Robinhood simplifies crypto trading, Coinbase focuses on institutions, and blockchain finance takes off together.

Author: Brendan on Blockchain

Translated by: Baihua Blockchain

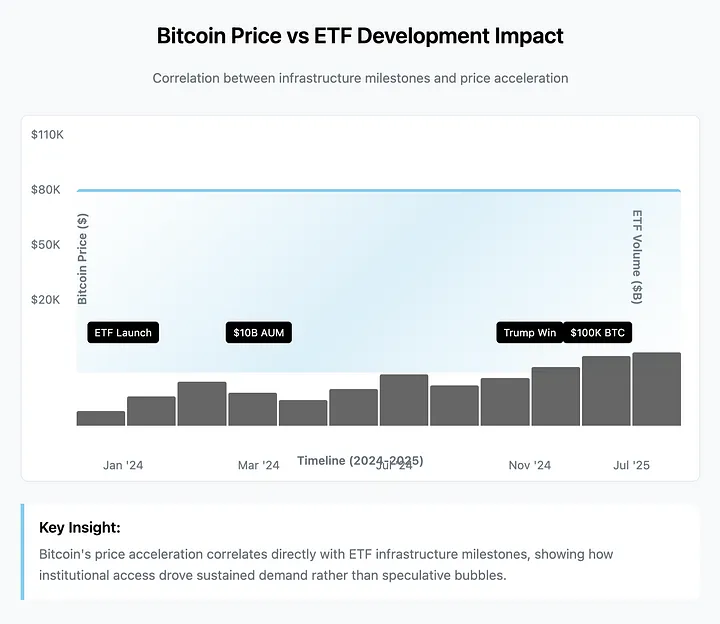

When Bitcoin breaks $100,000 in December 2024, it will not just be another price milestone, but the pinnacle of a larger event. In January 2024, the U.S. Securities and Exchange Commission (SEC) approved the spot Bitcoin ETF, fundamentally changing the way institutional funds flow into cryptocurrency, and we are witnessing this outcome in real-time.

What impresses me about this moment is that after years of regulatory resistance, the approval not only legitimizes Bitcoin but also creates a new layer of infrastructure that traditional finance can access. The result? Bitcoin has rapidly transformed from a digital wonder into a portfolio essential, with a speed that has exceeded everyone's expectations.

The transformation of infrastructure is where it gets really interesting. These are not traditional investment products. Spot Bitcoin ETFs hold actual Bitcoin, rather than contracts or derivatives. You can think of it as holding physical gold bars in a gold ETF, except here the "vault" is digital, and the custodians are companies well-versed in crypto technology, suddenly managing billions in institutional funds.

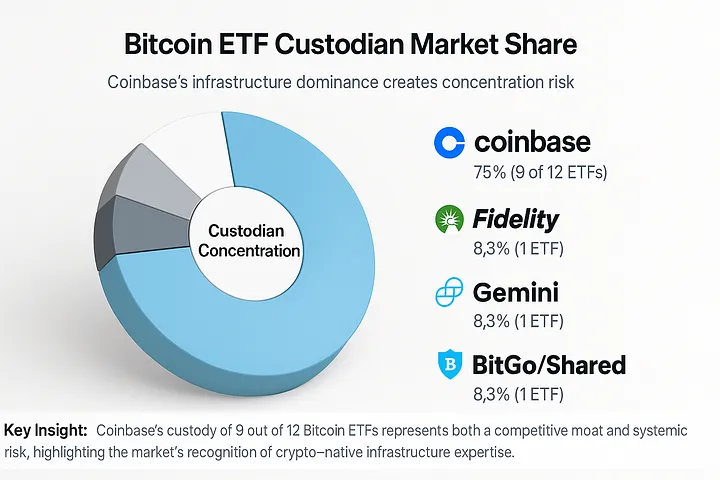

Of the 12 spot Bitcoin ETFs currently trading, 9 rely on Coinbase for custody.

Coinbase custodies 9 out of 12 Bitcoin ETFs, which brings both competitive advantages and concentration risks. This dominance in infrastructure creates stable revenue but also raises questions about single points of failure in the crypto ecosystem.

This is not coincidental; the market recognizes that crypto infrastructure requires crypto expertise. Traditional banks, which have long touted "blockchain solutions," suddenly realize they need companies that truly understand how to safeguard digital assets at an institutional scale.

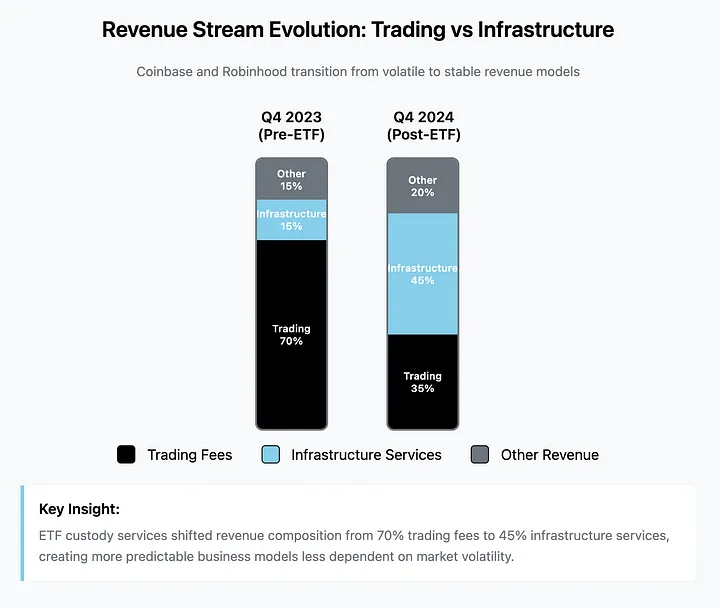

This concentration brings about interesting dynamics. Coinbase has transformed from a platform reliant on trading fees (making a fortune in bull markets and starving in bear markets) into a key piece of financial infrastructure. ETF custody generates predictable revenue regardless of market sentiment. It’s like going from a casino to a bank that handles casino funds.

The data speaks for itself. Coinbase achieved its best performance in history in 2024, and analysts expect massive growth in 2025. The company has shifted from riding the crypto wave to becoming the infrastructure impacted by the institutional wave.

But the role of infrastructure will attract competition, and Robinhood is catching up in a different way. While Coinbase focuses on institutional custody and compliance, Robinhood targets retail investors frustrated by the complexities of crypto.

The ETF revolution has changed the revenue model for crypto platforms. Trading fees have dropped from 70% to 35%, while infrastructure services have grown from 15% to 45%, creating a more predictable business model and reducing reliance on market volatility.

Robinhood's recent moves reflect this strategy: launching tokenized U.S. stocks in Europe, staking major cryptocurrencies, perpetual futures trading, and a custom blockchain for real-world asset settlement. Robinhood is building an entry point for mass adoption, while Coinbase is managing the treasury.

Robinhood's commission-free crypto trading and simplified user experience have gained market share, especially in a context where regulatory clarity reduces friction. Record trading volumes and analysts' optimistic forecasts for 2025 indicate that this retail-centric approach complements rather than directly competes with institutional infrastructure.

Then there’s BTCS Inc., which offers a completely different set of lessons. As the first cryptocurrency company to go public on Nasdaq in 2014, BTCS represents a pure play on crypto business models. The company pioneered "Bividends" (paying dividends to shareholders in Bitcoin rather than cash) and operates blockchain analytics while holding direct crypto assets.

BTCS currently holds 90 Bitcoins and is expanding to 12,500 Ethereums through strategic financing. The company demonstrates how crypto-native enterprises can adapt in institutional validation without abandoning their core principles. While giants vie for dominance in infrastructure, specialized players are also carving out sustainable niches.

What makes this ecosystem transformation fascinating is the speed at which traditional finance is absorbing what should have been a disruptive technology.

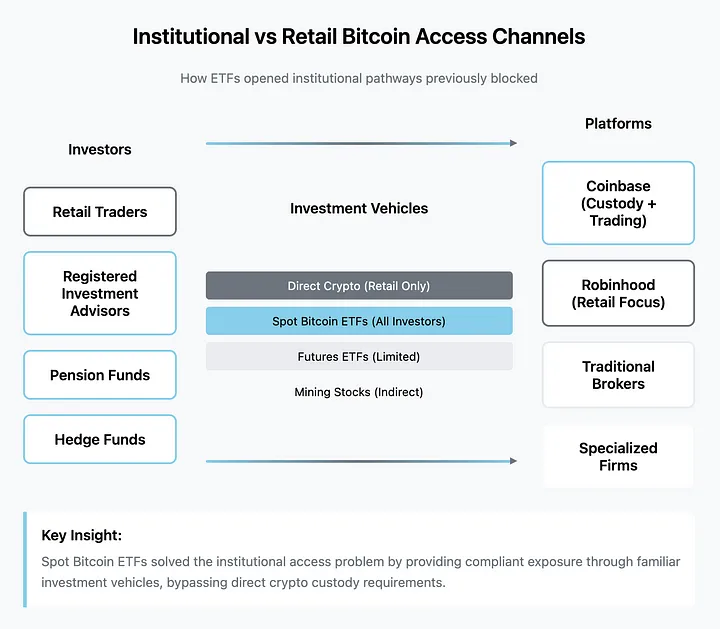

Spot Bitcoin ETFs solve the institutional access problem by providing compliant investment tools. The chart below shows how different types of investors can gain Bitcoin exposure without directly holding crypto assets.

ETFs provide institutional investors with the necessary compliance packaging, transforming cryptocurrency from an alternative asset into a part of their portfolios.

The regulatory environment indicates that this acceptance is permanent. Political leaders openly support cryptocurrency as a national strategic infrastructure, and the SEC's ongoing evolution suggests that the framework will expand rather than contract. Ethereum ETFs, multi-crypto funds, and integration with traditional wealth management are logical progressions.

Institutional behavior confirms this maturation. Recent filings show that during the volatility of Q1 2025, some asset management firms reduced their Bitcoin ETF positions while others allocated for the first time. This is not speculation but portfolio management. Institutions view cryptocurrency as an asset class that requires risk assessment and allocation decisions.

The infrastructure supporting this transformation continues to solidify. Custody solutions have evolved from trading platform wallets to institutional-grade security. Trading infrastructure now handles billions in daily transaction volume without the failures common in early crypto markets. The regulatory framework provides clarity for compliance officers who are nervous about digital assets.

Market structure reflects this evolution. Price discovery occurs on regulated trading platforms with institutional participation, rather than on fragmented crypto-only platforms. Liquidity comes from various sources, including algorithmic trading, institutional arbitrage, and retail participation through familiar brokers.

But what I find most striking is that we are witnessing the creation of parallel financial infrastructure rather than a replacement of existing systems. Cryptocurrency has not disrupted traditional finance; it has forced traditional finance to build systems compatible with crypto.

Coinbase has become the bridge between the Bitcoin network and institutional custody needs. Robinhood has created a crypto trading experience that feels like stock trading. ETF providers package crypto exposure into familiar investment tools. Each player addresses specific friction points rather than demanding a wholesale adoption of a new paradigm.

This infrastructure approach explains why the approval of Bitcoin ETFs has triggered such dramatic price fluctuations.

The acceleration of Bitcoin's price is directly related to the milestones of ETF infrastructure, rather than a speculative bubble. The correlation between regulatory developments, ETF trading volumes, and sustained price growth indicates that institutional demand is driving the market.

Institutional funds are not waiting for cryptocurrency to mature; they are waiting for compliant access methods. Once these methods exist, allocation decisions will follow standard portfolio logic rather than speculation.

The winners of this transformation may not be the platforms with the most users or the highest trading volumes. They are the companies providing reliable infrastructure for an asset class that institutional investors can no longer ignore.

Success metrics are changing as well. Revenue stability is more important than growth rates. Regulatory compliance brings competitive advantages. Technological reliability determines institutional trust. These factors favor mature players with the resources to build robust infrastructure over startups promising disruption.

Looking ahead, the infrastructure is already in place. The regulatory framework continues to evolve in supportive ways. Institutional adoption follows predictable patterns based on risk tolerance and allocation models. The speculative phase is ending; the phase of infrastructure utilization is beginning.

The revolution is not about Bitcoin prices reaching six figures, but about the infrastructure that makes cryptocurrency a standard component of diversified portfolios. Companies that build and continue to maintain this infrastructure will control the future of institutional crypto adoption.

This is where true value creation and capture lies.

Article link: https://www.hellobtc.com/kp/du/07/5928.html

Source: https://a.c1ns.cn/q2B3o

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。