Solana ETF Delayed as SEC Demands Staking and Trust Details Added

The U.S. Securities and Exchange Commission (SEC) has asked companies planning to launch SOL spot ETFs to update their filings by the end of July. These updates must now include information about how funds will handle subscriptions, redemptions, and pledging.

Although the SEC’s official decision deadline is October 10, 2025, it is now requesting changes earlier than expected. While this move shows progress, it also means the Solana ETF delayed again.

Top Financial Firms Behind the Filings

On June 13, leading firms like Fidelity , Grayscale, Franklin Templeton, Bitwise, VanEck, Canary Capital, and 21Shares either filed or updated their applications for ETFs. A new addition in all filings is staking. This feature allows the funds to earn extra rewards from the blockchain.

For example, Bitwise and Canary noted that their cryptocurrencies would be held in trust accounts and staked through Coinbase Custody. The rewards, paid in SOL or cash, would go back to the fund, helping increase its value.

Why the Solana ETF Delayed Timeline Matters?

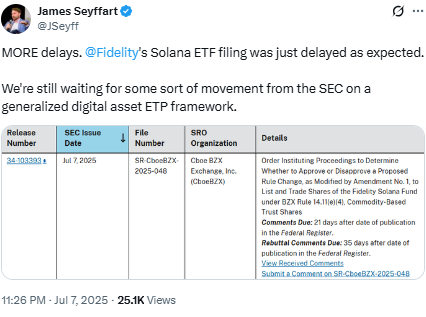

Even with the updated filings, experts say more waiting is likely. Bloomberg analyst James Seyffart explained that the SEC has not yet created a clear rulebook for digital asset ETFs. Until that happens, the Solana ETF delayed further, not because of a rejection, but because of missing guidelines. The most recent is Fidelity Solana ETF delayed.

Source: James Seyffart

Some believe the SEC’s request for revisions shows it’s seriously considering approval. So, while Solana ETF delayed, it could also be one step closer to being approved.

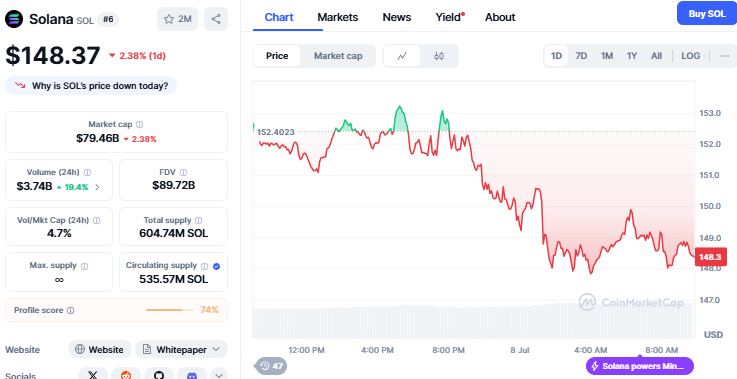

After the news the price of this altcoin has gone down by 2.3% within a day, currently trading at $148.37, the trading volume has risen by 19% to reach $3.74 Billion.

Source: CoinMarketCap

First SOL Staking ETF Already Approved

On July 2, the SEC quietly approved the REX-Osprey SOL Staking Exchange Traded Fund (SSK), a first-of-its-kind fund in the U.S. It offers both SOL price exposure and staking rewards, with an estimated annual yield of 7.3%.

The approval came as a surprise, especially since many expected the it can be delayed again. After the launch, SOL’s price jumped 6% to 12%, reaching around $160, showing strong investor interest.

What Is a Staking Exchange Traded Fund?

Unlike regular ETFs that only track price, staking Exchange Traded Funds allow the fund to earn rewards by participating in the network. These rewards help grow the fund's value or can be shared with investors.

The REX-Osprey Exchange Traded Fund may pave the way for more funds with similar features, especially for other proof-of-stake coins like Ethereum and Cardano.

What This Means for Solana?

Even though the Solana ETF delayed, interest in these products is growing. If more funds are approved, large investors could start buying and staking more SOL, which may push up its price over time.

As firms respond to the SEC’s requests, the delay might be frustrating, but it also signals that approval could be on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。