Tether BTC Mining, Trump Powell Clash, Remixpoint BTC, Crypto Today

Crypto doesn't sleep, and something new is always on the go each day. From unexpected price spikes to new project announcements and shocking collaborations, today's headlines indicate just how quickly things are moving in this space. Whether you're a trader, investor, or simply interested, here's a brief rundown on today’s headlines in the world of crypto currencies.

Tether Bitcoin Mining Partnership Targets World’s Top Miner Spot:

Tether, the issuer of the world's largest stablecoin USDT, has made tremendous plans to become the world's largest Bitcoin miner by the close of 2025. In a recent interview, CEO Paolo Ardoino revealed that Tether is heavily investing in commodity trading and Bitcoin mining to diversify beyond stablecoins. According to the company, the transition will not discredit the dollar but rather prop it up as the dominant currency by enhancing USDT's utilization globally.

Tether also intends to introduce a new stablecoin specifically designed for the U.S. market to accompany fresh American regulations. Tether won't go public despite huge profits, preferring to remain agile as it expands. The company's new open-source wallet will enable users to choose the lowest-priced network for transactions. With this aggressive plan, Tether hopes to diversify its business, enhance its position within world finance, and mold the next chapter in the future of crypto.

Source: Wu Blockchain

Trump Calls for Jerome Powell to Resign:

On July 9, 2025, President Trump told Federal Reserve Chair Jerome Powell to resign if he really misled Congress about expensive office renovations. Trump says Powell’s high interest rates are slowing the economy and hurting virtual currency, too. Even though rates were cut a bit this year, they still sit at 4.25%–4.50%, and Powell doesn’t plan to cut more right now.

If Powell leaves, names like Kevin Hassett or Christopher Waller could step in both back lower rates. That could help Bitcoin bounce if rates drop sooner. But for now, most experts think the Fed will keep rates steady at the July 30 meeting. If they stay high, virtual coins could stay stuck, too. Whether Powell stays or goes, the next Fed move could decide if crypto heats up or cools off again.

Source: X

Truth Social Crypto ETF S-1 Filing Lists BTC and Altcoins:

Truth Social, the platform linked to President Trump, has officially filed an S-1 with the SEC for a brand-new cryptoETF. If approved, this “Truth Social Crypto ETF” would let investors get easy exposure to top crypto coins without owning them directly.

The fund plans to hold 70% Bitcoin, 15% Ethereum, plus Solana, Ripple, and Cronos to round out a “blue-chip” crypto mix. It would list shares on NYSE Arca through sponsor Yolkville America Digital.

This move comes as crypto ETFs gain steam in the US. Major players such as BlackRock are increasing BTC and ETH funds, and new filings indicate there is also strong demand for additional altcoin choices.

Truth Social's launch is a gutsy move for Trump's brand, combining politics, social media, and finance into one headline-grabbing product.

Source: X

Remixpoint Bitcoin Invests $215M to Expand BTC Holdings:

Japanese company Remixpoint is going all-in on Bitcoin. The energy consulting firm just secured about $215 million to buy more BTC, pushing its goal to hold 3,000 Bitcoins. Right now, it already owns over 1,000 BTC.

What’s grabbing attention is how far Remixpoint is willing to go, it will even pay its CEO’s salary fully in Bitcoin. This makes it the first company in the world to do that.

While the prices jump around a lot, Remixpoint says it’s ready for the ups and downs. Its plan shows a clear bet: Bitcoin isn’t just an investment anymore, it’s becoming a real part of how companies manage their money. Other firms in Sweden and Canada are making similar moves, showing this trend is catching on fast.

Source: Wu Blockchain

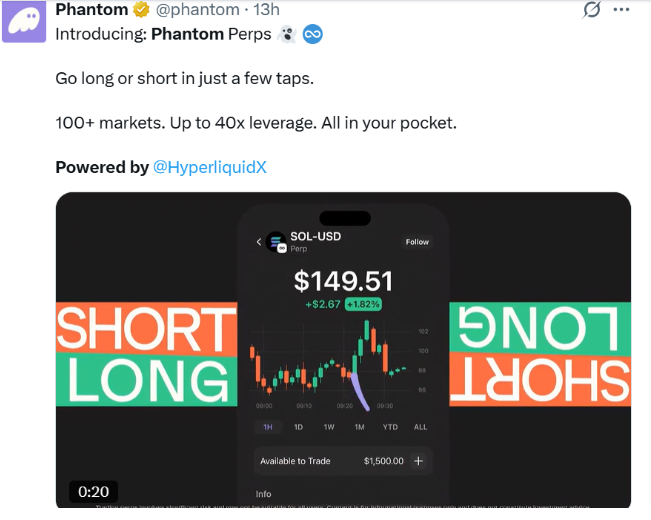

Phantom Perps Now Live: Trade 100+ Tokens In-Wallet

One of the most popular virtual currencies, Phantom, has just launched "Phantom Perps", a new feature that enables its 15 million users to buy and sell perpetual contracts with up to 40x leverage straight from the app. Built using Hyperliquid, what this means is that individuals can now trade large coins such as Bitcoin, Ethereum, Solana, and even meme coins like PEPE, without ever leaving their wallet.

The shift is huge: if only 10% of Phantom's user base gives it a shot, that's 1.5 million new on-chain traders in one night, potentially doubling the size of the on-chain market.

Unlike messy trading interfaces, Phantom Perps is mobile-first and simple to use. It provides stop-loss, take-profit, and real-time price notifications, all while leaving users completely in control of their funds.

By partnering with Hyperliquid rather than Jupiter, Phantom wants to deliver near-institutional-level trading velocity and low costs directly to your phone. The strategy? Turn wallets into the new center for DeFi trading, no centralized exchange required.

Source: X

Today's news reveals how rapidly it is evolving from large corporations introducing additional Bitcoin, to new ETFs and trading platforms, to politics dictating the market. Whether it's Tether's mining proposal, Trump's frowning on the Fed, Remixpoint's aggressive Bitcoin wager, or Phantom's new trading options each move is driving it to new territories. As the market shifts, the traders and investors will be observing what is next.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。