Tokenization of US Stocks: It's Not "Moving On-Chain," But "Planting in the Heart."

Written by: Daii

The excitement around USD stablecoins has not yet subsided, and the wave of US stock tokenization has quietly emerged.

While you are still amazed that Apple stocks can also be bought on-chain, the American financial system has already subtly embedded itself into your wallet.

Tokenized US stocks may seem like just a new technical trend: 24/7 availability, low barriers to entry, divisible, and combinable. But what you truly gain is far more than these conveniences. You have acquired a complete set of "financial operating systems" honed over the years, led by the SEC and practiced on Wall Street—regulatory logic, compliance standards, and information disclosure systems, all embedded in the code behind these on-chain tokens.

Stablecoins export US dollar credit, while US stock tokenization exports the American regulatory system itself.

You no longer need a US identity, nor do you need to open an account on NASDAQ; with just a wallet address and a USDC, you can buy AAPLx or TSLAx at three in the morning. However, enjoying this "global liquidity dividend" also means that global capital increasingly operates under rules set by the US.

This is not a conspiracy; it is an overt strategy.

On the surface, US stock tokenization is a technological innovation; in essence, it is an institutional export. It appears to be an open market, but in reality, it uses "regulatory compliance" as a banner and "trustworthy transparency" as bait to siphon attention, asset flow, and the redistribution of financial sovereignty globally.

This is an expansion without war, a global credit conquest completed in the name of compliance.

1. Tokenized Assets: Turning US Stocks into Global "Programmable Assets"

What is US stock tokenization? Simply put, it is the process of packaging the rights to the earnings, dividends, and even some governance rights of US stocks into tokens issued on-chain through a special purpose vehicle (SPV) or custodian using blockchain technology.

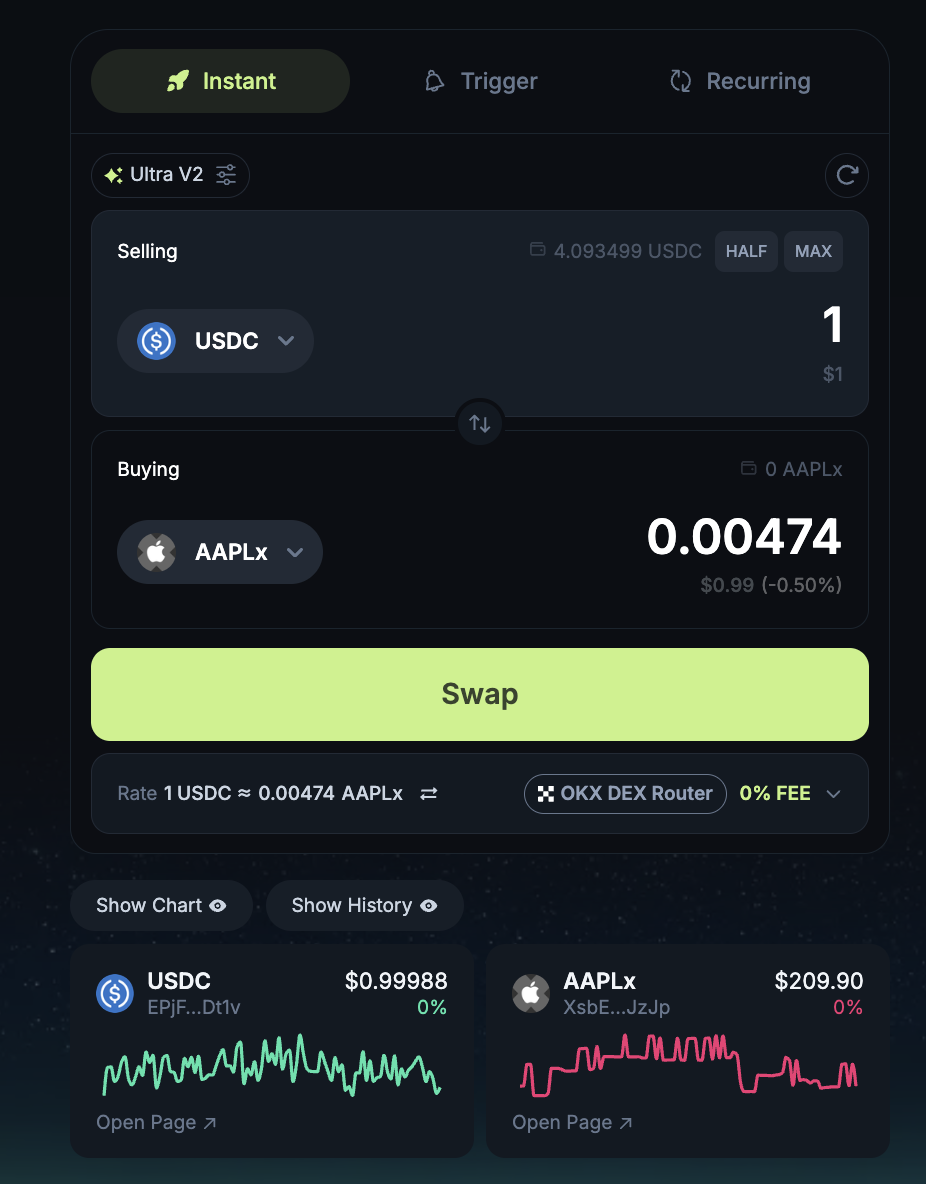

Specifically, you can now buy 0.0047 shares of APPLx with 1 USDC on Jupiter. APPLx is the tokenized representation of Apple Inc. stock on the Solana blockchain, corresponding to the Apple shares held on your behalf by the SPV custodian in the real world.

The generation process of this APPLx (Tokenized Apple Stock) token is actually a combination mechanism of cross-border compliance and technical mapping, covering three stages: traditional finance, digital asset custody, and blockchain issuance. The overall process is as follows:

Real-World Share Acquisition: First, Backed Finance AG, headquartered in Switzerland and registered as a digital asset service provider with the Swiss Financial Market Supervisory Authority (FINMA), purchases a certain number of Apple (Apple Inc., AAPL) common shares on the NASDAQ public market through its partner brokers, such as Interactive Brokers LLC or other licensed brokers in the US.

Custody and SPV Structuring: The acquired AAPL shares are not held by Backed itself but are fully deposited under a regulated third-party financial institution (usually SIX Digital Exchange Custody or an equivalent custodian) and held by a specially established SPV entity. This SPV entity is typically registered in Liechtenstein or Zug, Switzerland, has an independent legal status, and its sole responsibility is to "hold and map shares," without engaging in any other business activities to ensure asset isolation and legal clarity.

Legal Structuring & Claim Rights: Backed Finance will issue detailed legal disclosure documents for each type of token (e.g., ISIN mapping, token terms, prospectus under Liechtenstein TVTG/Blockchain Act), ensuring that token holders have economic rights to the underlying assets but do not directly possess traditional shareholder rights such as voting rights. These documents are generally publicly archived on Backed's official website or compliance disclosure platforms (such as DACS or Swiss Prospectus Register) for regulatory review and investor access.

Token Minting on Solana: Under the above compliance framework, Backed Finance will mint APPLx tokens on the Solana blockchain at a 1:1 ratio based on the number of custodied assets, with each token representing one share of actual Apple stock. These tokens are typically implemented using smart contract standards (such as SPL Token) and are initially distributed under the control of Backed's on-chain multi-signature wallet. Token holders receive APPLx through DeFi wallets (such as Phantom) without needing to open a NASDAQ account or provide US tax documents like W-8BEN.

On-chain Circulation & Redemption: APPLx can be traded, split, staked, and provided liquidity (LP) on Solana ecosystem platforms such as Jupiter Aggregator, Meteora, and Marinade Finance. If users wish to redeem for real stocks (usually limited to qualified investors), they must submit KYC documents and go through Backed's redemption process, with the SPV instructing brokers to transfer the actual shares.

This is a structure of "real stocks → SPV custody → legal mapping → on-chain tokens," emphasizing the authenticity, compliance, and traceability of the assets. Although holders are not "shareholders" in the traditional sense, they gain rights to stock earnings through trust structures and contractual agreements, anchoring the value of the traditional market in the blockchain world.

What does this mean?

Although you are only buying a token on the blockchain, the governance logic behind it is indeed defined by the US legal system.

In other words, on-chain tokens have become a "coded" expression of traditional US stock governance rules.

2. Why US Stocks?

Some may ask, since tokenization is a global technological innovation, why are European stocks, Hong Kong stocks, or even Chinese A-shares not leading the way?

The market has never prohibited the tokenization of stocks from other countries, especially since blockchain is decentralized. The only reason US stocks can become the pioneers of tokenization is that they have enough appeal; many people want to buy them.

So, why do US stocks have such great appeal?

It boils down to two words: "transparency."

Transparency is the most scarce resource in the modern financial system. The reason US stocks can form a "high premium + strong consensus" among global investors is not sentiment but a complete set of extremely transparent regulatory systems.

Of course, the high transparency of the US stock market is not innate but guaranteed by a whole set of legal rules.

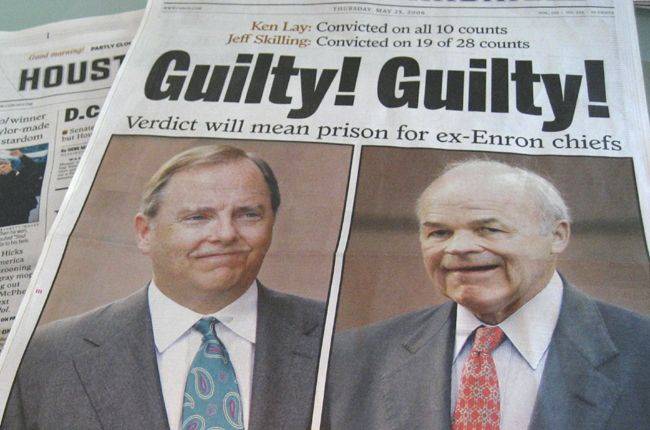

Take the Sarbanes–Oxley Act (SOX) in the US as an example; it is a "ironclad" law introduced in 2002 after the Enron scandal, which clearly stipulates:

The CEO and CFO of publicly traded companies must personally sign off on the financial figures in the annual report,

Once financial fraud is discovered, management will face criminal liability and even imprisonment.

Such a system greatly raises the responsibility threshold for corporate governance. Compared to the phenomenon of "high valuation + fake financial reports + no consequences" in some Asian markets, the credibility of US financial reports has become its most compelling selling point.

Furthermore, the US Securities and Exchange Commission (SEC) requires all publicly traded companies to publish a 10-Q report quarterly and a 10-K report annually, covering core data such as revenue, costs, shareholder structure, and risk disclosures.

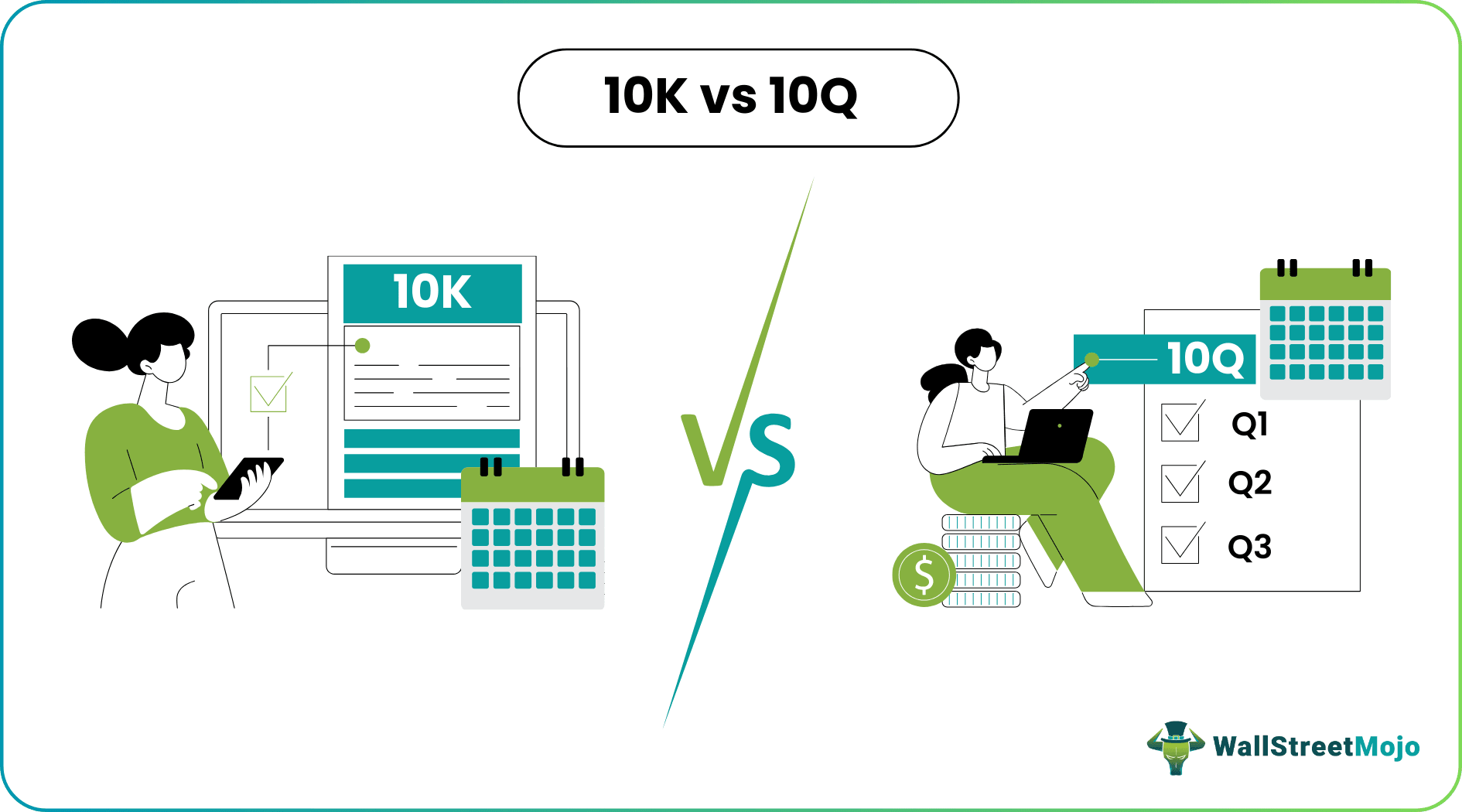

Let’s briefly explain the 10-Q and 10-K reports. These report names sound like some kind of code, but they actually originate from the numbering naming system in US securities regulations.

📘 What is a 10-K?

The "10" in "10-K" indicates that it belongs to the form numbering system established by the SEC (Form 10 series), while "K" is the classification code specifically for annual reports.

This name first appeared in the implementation rules of the Securities Exchange Act of 1934, where the SEC requires publicly traded companies to submit a "Form 10-K" report annually to disclose the company's overall operating, financial, and compliance status for the previous fiscal year.

Therefore, "10-K" actually means "Form 10 - K category usage," which has conventionally become the official code for US stock annual reports.

📗 What is a 10-Q?

Similarly, "10-Q" is the one specifically for quarterly reports (Quarterly Report) in the "10 series forms." Here, "Q" is an abbreviation for "Quarterly." Publicly traded companies in the US must submit three 10-Q reports each year, covering the first, second, and third quarters (the fourth quarter is included in the 10-K annual report).

Compared to the 10-K, the format of the 10-Q is slightly lighter, but it still needs to follow the financial structure and disclosure elements clearly specified by the SEC, ensuring that investors can make timely judgments about the company's short-term operational changes.

Thus, the naming of 10-K and 10-Q itself reflects the rigor and standardization of the US securities regulatory system. Each report can be accessed in the SEC's EDGAR system (https://www.sec.gov/edgar.shtml), which has also become one of the technical and institutional cornerstones for building "the highest transparency in the world" in the US stock market.

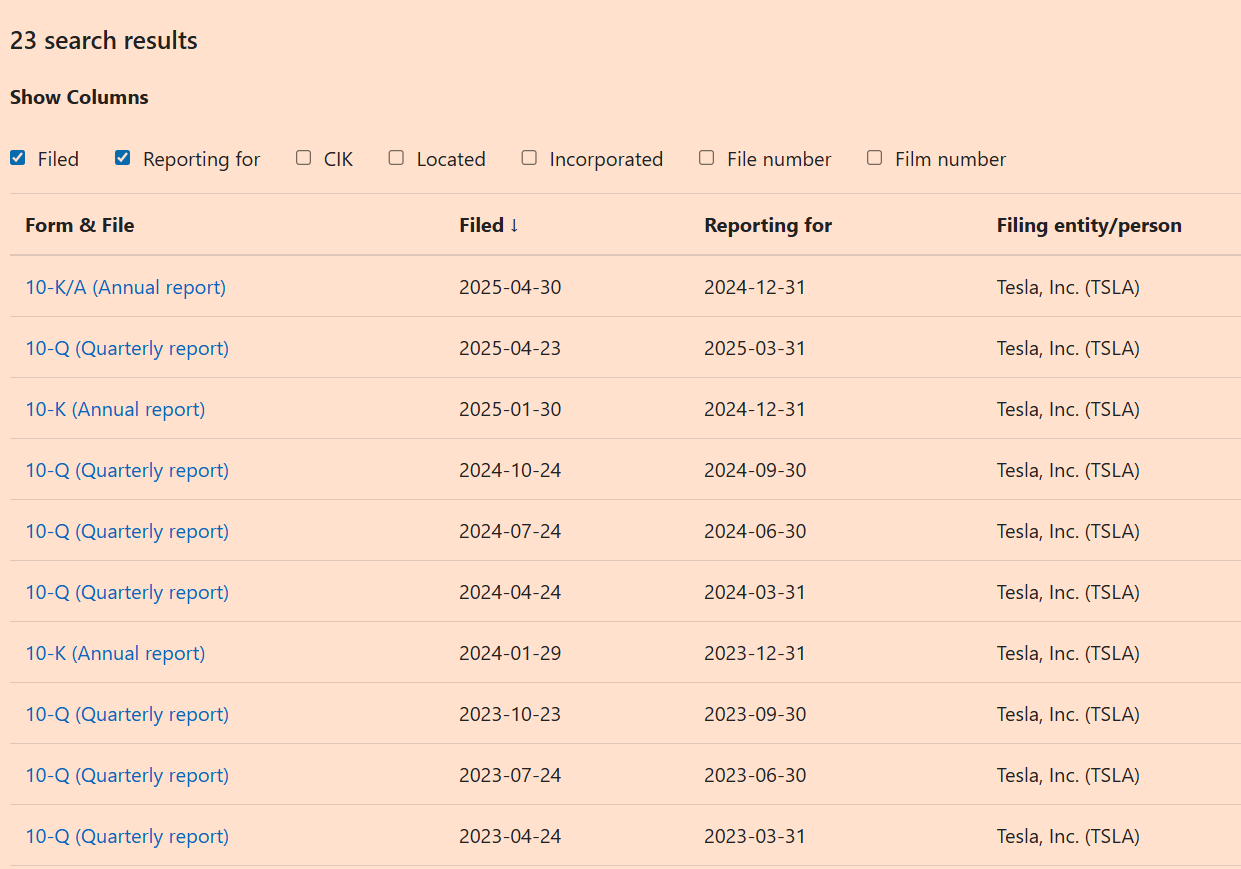

For example, you can view all the latest 10-K and 10-Q reports for TSLA through this link.

The underlying trust built by this information disclosure is exactly what the on-chain world craves.

Now, through tokenization, this "institutional transparency" of US stocks is being packaged into the blockchain world in the form of "code templates," allowing global users to enjoy the benefits of American regulation without needing to have a US identity.

3. The "Value Engine" of US Stock Tokenization = Regulatory Dividend + Liquidity Dividend

If the global circulation of USD stablecoins is the US central bank's "anchoring trust" output project, then the rise of US stock tokenization resembles a self-fulfilling prophecy driven by market demand and feedback on regulatory trust.

The regulatory dividend of US stocks lies in providing the "credibility" of assets; the liquidity dividend of the crypto market further releases the "accessibility" of US stocks in the global market. These two aspects are highly coupled through US stock tokenization—one supported by compliance and the other driven by technology, with both being mutually causal and reshaping the fundamental logic of global asset allocation.

3.1 Liquidity Dividend: Breaking Time and Space Constraints, US Stocks Open Around the Clock

In traditional securities markets, trading hours have always been a natural limitation. The trading hours for US stocks are Monday to Friday, from 9:30 AM to 4:00 PM Eastern Time, which translates to the late-night hours in Asia. Ordinary Asian users wishing to invest in popular stocks like Tesla, Nvidia, and Microsoft often face constraints due to time differences, account thresholds, and even cross-border regulations.

However, everything changed after tokenization.

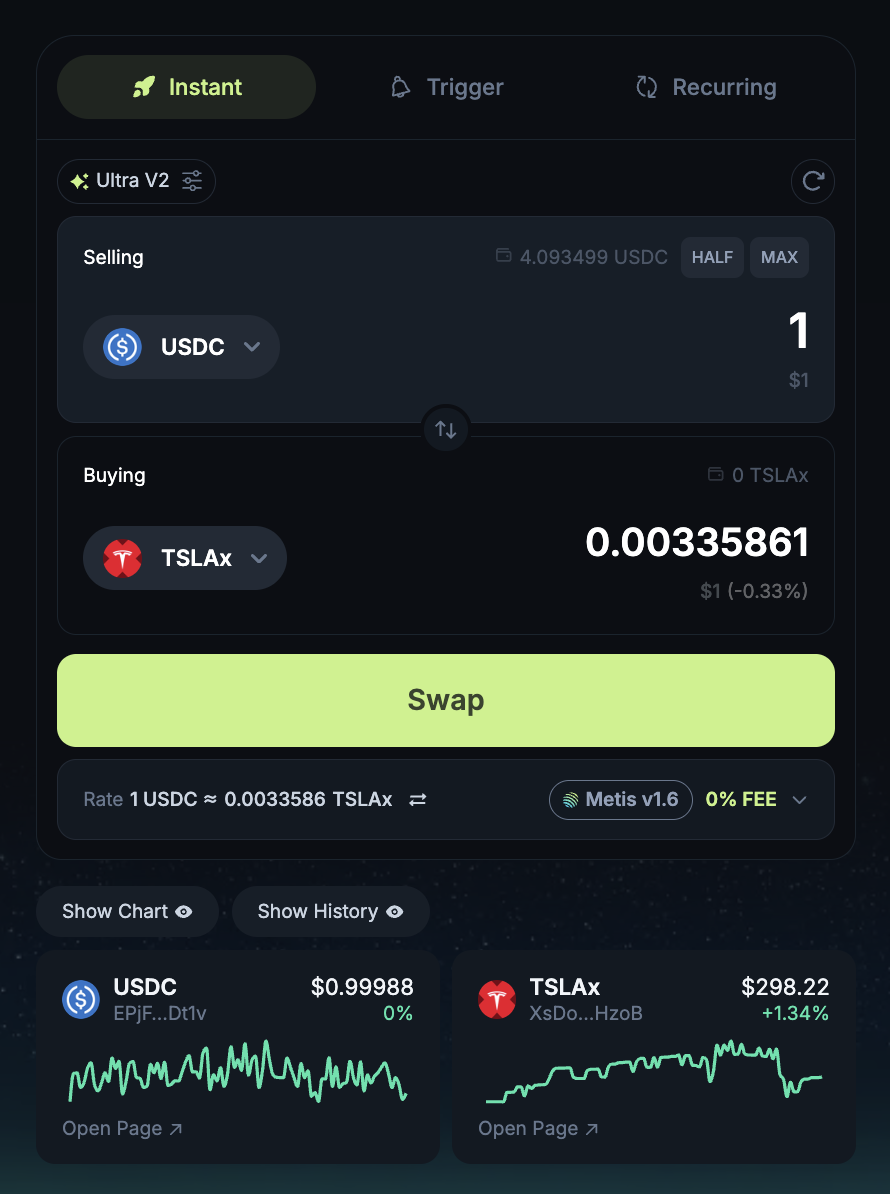

For example, on the Jupiter decentralized exchange on the Solana chain, users can now buy and sell tokenized US stocks like TSLAx and AAPLx at any time using USDC, without any time, geographical, or identity restrictions. The trading of these tokens follows the AMM automated market-making logic, operating 24/7 without the need to wait for market opening, match counterparties, or undergo account verification.

On-chain, "US stocks never close" is no longer just a slogan; it is a real experience.

3.2 Fragmented Ownership: Breaking High Barriers, Amplifying Participation

The minimum trading unit for traditional stocks is "one share," which is particularly significant for high-priced assets. For example, at the end of 2024, one share of Amazon (AMZN) costs over $150, and one share of Berkshire Hathaway Class A exceeds $500,000. For most small retail investors, these are almost unattainable investment targets.

Tokenization makes these assets "programmable" and "divisible."

Tokenized US stocks like TSLAx and AAPLx can be traded in precise units of 0.0001, allowing users to hold "0.001 stock tokens of Tesla" with just $1 of USDC. This highly fragmentable structure, combined with the global circulation capability of stablecoins, opens up investment opportunities for billions of users worldwide who have never engaged with US stocks.

This is not just about convenience; it is about democratizing participation rights. Asset allocation no longer relies on intermediaries and account qualifications but solely on whether you have an on-chain wallet.

3.3 DeFi Integration: From "Investment Products" to "Callable Asset Components"

The significance of US stock tokenization lies not only in "being purchasable on-chain" but more importantly, in opening the imaginative boundaries of real assets for DeFi—

On-chain, these stock tokens are no longer just "underlying assets" but "callable asset components": they can circulate, combine, and nest within various smart contracts, gradually integrating into the financial Lego system of the DeFi world.

Currently, tokenized US stocks like AAPLx and TSLAx have gained initial liquidity support on the Solana chain and can be traded 24/7 on DEXs like Raydium. This also means you can provide liquidity for TSLAx here and earn transaction fees.

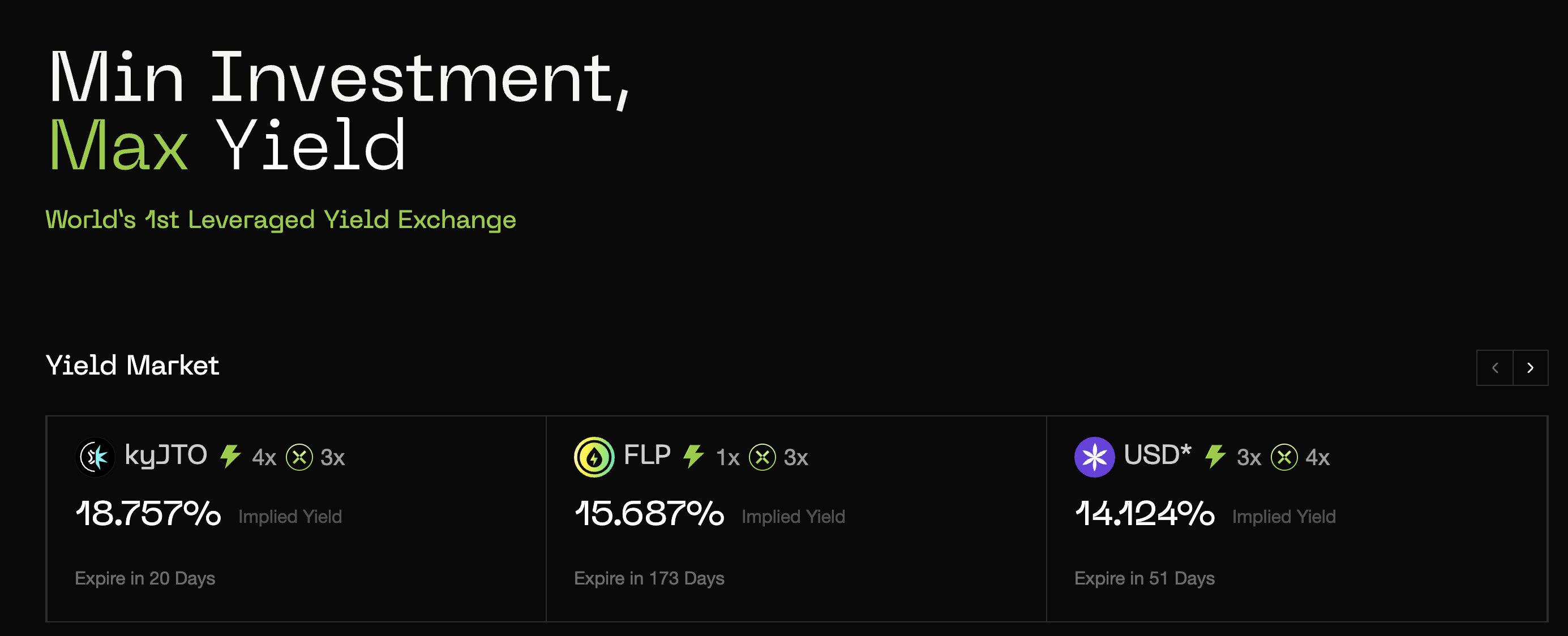

Although US stock tokens have not yet been integrated into lending protocols like Kamino or interest rate protocols, there is a clear expectation within the industry: once the liquidity, custody structure, and legal framework of these stock tokens are sufficiently robust, they will be able to be collateralized, staked, and even "split into yield rights" into PT (Principal Token) + YT (Future Cash Flow Token) structures, thus introducing a "cash flow secondary market" for real-world assets.

For example, in the future on Rate-X, users may tokenize and package the dividend income from TSLAx to sell in the form of YT, thereby obtaining liquidity in advance—this entire process will require no shareholder meeting approval and no signing of any offline contracts, fully executed and settled by smart contracts.

This is precisely the greatest appeal of the combination of tokenization and DeFi: it is not simply about "moving stocks on-chain," but about making stocks into an asset module that can be combined, called, and nested, thereby unleashing structural innovation capabilities that traditional finance lacks.

Of course, all of this is still in its early stages, but the direction is set. As platforms like Dinari and Backed Finance advance compliance and asset custody transparency, we are witnessing an experiment on "how traditional assets can be embedded into open financial systems" gradually becoming a reality.

3.4 "Public Access" to the Primary Market: First Circulation of Unlisted Equity

Recently, Robinhood EU launched a tokenized equity service in the EU that further breaks the monopoly of the primary market. In addition to traditional US stocks like Apple and Google, it has also launched tokenized equity for OpenAI and SpaceX, allowing users to gain economic exposure to these star unlisted companies for just a few dozen dollars through USDC.

Although this practice still faces legal controversies (OpenAI has publicly stated it is "unauthorized"), the trend it reflects is extremely clear: private equity will no longer be a field accessible only to venture capital and family offices, but is becoming an "on-chain accessible asset class."

This means that the "pre-IPO market" on-chain may be earlier, more transparent, and have better pricing feedback mechanisms than actual IPOs.

3.5 Summary

The true value of US stock tokenization lies not in "moving stocks on-chain," but in:

The US securities regulation provides a credible "trust template";

Blockchain offers a "global interface" that can be infinitely replicated, fragmented, and combined.

The regulatory dividend instills confidence that this is a real, redeemable asset; while the liquidity dividend transforms it into a "new type of financial Lego" that operates around the clock, is combinable, and can generate returns.

This is why the world is embracing US stock tokenization. This is not a technological revolution but an institutional evolution about "how value trust expands."

The above discusses the positive aspects of US stock tokenization. However, do not forget that this new path, while shining, is not without its traps.

4. Do Not Forget the Risks of Centralization

You might think that US stock tokenization is a brand new thing. However, in reality, this game has quietly played out three years ago amid the chaos of the crypto world.

In April 2021, the popular FTX launched a product called FTX-CM Equity for US stock tokenization. This product claimed to allow 24/7 trading on-chain and even provided a seemingly reliable promise of "redeemable for real stocks at any time."

However, when FTX collapsed in November 2022, people were shocked to discover that these seemingly legitimate tokens, which claimed to be redeemable, could not even produce a complete custody certificate. The "on-chain US stocks" held by investors instantly turned into "digital shells" that could not be exchanged for real stocks. In just one night, countless investors' on-chain assets vanished into thin air.

Ironically, FTX's promotional materials prominently featured "compliant custody" and "transparent settlement." This is akin to buying a luxurious villa with great excitement, only to find that the name on the property deed is not yours at all.

The FTX case is not an isolated incident. The currently popular US stock tokenization platform xStocks is also facing a similar trust crisis.

By the end of 2024, with the surge in US stock tokenization, crypto trading platforms like Kraken and Bybit have chosen xStocks' infrastructure to issue tokenized products for popular stocks including Apple (AAPL) and Tesla (TSLA).

However, xStocks' dark history raises concerns. In June 2024, xStocks was exposed by the media: its early team members had previously participated in the notorious DAOstack project, which had faced widespread community skepticism due to opaque governance token distribution and the founding team's "soft rug" (soft exit).

I am not saying that xStocks will inevitably repeat the mistakes of FTX, but the key question is: why should you trust it?

Centralized institutions inherently have trust gaps.

History tells us: unregulated centralized institutions find it hard to resist the temptation to "do harm." NASDAQ and the New York Stock Exchange are trusted not because they are inherently noble, but because the SEC's strict and almost harsh regulations, quarterly financial audits, and frequent and public asset reserve verifications leave these centralized platforms "no opportunity to do harm."

However, the uniqueness of US stock tokenization determines that it cannot be completely decentralized—on-chain tokens must correspond to real-world stocks or rights. Therefore, this model inevitably relies on centralized institutions to complete key processes such as asset custody, clearing, and redemption.

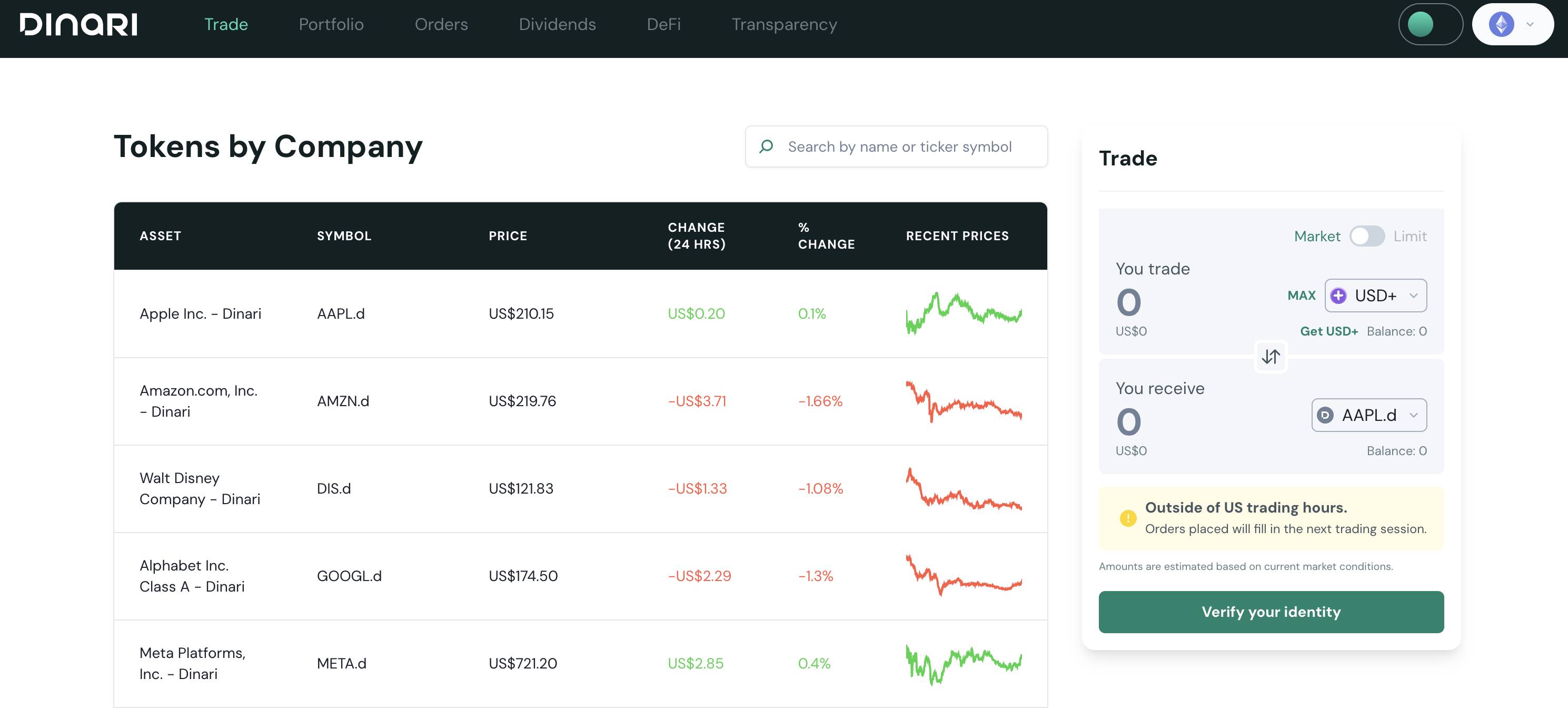

Since we cannot escape centralization, what we can do is build a trust system that is sufficiently transparent, strongly regulated, and verifiable, ensuring that custodians cannot act maliciously or disappear at will. This auditable trust model is precisely the path that Dinari is attempting.

In June of this year, the San Francisco-based company Dinari became the first US stock tokenization platform in history to obtain a Broker-Dealer license. Obtaining this license means that Dinari must not only strictly adhere to SEC trading rules (such as SEC Rule 15c3-3 asset custody and segregation requirements) but also undergo public third-party financial audits and asset reserve verifications every year.

Dinari CEO Gabriel Otte clearly stated that the company's upcoming US stock tokenization business will be conducted entirely through a "regulated intermediary + blockchain real-time settlement" model, with asset custody and audit reports being fully transparent. Additionally, Dinari will connect with traditional financial platforms like Coinbase, Robinhood, and Cash App via API, rapidly spreading the SEC-reviewed legal and compliant model in a white-label manner.

Almost simultaneously, crypto giant Coinbase is also actively promoting similar business initiatives and has officially submitted a compliance license application to the SEC for stock tokenization services. Coinbase's CLO Paul Grewal publicly stated, "The future of tokenization must be driven by regulation, not by technology. Only then will on-chain US stocks truly be worthy of investor trust."

The actions of Dinari and Coinbase send a clear signal: the real competition in US stock tokenization is not about whose blockchain technology is more advanced, but about whose compliance and regulation are more transparent and stringent.

After all, the issue of centralization risk is not something that blockchain can fundamentally solve; only regulation that is powerful enough to be awe-inspiring is the ultimate answer.

Conclusion: US Stock Tokenization is Not "Moving On-Chain," but "Planting in the Heart"

In this era where capital and code are intertwined, regulation and protocols are quietly merging. US stock tokenization is not just an evolution of asset forms but also an expedition of the trust system.

This expedition requires no fleet, relies on no military force, but uses code as the vessel and institutions as the sails, engraving "verifiable transparency," "executable rules," and "inheritable trust" into the on-chain world.

What we are witnessing is not a simple "on-chain" process, but a subtle institutional expansion—American financial logic, with governance as its banner and compliance as its legitimacy, is sowing digital estates across the borderless land of DeFi.

Here, the SEC's numbering transforms into consensus instructions for smart contracts, the KYC process is embedded in wallet signature permissions, and the trust that originally belonged to Wall Street can now take root in any decentralized wallet.

This is the true face of US stock tokenization:

It is not about turning stocks into code, but about transforming institutions into consensus, forging trust into liquidity, and compressing financial governance into portable modules of civilization.

When the control of assets is no longer determined by brokerages but arbitrated by code; when the boundaries of trust are no longer national borders but the thickness of compliance standards—

We can finally say:

US stock tokenization is not the end, but the prologue to the reconstruction of the global financial structure, a silent expansion of "code civilization."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。