According to community voting, the support rate for the WLFI tradable proposal exceeds 99.9%, while KERNEL's maximum increase exceeds 30%. What is the connection between the two projects?

Written by: Nicky, ForesightNews

On July 10, the official page of the Trump family crypto project World Liberty Financial (WLFI) showed that the community voting for its token transferability proposal has entered the final stage — with a support rate of 99.93% and an opposition rate of only 0.07%. The voting will end on July 17. If the proposal passes, WLFI will officially launch "transferability."

On May 28 of this year, WLFI announced its integration with Kernel DAO for its USD1, making it a re-stakable asset. The core of this collaboration is to upgrade stablecoins from traditional "static lending tools" to "dynamic infrastructure supporters." For WLFI, this means its stablecoin can provide economic security for third-party applications; for Kernel DAO, it is a key opportunity to validate the feasibility of its re-staking model.

As a result of this news, KERNEL saw a maximum increase of over 23% on the same day, subsequently dropping from $0.206 to $0.999 by June 22. As of the time of writing, KERNEL's price has retraced from the post-increase $0.146 to around $0.115, highlighting the need for caution regarding investment risks.

WLFI×Kernel DAO: The "Third-Party Security Empowerment" Experiment of USD1

WLFI's USD1 stablecoin previously existed mainly as a circulating medium within its ecosystem. According to WLFI's official description, the integration with Kernel DAO allows users to stake USD1 into the Kernel network, making it a "re-stakable asset" — this portion of the asset can not only provide economic security for applications within the Kernel ecosystem but also earn Kernel points as rewards.

The essence of this mechanism is to transform stablecoins from "idle assets in a liquidity pool" into "energy units that support decentralized infrastructure." In traditional lending models, the yield from stablecoins mainly comes from borrowing demand (annual yield of about 2% - 4%), and funds are locked with a single purpose; however, through Kernel DAO, the yield source of USD1 expands to support various infrastructures such as Rollup sequencers, decentralized oracles, and data availability networks. The operation of these infrastructures requires stable funding support, so users holding USD1 effectively become "distributed security nodes," with yields dynamically adjusted according to demand.

For users, the appeal of re-staking lies in "yield upgrades" and "function expansion." The re-staked USD1 maintains high liquidity: users can deposit it into stablecoin pools on platforms like Curve to earn additional yields or use it as collateral for lending, structured products, and other strategies. This means that USD1's "working mode" has upgraded from "single power supply" to "multi-line collaboration," supporting network operations while providing users with staking yields.

Kernel DAO: Infrastructure Service Provider for Cross-Chain Re-Staking

To understand why WLFI chose to collaborate with Kernel DAO, it is essential to clarify what Kernel DAO is.

Kernel DAO is a DeFi protocol focused on re-staking technology, with the core goal of activating the utility of existing assets through a "re-staking" model. "Re-staking" refers to users reinvesting already staked assets (such as stablecoins) into decentralized networks while supporting multiple protocols or infrastructures, thereby breaking through the limitations of traditional staking, which involves "asset locking and single yield."

Kernel DAO's business covers multiple public chains, with core products including:

- Kernel: A cross-chain re-staking protocol running on BNB Chain, allowing users to stake assets like BNB and BUSD, which are then algorithmically allocated to different decentralized validator networks (DVNs), providing security for infrastructures such as Rollup sequencers, oracles, and data availability networks;

- Kelp: A liquidity re-staking protocol on Ethereum, focusing on releasing the liquidity of staked assets within the Ethereum ecosystem, allowing users to earn additional yields through re-staking LP (liquidity pool) tokens;

- Gain: A RWA tokenization yield protocol that transforms traditional financial assets like real estate and corporate bonds into on-chain yields through compliance methods, promoting the connection between DeFi and the real economy.

These three products are governed by the KERNEL token, with early supporters and ecosystem participants able to earn incentives through staking or contributions. Currently, the KERNEL token has been listed on major exchanges such as Binance, Coinbase, Upbit (BTC/USDT trading pair), and Bithumb (Korean won trading pair).

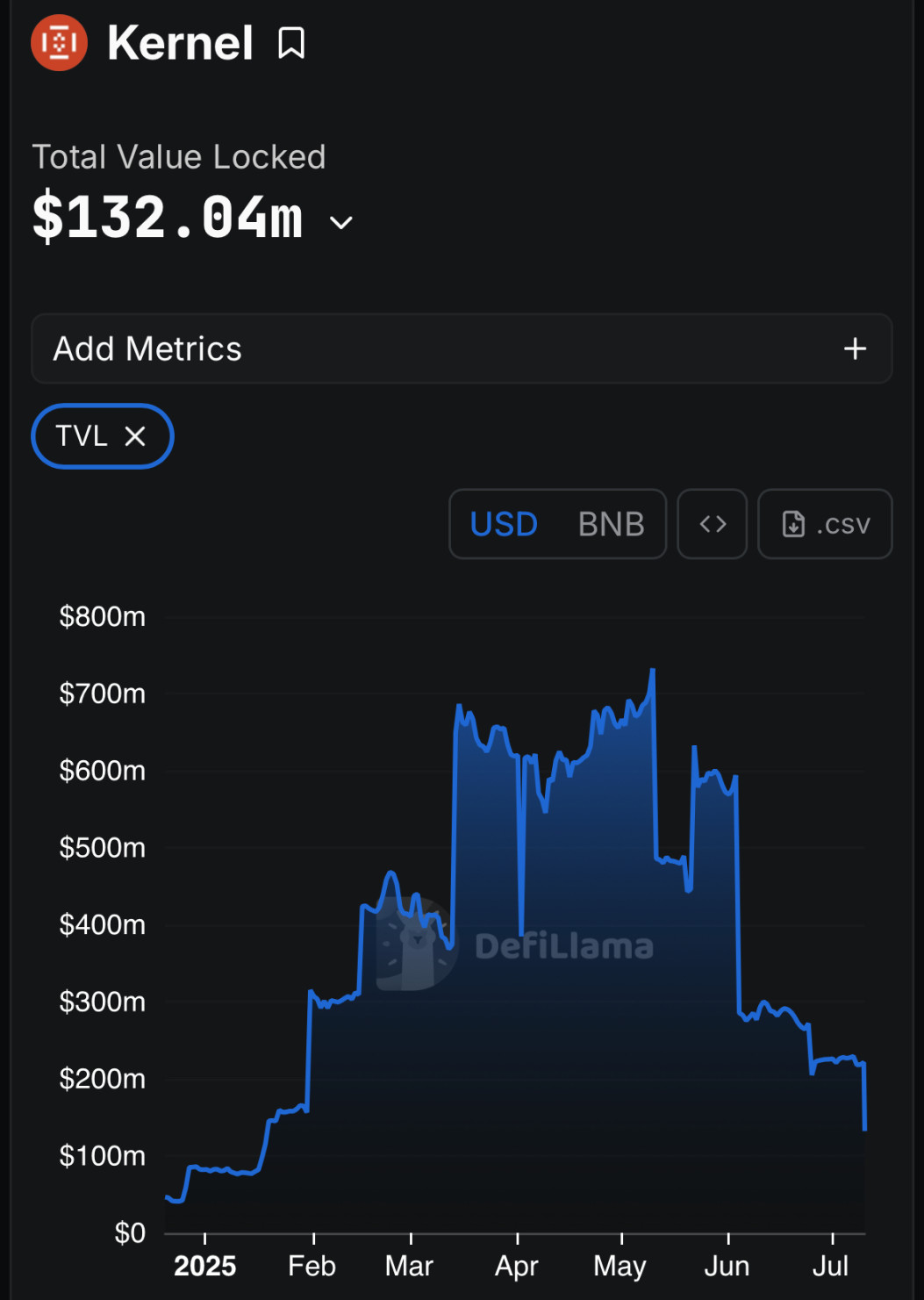

According to DefiLlama data, as of July 10, 2025, the total locked value (TVL) of Kernel DAO reached $1.47 billion, with Kernel's TVL at approximately $132 million.

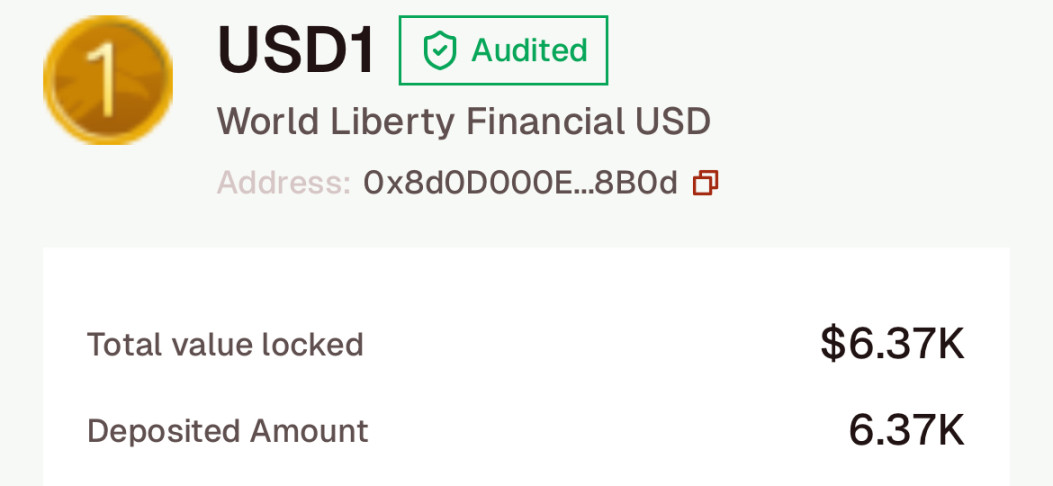

Current Status and Potential: The "Early Stage" Characteristics Behind $6,370

Although the collaboration between WLFI and Kernel DAO is seen as an experiment in "stablecoin re-staking," the current data still appears immature. According to Kernel's official website, as of today, the total re-staking amount of USD1 in Kernel is only $6,370. This figure is almost negligible against Kernel DAO's total locked value (TVL) of $1.47 billion and Kernel's TVL of $132 million.

However, a "small base" also signifies growth potential. From an industry trend perspective, the re-staking model for stablecoins is on the rise: the low yields of traditional lending (3% APY) contrast sharply with the high yields of re-staking (approximately 5% APY, which can exceed 10% when combined with liquidity strategies), leading more users to pay attention to the new paradigm of "allowing stablecoins to participate in infrastructure support."

If WLFI's community vote passes smoothly, the "re-staking entry" for USD1 will be further opened, encouraging more users to shift from "holding" to "participating." Perhaps in the future, WLFI will also join the ranks of re-staking, injecting incremental funds into Kernel DAO.

Conclusion: The "Second Curve" Experiment of Stablecoins

The collaboration between WLFI and Kernel DAO is not only an upgrade of a single stablecoin's functionality but also a re-empowerment of the stablecoin's value, with its value dimensions being redefined. The value of traditional stablecoins remains at "transaction medium" or "value storage," while the re-staking model allows them to become "co-builders of infrastructure" — this may represent the "second curve" of stablecoins.

For investors, the story of Kernel DAO is just beginning: the $6,370 re-staking amount is a starting point rather than an endpoint. With WLFI's push, its growth potential is worth paying attention to. Of course, risks also exist — re-staking relies on the stability of the infrastructure, and if validator nodes fail or smart contracts have vulnerabilities, it could impact yields or even the safety of the principal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。