Original Author: ChandlerZ, Foresight News

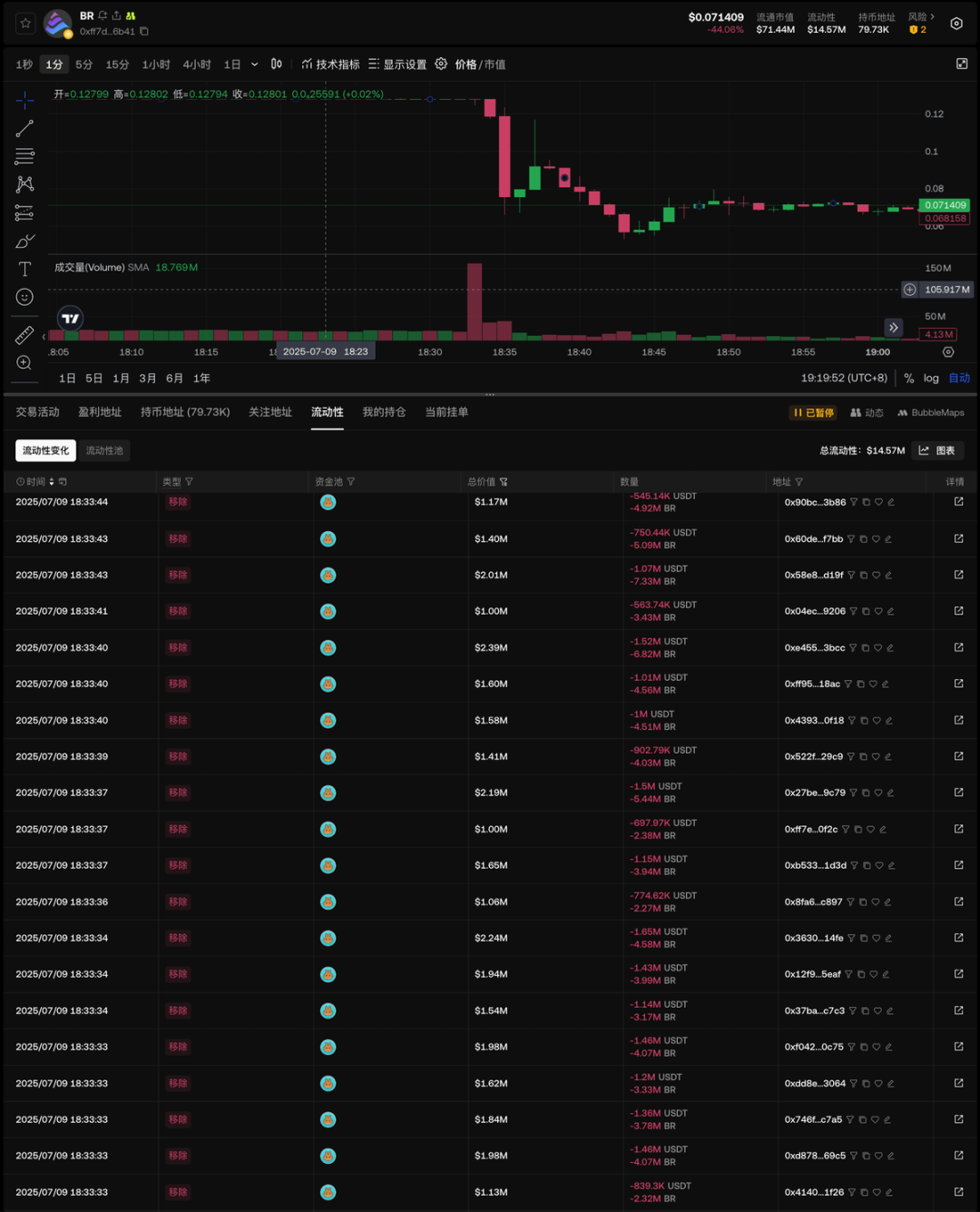

On July 9, Binance's Alpha project experienced a familiar flash crash. In less than 10 minutes, the star token BR in the recent Binance Alpha project plummeted from a high of 0.129 USDT to 0.053 USDT, instantly halving its price.

The process of the crash can be described as "clean and swift." According to @ai_9684xtpa's monitoring, the liquidity section of OKX showed that before the flash crash occurred, the liquidity of BR's trading pool remained stable at a high level, exceeding 60 million dollars at one point. However, the outbreak of the event concentrated within a mere 100 seconds, during which 26 addresses almost simultaneously withdrew 47.59 million dollars in liquidity. Following that, 16 addresses initiated large token sell-offs, including 3 addresses at the million-dollar level and 13 addresses at the 500,000-dollar level, with centralized selling pressure instantly breaking through liquidity, causing the price of BR to plummet, leaving only 14.56 million dollars in liquidity.

Here are the TOP 5 main addresses involved in the sell-off:

0x00E0E2225E48e40ac7A1C5C48C3359325C7F41c3

0x20c375580C4BD0DA36aec0c55406fa645F964FBd

0x63293340bb17D9bc0f66f1956a810f7BFC7c857B

0x58e837F8F9C1aCfE618AdbBa95314BE2ab55d19F

0x31A256E01900f93831361dF928EB32F83A6Af40E

Who is behind the sell-off?

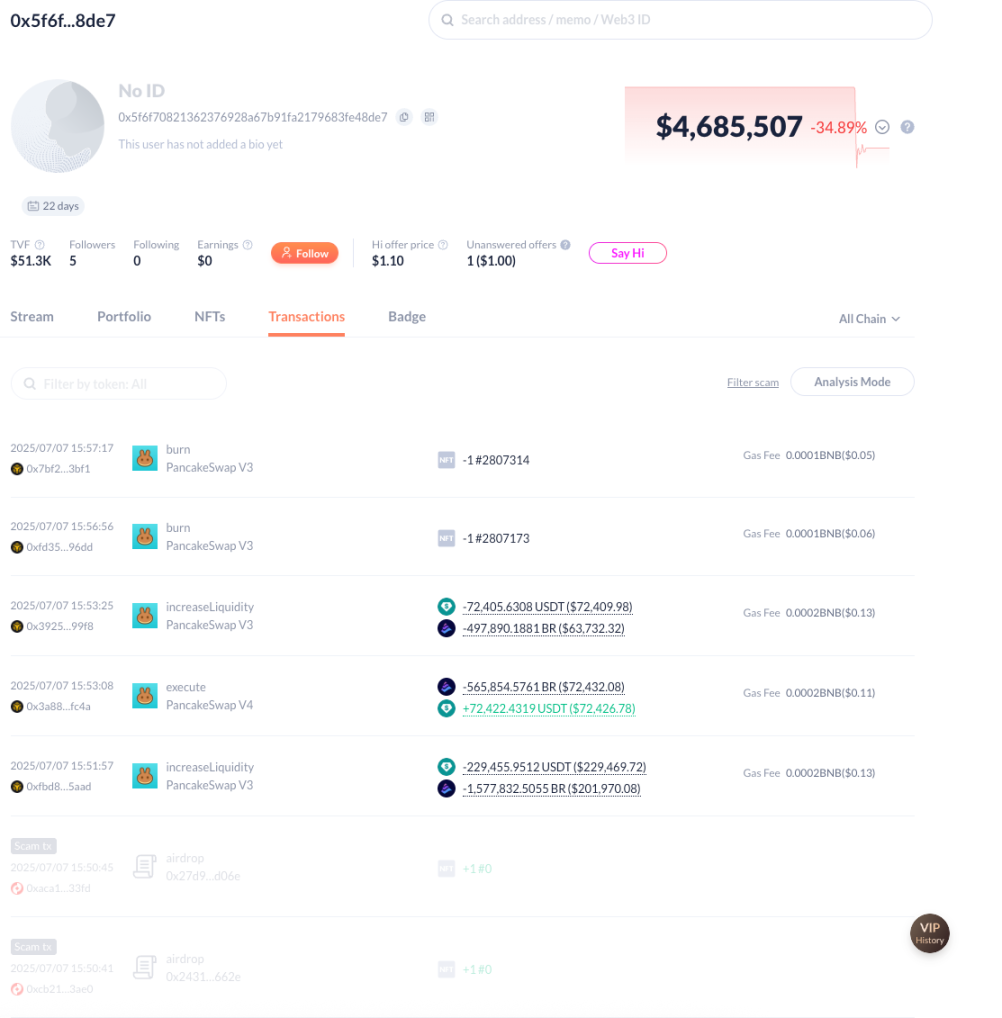

Analysis suggests that this sell-off does not appear to be the actions of the project team. Firstly, regarding motivation, given the previous ZKJ crash, such blatant actions seem too "obvious." This wave of large-scale trading is more likely aimed at entering a contract/spot market; secondly, regarding data, the main liquidity address of the project team, 0x5f6f70821362376928a67b91fa2179683fe48de7, still holds 4.685 million dollars in liquidity, with the last operation occurring on July 7, showing no activity during the crash.

The three main addresses involved in the million-dollar level sell-off were all newly created addresses from two weeks ago, which began accumulating large amounts of BR directly after withdrawing funds from exchanges between June 24 and June 28, indicating a clear intent and a single source of funds.

The TOP 4 sell-off address, 0x58e837F8F9C1aCfE618AdbBa95314BE2ab55d19F, has relatively more information, with its funds traceable back to 2017, having interacted with established exchanges like Yunbi/Zhongbi/Liqui/YoBit, making it a definite OG.

The methods used are not much different from the last ZKJ crash, involving "instant withdrawal of liquidity + large sell-off + multi-address cooperation." However, it is quite challenging to investigate, as the main addresses have very singular sources of funds.

Lessons from the ZKJ flash crash

In fact, such operations have long been traceable. The ZKJ flash crash can be seen as a precursor to BR's recent plunge. Just under a month ago, on June 15, the ZKJ token also experienced a rapid decline of over 80%. According to a preliminary investigation report released by Polyhedra afterward, the ZKJ flash crash originated from multiple addresses coordinating to withdraw large amounts of liquidity from PancakeSwap V3 and then quickly selling off. This on-chain selling pressure directly triggered the liquidation mechanism on centralized exchanges, compounded by Wintermute transferring 3.39 million ZKJ to CEX in a very short time, further exacerbating market panic, ultimately leading to nearly 94 million dollars in forced liquidations. More notably, the ZKJ flash crash also occurred under the Binance Alpha incentive mechanism, creating a market structure with highly concentrated and unprotected liquidity. These highly similar characteristics almost overlap with the entire chain of the BR flash crash.

Currently, the BR project team states that they have not withdrawn liquidity and have made liquidity addresses public, assuring users that they will not withdraw liquidity in the future and urging users to remain rational. They also pointed out that to further support users trading in the PancakeSwap BR/USDT trading pool, they will provide a special airdrop plan for PancakeSwap BR/USDT traders. During periods of significant price fluctuations, if users experience noticeable price differences due to market volatility or slippage, they will be eligible for airdrop compensation. The specific rules and distribution plan for the airdrop will be announced and completed in the coming days.

Although the project team may not have "personally intervened," the inherent issues with the mechanism are hard to overlook. BR is one of the "score-boosting" tokens in the Binance Alpha project, where the project team attracts retail investors to provide liquidity to participate in Alpha activity point competitions through volume manipulation.

On June 25, on-chain data showed that BR had become the token with the highest trading volume in the Binance Alpha project, with a 24-hour trading volume of 238 million dollars. A suspected main address of Bedrock's official LP, starting with 0x9bd, has net invested 50 million BR (about 4 million dollars) since June 19 to provide liquidity, including selling 41.436 million tokens on-chain at an average price of 0.07959 dollars just 5 hours ago, worth 3.298 million dollars. Subsequently, this address added 9.27 million BR and 3.427 million USDT as bilateral liquidity to Pancake, generating 5,412 dollars in fees within five hours.

Concerns over Binance Alpha's liquidity mechanism

The community's reaction to such events is becoming increasingly intense. Crypto OG @BroLeonAus quickly pointed out after the BR crash that the risks of this "volume manipulation + liquidity absorption" model have long been evident. As early as when BR and projects like AB were still in their early stages, behaviors such as linear candlesticks, low trading fees, and continuous guidance for liquidity to join were observed, exhibiting typical "score-boosting and liquidity absorption" tendencies. Now that both have shown signs of flash crashes almost simultaneously, it seems prophetic.

In his view, the current point calculation rules adopted by the Binance Alpha mechanism have obvious flaws, indirectly encouraging project teams to create superficial activity to gain platform exposure and rewards. Under this design, it is sufficient to create an illusion of "deep liquidity, stable trends, and low fees" on-chain to attract a large number of retail investors as LPs, leading to liquidity accumulation. The project team only needs to "bait" and wait; once conditions are ripe, they can quickly withdraw liquidity and realize profits, leaving ordinary users as the last holders.

BroLeon revealed that last week, the Bedrock team had communicated with him regarding promotional cooperation, and he explicitly proposed risk control suggestions, requesting third-party locking of project team liquidity to ensure user safety. However, the other party did not provide a clear response, and cooperation could not proceed. He emphasized that while there is currently no conclusive evidence indicating that the BR project team directly participated in this sell-off, the greater responsibility lies with the Binance wallet team, which ignored the significant risks and loopholes in this rule.

The platform originally intended to benefit retail investors, but the actual situation has turned into the project team exploiting the mechanism's loopholes to harvest retail investors, which in turn has triggered negative sentiment towards the platform. This outcome clearly contradicts the original intention. In the current DeFi market, any incentive mechanism that cannot constrain its boundaries from being abused can become a "cash machine" for speculators. Alpha was once seen as Binance's positive exploration of the on-chain liquidity ecosystem, aiming to use platform incentives to encourage more users to participate in on-chain trading, increasing token activity and dispersion.

However, it now appears that the original design intent of this model has gradually been distorted. The incentive mechanism is not linked to locking or real liquidity, leading to rampant volume manipulation; project teams or short-term arbitrageurs can induce the market to create a facade of prosperity without bearing much cost, ultimately completing a harvest in a state of lack of scrutiny and constraints. Without reform, relying solely on post-event compensation or explanations is unlikely to prevent the next "flash crash" from occurring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。