. Saurabh's article today elaborates on our reasons for investing in Hyperliquid.

For the sake of disclosure, at the time of writing this article, we have not contacted anyone at Hyperliquid. No marketing managers were harmed in the writing of this article. We will continue to invest, co-build, and research the future of on-chain development markets. Our argument is that, given Hyperliquid's ability to attract venture capital, it will become a primary avenue for building applications in the coming months.

Long before the term "blockchain" emerged, merchants utilized a shared infrastructure known as the "Silk Road." Although this route had existed for centuries, it was considered dangerous and inefficient. Local warlords charged tolls, bandits attacked caravans, and merchants had to navigate dozens of different legal systems and currencies. Each trading post operated independently, hoarding information and charging fees based on market tolerance.

During the peaceful period of the Mongol Empire, Genghis Khan improved the business environment by unifying the fragmented Silk Road. Eastern European merchants could now travel to China without fear for their lives. Moreover, they could operate under a unified legal framework, use standardized measurements, and be protected by the same security forces. The Mongols established a system called “Yam” (Note: relay stations that provided food, shelter, and spare horses for Mongol army couriers). This was a relay network composed of way stations, horses, and sealed imperial tablets (Note: paiza, meaning "imperial tablet", was a plaque carried by Mongol officials and envoys to signify certain privileges and authority). This allowed merchants to cover greater distances and improved the transportation of goods.

Yams functioned like easily replicable nodes. They created network effects, making the entire system stronger with the addition of each new participant. The more merchants used the route, the higher the security, the more reliable the services, and the lower the costs for everyone. The Mongolian trade network lasted for centuries, achieving one of the greatest disseminations of knowledge, technology, and culture in the medieval world.

Humanity has always solved the problem of scaling commerce in this way: by building shared infrastructure that continuously enhances with each new participant. Later significant inventions were like derivatives of the Silk Road, helping us conduct business more efficiently. With the advent of steamships, telegraphs, and container ships, we reduced the cost of transporting goods by several basis points, bringing it closer to zero. Today, even in the realm of digital finance, value transfer relies on a network where fundamentals remain unchanged.

There is a simple truth in financial markets: capital needs to flow, and it needs to flow efficiently. Joel has already explored this in his book “Money Moves”. The blockchain world has been building a tech stack for years while largely neglecting this fundamental principle. Most DeFi protocols launch with great fanfare, attract some initial liquidity during the incentive period, and then watch as users and trading volume shift to the next hot project offering higher returns. This is a predictable pattern in the DeFi space.

Traditional finance is not inclusive for the masses. But those with access to channels can leverage them to increase profits. Behind the glass doors of banks and prime brokers, dollars are re-mortgaged across different trades. The same collateral is used for different positions. As a result, the utilization of the entire engine approaches 100%. But only a few institutions have access to these controls.

DeFi has opened these doors wide: anyone with a browser can borrow, swap, or hedge. But the cost of openness is that collateral is stranded. Isolated margin accounts, over-collateralized loans, and liquidity pools that cannot communicate with each other. In the chart below titled “Permissionless Markets vs. Capital Efficient Markets,” traditional markets sit in the lower right corner, DeFi lingers in the upper left corner, while the upper right corner remains empty. Hyperliquid's bet is to plant a flag in this blank space. This is important because if financial institutions are to use blockchain infrastructure, they will not do so simply because it offers permissionless access. They want a system that is as efficient as their existing systems. Without institutional-level adoption, cryptocurrency cannot unlock the next growth phase.

Our previous articles on Hyperliquid primarily focused on exchanges. This article will explore the Hyperliquid ecosystem and how it attempts to change the capital efficiency and liquidity of DeFi.

Hyperliquid's bet is that "less is more," and by reducing interference and unnecessary actions, wealth can accumulate and grow better. Moreover, crucially, it will bring its friends along. Hyperliquid does not aim to be a general-purpose computer or a metaverse theme park. It seeks to become the financial district of Manhattan, squeezed into a single matching engine.

The question is, can Hyperliquid turn the exchange into a gravity well of such density that capital cannot escape? The answer lies in two interwoven ideas: how fast the flow of value is and how difficult it is for value to escape.

Capital Transfer

First, blockchain is related to currency. This may sound obvious, but it is worth examining what "transferring funds" actually means in practice. The Silk Road succeeded because it made trade easier, faster, and safer than other methods. But it was not unique. Throughout history, many have accumulated wealth by controlling integrated infrastructure networks.

The Rothschild family is renowned in the financial services industry, but their fortune was built on a powerful information network in 19th-century Europe. While other financiers had to wait days to receive news via horses and ships, the Rothschilds used carrier pigeons, private messengers, and strategic telegraph investments to relay market intelligence within hours. The family later invested in railway construction across Europe, not for the transport revenue, but because railways were the arteries of 19th-century commerce. Controlling the railways meant controlling the economy.

J.P. Morgan in the United States employed a similar strategy. He financed railway construction and organized industries around the railways. He integrated competing rail lines into a comprehensive network, standardized gauges so that trains could genuinely connect, and eliminated redundant lines. When Andrew Carnegie needed to transport steel from Pittsburgh, he chose to ship it via Morgan's railways. When John D. Rockefeller needed to move oil from Pennsylvania to refineries, he opted to deal with Morgan's railway empire.

Morgan's true innovation lay in the vertical integration of the infrastructure itself. He controlled the steel companies that built the railways, the banks that financed the expansion, and the railways that transported goods. This became almost a circulatory system of American capitalism. By the time he completed all this, you could not transfer funds, materials, or information within the United States without paying a fee to Morgan at some point in the chain.

Any chain that enables capital to flow smoothly between its various parts has an inherent advantage.

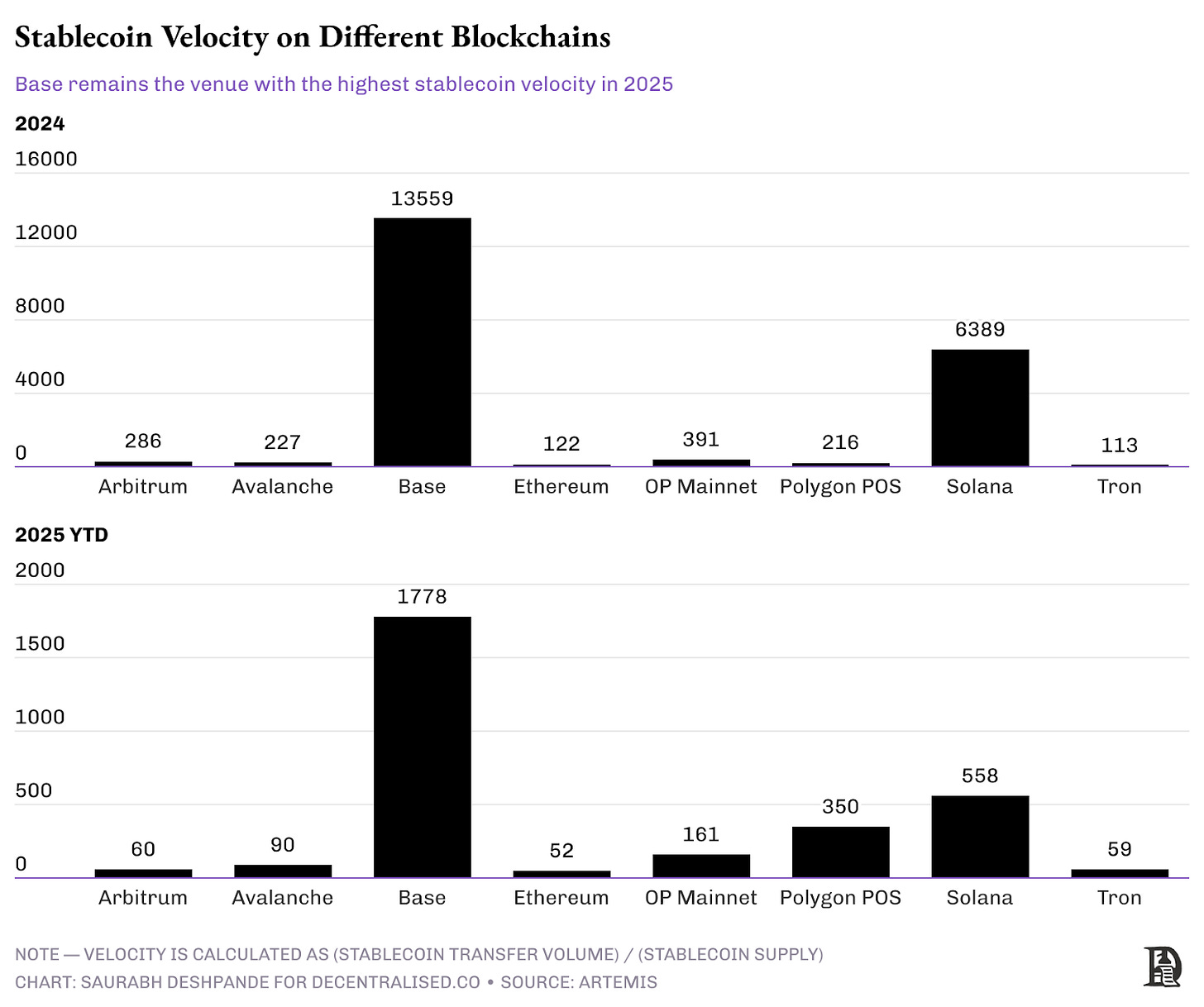

Stablecoins have become a killer application for cryptocurrency. As of June 22, Ethereum, Solana, and Tron have transferred $12.2 trillion in stablecoins in 2025. Major blockchains have found their niche in the way stablecoins are transferred. Tron has become the dominant network for payments in emerging markets, while Ethereum handles larger institutional transfers, and Solana excels in high-frequency, small-value transactions.

Solana became the preferred platform for memecoin trading in 2024. This is reflected in the speed of stablecoin transactions on Solana. With a stablecoin supply of only $1.8 billion, it settled $11.5 trillion in stablecoin transactions. In other words, each stablecoin was traded over 6,300 times. With the rise of AI agents, trading activity on Base has also surged. Due to the lower supply, the trading speed of stablecoins in 2024 was excessively high. However, Base was the only chain that settled more stablecoins in the selection. In 2025, the number of stablecoin transactions on Base exceeded 1,700.

These numbers indicate that when fees approach zero, the behavior of money changes. On Ethereum, when the cost of a transaction is $10, small traders are less likely to regularly invest $50 or $100. But on Solana, we often see this situation, where fees are below a cent. Exchanges, liquidity providers, and MEV extractors make money through fees and slippage. Validators profit from bribes from MEV extractors. You are not making high profits on small trades; you are making slim profits on massive trading volumes. When friction disappears, speed is everything.

On-chain activities can be divided into two parts—high-value activities (such as Ethereum, due to its high liquidity) and low-value but high-frequency activities (such as Base and Solana). Is it possible for both types of activities to coexist on a single chain? Hyperliquid's approach is intriguing. Its ecosystem is not optimized for a specific type of capital flow but provides infrastructure for all types of capital flows.

The Hyperliquid ecosystem consists of two parts.

Hyperliquid DEX is powered by HyperCore, which is a native L1 order book system, and

HyperEVM is a high-performance blockchain based on EVM built by the Hyperliquid team.

While both are building blocks, the precompiled and builder code serve as the distribution mechanism.

Precompiled contracts are specialized smart contracts that connect HyperEVM and HyperCore, enabling seamless data access and execution across environments. These contracts allow developers to directly access trading data, such as perpetual contract positions, spot balances, value rights, oracle prices, and staking delegations.

Builder code on Hyperliquid acts as a recommended identifier that developers can use when building applications or tools on the platform. When users interact with Hyperliquid through a developer's application (such as a trading bot or interface), the developer's builder code will earn rewards. This allows them to earn a share of the trading fees generated by users. This creates a direct profit pathway for developers building valuable tools and applications within the Hyperliquid ecosystem.

Improving Capital Efficiency

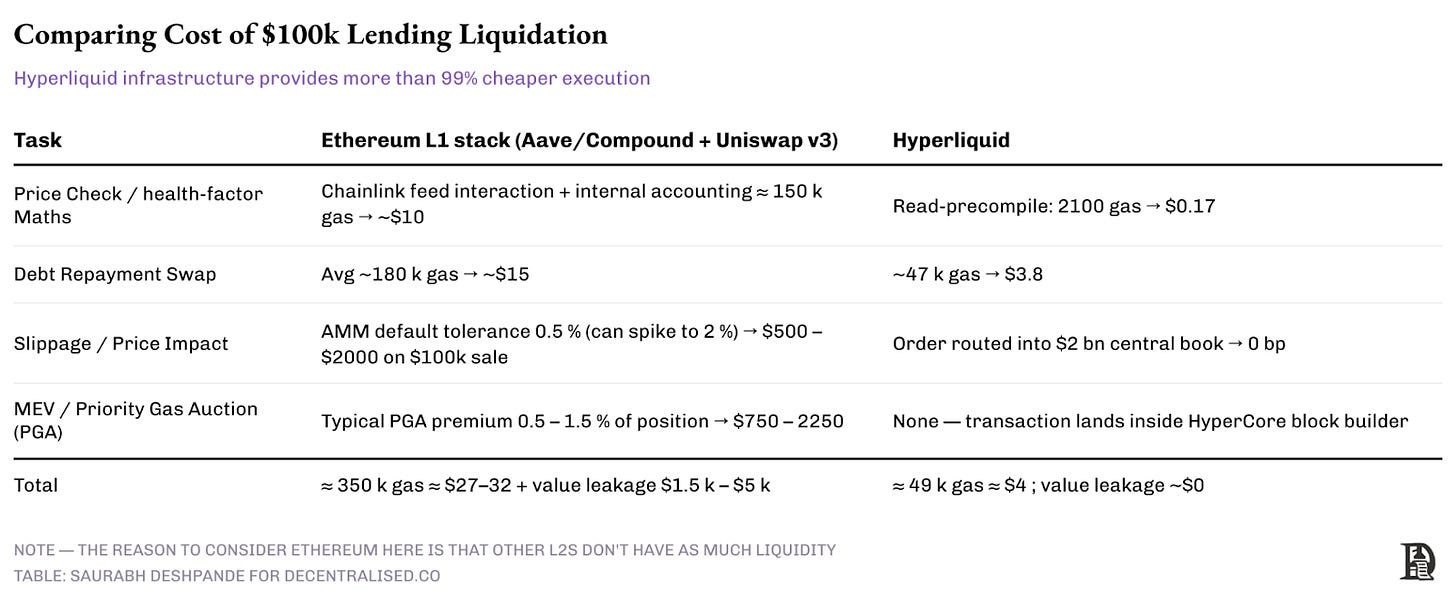

Traditional DeFi lending protocols are extremely inefficient in managing collateral positions. On Ethereum-based platforms like Compound or Aave, liquidating a $100,000 USDC loan backed by $150,000 worth of ETH requires multiple costly operations:

Oracle price calls consume 80,000 gas ($10-30),

External DEX swap costs 150,000 gas ($15-50), and

Slippage losses due to AMM mechanisms range from 0.5-2% ($500-2000)

Front-running liquidators extracting MEV can add about 1% in value loss, typically resulting in a total inefficiency of $500-3,000 per liquidation.

Hyperliquid's precompiled features eliminate these inefficiencies by directly integrating the order book. Lending smart contracts can read prices directly from the HyperCore order book using the read precompiled function and send liquidation orders directly through the system contract HyperEVM. The same $100,000 liquidation scenario only requires 2,100 gas to obtain price data and 47,000 gas to execute. This significantly reduces costs compared to traditional Ethereum-based protocols while eliminating slippage by accessing over $2 billion in order book liquidity.

As a result, liquidating $100,000 through a lending application on Ethereum costs about $27, plus value leakage through MEV (around $15,000), while on Hyperliquid, it costs less than $5.

Protocolized Liquidation

Precompiled support enables protocolized liquidation, where lending protocols implement an automatic liquidation mechanism similar to the perpetual contract system on HyperCore.

In traditional finance, when you are unable to meet a margin call, your broker will immediately sell your stocks at market price. This is convenient and does not result in any value loss, as they can directly access deep markets.

In most DeFi protocols, the situation is more complex. When your loan encounters issues, the protocol must find someone willing to liquidate you and hope they can sell your collateral across multiple exchanges without incurring too much slippage. It's like having to sell your house through a series of intermediaries instead of directly on the market.

Hyperliquid operates more like traditional finance. When your collateral drops too low, the smart contract will sell it directly into a deep order book that handles billions of dollars in daily transactions. Your position will be closed at a fair market price without needing to find someone to take over your loan and leak value.

This architecture improves capital efficiency at the protocol level. Traditional DeFi protocols maintain separate liquidity reserves, typically offering a loan-to-value (LTV) ratio of 75% due to execution risks. A hyper-liquid lending protocol can eliminate buffers and offer LTV ratios above 90% because liquidations are executed with deep liquidity guaranteed. This allows users to deploy capital 20-25% more efficiently while maintaining the same risk profile. Ultimately, this creates a unified liquidity layer that provides institutional-level execution capabilities to every DeFi protocol, with complete transparency and composability.

Liquidity as a Moat

Liquidity is the lifeblood of financial applications. If your product is great but lacks liquidity, it is not considered a product. In traditional DeFi applications, liquidity is mostly a zero-sum game. DeFi is somewhat composable, but we have not truly unified liquidity. When one platform has liquidity, others lack it.

Blockchains like Ethereum face a problem: when Aave needs to liquidate a large position, it must split it into multiple blocks (which reduces gas efficiency) to obtain liquidity from different platforms, or it risks incurring slippage losses. As mentioned earlier, for a $100,000 liquidation, Ethereum often ends up paying $1,000 to different intermediaries. This forces projects to integrate with multiple external DEXs, increasing complexity, gas costs, and execution risks, while still failing to guarantee optimal pricing.

On the surface, this is just a liquidity problem. But it spills over and occupies the team's scarce resources. Ultimately, poor execution is detrimental to the protocol. Therefore, founders end up spending their valuable time on activities that are not core to their business. If you are a lending protocol, one of your core goals is to increase the scale of loans. Of course, how to liquidate bad debts is also important. But if there is a better way to access large liquidity pools, it means you do not have to worry about finding the optimal way to liquidate risk positions; you can spend your time on growth rather than maintenance.

New protocols often launch with minimal liquidity, creating a "chicken or egg" problem where traders avoid the platform due to poor execution, which in turn prevents liquidity providers from earning deserved fees.

Looking back at how our traditional financial system solved these problems often makes sense. Exchanges like London, New York, and Mumbai ultimately prevailed because everyone traded there. At that time, there were no L2s to segment users, nor the liquidity brought by L2s. The network effects in finance are particularly strong because they have a compounding effect: more participants mean better prices, which attract more participants, ultimately creating better prices.

Hyperliquid is addressing this issue by strengthening liquidity collaboration. Do you believe your application can bring liquidity and benefit from it?

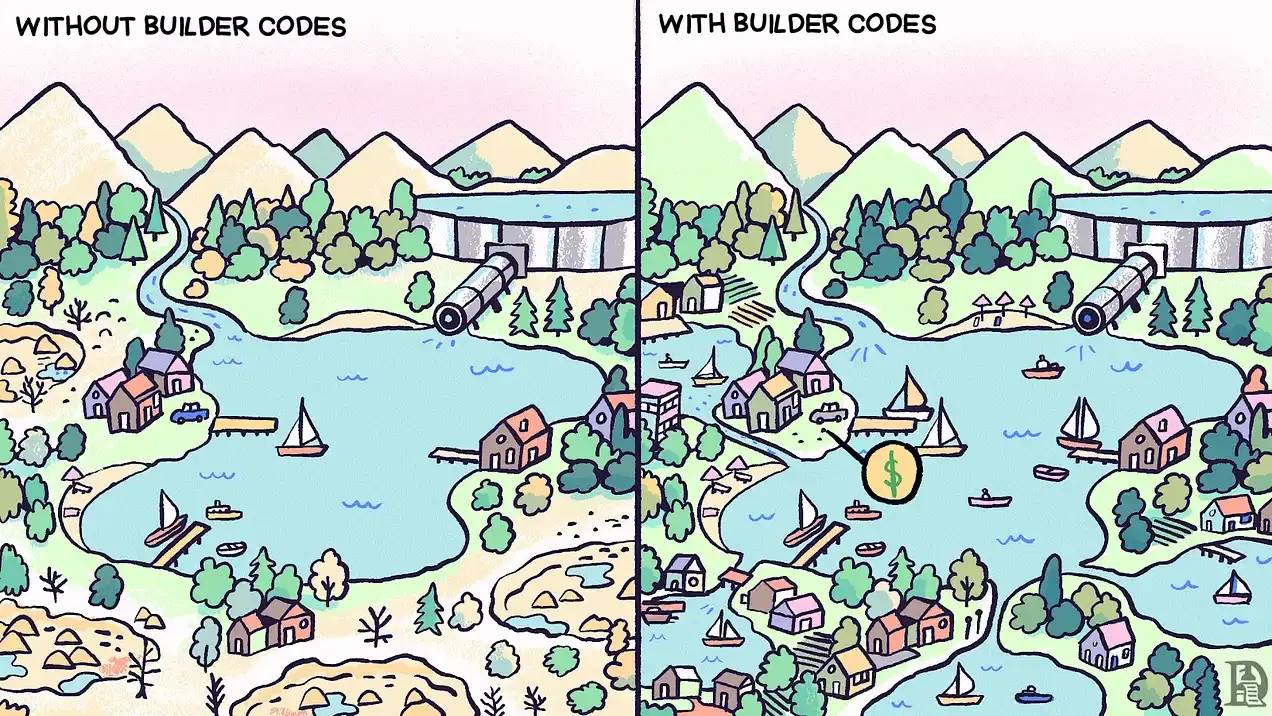

Hyperliquid's builder code is a permissionless fee-sharing mechanism that allows DeFi developers to earn from the transactions executed by their applications. They aim to solve this problem by allowing all applications to access the same unified liquidity pool of over $2 billion, avoiding fragmentation. Hyperliquid is not only one of the most liquid exchanges in the DeFi space but also in the cryptocurrency space. All projects built on HyperEVM can easily leverage this liquidity.

Applications built using builder code do not compete for liquidity; instead, they contribute to and benefit from the shared liquidity layer. When users trade through any builder code application, they access the same deep order book as the Hyperliquid core exchange. This applies to mobile wallets, trading bots, and complex DeFi protocols alike.

This architecture means that newly launched lending protocols do not need to build liquidity themselves or integrate with multiple external decentralized exchanges (DEXs). Lending smart contracts can use the precompiled mechanism to read prices directly from the HyperCore order book and send liquidation orders directly through system contracts, instantly obtaining institutional-level liquidity depth. The protocol benefits from the same liquidity that serves billions of transactions daily, ensuring efficient liquidations regardless of the protocol's establishment time or scale.

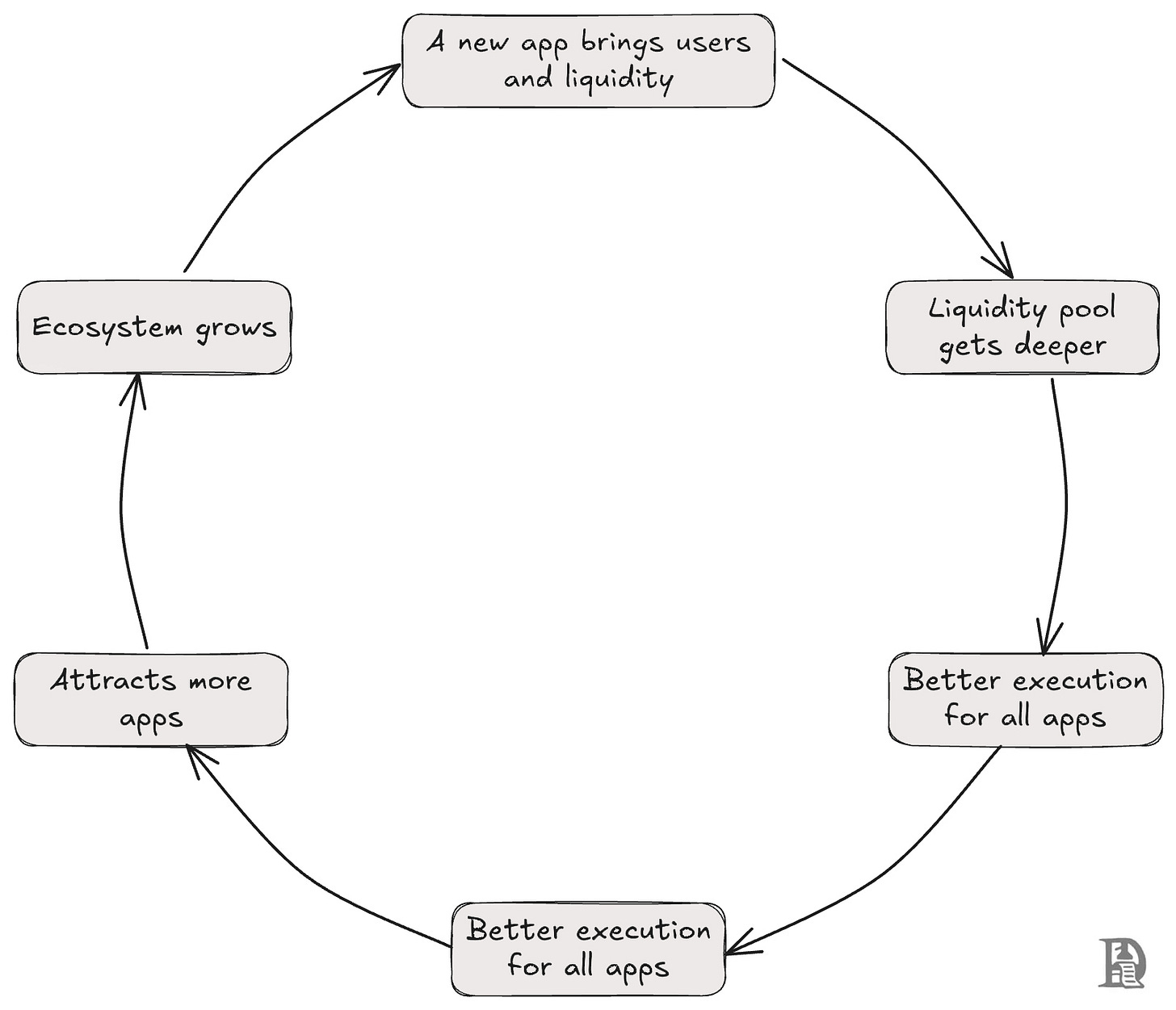

Builder Code Network Effects

In most DeFi ecosystems, new applications are like new restaurants opening on the same street. They compete for the same customer base, dividing the existing pie. On Ethereum or Solana, when a new DEX launches, it must persuade users and liquidity providers to leave Uniswap or Raydium. This is a zero-sum game: the gains of one application are the losses of another.

Builder code completely disrupts this. Every new application on Hyperliquid actually enhances the entire ecosystem, just like adding a store to a shopping mall. When a new trading bot launches and brings in 1,000 active users, these users increase the trading volume for HyperCore's liquidity pool (which all other applications use). The larger the trading volume, the better prices everyone can obtain. The stronger the execution of the lending protocol, the smaller the spreads on derivatives platforms, and even competing trading bots can benefit from deeper liquidity.

This is a positive-sum game because as the shared infrastructure becomes stronger, everyone wins. Instead of competing for a fixed share, each new participant contributes to a larger pie for others.

Now that liquidity can be achieved with just a few lines of code, the quality of applications becomes even more important.

This dynamic has reversed the traditional state of liquidity fragmentation in DeFi. These protocols no longer launch with empty order books or extremely low AMM liquidity; instead, they immediately inherit the execution quality of the entire Hyperliquid ecosystem. Derivatives trading applications launched today can offer the same low spreads and deep liquidity as mature protocols, thereby eliminating the typical entry barriers faced by existing platforms.

The unified liquidity model also enables complex cross-protocol interactions that were previously unattainable. Decentralized hedge funds can execute complex multi-asset strategies across different builder code applications while maintaining consistent execution quality, as all trades ultimately settle based on the same order book.

This reminds me of how every factory used to be half a power plant. Due to transportation limitations, electricity could only be produced within the factory. Factories had to install steam engines, constantly feeding coal into the boilers day and night, while intricate belts were pulled to massive overhead drive shafts. A significant portion of the workforce spent their days adding coal, tightening pulleys, and lubricating bearings. These tasks could only maintain the factory's lighting but did nothing to enhance the quality of the products on the production line.

Then came the public alternating current grid and small electric motors. Factories could now purchase kilowatt-hours of electricity just like buying water. Maintenance staff were reduced; workshop layouts became flexible; management's focus shifted from "maintaining boiler pressure" to "how to double production?"

The role of builder code is similar. It frees developers from the constraints of acquiring and managing liquidity. They can prioritize user experience and focus on building applications with outstanding experiences.

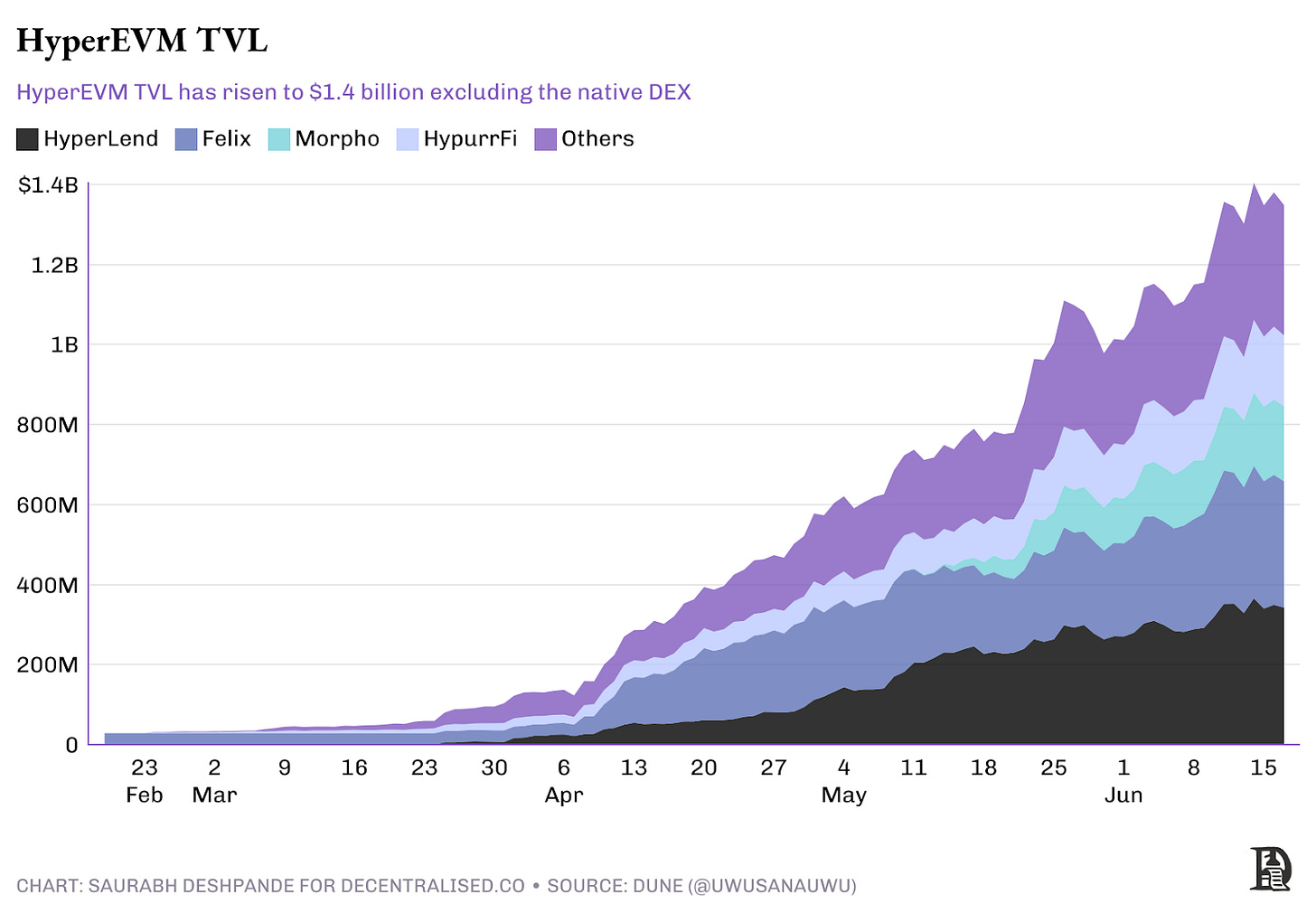

HyperEVM Ecosystem

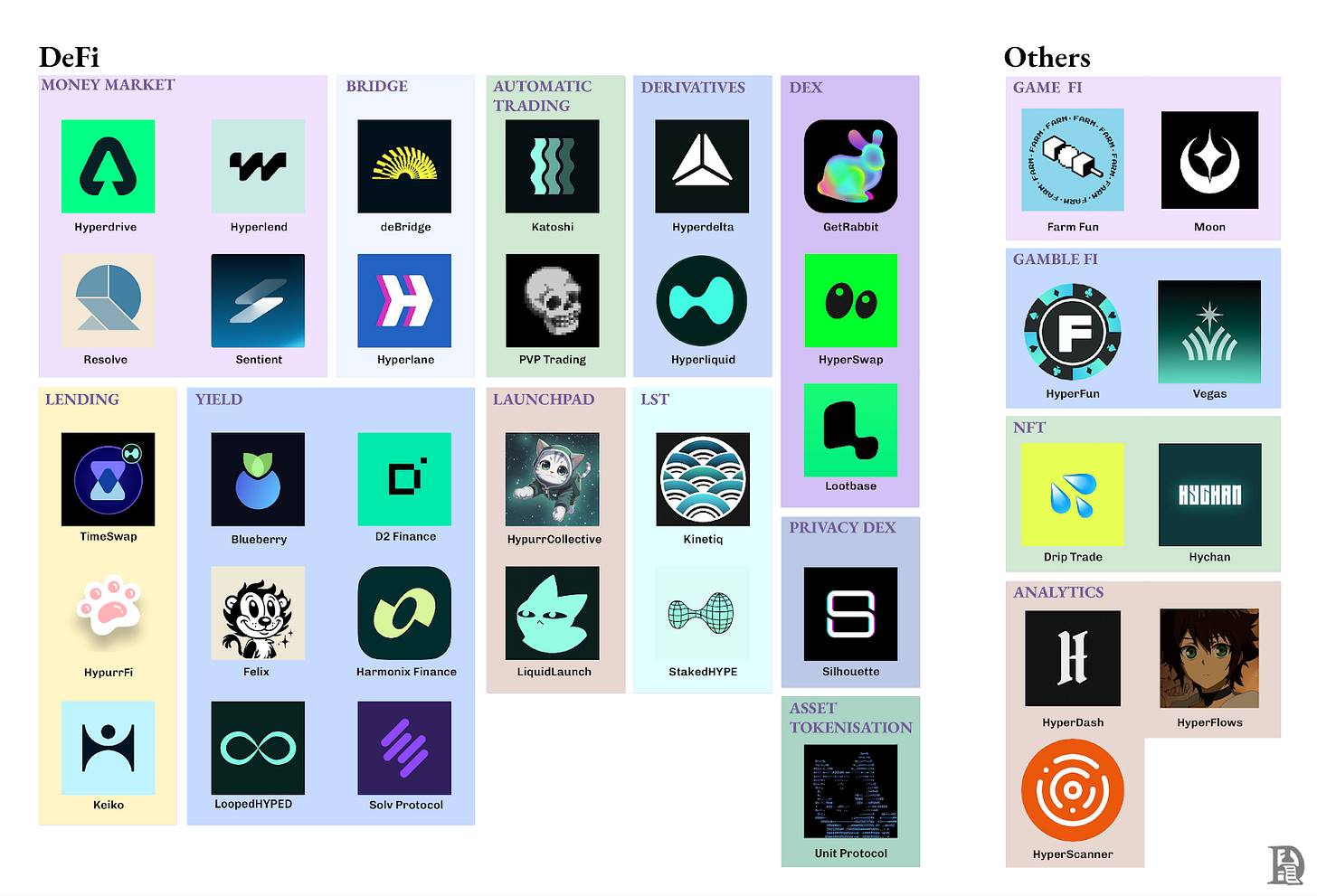

The HyperEVM ecosystem has rapidly evolved into a comprehensive DeFi infrastructure with a total value exceeding $1.5 billion, encompassing over 100 projects. HyperEVM employs the same HyperBFT consensus mechanism as HyperCore, allowing direct interaction with spot and perpetual contracts through precompiled and system contracts. HyperEVM | Hyperliquid Documentation. This unique architecture enables protocols to build complex financial applications that leverage the liquidity of the native order book while maintaining full compatibility with EVM.

Image: Note—this market map is not exhaustive.

The projects range widely, from lending markets to liquid staking to synthetic assets. But they all benefit from the same unified liquidity layer. Applications from different industries are being built on Hyperliquid.

Lending and Money Markets:

HyperLend ($470 million TVL) — A primary lending protocol that directly accesses order book liquidity for instant, efficient liquidations.

HypurrFi ($319 million TVL) — A leveraged lending market and home to the USDXL stablecoin, backed by U.S. Treasury bonds.

Unit Protocol — Introduces BTC, ETH, and SOL as uBTC, uETH, etc., into Hyperliquid's bridging layer.

Felix Protocol - A multi-collateral stablecoin (feUSD) that reduces reliance on external stablecoins.

Exchanges:

- HyperSwap and KittenSwap — AMM-based DEXs that handle $75 million in daily trading volume, unlike major exchanges, they still need to guide their own liquidity.

Liquid Staking:

StakedHYPE - Simple liquid staking, stHYPE automatically compounds rewards.

Kinetiq - An intelligent validator selection system that automatically delegates to the highest-performing validators.

LoopedHYPE - Automatically leverages staking yield through 3x to 15x leverage, with potential annualized returns exceeding 10%.

The rapid growth of the ecosystem indicates that eliminating liquidity guidance friction will yield significant benefits. With the launch of protocols and the convenience of instant access to deep liquidity, the total locked value (TVL) of HyperEVM has steadily climbed to $1.5 billion.

What Does All This Mean?

I believe Hyperliquid has four distinct advantages.

First, of course, is instant access to deep liquidity while reducing execution risk. Launching on Hyperliquid means immediate access to a powerful liquidity pool that services billions in daily transactions. This eliminates the typical cold-start liquidity challenges that plague new protocols. Additionally, direct access to unified liquidity can significantly reduce execution risks such as slippage and MEV extraction, ensuring that trades are smoother and safer from the outset.

The second is permanent fee sharing. Builder code embeds a permanent fee-sharing mechanism into every transaction, providing a sustainable economic model. This ensures that protocols can continuously earn revenue proportional to the actual value they create, rather than relying on temporary incentives or unsustainable liquidity mining schemes.

The third is focus on development. Developers can freely allocate their energy and resources to creating higher-quality products and optimizing user experiences. They no longer need to invest significant time, money, or effort in maintaining liquidity incentives, managing liquidity pools, or negotiating with partners to sustain liquidity.

BasedApp exemplifies this. They did not spend months building trading infrastructure from scratch; instead, they focused on what users truly want: "holding, trading, and using cryptocurrency in the real world." After launching their mobile application, they can fully access Hyperliquid's liquidity for perpetual contract trading, combined with their established Visa card infrastructure for real-world spending. As founder Edison Lim stated, they can focus on creating "the operating system for on-chain finance" rather than solving liquidity guidance issues.

Finally, cross-protocol synergies. Each new protocol enhances the shared liquidity ecosystem, creating a virtuous cycle where increased activity attracts more participants and further deepens the liquidity pool. This interconnected approach can create lasting network effects, benefiting all participants and ensuring the continued growth of the entire ecosystem.

Most ecosystem building follows similar strategies: providing funding to developers and organizing hackathons. While these methods are valuable, they overlook the fundamental issue. The real friction lies in the ongoing competition for liquidity, not in a lack of funds or ideas. Every new protocol must secure its liquidity through connections and then compete against profit-driven capital when incentives fail. Builder code completely disrupts this burden. Once integrated, you inherit a $2 billion order book and earn a share of fees based on the traffic you generate. Teams like Lootbase can focus their energy on the product without worrying about fragmented liquidity provider (LP) incentive mechanisms.

For developers, this creates a fundamentally different value proposition. On other chains, you might receive $50,000 in funding to build a DEX, but then spend six months convincing market makers to provide liquidity and waste a lot of time on incentives. On Hyperliquid, you can access over $2 billion in order book liquidity from day one. Your success depends on building an excellent product, not on your ability to persuade venture capital firms to fund liquidity mining.

Hyperliquid will face competition from new chains like MegaETH and Monad, which are set to launch with impressive technical specifications. Whether these new chains can match Hyperliquid's shared liquidity and capital efficiency approach remains to be seen. Technical performance is a key point right now, while economic design is the fundamental factor in creating lasting value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。